Home

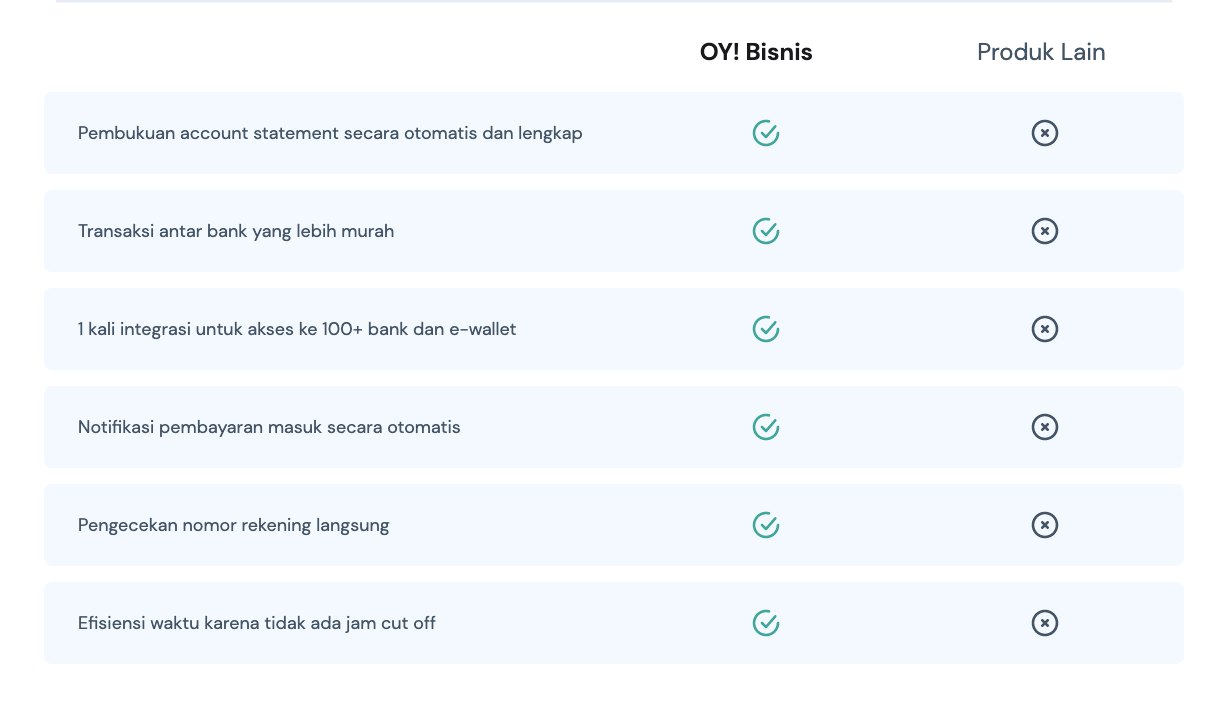

Welcome to OY! We aim to be among the world class financial services and always put our customers first in everything that we do. Armed with receive money (accepting payments) and send money (fund disbursement) products and services, we are ready to help your business achieve higher growth through swift and secure payment infrastructure solutions.

How OY! Can Help

Our Product Suites

Money-Out (Disbursement)

- API Disburse

- Bulk Disbursement

Money-In (Accepting Payments)

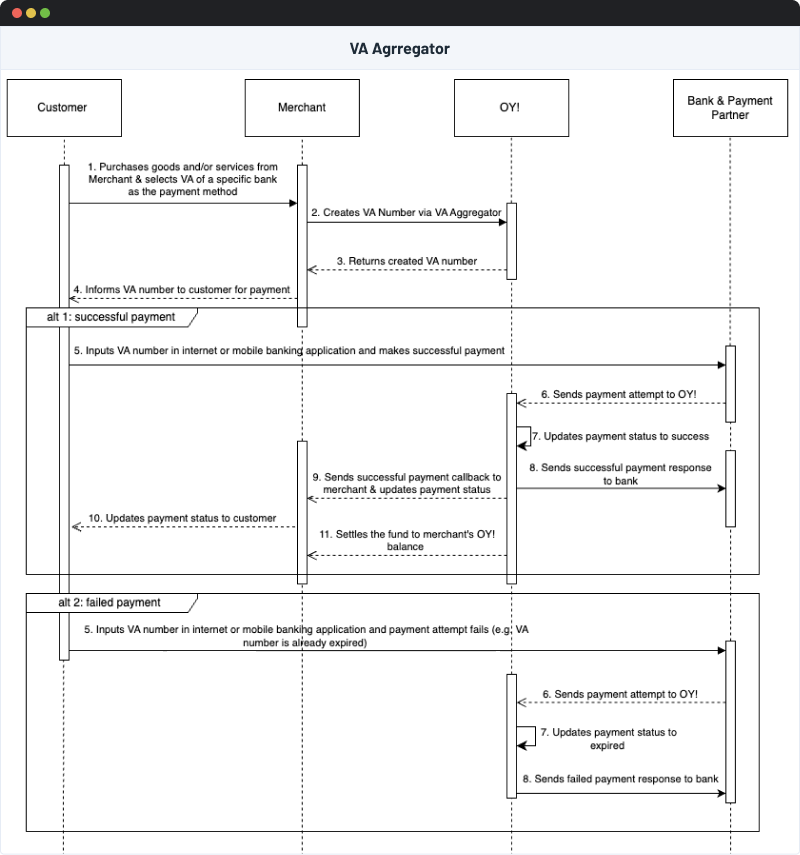

- Virtual Account (VA) Aggregator

- Payment Link Page/Invoice

Registration Process

Registration process begins with creating an account. Creating an account is 100% free and enables you to try our product suites in staging/test environment, where you can execute money-in and money-out dummy transactions (without real money movement).

After successfully creating an account, if you are interested to go live (execute real money-in and/or money-out transactions) or integrate with OY!, you are required to upgrade your account by submitting supporting legal documentations.

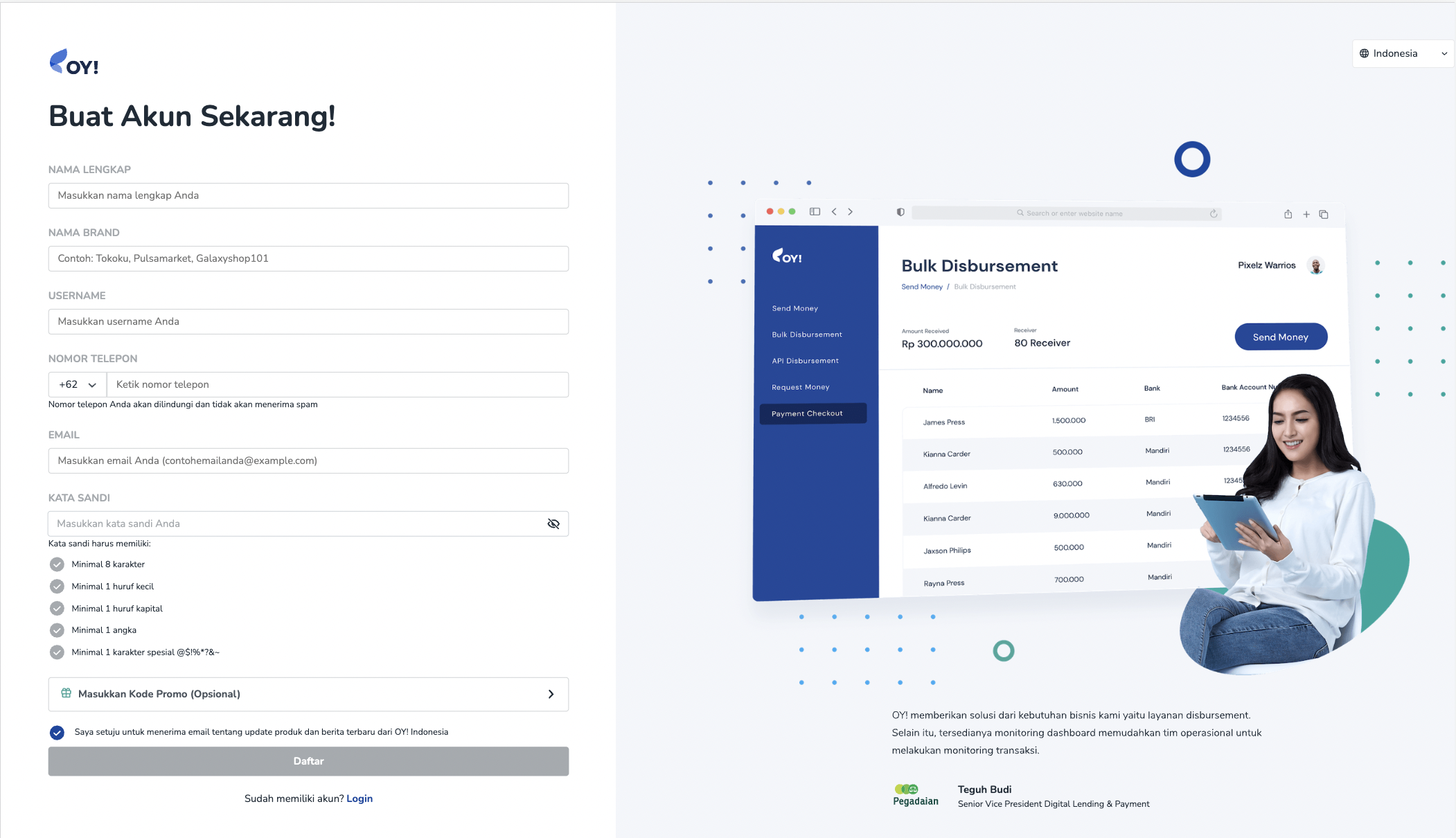

Creating Account

Follow the steps below to create an account:

1. Register on the OY! dashboard: To create your account, please register here, and complete the form with all the required information.

Please note that your username cannot be changed once the registration form is submitted.

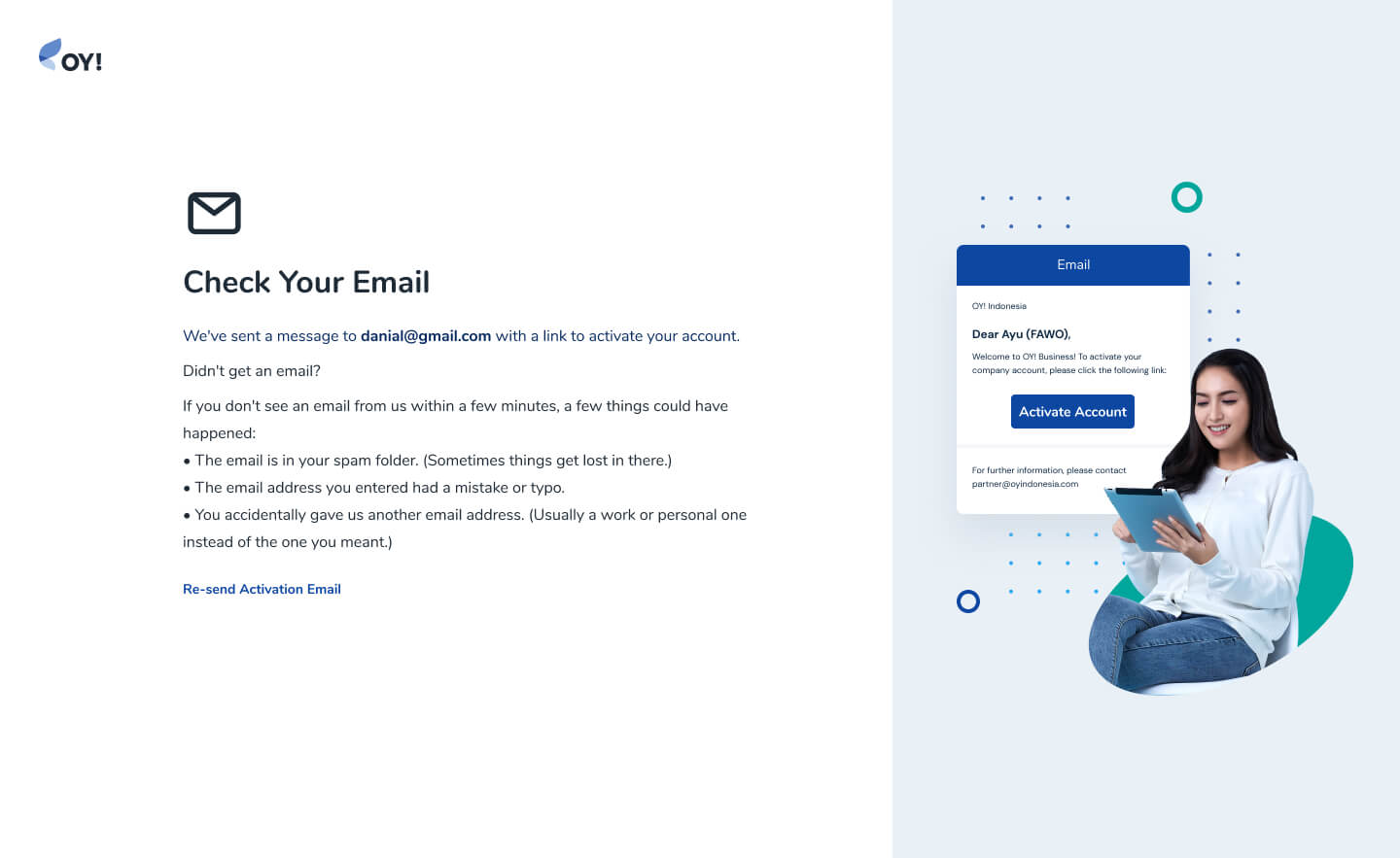

2. Activate your account: Once the registration is submitted, an activation link will be sent to the email registered. Once you are successfully logged in, you will be able to try our product suites in staging/test environment, where you can execute money-in and money-out dummy transactions (without real money movement). If you are ready to proceed to go live or integrate with OY!, refer to the below sections for more information on the steps to upgrade your account.

Once you are successfully logged in, you will be able to try our product suites in staging/test environment, where you can execute money-in and money-out dummy transactions (without real money movement).

If you are ready to proceed to go live or integrate with OY!, refer to the below sections for more information on the steps to upgrade your account.

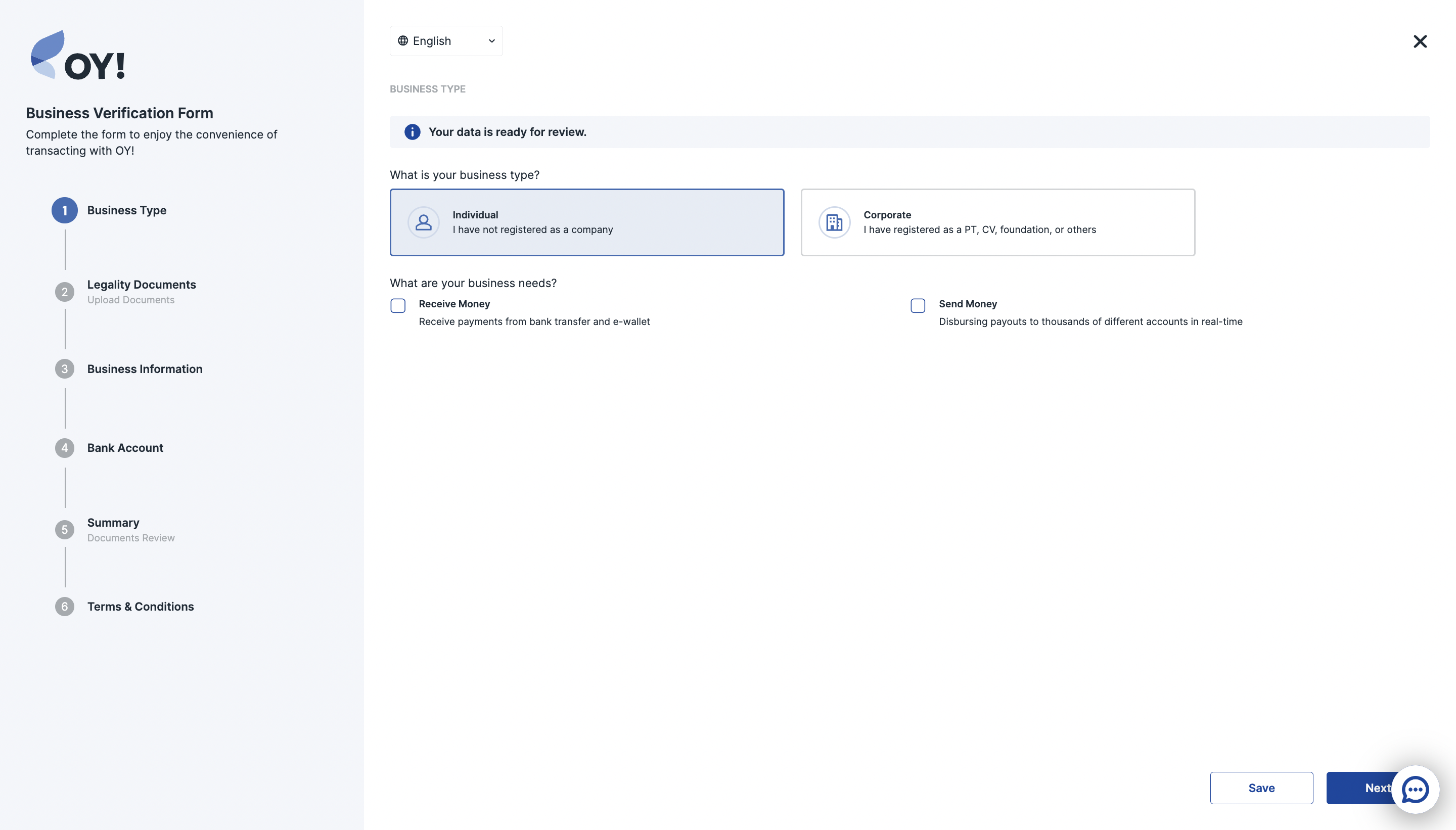

Verifying Your Business

Follow the steps below to verify your business:

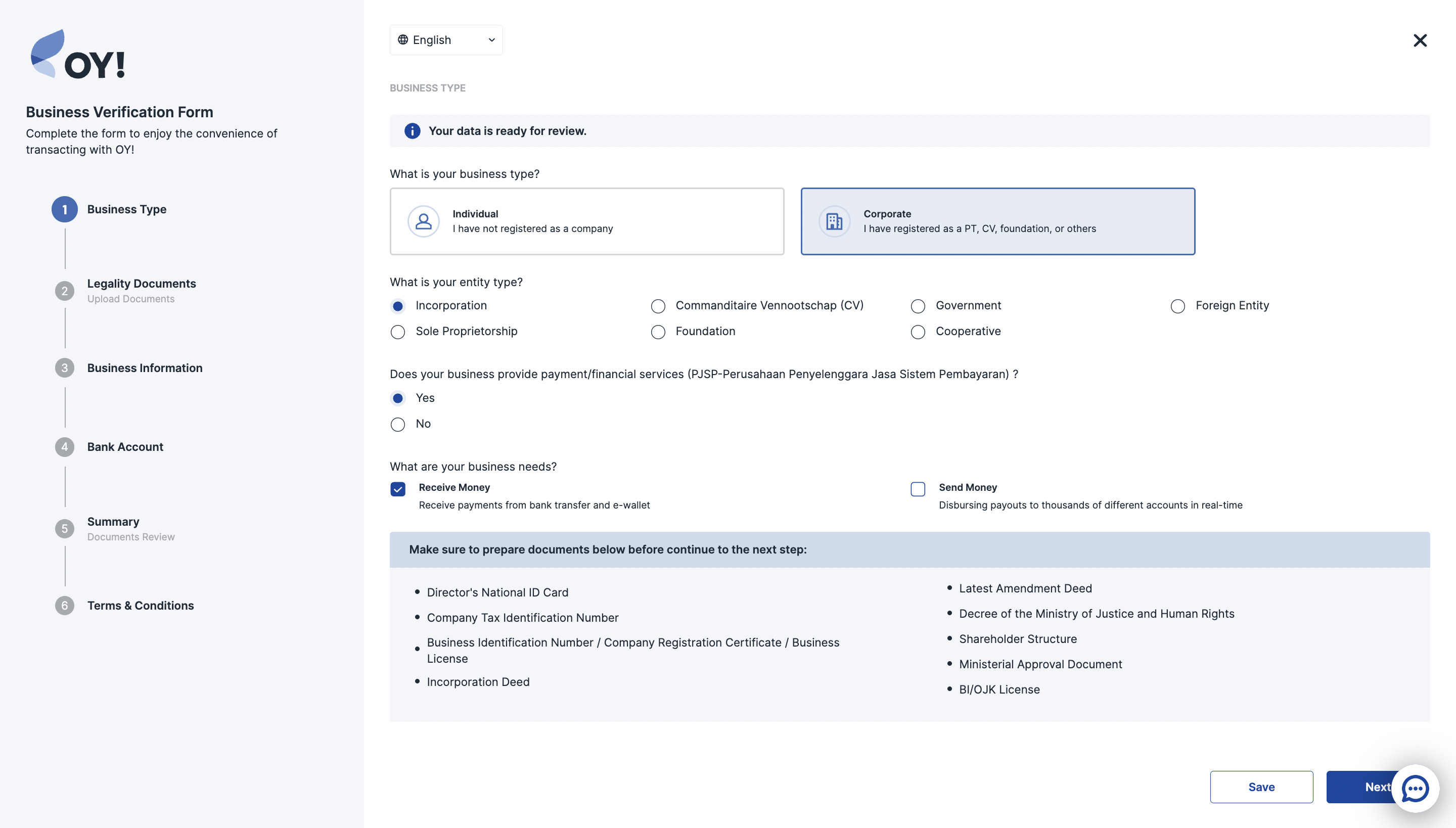

1. Request to Verify your Business: To access the full version of our products and services, please select “Verify Your Business” on the menu at the left side of the OY! dashboard (Production environment) and complete all the required information.

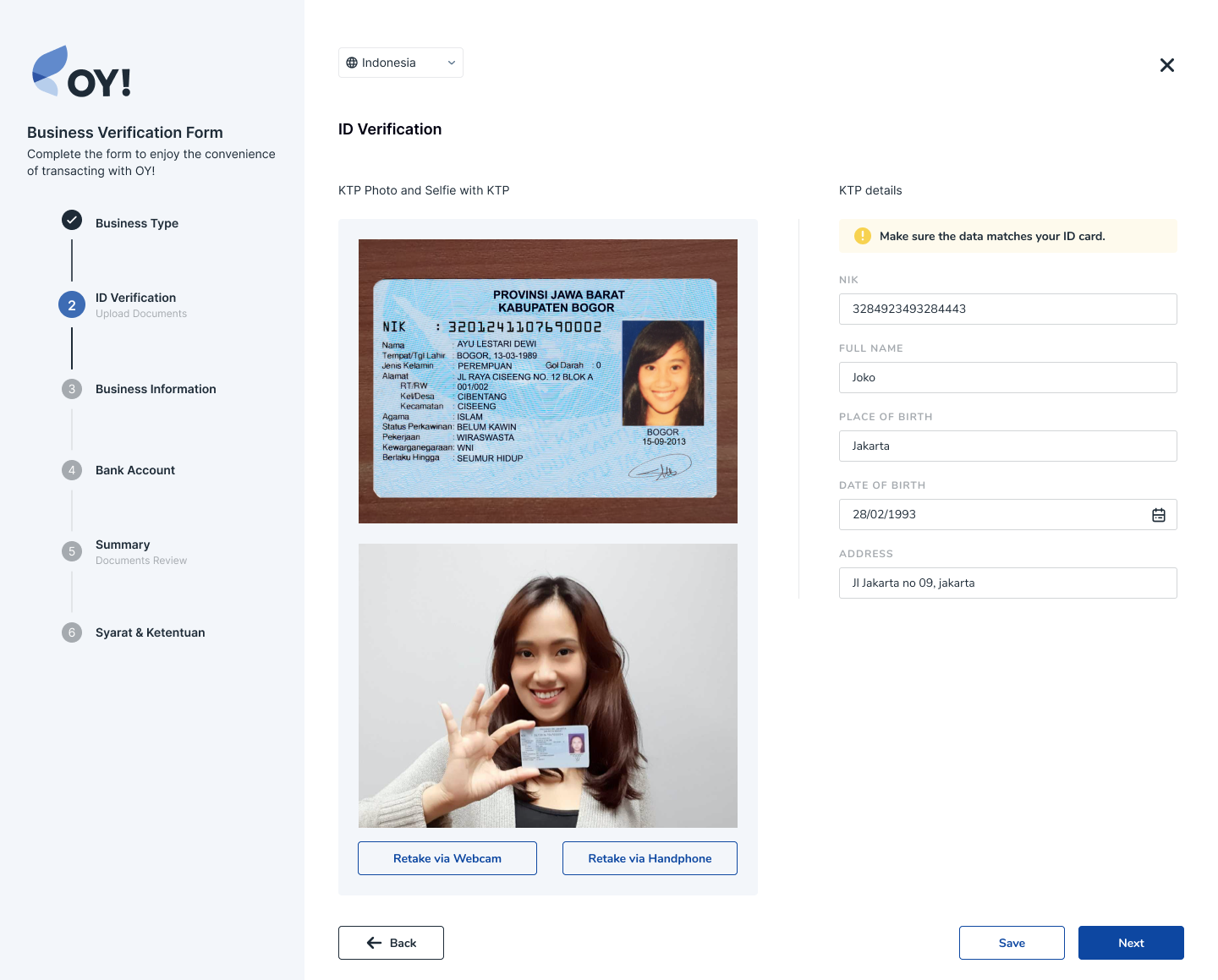

2. For Individual User: Upload ID Card for Identity Verification: Please take an identity card photo and a Selfie photo holding an identity card. The system will automatically read your Identity card photo to fill the form, make sure all information is correct based on your ID card.

- For Individual type of business

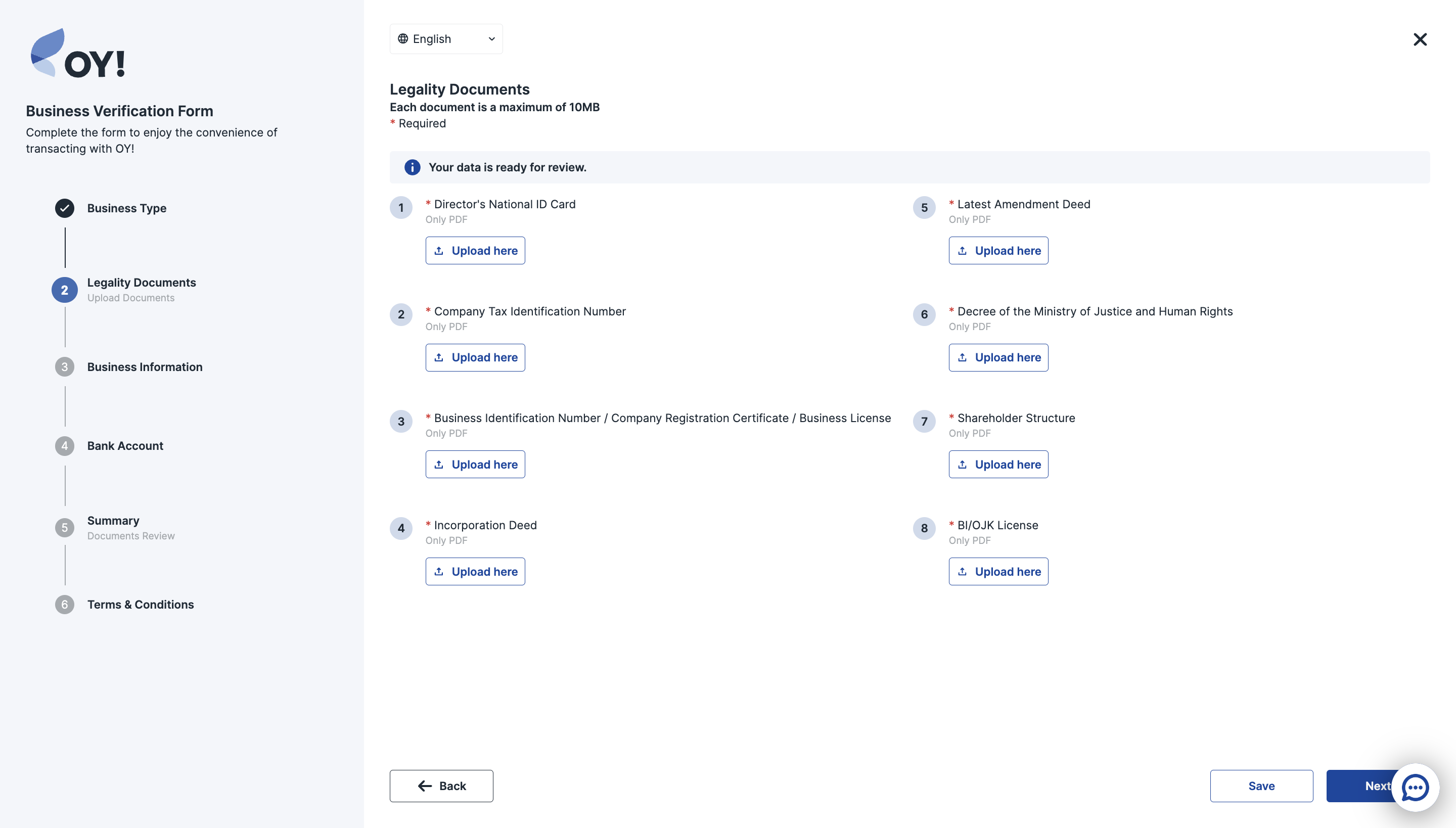

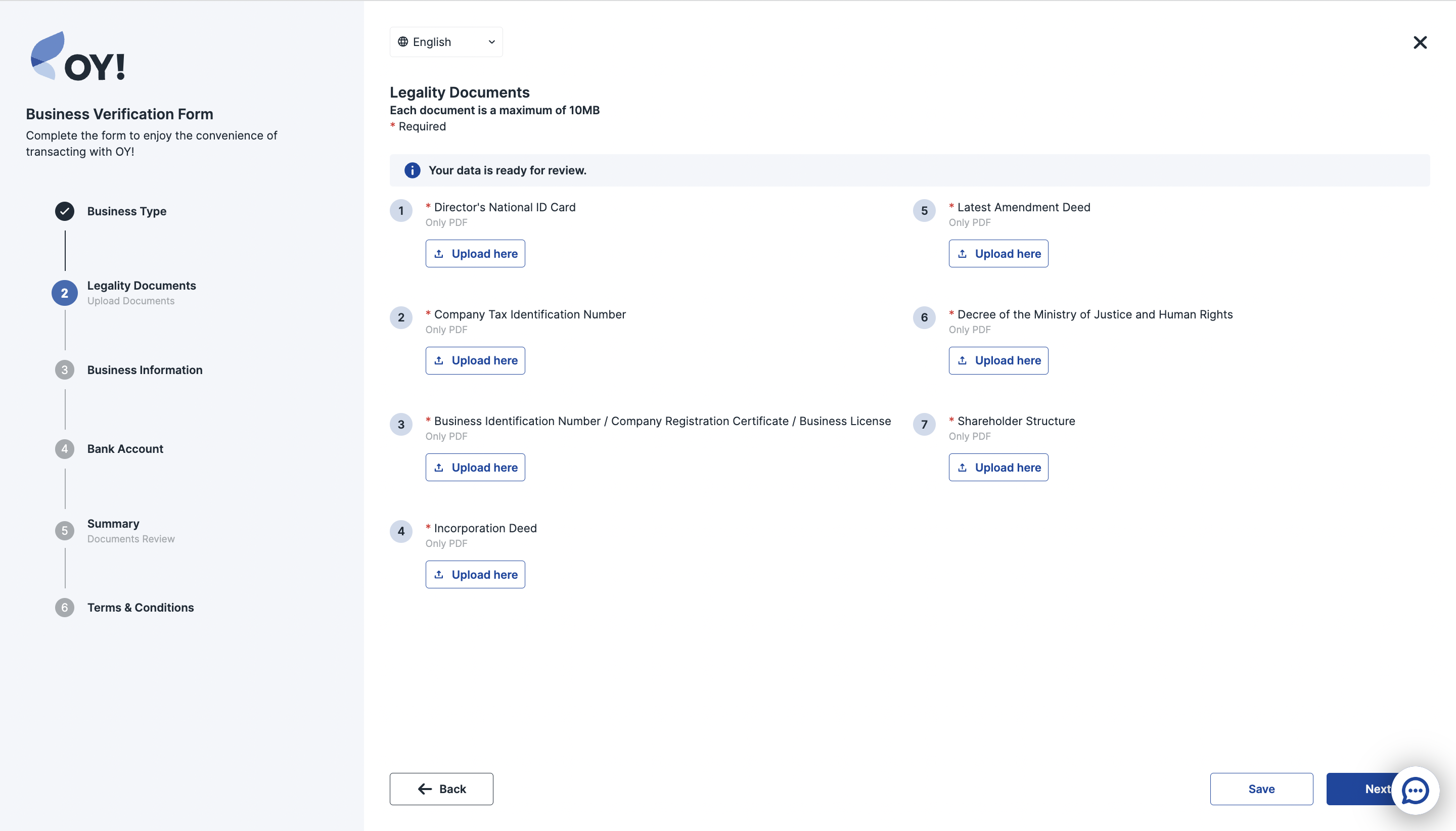

2. For Corporate User: Upload the Legality Documents: We ask for different legality documents for different types of corporate entities. After choosing your corporate type we will show you what document you need to submit.

Please upload the required supporting documents according to your business type. Documents are only accepted in PDF format and must be less than 10 MB in size each.

Here is an example for Corporate (PJSP) type of business

For Corporate (Non PJSP) type of business

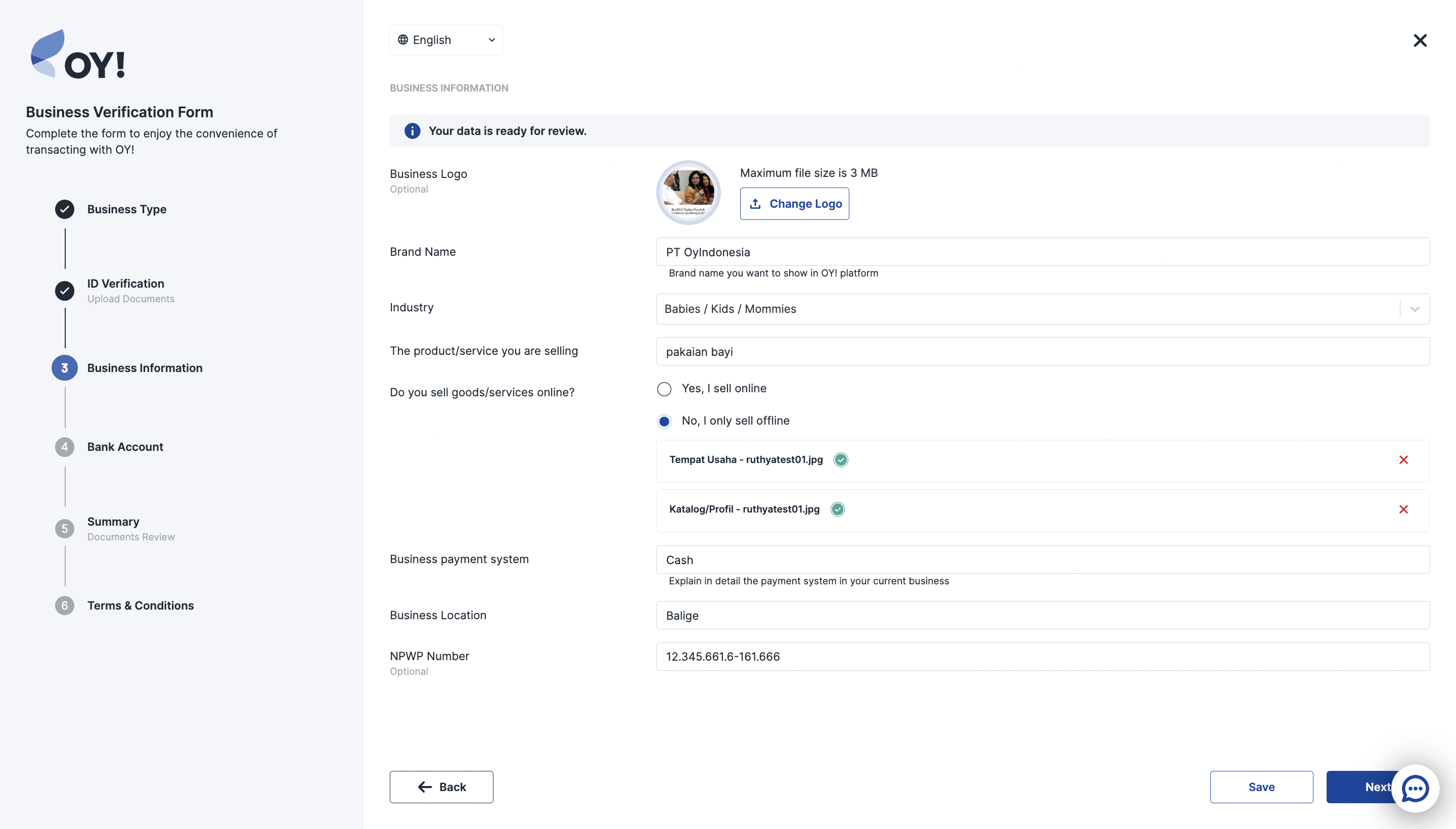

3. Fill Business Information Form: Let us know more about your business by filling out the Business Information form. Please note that you will not be able to change this field in the need revision status.

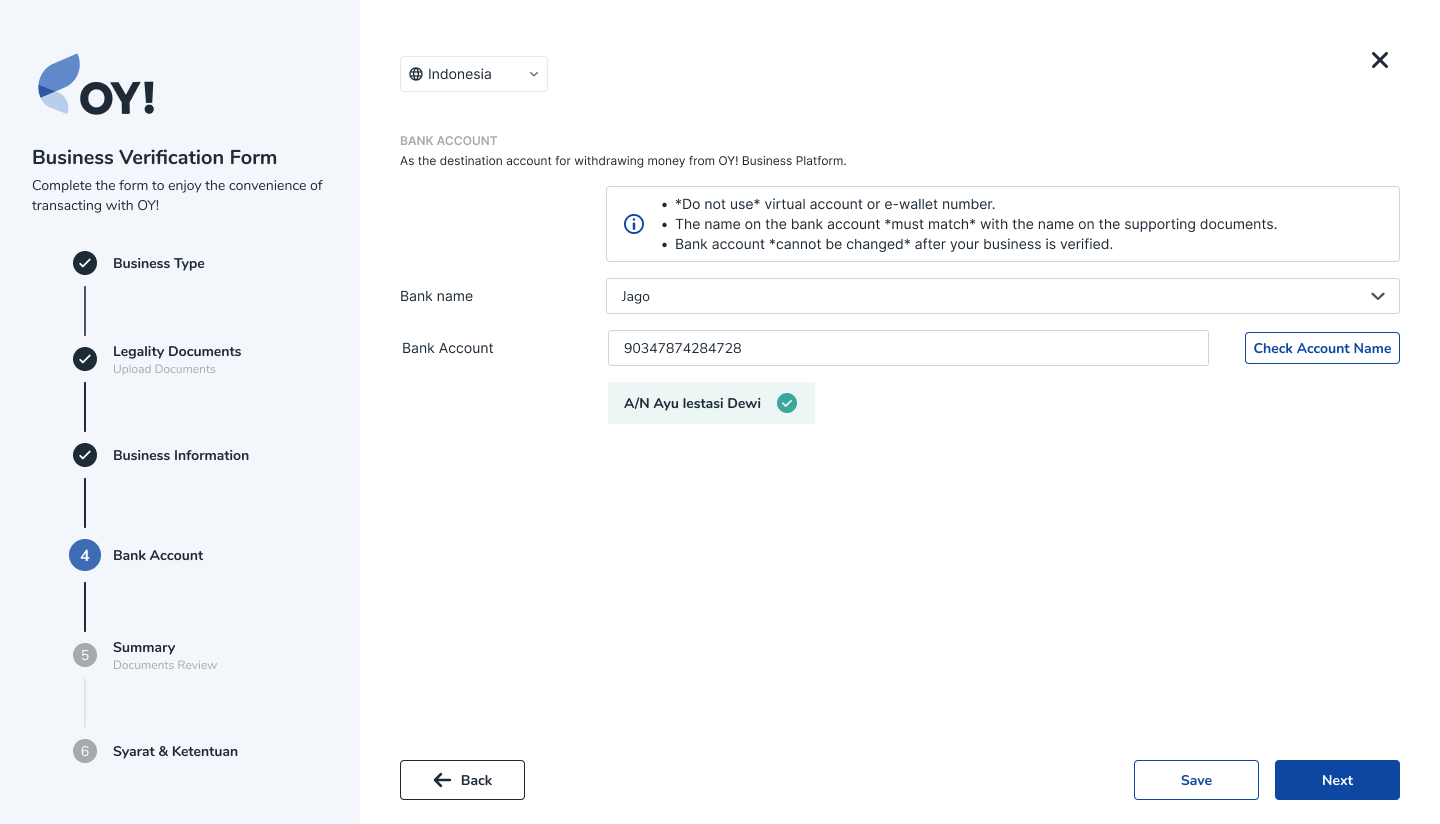

4. Submit your Bank Account: Add Bank Account Information as the destination account for withdrawing money from OY! Business Platform.

Please note that the receiving bank account information cannot be changed via the OY! dashboard once your business verification request is approved for security reasons. Please contact us at partner@oyindonesia.com to change the receiving bank account information.

5. Submit your Request: Click “Submit”, and a new status of “Waiting for Approval” should appear on the Home page, indicating that your request has been submitted along with your supporting documents.

This process should take about 1-2 working days. In the event that the status of your request is Need Revision or Rejected, please keep reading below. Otherwise, you are good to go!

Status: Need Revision

Upon reviewing the upgrade request, we might ask for additional documentations. Please follow the steps below:

1. Read our report: A report will be sent to your email regarding the information and documents that will need to be revised or added.

2. Refill out the form: We will show you which part of the form and document that will need to be revised. When submitting another request to verify your business, please resubmit all your supporting documents. Documents are only accepted in PDF format and must be less than 10 MB in size.

3. Submit your request: Click “Submit & Request to Upgrade”, and a new status of “Upgrade Account Requested” should appear on this page, indicating that your request has been submitted along with your supporting documents.

Please note that after 3 or more revision processes, you will need longer waiting time to submit your next verification request. We will inform you via email or dashboard when you can do the next submission.

For further inquiries, please contact us at partner@oyindonesia.com and our representative will get in touch.

Status: Rejected

For further inquiries regarding this review, please contact us at partner@oyindonesia.com and our representative will get in touch.

Required Supporting Documents

Below is the list of documentation to be submitted for an upgrade request:

- For Individual type of business

- ID Card

- For Corporate (PJSP) type of business

- Company’s Nomor Pokok Wajib Pajak (NPWP)

- Surat Izin Usaha Perdagangan (SIUP)/ Tanda Daftar Perusahaan (TDP) / Nomor Induk Berusaha (NIB)

- SK Kemenhukam

- Legalized Akta Perubahan Terakhir

- Legalized Akta Pendirian Perseroan

- Director’s National ID Card (KTP)

- Shareholder Structure

- License from BI/OJK

- Pengesahan Kementerian Terkait

- For Corporate (Non PJSP) type of business

- Company’s Nomor Pokok Wajib Pajak (NPWP)

- Surat Izin Usaha Perdagangan (SIUP)/ Tanda Daftar Perusahaan (TDP) / Nomor Induk Berusaha (NIB)

- SK Kemenhukam

- Legalized Akta Perubahan Terakhir

- Legalized Akta Pendirian Perseroan

- Director’s National ID Card (KTP)

- Shareholder Structure

- Pengesahan Kementerian Terkait

Completion/Go-Live Checklist

Once you're ready to execute real money-in and money-out transactions or integrate with OY!, follow the below check-list to ensure you're all set up:

Create an account

Upgrade your account by submitting the required documentations

Have your upgrade request approved

(Required if you want to use our API) Submit your IPs and callback URLs (both for staging and production environment) to your business representative or to partner@oyindonesia.com

(Required if you want to use our API) Request your staging and production API Key to our business representative (note: you are not required to upgrade your account to request staging API Key. Upgrade is only required if you want to request Production API Key).

(Optional) Perform testing. We recommend that you thoroughly test before going live. We’ve provided a Staging Mode in our dashboard, where you can test transactions to understand how our products work, without using real money. If you are a developer, you can also test your integrations.

(Optional) If your company wants to have multiple users: Create additional sub-account users under User Management

OY! Dashboard Tutorial

Login

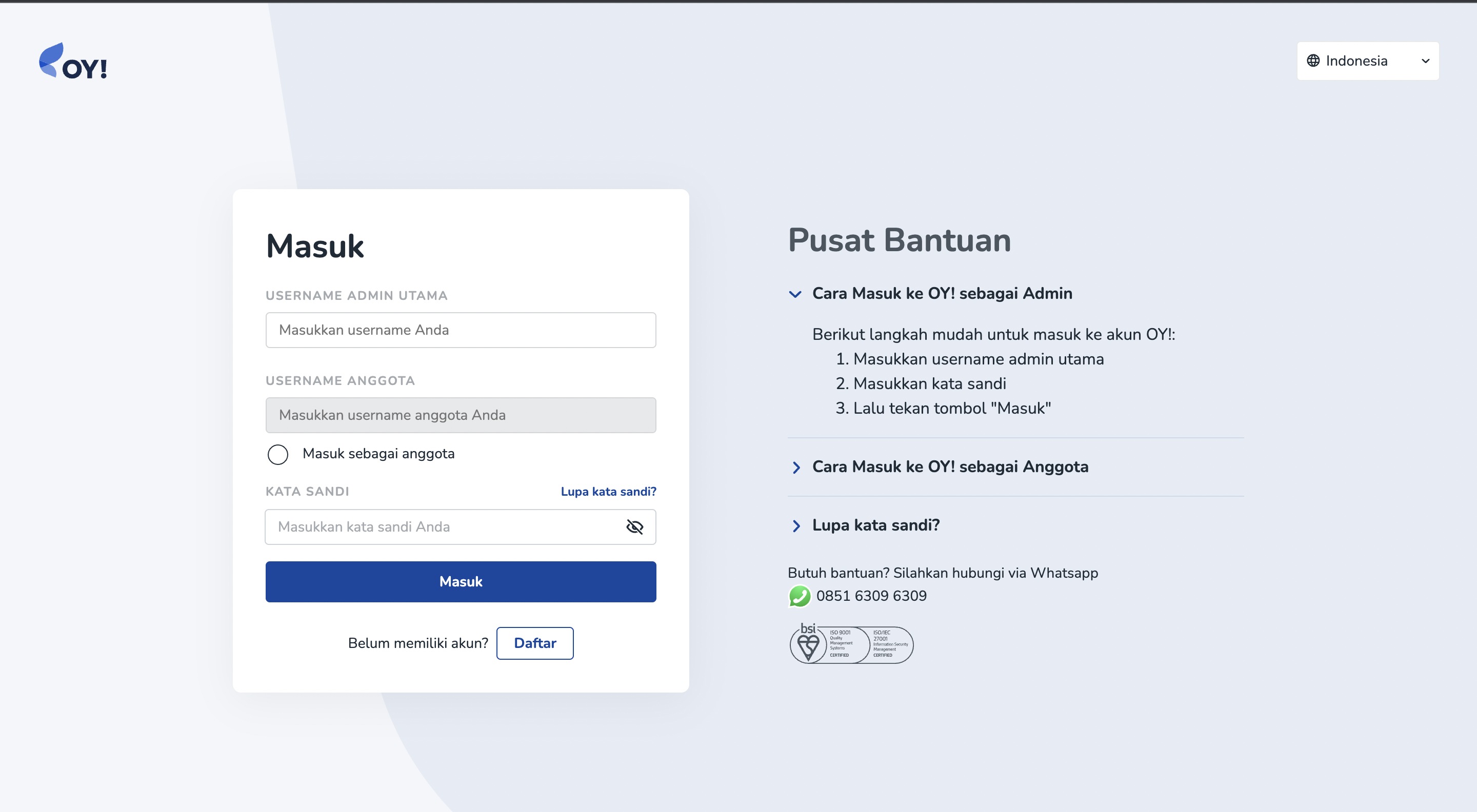

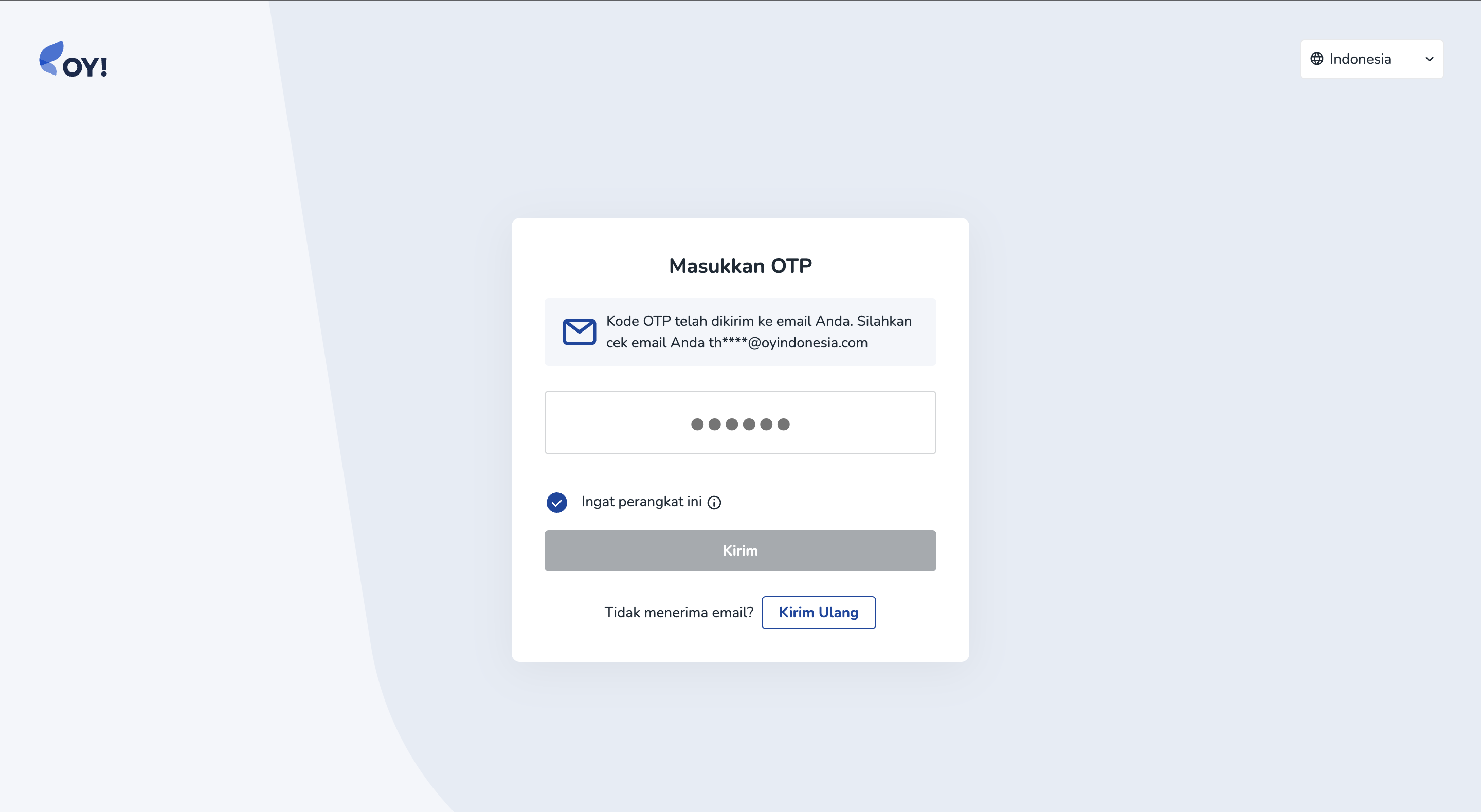

To be able to login to Dashboard;

- Go to https://desktop-business.oyindonesia.com/login.

- Make sure the username and password that you input are correct.

- You will be redirected to the input the OTP page. The OTP will be sent to the email associated with your username. Then, input the OTP number.

If you tick the 'Remember this device' option, you are not required to input an OTP when you log back in next time. Hence, point 2 is required only when you login for the first time after you create your account.

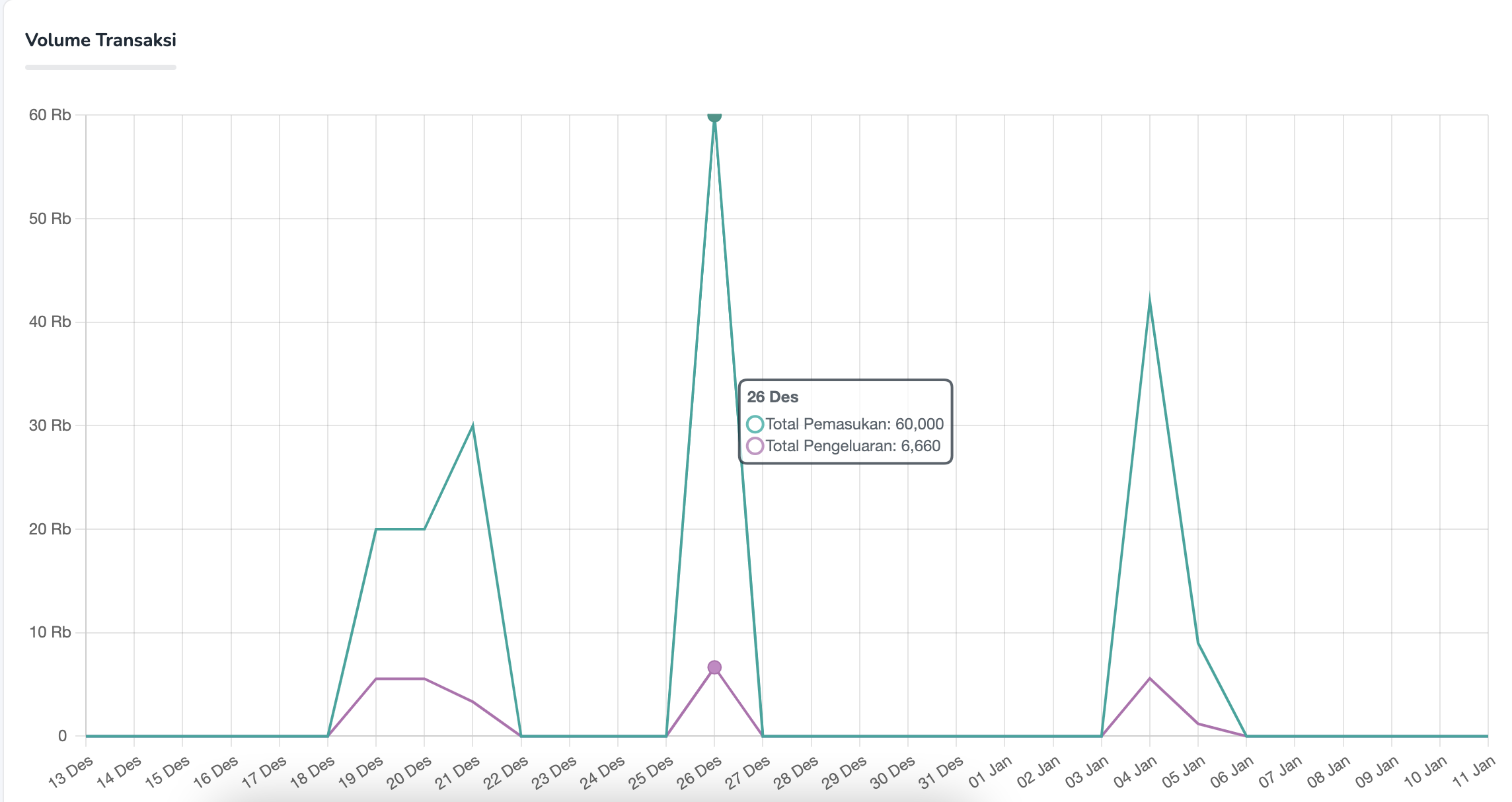

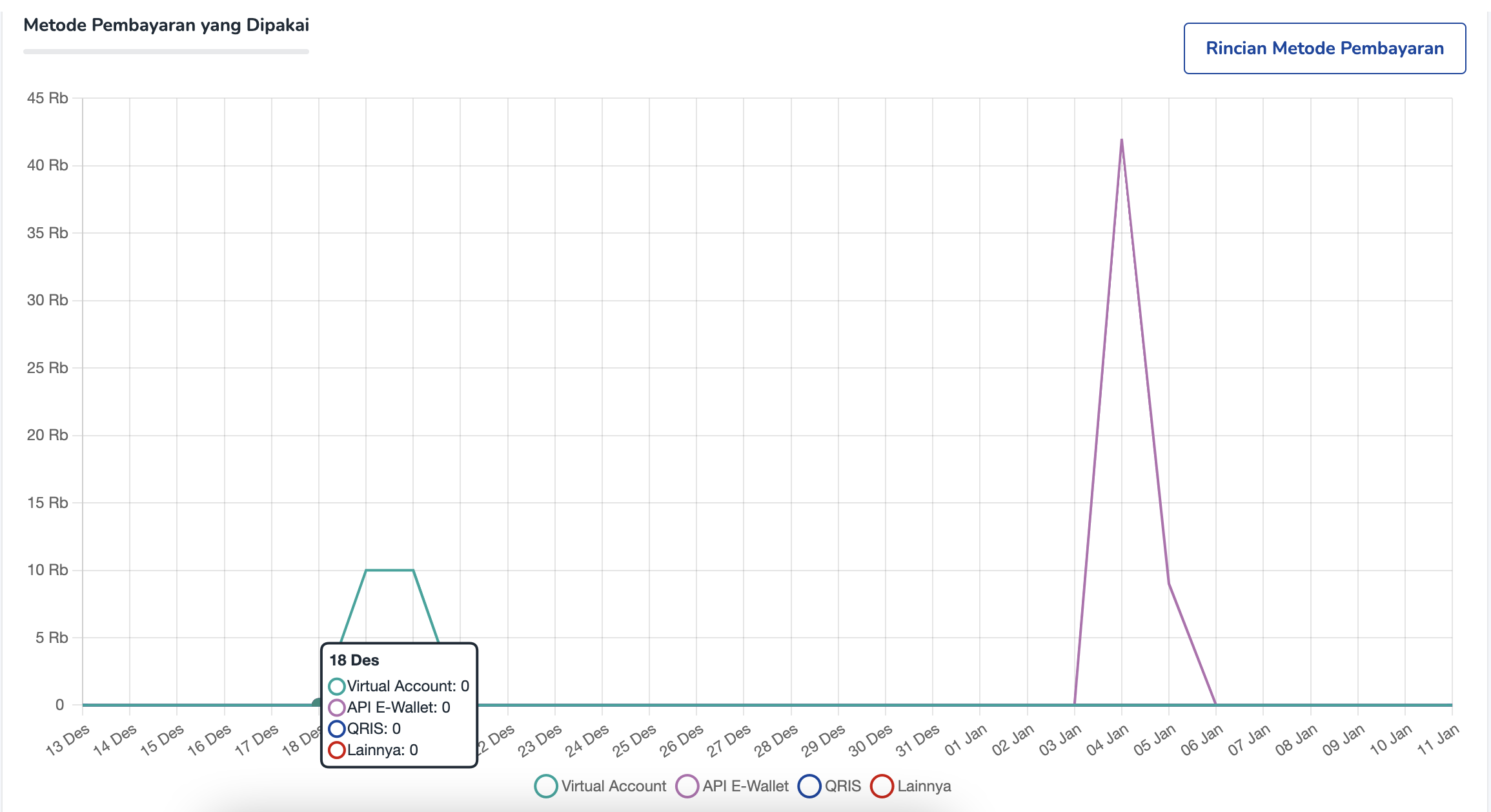

Dashboard Analytics

Analytics feature allows you to get some insights about your earning and spending transaction that happened in OY!. With this feature, you can get information about how much money you have spent and how much money you have earned in a time interval. You can see your transaction growth on daily, weekly, or monthly basis. You also can select the time range. You will get some insights about the trend of your business transaction. Therefore, this feature can help you to generate new business decision to grow your business.

- You can select which time granularity and time period you want to see you transaction growth with.

- The increase and decrease indicator will compare your transaction performance from the time period you select vs the previous period.

- If you put your cursor in a line point, the number of transaction volume will be displayed.

For VA, Payment Link, and E-wallet users. Now you can see the comparison of conversion between each payment method your end users are using. This data can be a great insight for you so you know which channel most of your users are using.

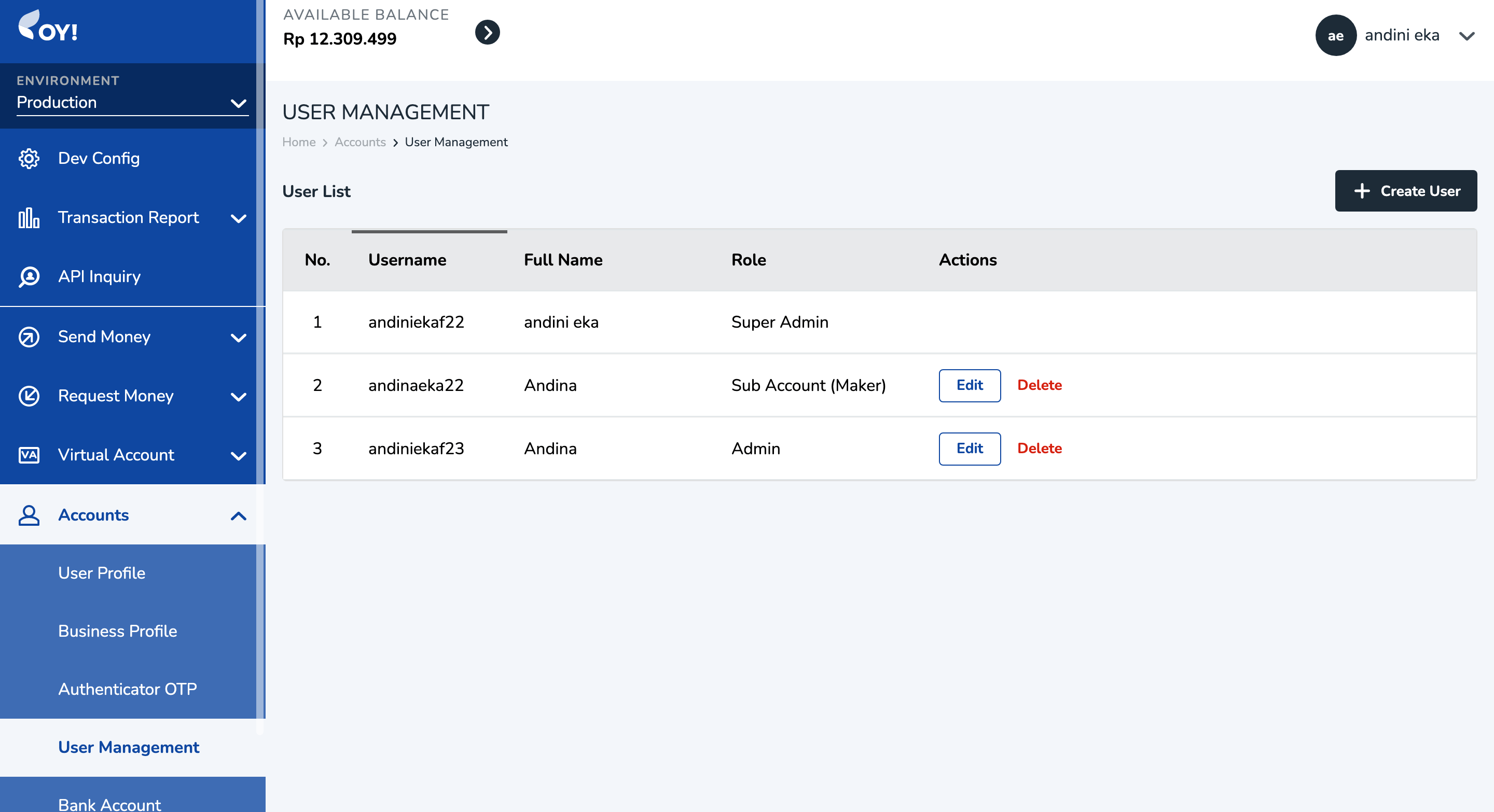

User Management

If you have a Super Admin role, you are able to add account for your team members and define the role for them.

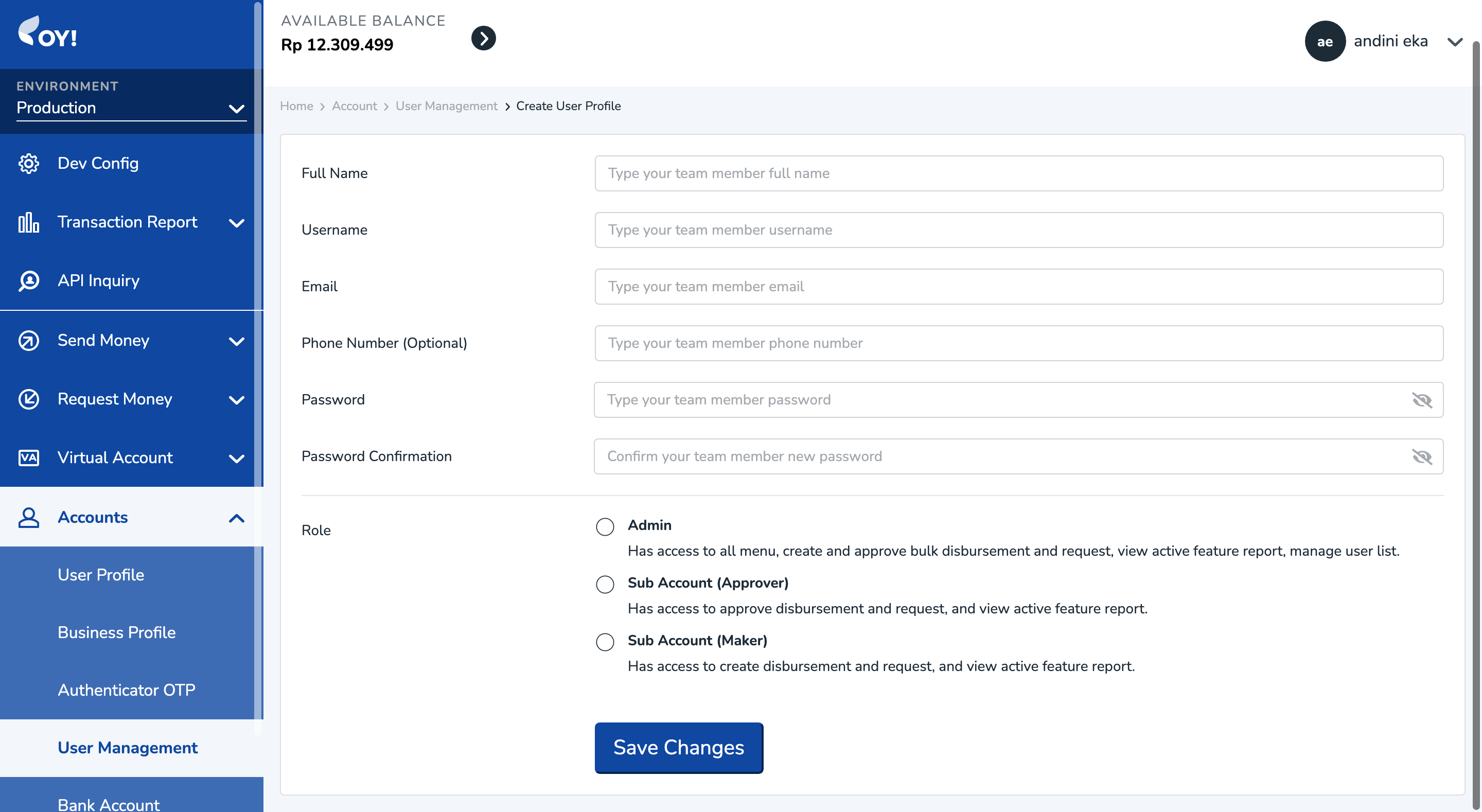

These are the following steps to add new users;

- Login to Dashboard.

- Go to Accounts -> User Management.

- Click the 'Create User' button

- Fill in the full name, username, email, phone number (optional), and password

- Choose the role that you want to assign your team member(s) to. You can select between Admin, Approver, and Maker

Aside from adding new users, a Super Admin is also able to edit and delete their existing users through clicking edit/delete button on the User List table.

Here are the access control matrix in OY! Dashboard:

Dashboard features

| Task | Superadmin | Admin | Approver | Maker |

|---|---|---|---|---|

| Upgrade Account | Can upgrade | Can upgrade | - | - |

| Analytics | Can view | Can view | Can view | Can view |

| Account Statement | Can view and export | Can view and export | Can view and export | Can view and export |

| Settlement Report | Can view and export | Can view and export | Can view and export | Can view and export |

| Top up Balance | Can top up | Can top up | Can top up | Can top up |

| Withdraw Balance | Can withdraw | Can withdraw | Can withdraw | Can withdraw |

| Add User | Can add user | Can add user | - | - |

| User Profile | Can view and edit | Can view and edit | Can view and edit | Can view and edit |

| Business Profile | Can view and edit | Can view and edit | Can view and edit | Can view and edit |

| Authenticator OTP | Has permission | Has permission | Has permission | Has permission |

| Add Payment Method | Can add | Can add | - | - |

| Set up auto report | Can set up | Can set up | - | - |

| Set up auto withdrawal | Can set up | Can set up | - | - |

| Set up multi approval | Can set up | Can set up | - | - |

| Set up notification settings | Can set up | Can set up | - | - |

| Set up developer options | Can set up | Can set up | - | - |

| Add transaction category | Can add | Can add | - | - |

| Config Transaction Receipt | Can config | Can config | Can config | Can config |

Multi Entity Management

| Task | Superadmin | Admin | Approver | Maker |

|---|---|---|---|---|

| Create Sub-entity | Can create | Can create | - | - |

| Top up Sub-entity via Dashboard | Can top up | Can top up | - | - |

| Disconenct Sub-entity | Can disconnect | Can disconnect | - | - |

Bulk Disbursement Product

| Task | Superadmin | Admin | Approver | Maker |

|---|---|---|---|---|

| Create Disbursement Campaign | Can create | Can create | - | Can create |

| Approve Disbursement Campaign | Can approve | Can approve | Can approve | - |

| View and Export Bulk Disbursement Report | Can view and export | Can view and export | Can view and export | Can view and export |

Claim Fund Product

| Task | Superadmin | Admin | Approver | Maker |

|---|---|---|---|---|

| Create Claim Fund | Can create | Can create | - | Can create |

| Approve Claim Fund | Can approve | Can approve | Can approve | - |

| View and Export Claim Fund Report | Can view and export | Can view and export | Can view and export | Can view and export |

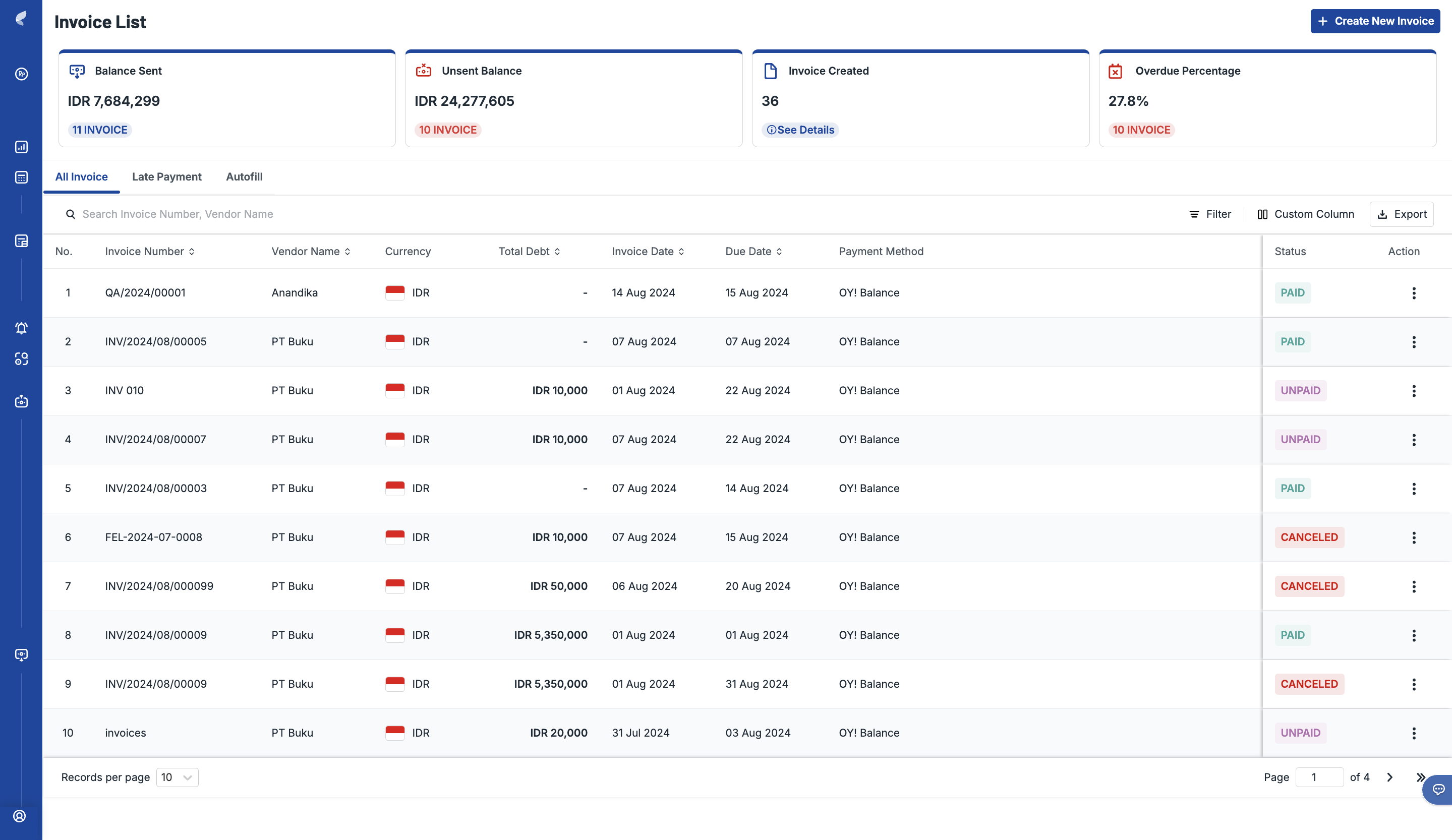

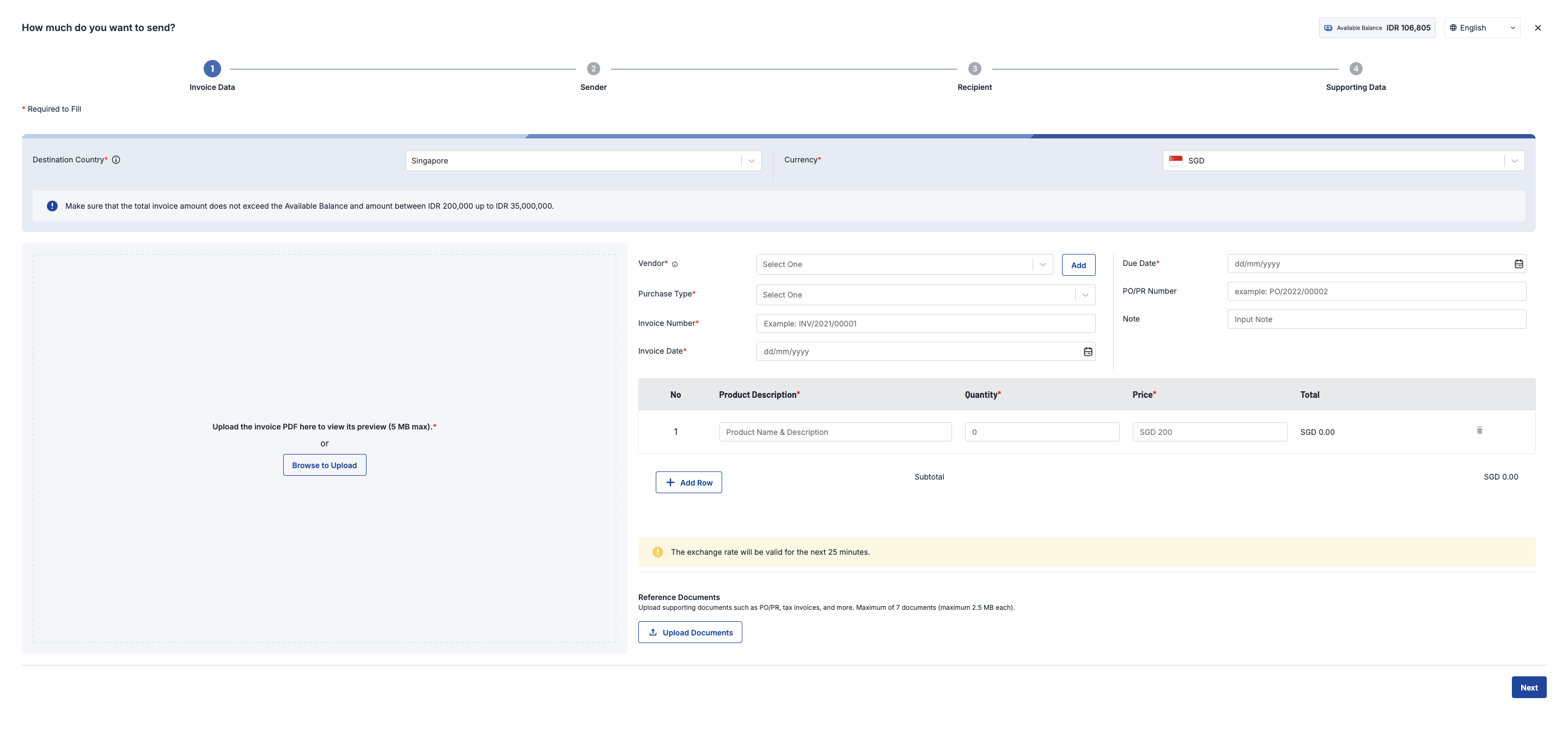

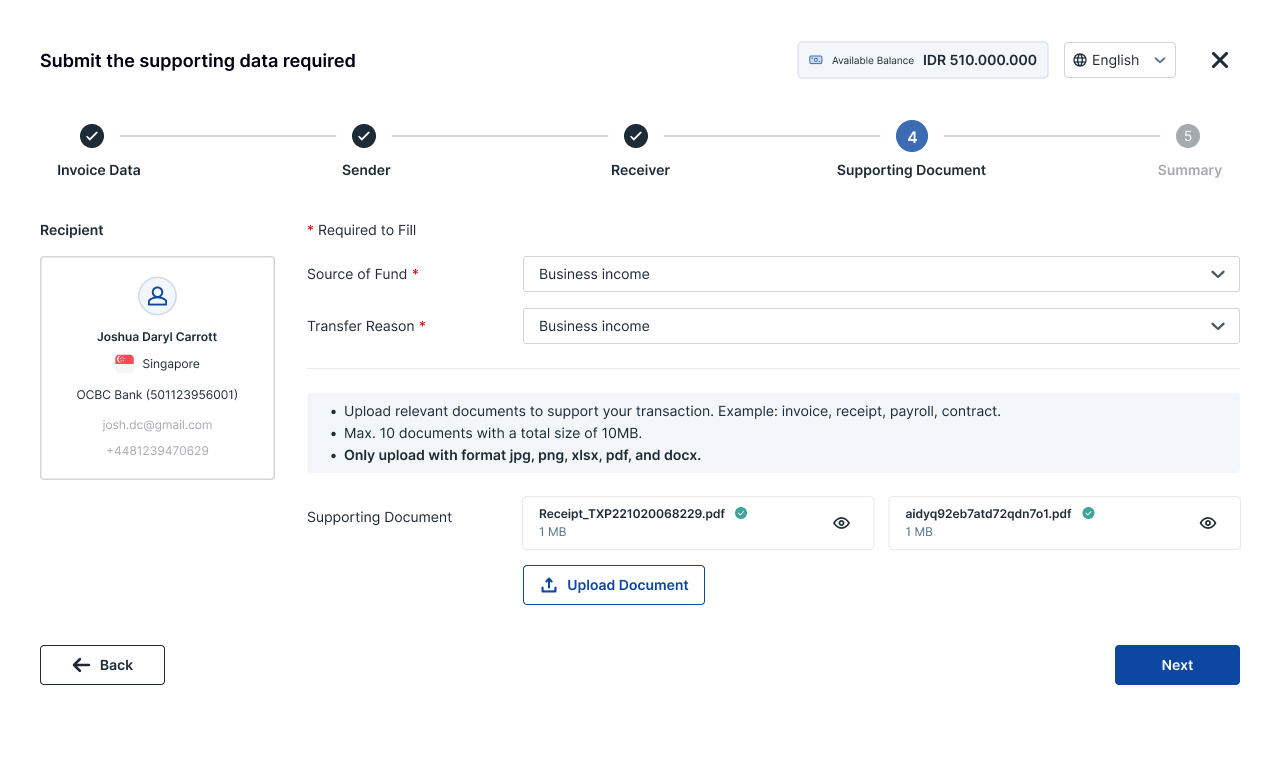

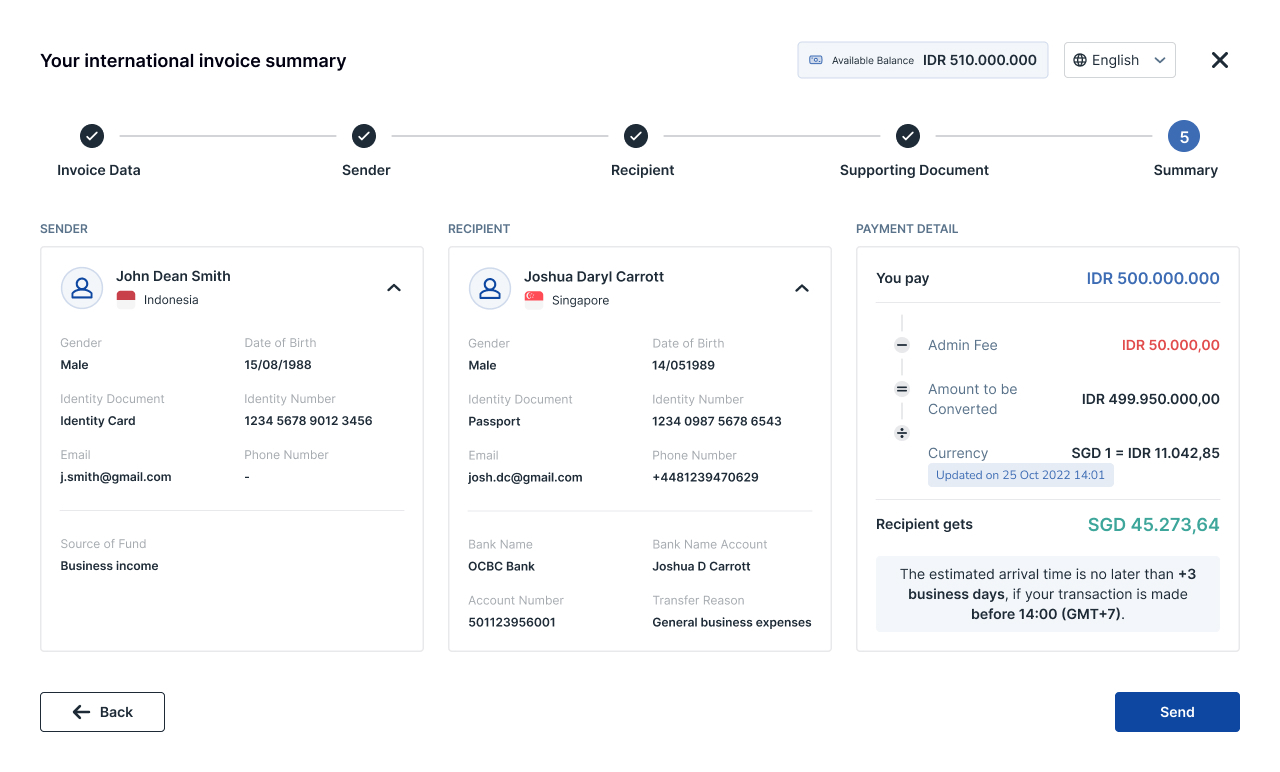

Account Payable Invoice

| Task | Superadmin | Admin | Approver | Maker |

|---|---|---|---|---|

| Create AP Invoice | Can create | Can create | - | Can create |

| Approve AP Invoice | Can approve | Can approve | Can approve | - |

| View and Export AP Report | Can view and export | Can view and export | Can view and export | Can view and export |

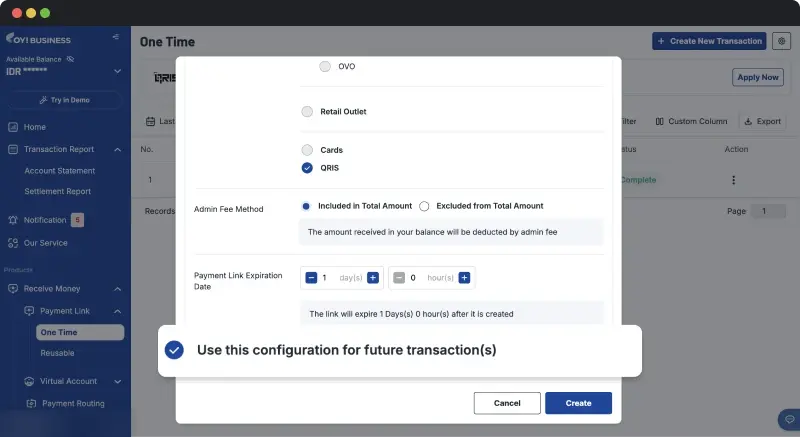

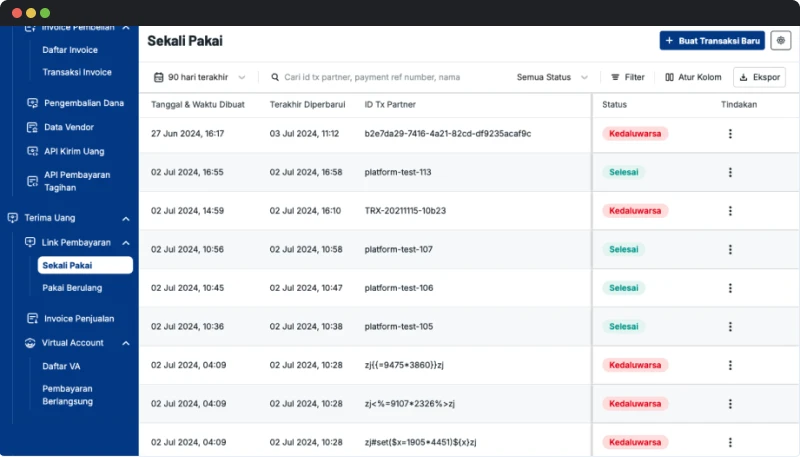

Payment Link One time and Reusable Product

| Task | Superadmin | Admin | Approver | Maker |

|---|---|---|---|---|

| Create Payment Link | Can create | Can create | Can Create | Can create |

| View and Export Payment Link Report | Can view and export | Can view and export | Can view and export | Can view and export |

Virtual Account

| Task | Superadmin | Admin | Approver | Maker |

|---|---|---|---|---|

| Create VA via Dashboard | Can create | Can create | Can Create | Can create |

| View and Export VA Report | Can view and export | Can view and export | Can view and export | Can view and export |

E-Wallet Aggregator

| Task | Superadmin | Admin | Approver | Maker |

|---|---|---|---|---|

| View and Export E-Wallet Report | Can view and export | Can view and export | Can view and export | Can view and export |

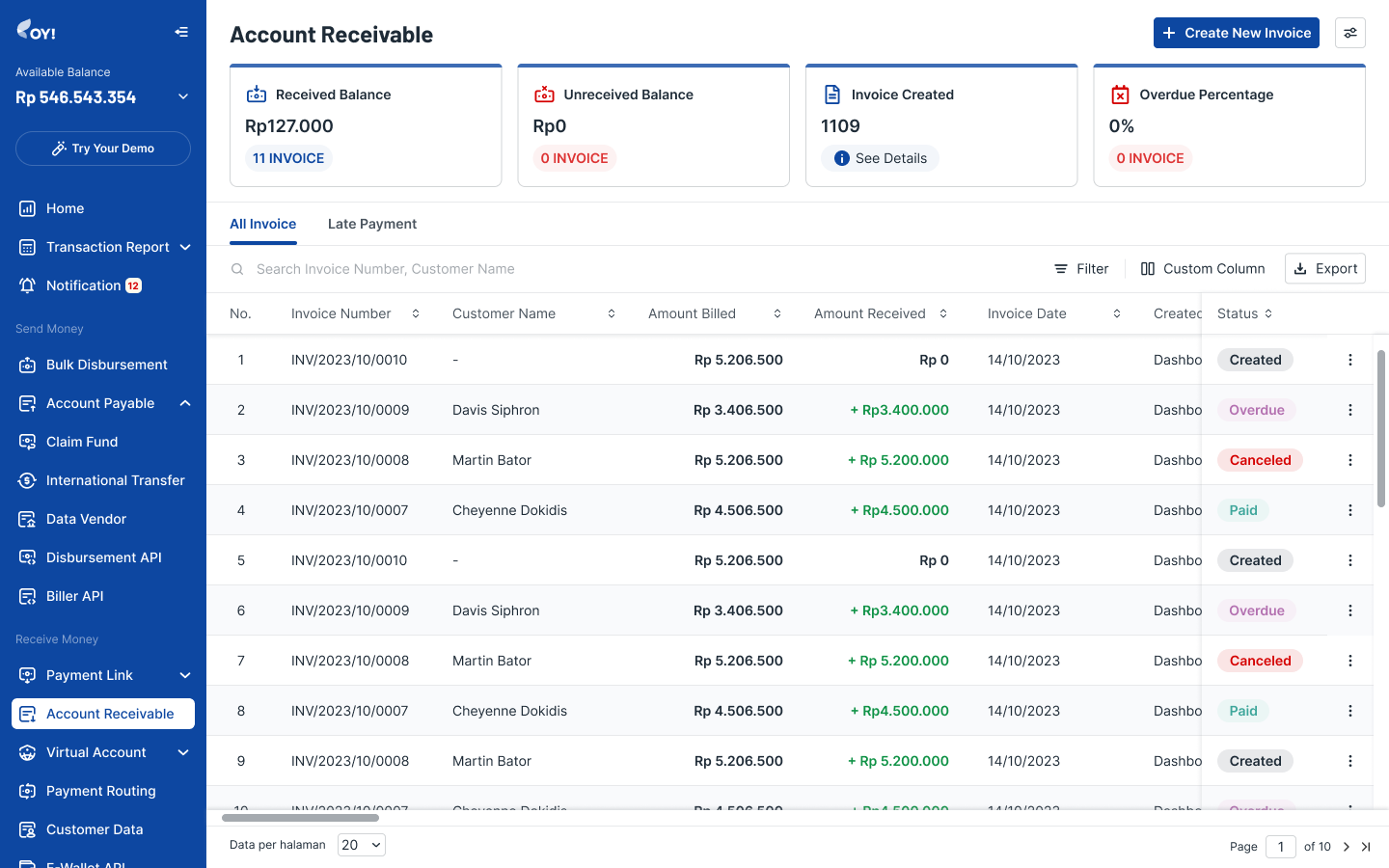

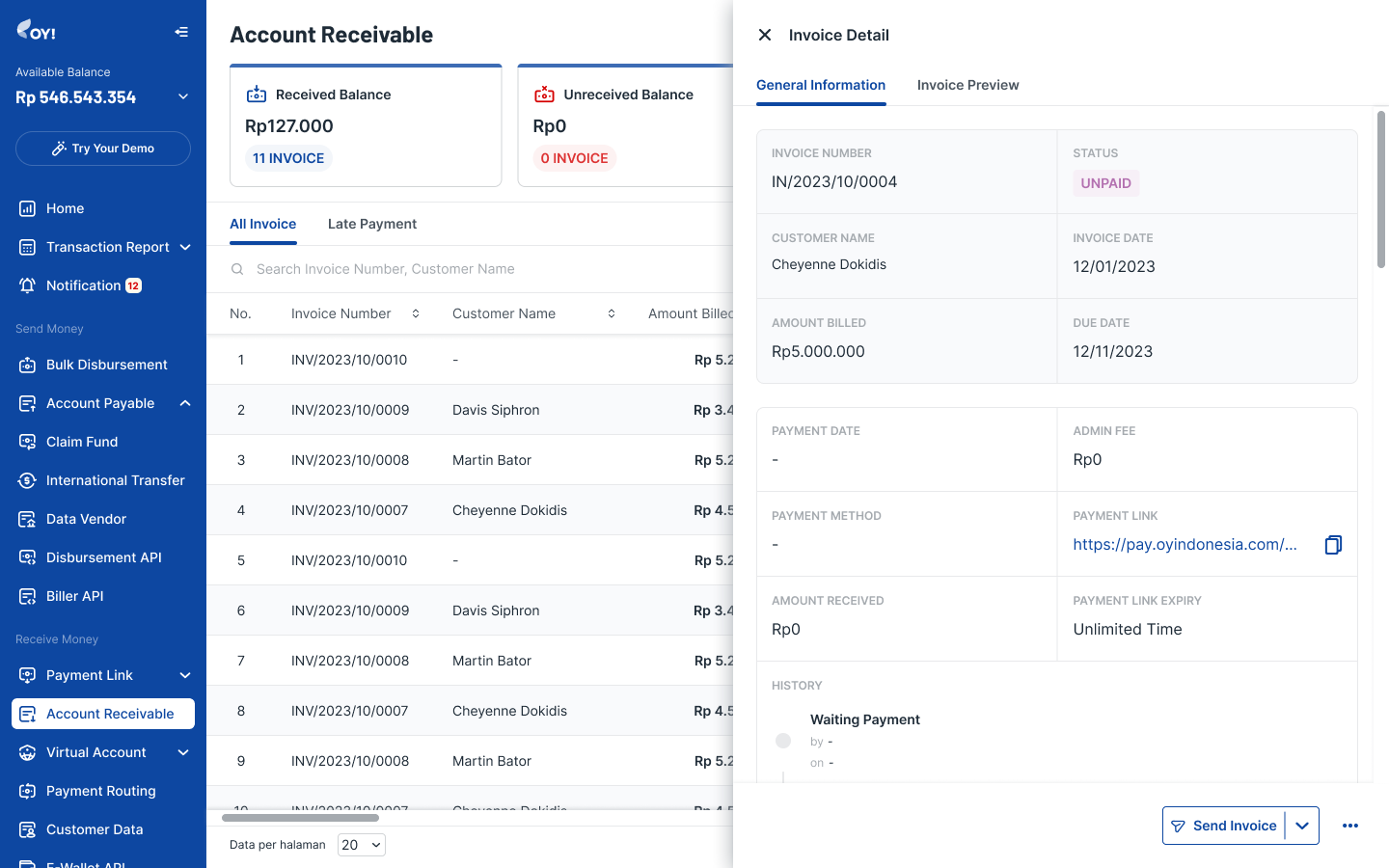

Account Receivable Invoice

| Task | Superadmin | Admin | Approver | Maker |

|---|---|---|---|---|

| Create AR Invoice | Can create | Can create | Can create | Can create |

| View and Export AP Report | Can view and export | Can view and export | Can view and export | Can view and export |

API Inquiry

| Task | Superadmin | Admin | Approver | Maker |

|---|---|---|---|---|

| View and Export API Inquiry Report | Can view and export | Can view and export | Can view and export | Can view and export |

API Transaction Data

| Task | Superadmin | Admin | Approver | Maker |

|---|---|---|---|---|

| View and Export API Transaction Data Report | Can view and export | Can view and export | Can view and export | Can view and export |

2-Factor Authentication

To increase the security of your account, you can set up 2-factor Authentication. Currently, the security method that OY provides is through an authenticator app

These are the following steps to set up the 2-factor authentication;

- Login to Dashboard.

- Go to Accounts -> Authenticator OTP.

- Download Authenticator App in your smartphone (from Play Store/App Store) or PC (you can download an extension for your browser). Examples of the app: Google Authenticator, Microsoft Authenticator, Authy, etc

- Scan the barcode displayed on your OY Dashboard with your Authenticator App OR enter the setup key displayed next to it on your Authenticator App.

- Please type in the 6-numerical code displayed on your Authenticator App in the 'Authenticator OTP' on OY Dashboard.

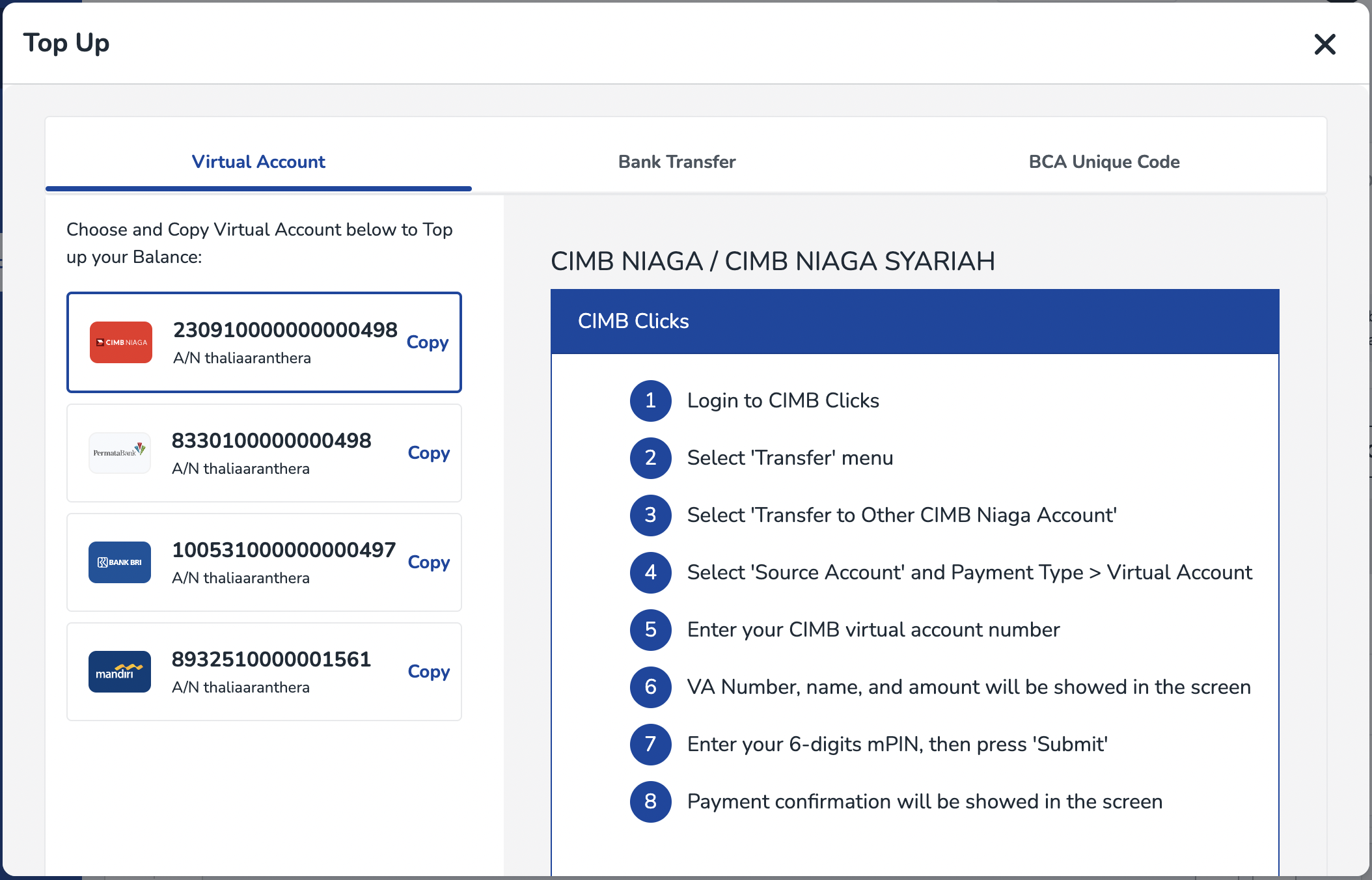

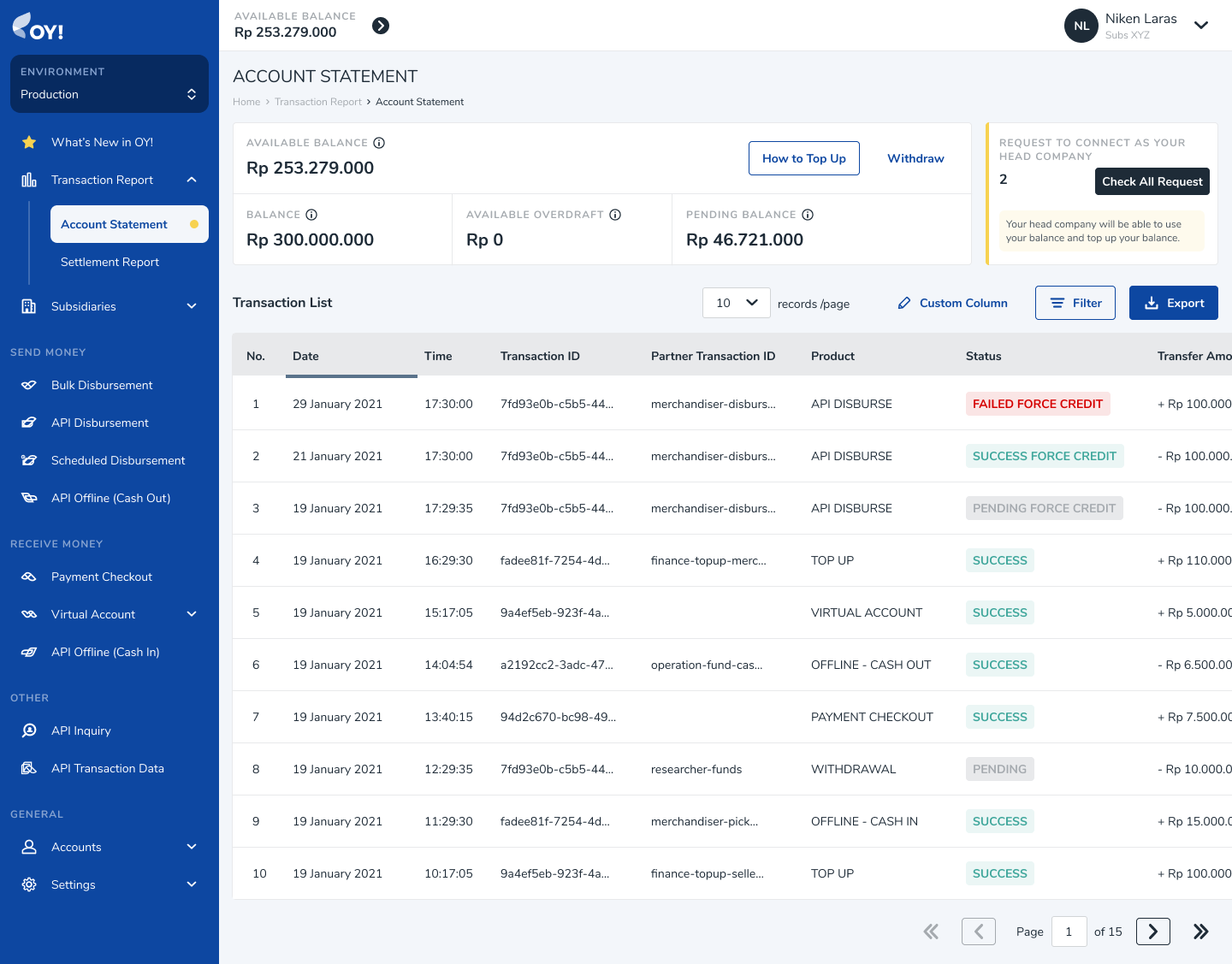

Top Up

Top up is used to add balance to your OY account.

Here's how you can access the top-up menu on your dashboard;

- Login to Dashboard.

- Go to Transaction Report -> Account Statement.

- Click the 'How To Top Up' button. There are 2 ways in which you can top up your OY account:

Top Up via Virtual Account

The Virtual Account number information can be found on 'How to Top Up Balance via VA' tab once you click the 'How To Top Up' button. If you choose to top up via VA, the topped up amount will be credited into your account real-time and you do not need to send any manual confirmation to OY

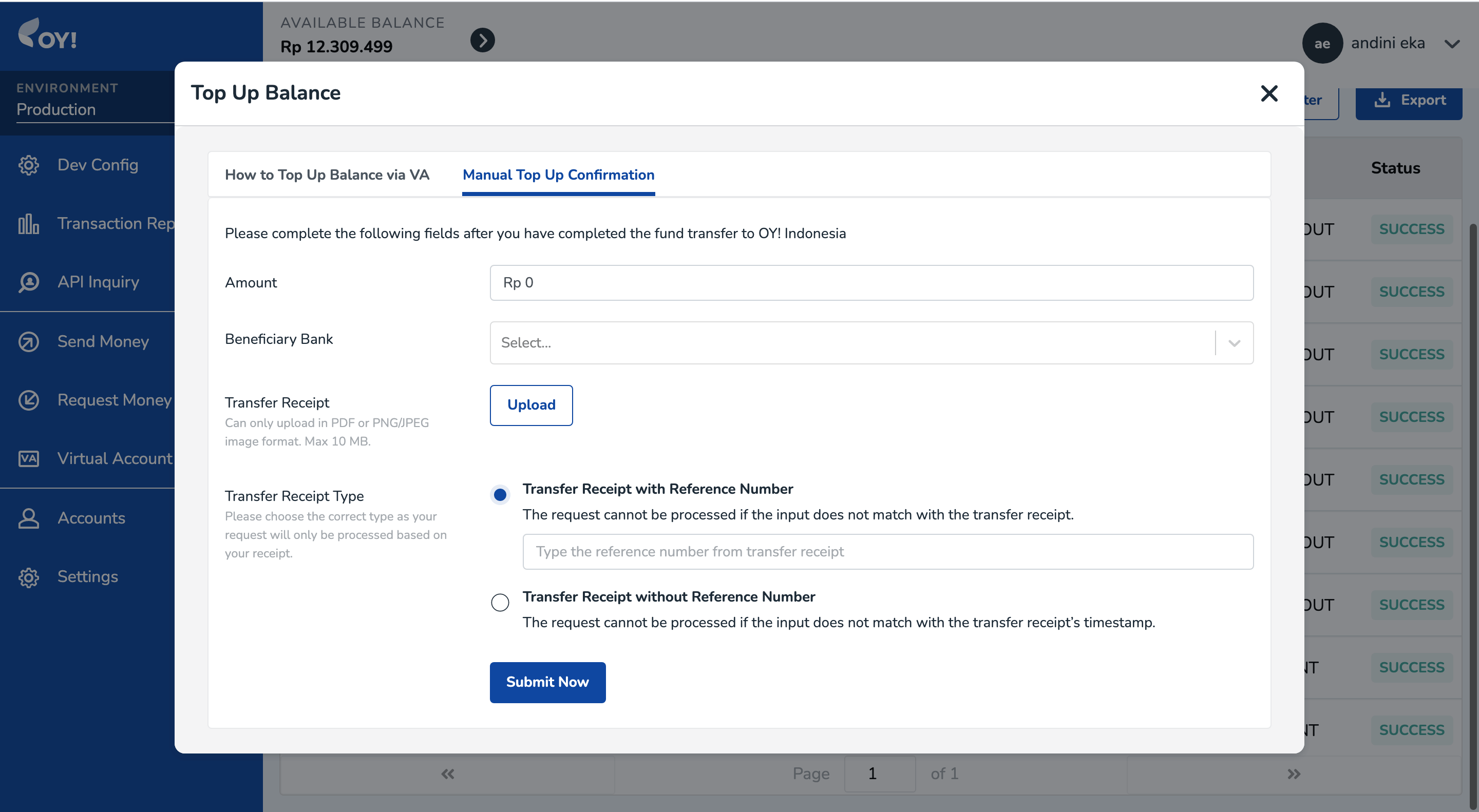

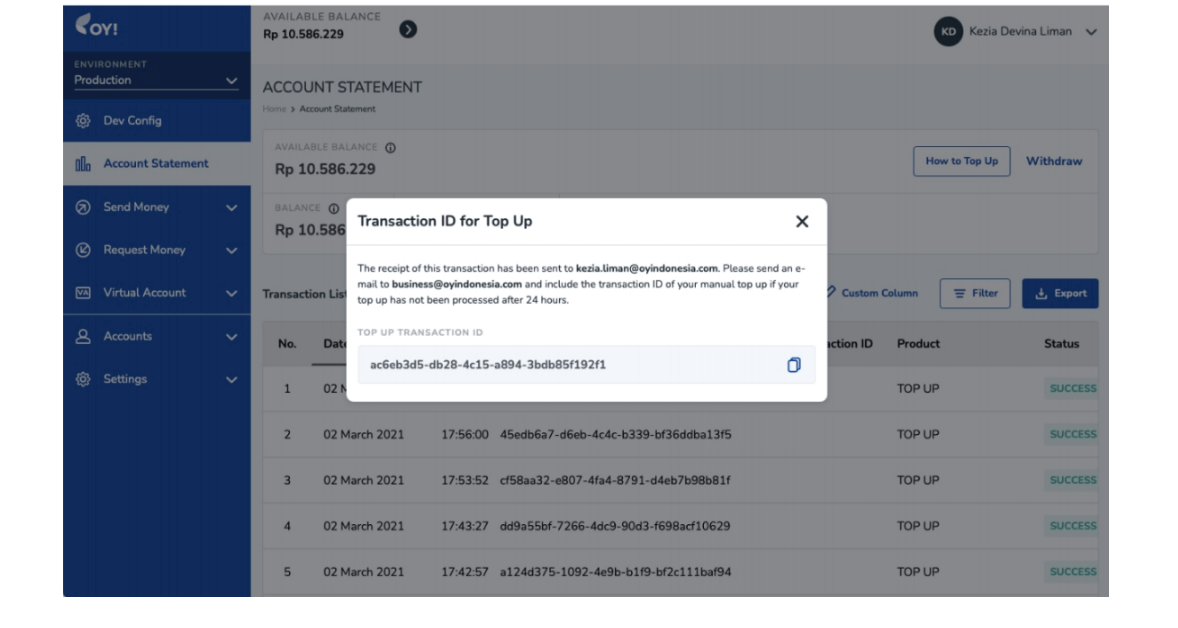

Manual Top Up via Bank Transfer

Aside from Virtual Account, you can also transfer the top up money to OY's giro account. If you choose to top up via this method, you need to perform a manual confirmation in order that your money can be credited into your account.

After you have completed the fund transfer to OY! Indonesia, you need to perform the following steps;

- Click the 'Manual Top Up Confirmation' tab on the top-up menu

- Fill in the fields with the following information;

| Field Name | Description |

|---|---|

| Amount | The amount that you have topped up (as per written in the Bukti Transfer) |

| Beneficiary Bank | A dropdown where you can choose to which bank you have transferred the top up amount to |

| Transfer Receipt | Click the upload button to upload the Bukti Transfer obtained after you have successfully performed the transfer. Can be in PDF, PNG, or JPEG format, with max. file size 10 MB |

| Transfer Receipt Type | Transfer Receipt with Reference Number --> If your uploaded transfer receipt displays the reference number, you need to choose this option. Transfer Receipt without Reference Number --> If your uploaded transfer receipt doesn't display the reference number, you need to choose this option and fill in the date & timestamp according to your Bukti Transfer. |

- Click 'Submit Now'

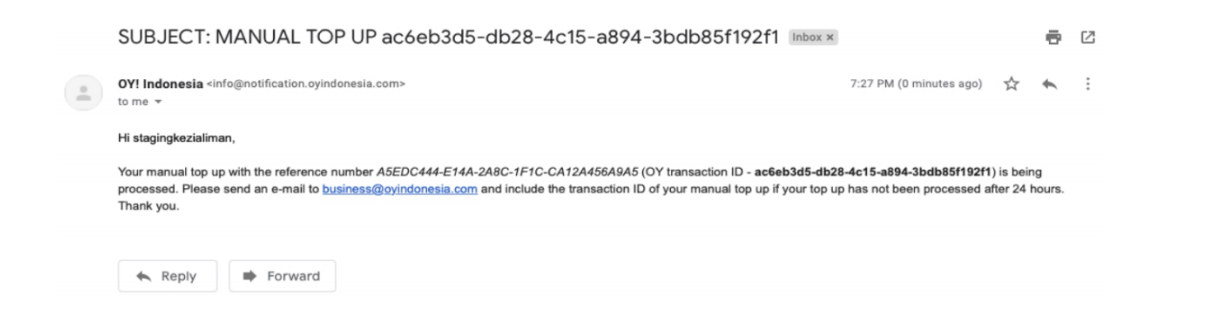

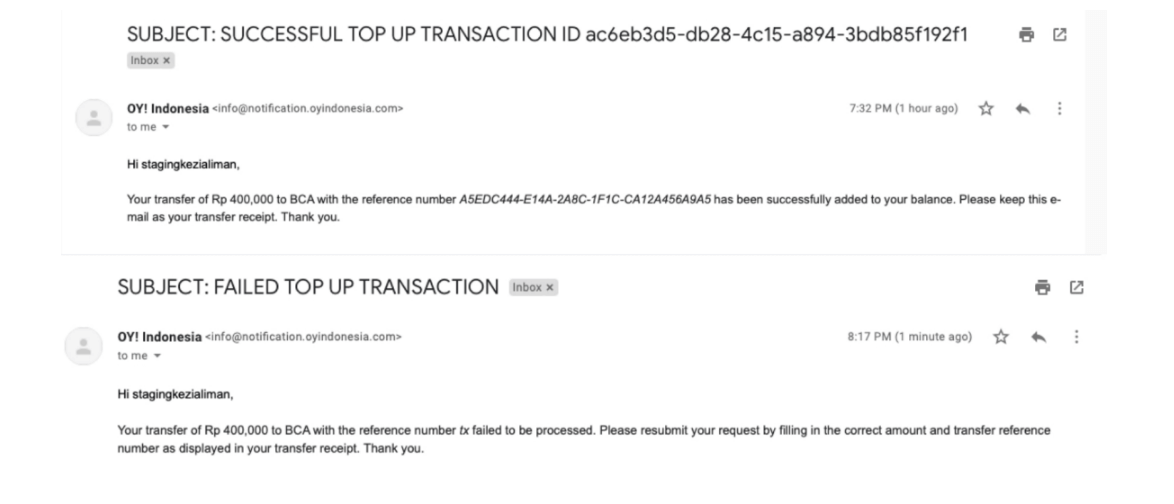

- You will receive a receipt of your transaction in your email, stating that your transaction is currently being processed

- You will receive an email confirming whether your top up is success or failed

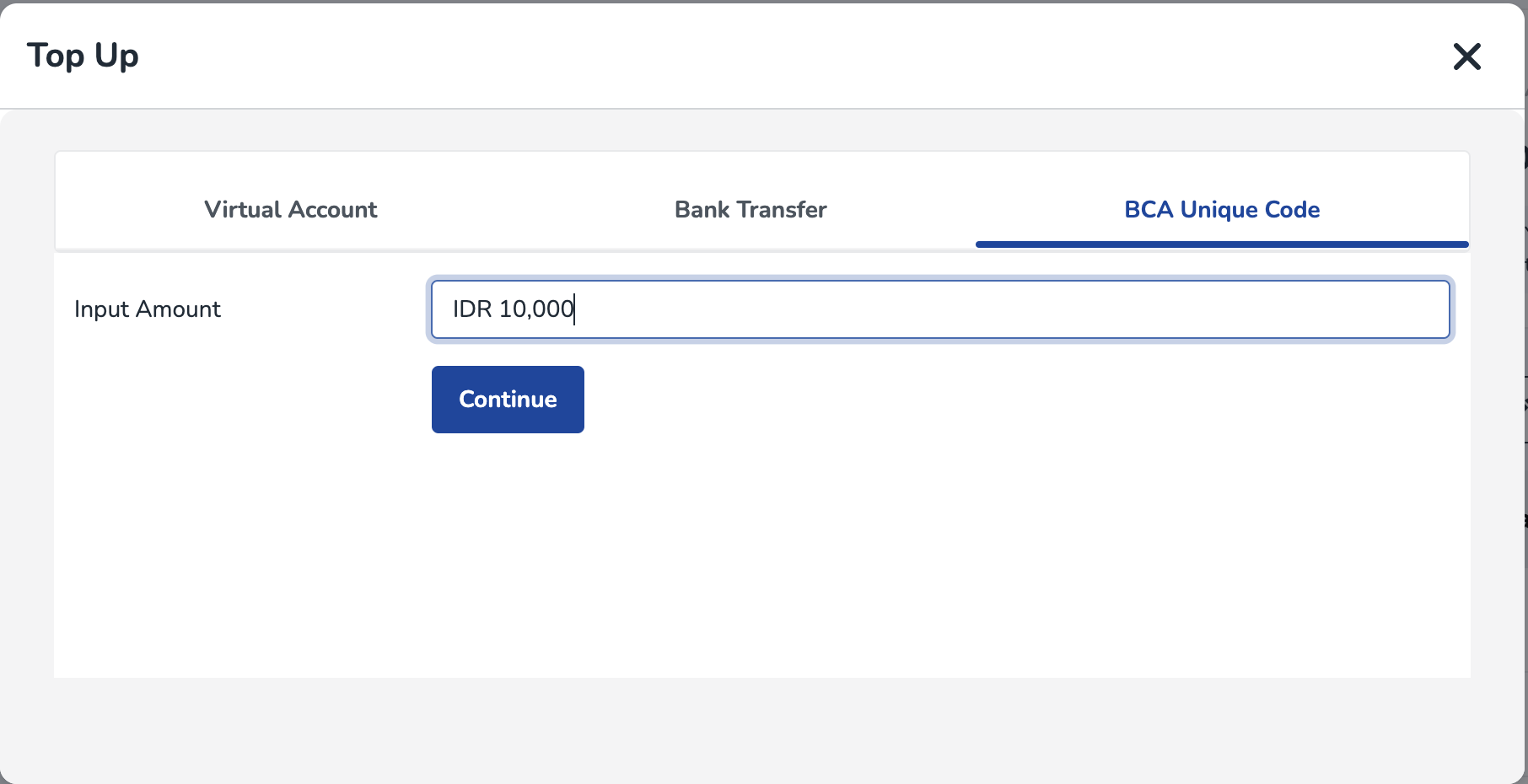

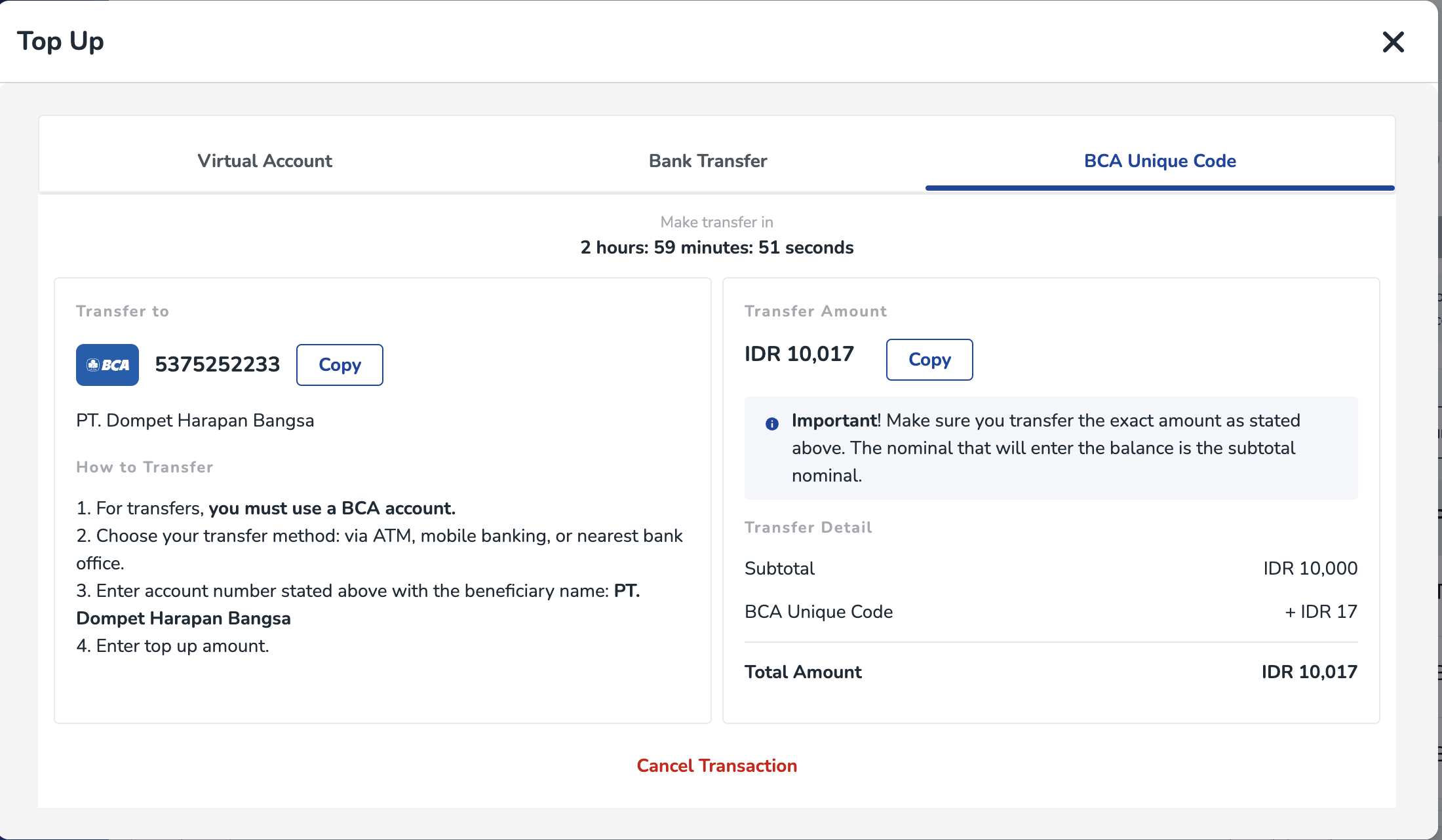

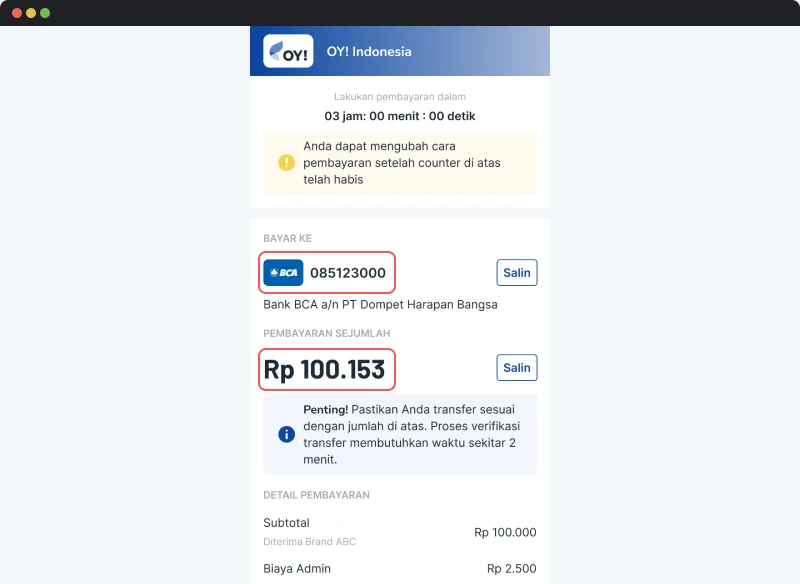

Top Up using BCA with Unique Code

Now, we provide you with a new method for BCA. Top-up using BCA with a unique code allows you to top up your balance in a real-time manner. You do not have to confirm manually as we will automatically detect your top-up and reflect it to your balance.

Steps:

- In the top up page, click on the “BCA Unique Code” tab.

- Input the amount you want to top up. Note : The minimum amount that we allow for this method is IDR10,000.

- OY! will display the amount you input PLUS three-digits unique code generated by us. Transfer the exact nominal that appeared on the screen to the bank account stated on the page. Please make sure to use BCA bank account.

- After the transaction is successful, the ORIGINAL AMOUNT will be reflected in your balance. Note : The operational hour for this method is every day, from 3.01 AM to 8.00 PM. Outside those hours, this method will be closed.

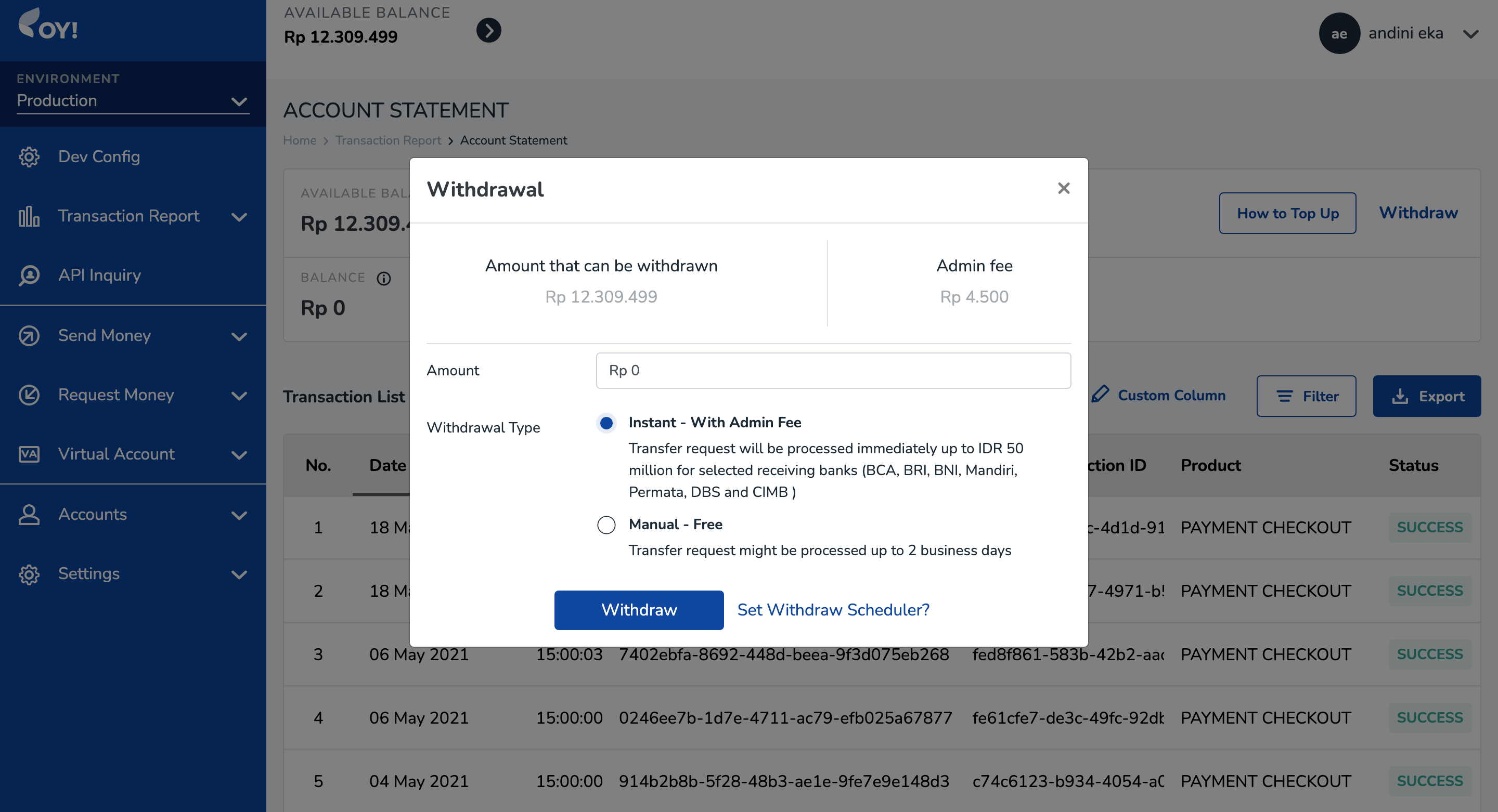

Withdrawal

When you want to withdraw, do the following steps:

- Go to Transaction Report -> Account Statement

- Click Withdraw

- Fill in the amount that you want to withdraw

- Choose your withdrawal type. You can pick one from the following options:

- Instant with admin fee -> This means that your withdrawal will be processed and arrive into your receiving bank real-time. If the amount to be withdrawn is <= IDR 50 million and the receiving banks are BCA, BRI, BNI, Mandiri, Permata, DBS and CIMB Niaga, you can choose this option. You will be charged an admin fee if you choose this option

- Manual -> This means that your withdrawal will be processed up to 2 business days. If the amount to be withdrawn is > IDR 50 million OR the receiving banks are not BCA, BRI, BNI, Mandiri, Permata, DBS or CIMB Niaga, you have to choose this option. You will NOT be charged an admin fee if you choose this option.

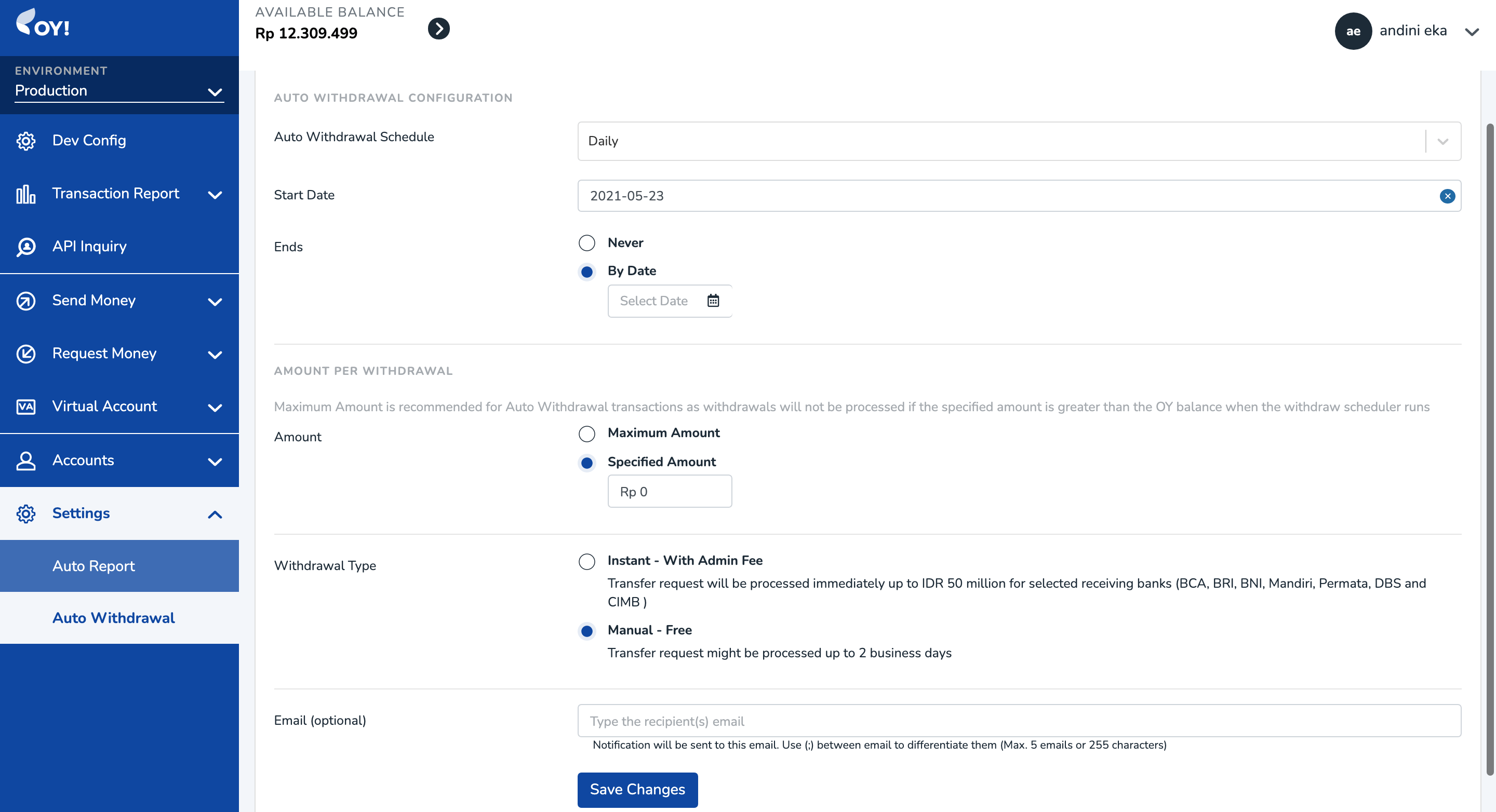

Setting Up Auto Withdrawal Process

If you want to set up an Auto Withdrawal periodically, go to Settings -> Auto Withdrawal.

Here's how you can configure the auto withdrawal settings;

| Field Name | Description |

|---|---|

| Auto Withdrawal Schedule | The schedule of your auto withdrawal. Options available: Daily, Weekly, Bi-Weekly, Monthly |

| Start Date | Start date of your auto withdrawal schedule |

| Ends | Options available: Never -> if the auto withdrawal will go on for an indefinite time, By Date -> if the auto withdrawal will end on a specific date. If you choose this option, you need to fill in the date on which you plan to end the auto withdrawal process |

| Amount | Amount to be automatically withdrawn. Options available: Maxiitym amount -> Withdraw the maximum available balance, Specified Amount -> custom specified amount. Note: Maximum Amount is recommended for Auto Withdrawal transactions as withdrawals will not be processed if the specified amount is greater than the OY balance when the withdraw scheduler runs |

| Withdrawal Type | Options available: 1) Instant, or 2) Manual. |

| An email we will send the notification to. Use (;) between email to differentiate them (Max. 5 emails can be inputted) |

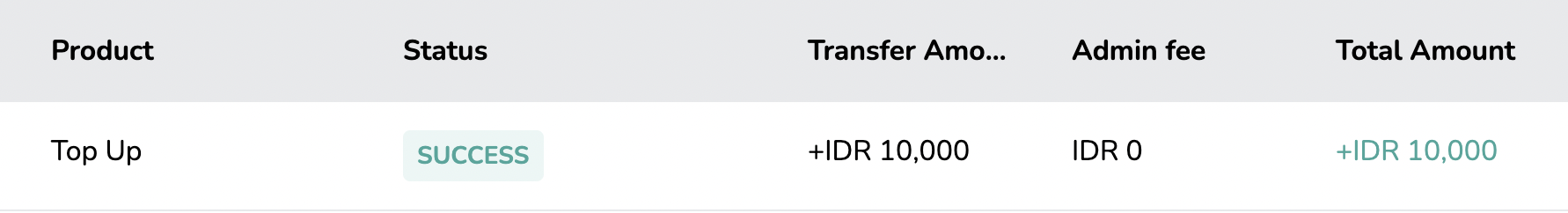

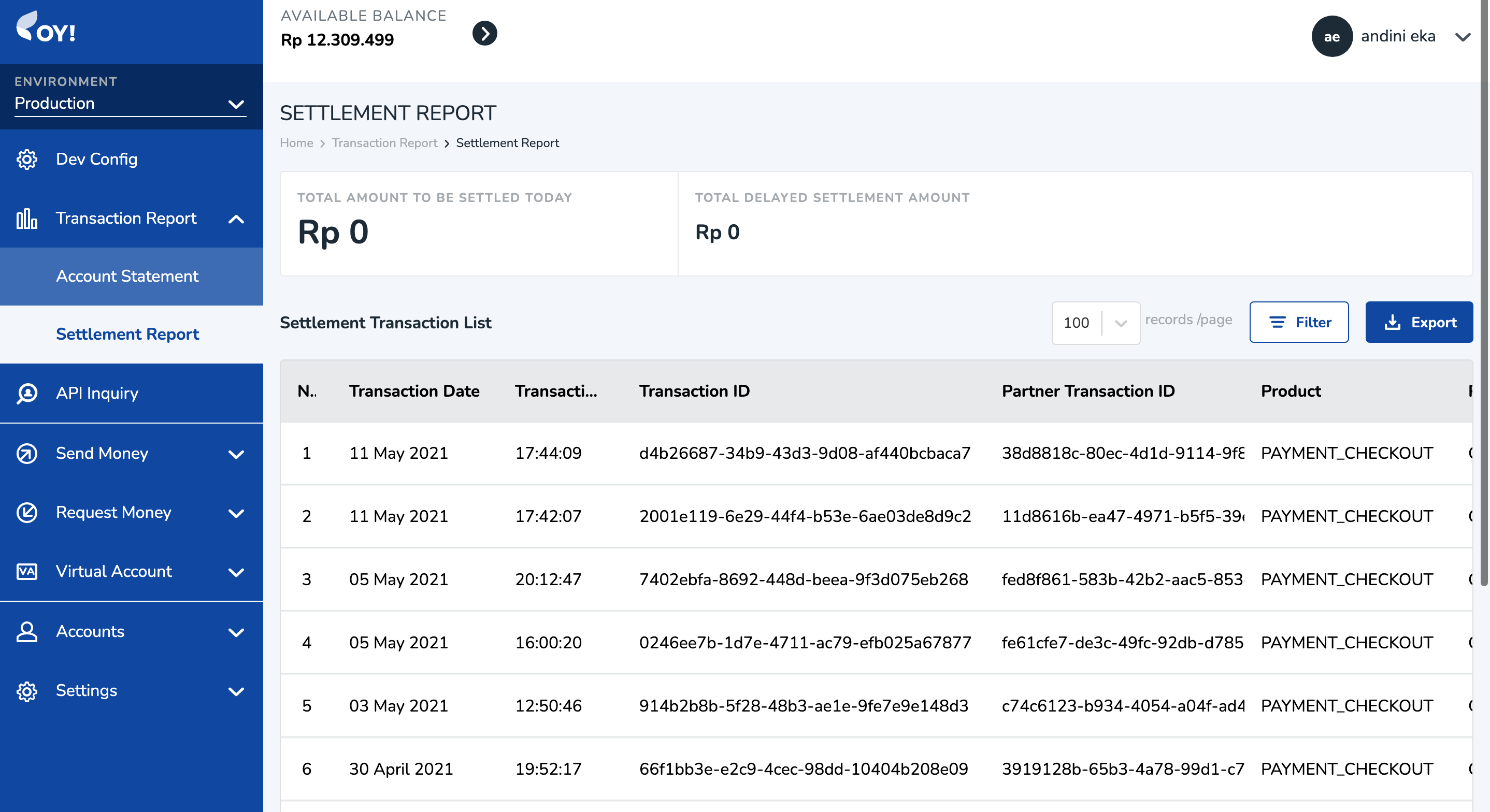

Transaction Report - Settlement Report

Settlement Report stores the list of transactions corresponding to payment methods that are not settled on a real-time basis (delayed settlement). For example, if for VA BCA the settlement time is H+2, each new VA BCA transaction performed by your customers will appear on the Settlement Report.

To access the Settlement report;

- Login to Dashboard

- Go to Transaction Report -> Settlement Report

The Settlement Report consists of the following information;

- Total Amount to be Settled Today: This tells you the sum of amount scheduled to be settled to your account statement balance today

- Total Delayed Settlement Amount: This tells you the sum of amount not yet settled to your account statement. (the settlement status is still not SUCCESS)

- The Settlement Transaction List Table

| Field Name | Description | Example |

|---|---|---|

| Transaction Date | The date on which your customer performs the transaction | 11 May 2021 |

| Transaction Time | The time at which your customer performs the transaction | 17:44:09 |

| Transaction ID | A unique transaction ID given by OY | d4b26687-34b9-43d3-9d08-af440bcbaca7 |

| Partner Transaction ID | A unique transaction ID that is assigned by you for a given transaction | TXID_001 |

| Product | The product associated with a given transaction. This will be filled with VIRTUAL_ACCOUNT if the transaction comes from Virtual Account Aggregator product, or PAYMENT_CHECKOUT if the transaction comes from Payment Link product | VIRTUAL_ACCOUNT |

| Payment Method | The payment method associated with a given transaction. Possible values: VA [Bank Name], CARDS, QRIS, EWALLET SHOPEEPAY | VA BCA |

| Transfer Amount | The transaction amount (before getting deducted with admin fee | +Rp 10.000 |

| Admin Fee | The admin fee associated with a given transaction | -Rp 1.000 |

| Total Amount | The transaction amount that has been deducted with admin fee | +9,000 |

| Settlement Date | The scheduled settlement date for a given transaction | 12 May 2021 |

| Settlement Time | The scheduled settlement timestamp for a given transaction | 15:00:00 |

| Settlement Status | The settlement status for a given transaction. Possible values: WAITING (if the amount is not yet settled to your account statement balance), SUCCESS (if the amount has been settled to your account statement balance). | SUCCESS |

If the Settlement Status of a transaction is still WAITING, it will not yet appear as a row in your Account Statement report and the amount will not yet be added in your Account Statement balance.

If the Settlement Status of a transaction is already SUCCESS, it will appear as a row in your Account Statement report and the amount will be added in your Account Statement balance.

Callback for Delayed Settlement (Non-Real Time Settlement)

If your settlement is non-real time, for every transaction whose payment method is settled H+>0, you will receive two callbacks with details as follows:

- 1st Callback -> To be sent after your customer successfully executes the transaction. For example, if your customer executes the transaction on 11 May 2021 at 14:00:00, that is also when we send the 1st Callback to you. In the 1st callback, the settlement status is set to WAITING (because it is not yet settled to your Account Statement balance)

- 2nd Callback -> To be sent after the settlement status is changed from WAITING into SUCCESS. For example, if the settlement status is changed into SUCCESS on 12 May 2021 at 15:00:00, that is also when we send the 2nd Callback to you. In the 2nd callback, the settlement status is SUCCESS

Capability to Export and Filter the Settlement Report

Export: You are able to export/download the settlement report in CSV, PDF, and XLSX.

Filter: You are able to filter the settlement report by transaction date (range), product, payment method, settlement date (range), and settlement status

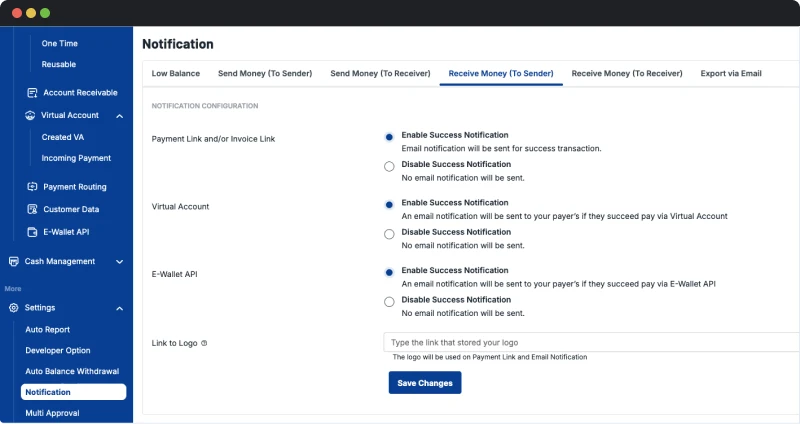

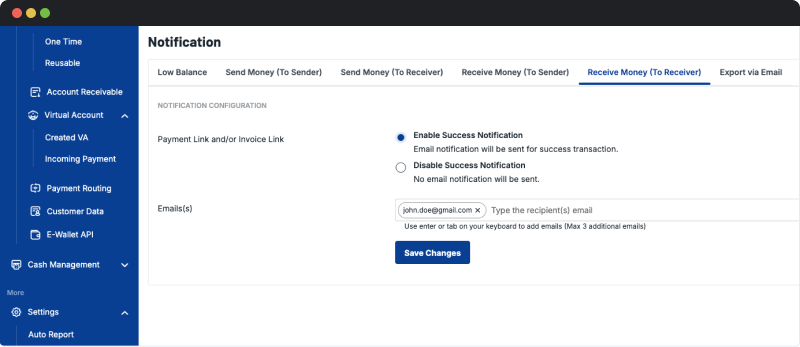

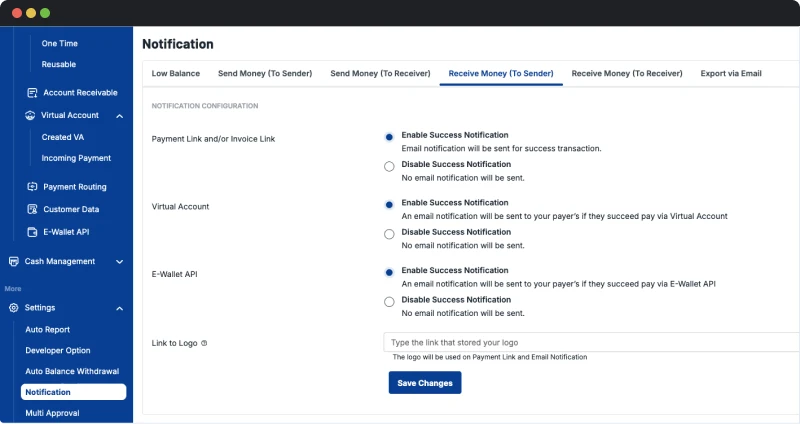

Notification

You can enable or disable notification settings for low balance, send money products and receive money products if you have a super admin or admin role:

- Login to dashboard https://business.oyindonesia.com/

- Go to Settings -> Notification

- If you want to notified by email if your balance is low, set in the "Low Balance" tab. Input the amount threshold and the email where the notification will be sent to.

- Choose whether or not you want notifications enabled or disabled for Bulk Disbursement or API Disbursement. a. Enable Notification: Email notification will be sent for pending, failed and success transactions. b. Disable Success Notification: email notification will only be sent for pending and failed transactions.

- Choose whether or not you want notifications enabled or disabled for Payment Link, or VA. a. Enable Notification: Email notification will be sent for success transactions. b. Disable Success Notification: No email notification will be sent.

- The email field: allows the user to add, remove, and edit email notification receivers in this column, which can hold up to three email addresses.

- Click ‘Save Changes’

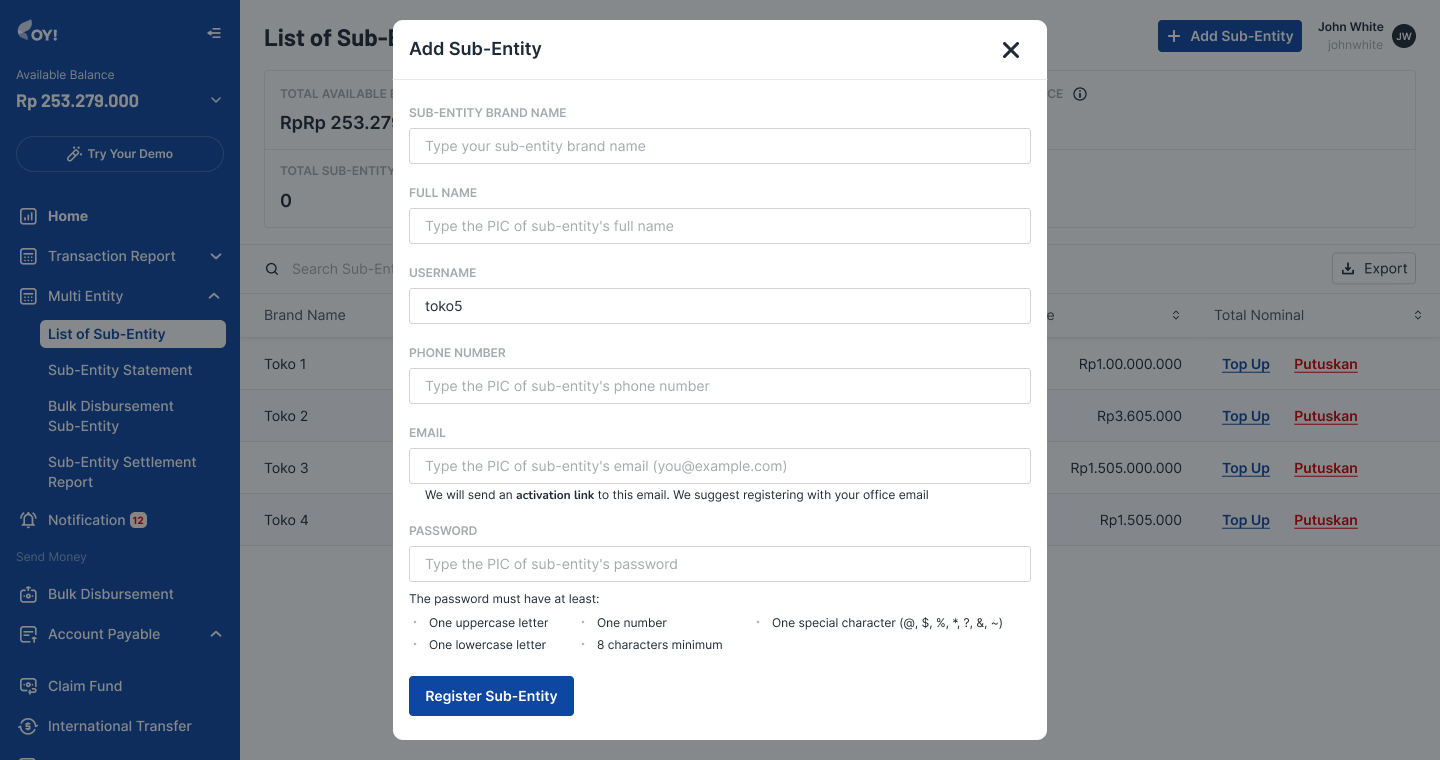

Multi Entity Management

Multi Entity Management is a feature that can help you handle complex relations between entities in your business in the OY! Dashboard. You can connect to other entities in the form of Main Entity - Sub Entities (1 to N relationship). The one who become the Main Entity will have a capability to oversee te sub-entities' transaction and execute transaction using its sub-entities' balance. Please contact our Business Development if you’re interested to use this feature.

With this feature you will be able to :

- Have a detailed report on transactions performed by all of sub-entity account.

- Distribute balance between the main entity account to sub-entity account.

- Use sub-entity account balance to disburse funds.

- Receive money using Payment Link on behalf of sub-entity's username.

- Free admin fee to disburse between related user.

Registration & Setup

Prerequisites

- Register an account on the OY! dashboard

- Activate your account through the activation link sent via email

- Upgrade your account

- Upgrade request is approved

- Contact our representatives to enable the feature

How To Use

To properly used Multi Entity Management, we required several accounts to be linked together. Each account can be used independently, and there will be some requirements that you should fulfil in order to use this feature. Please contact our representatives for more information.

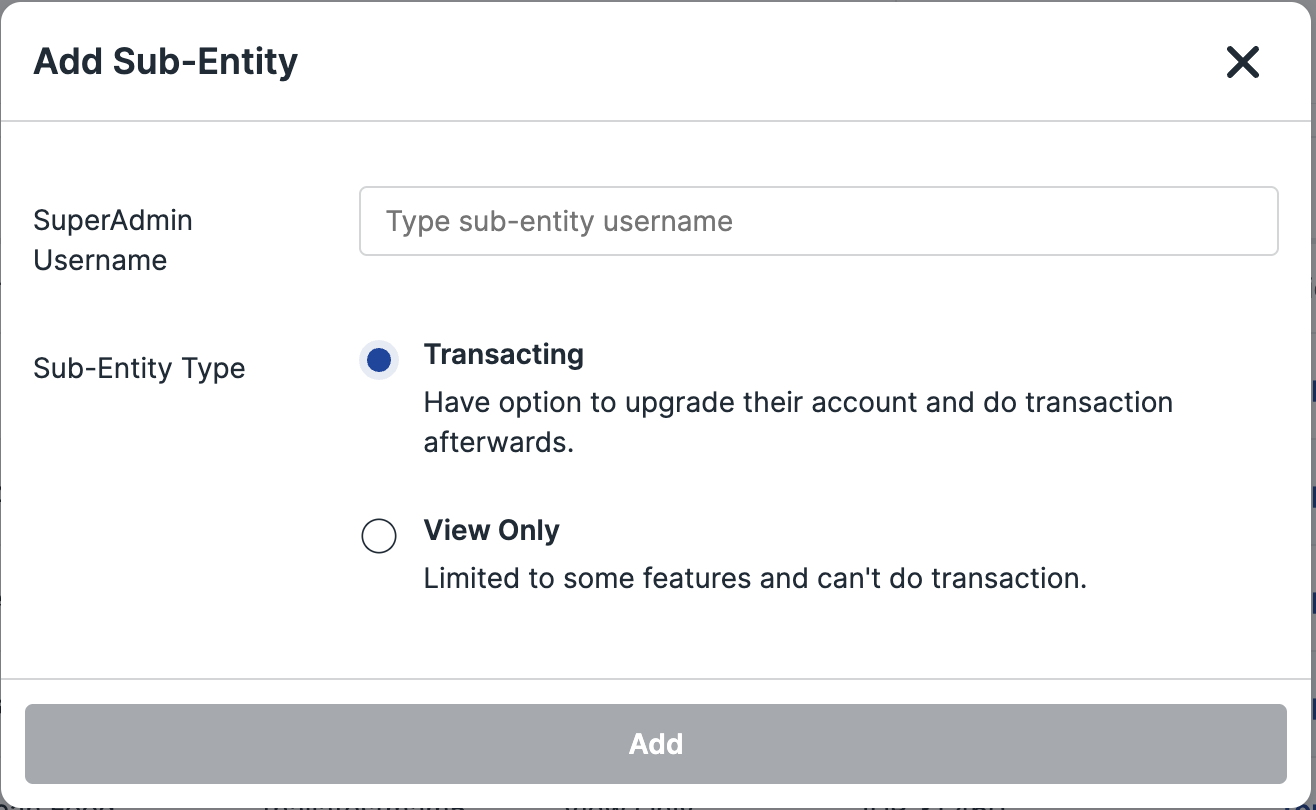

A. Link to Sub-entity Account

- For Main Entity Account

To add a new sub-entity,please 1) Log in to Dashboard with main account credential 2) Go to Multi Entity → List of Sub-entity

- Click the “+ Add Sub-Entity

- Fill in the username for the sub-entity you wished to connect. You can find your username from the menu Accounts → User Profile in the Username section

- Click Add and then if the account is found in the system you can confirm by clicking Connect in the confirmation window

After confirming, the request will be sent to the respective account to be accepted

After confirming, the request will be sent to the respective account to be accepted

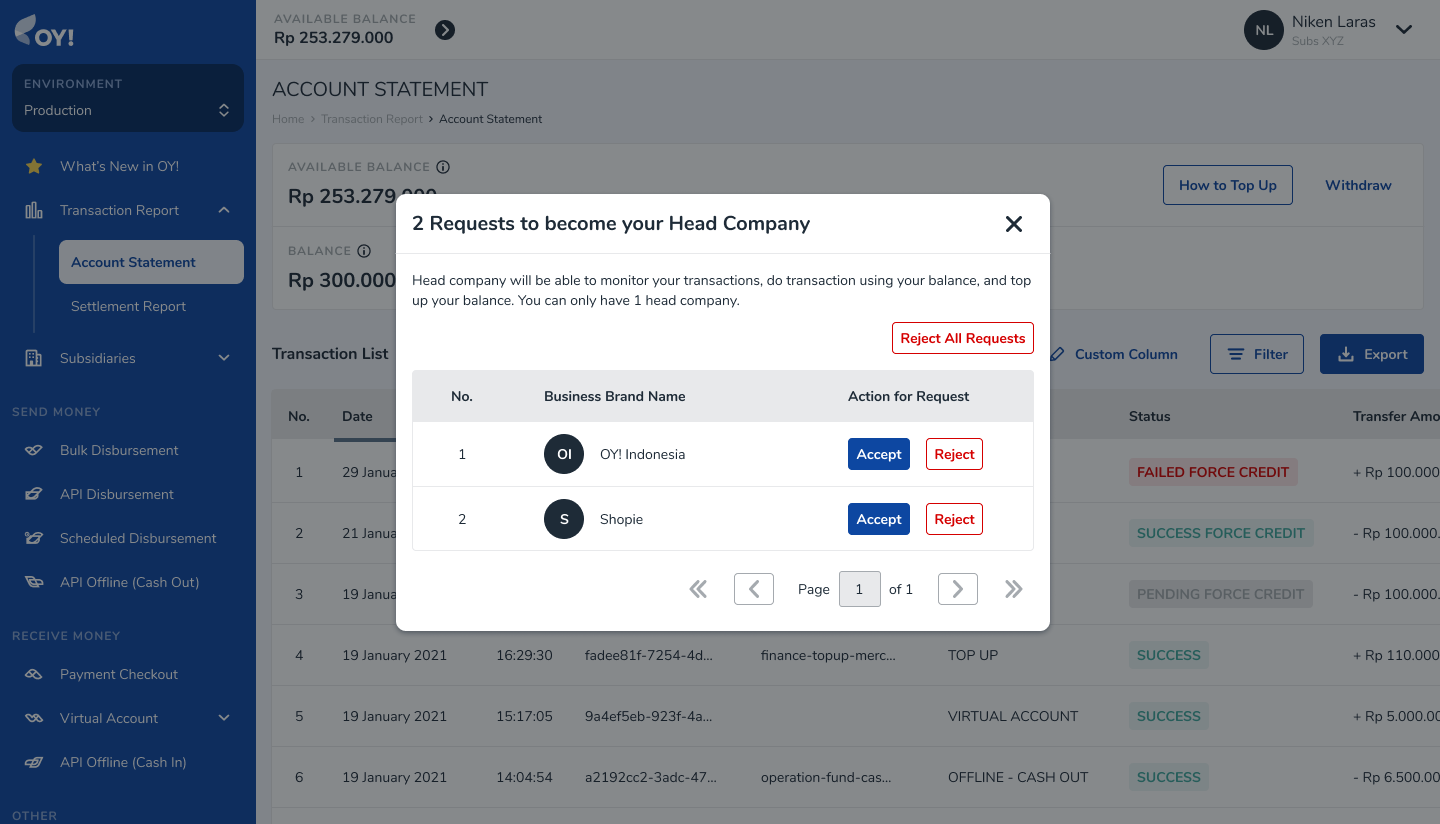

- For Sub-entity Account

To receive a request from a main entity , please 1) Log in to dashboard with child credential 2) Go to Transaction Report → Account Statement

- Click the “Check All request” button that can be found near the top right corner of the page

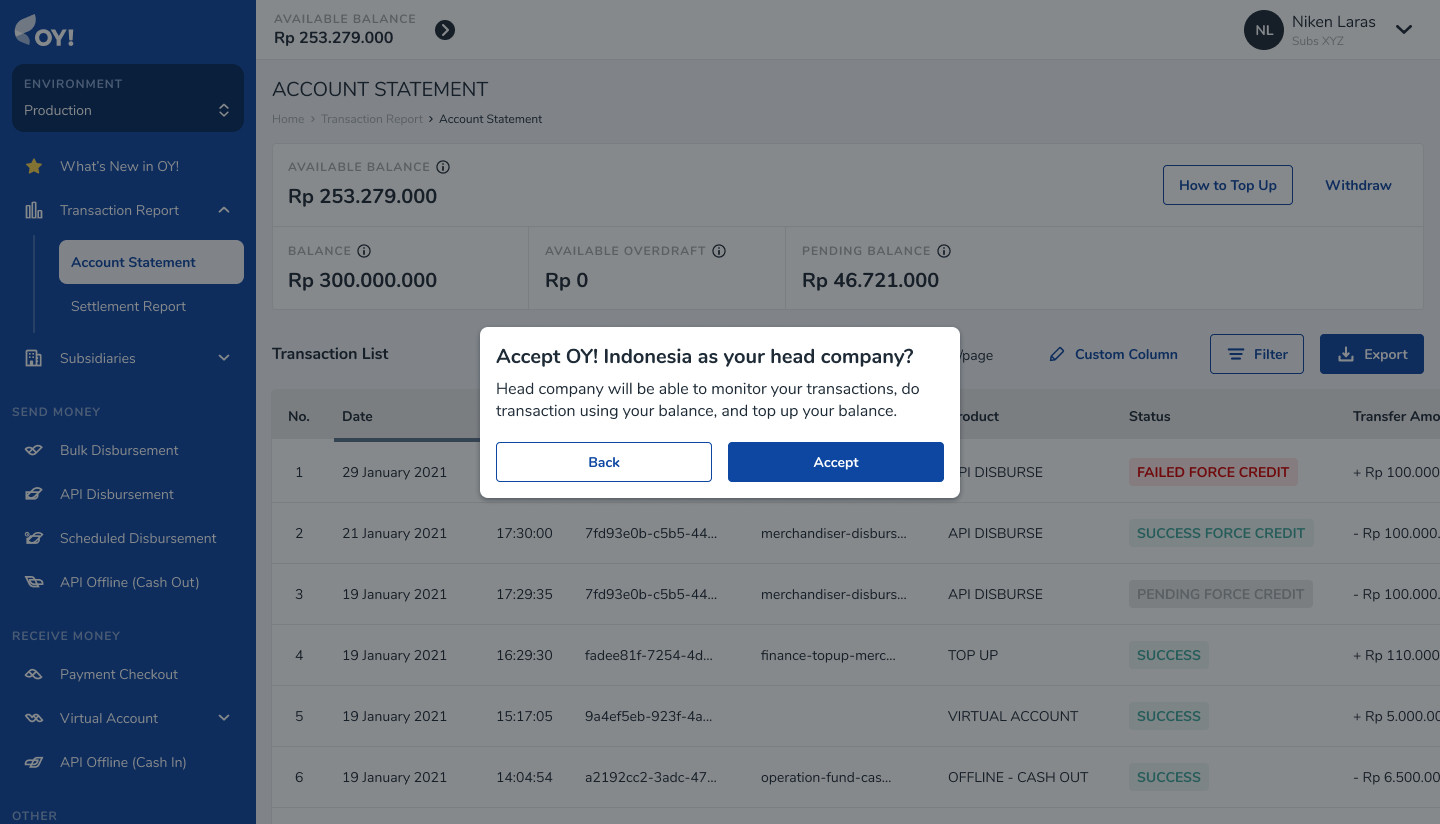

- You will see the incoming request to be the main entity account for your account, then you can choose which account is the correct account for the main entity by click Accept in the respective account and confirmation window

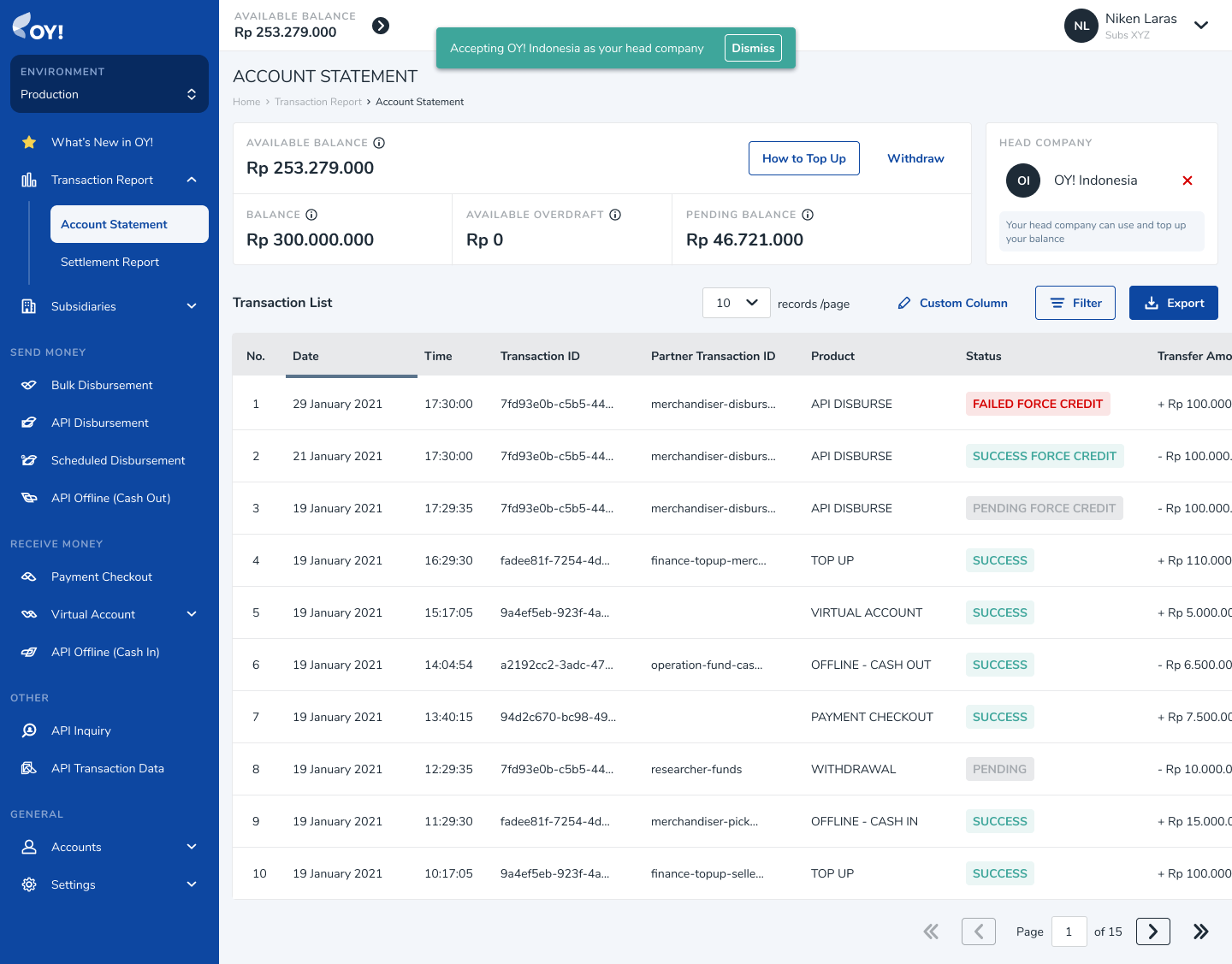

- After successfully received the main entity request to connect, you will find your parent information near the top right corner of your page, and you are now connected with your main entity.

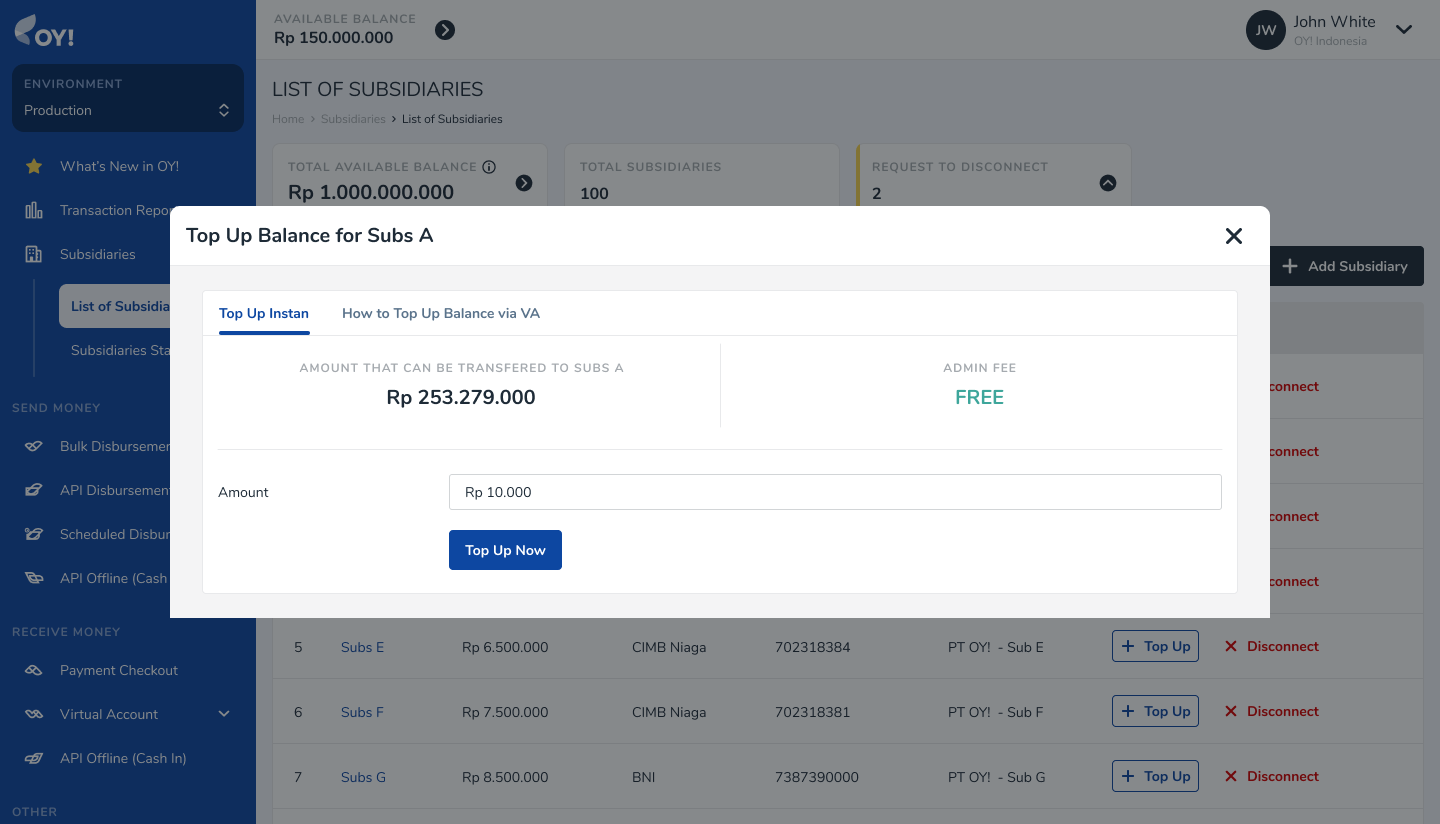

B. Topup money to a sub-entity account

After connected with your sub-entities, you can transfer money to the sub-entity account by accessing the menu Multi Entity → List of Sub-entity 1. Find the account that you wished to top-up 2. Click the “+ Top Up” button 3. Fill in the amount you wish to top-up 4. Click the “Top Up Now” button to proceed 5. You can also do Top Up by transfer to one of the VA provided (see “How to Top Up Balance via VA”

C. Disburse Money using a sub-entity's balance

In Multi Entity Management, you will be able to do disbursement using your sub-entity account on their behalf. To do this you could

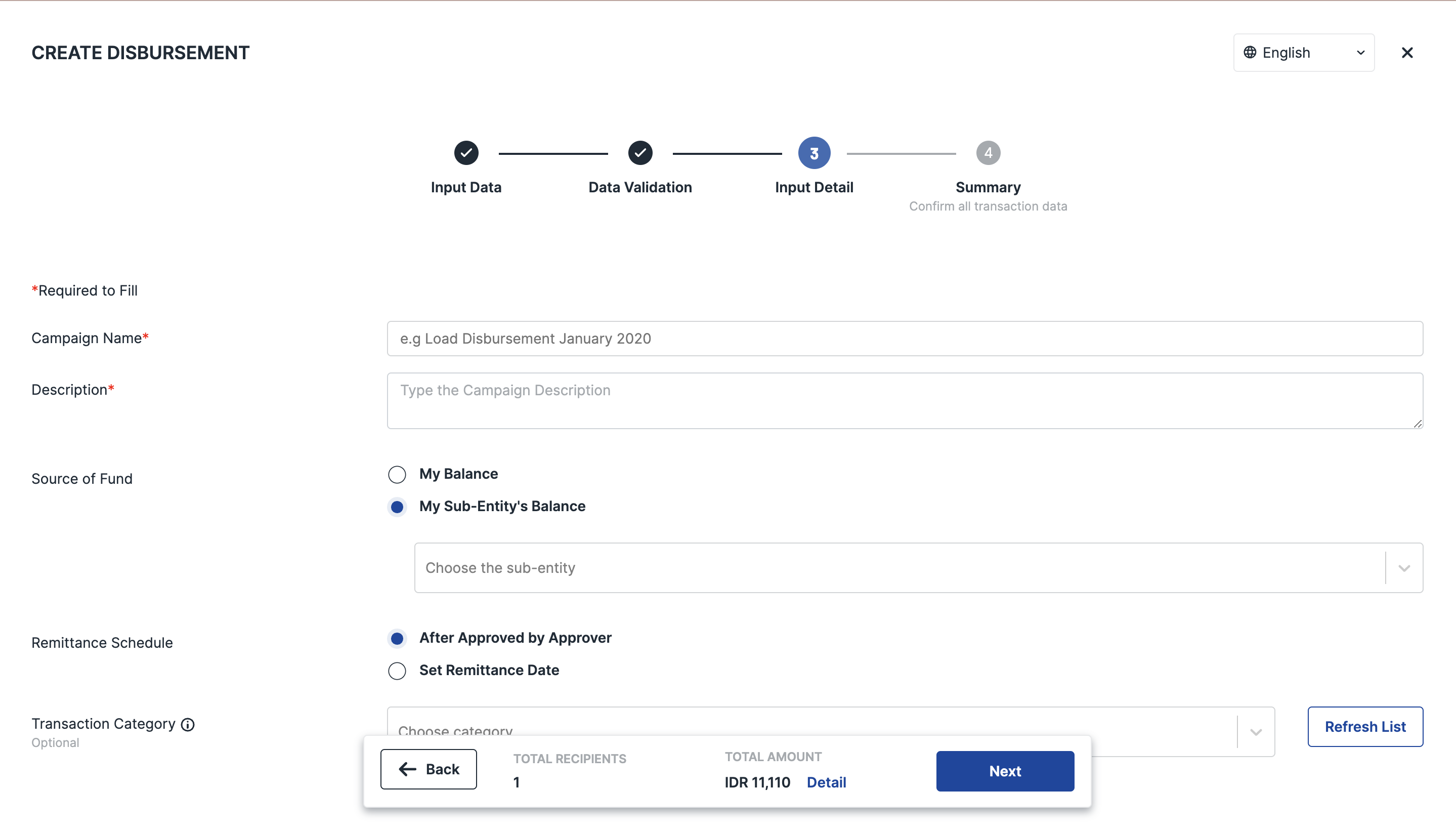

- Access the Bulk Disbursement menu and clicking on “+ Create Disbursement” button

- Select your sub-entity balance as a source of fund to do disbursement by selecting “My Sub-entity Balance” and choose the appropriate account.

- After choosing the balance you could proceed to do disbursement just like regular disbursement

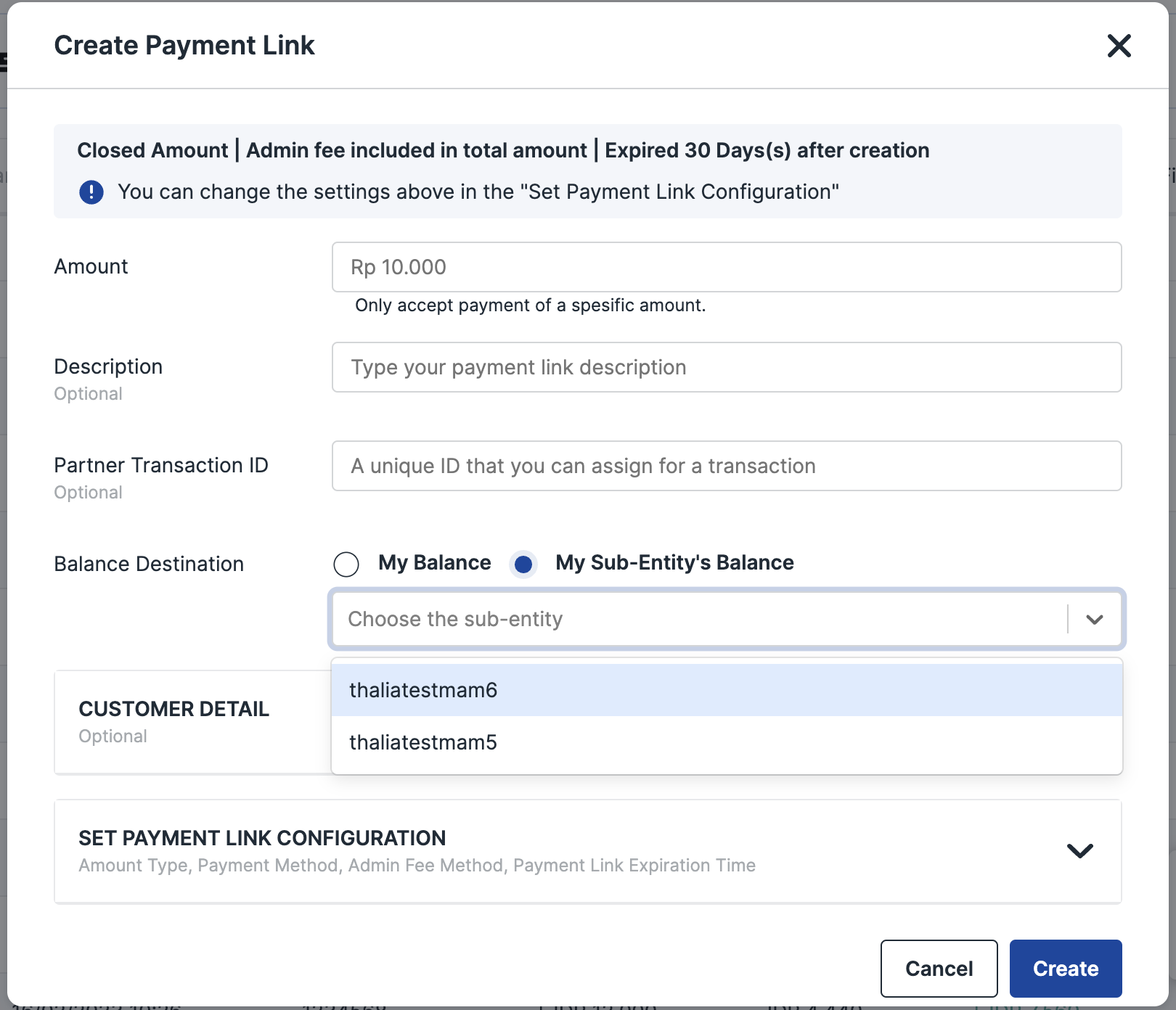

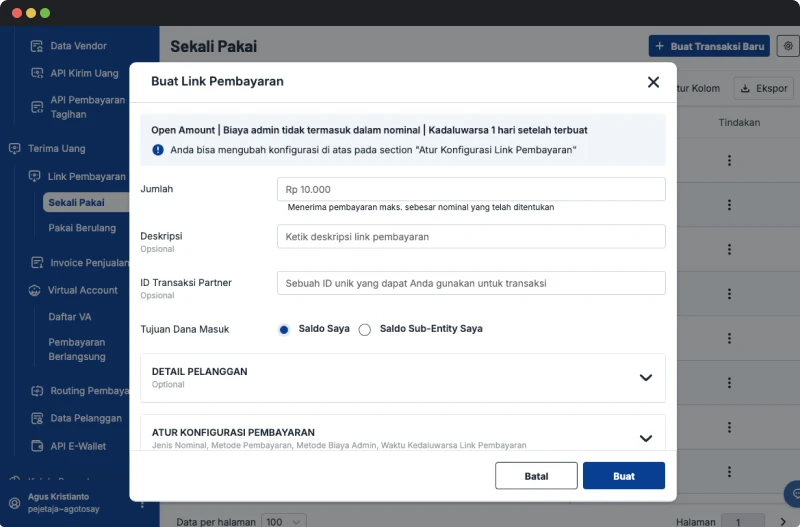

D. Create a payment link on behalf of a sub-entity account

With this feature, you will be able to accept payment from your users through Payment Link created on behalf of your sub-entity account. When your users make a successful transaction, the transaction will be recorded in the Sub-entity Account's balance. As a main entity, you are equipped with the ability to view the Sub-entity Account's balance and transaction list anytime through Multi Entity → Sub-entity Statement.

Follow the below steps to create a payment link on behalf of a sub-entity account:

Via API

Hit API Create Payment Link and fill in "child_balance" parameter with the username of a sub-entity account that you will set as the balance destination for the transaction. When your users make a successful transaction, the transaction will be recorded in the specified Sub-entity Account's balance.

Via Dashboard

- Click Payment Link -> One-time (if you want to create a one-time payment link) or Click Payment Link -> Reusable (if you want to create a reusable payment link)

- Click "Create One-Time Link" (for one-time payment link) or click "Create Reusable Link" (for reusable payment link)

- You will see a pop-up to proceed with the creation process

- Fill in "Balance Destination" with "My Balance" (if the balance destination of the transaction is your own) or "Sub-entity Balance" (if the balance destination of the transaction is your sub-entity's). If you select "Sub-entity Balance", you will see a dropdown to select a username of the sub-entity account. Only 1 sub-entity account is currently allowed to be a balance destination

- If you select "Sub-entity Balance", when your users make a successful transaction, the transaction will be recorded in the specified Sub-entity Account's balance.

Xero Integration

Xero is an accounting platform that is mainly used by companies. We have integrated our system to Xero system in order to help you optimize your workflow. By connecting your OY! account to your Xero account, you do not have to login to your Xero account. Means that you do not have to manually record your transaction that happened in OY! to Xero. You will get seamless experience of recording your transaction.

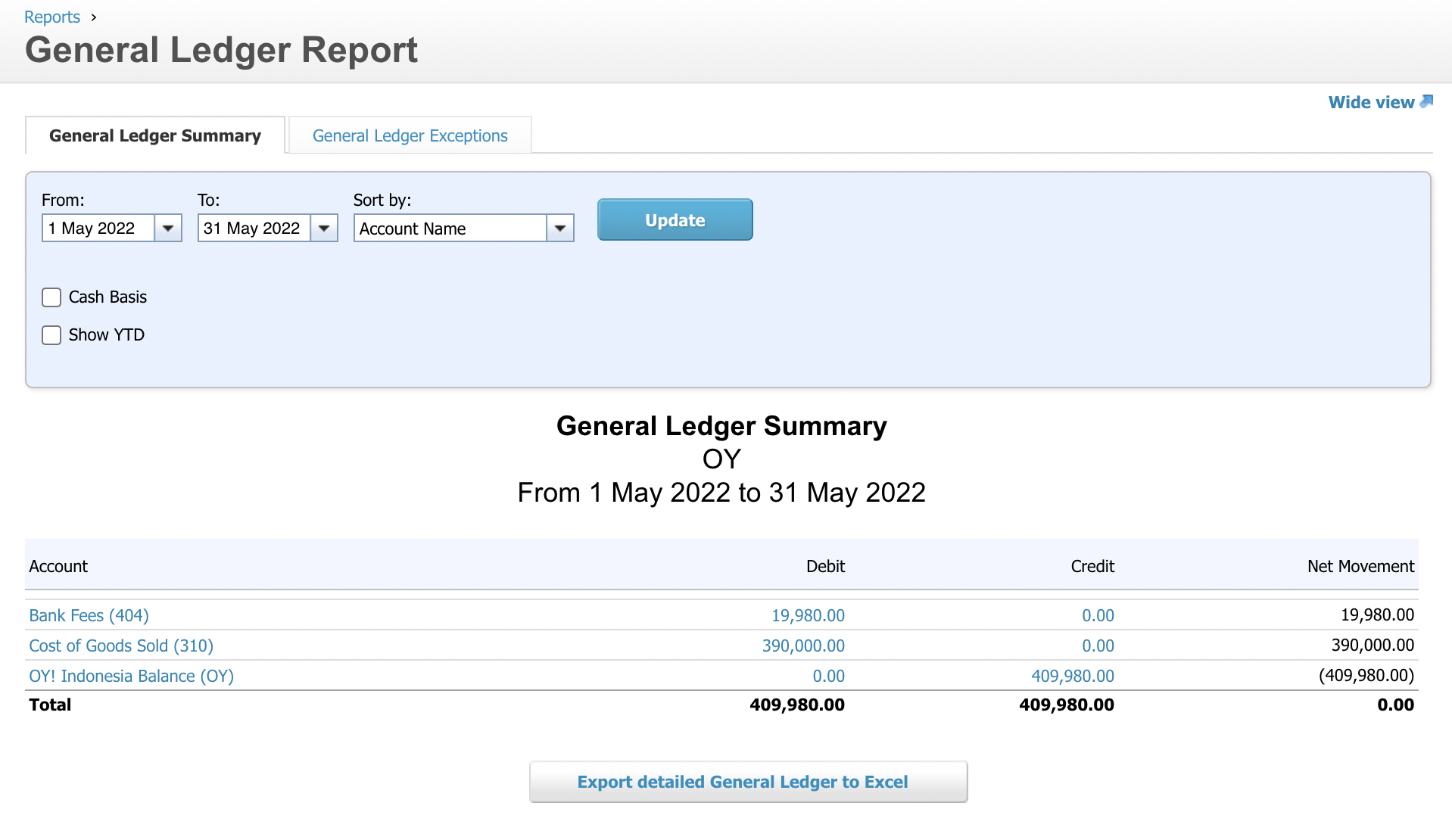

How does it works?

Once you have connected your Xero account in OY!, any transaction that happened in OY! will be automatically recorded to your Xero tenant account. Upon successful connection, we will trigger creation of new Bank Account, which is OY! Balance Bank Account. Any transaction that happened in OY! will be recorded in that bank account, to SPEND or RECEIVE money transaction. Then, you will be required to map your Xero’s Chart of Account. Mapping your Chart of Accounts will help us to put your transaction into a correct Account.

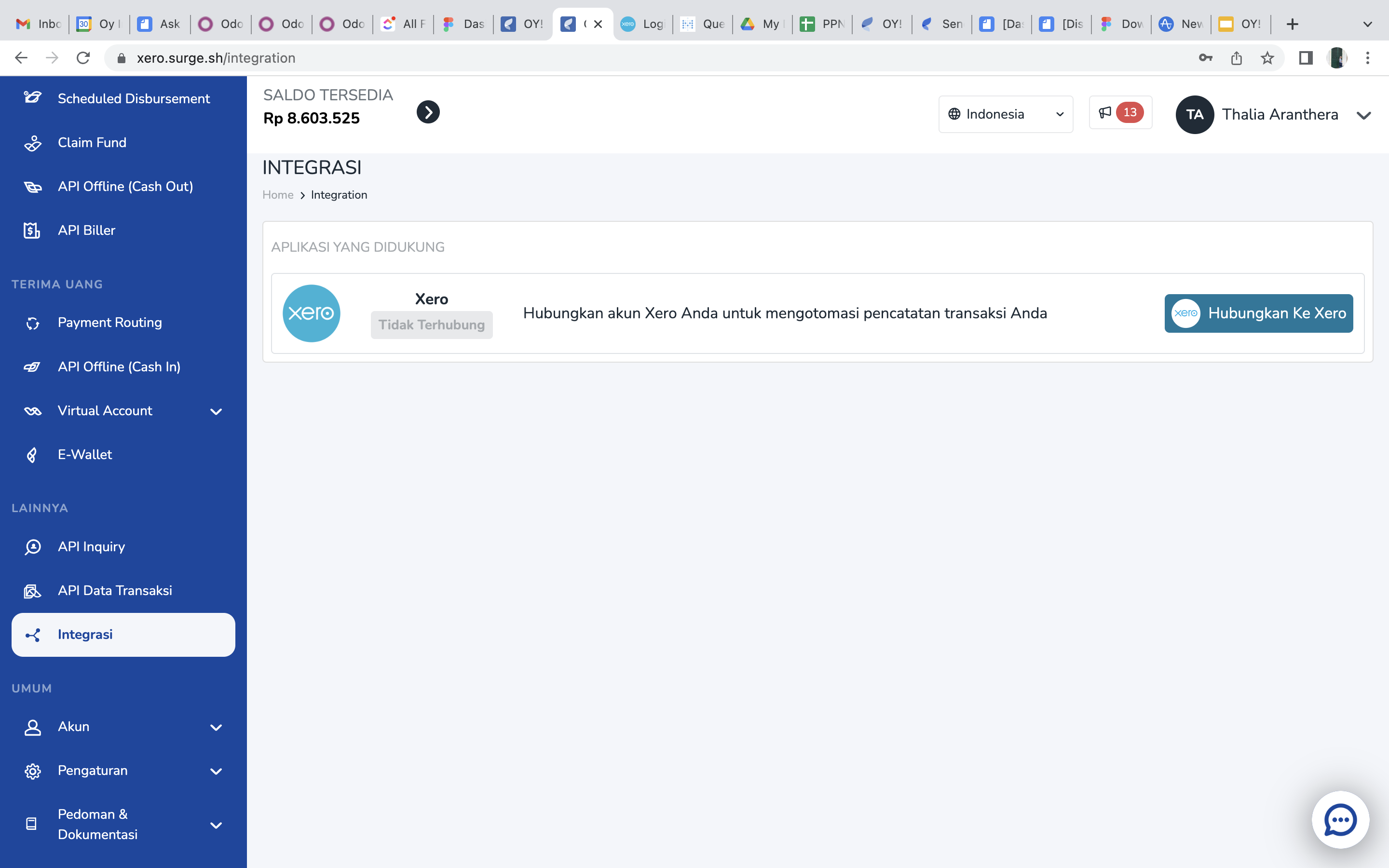

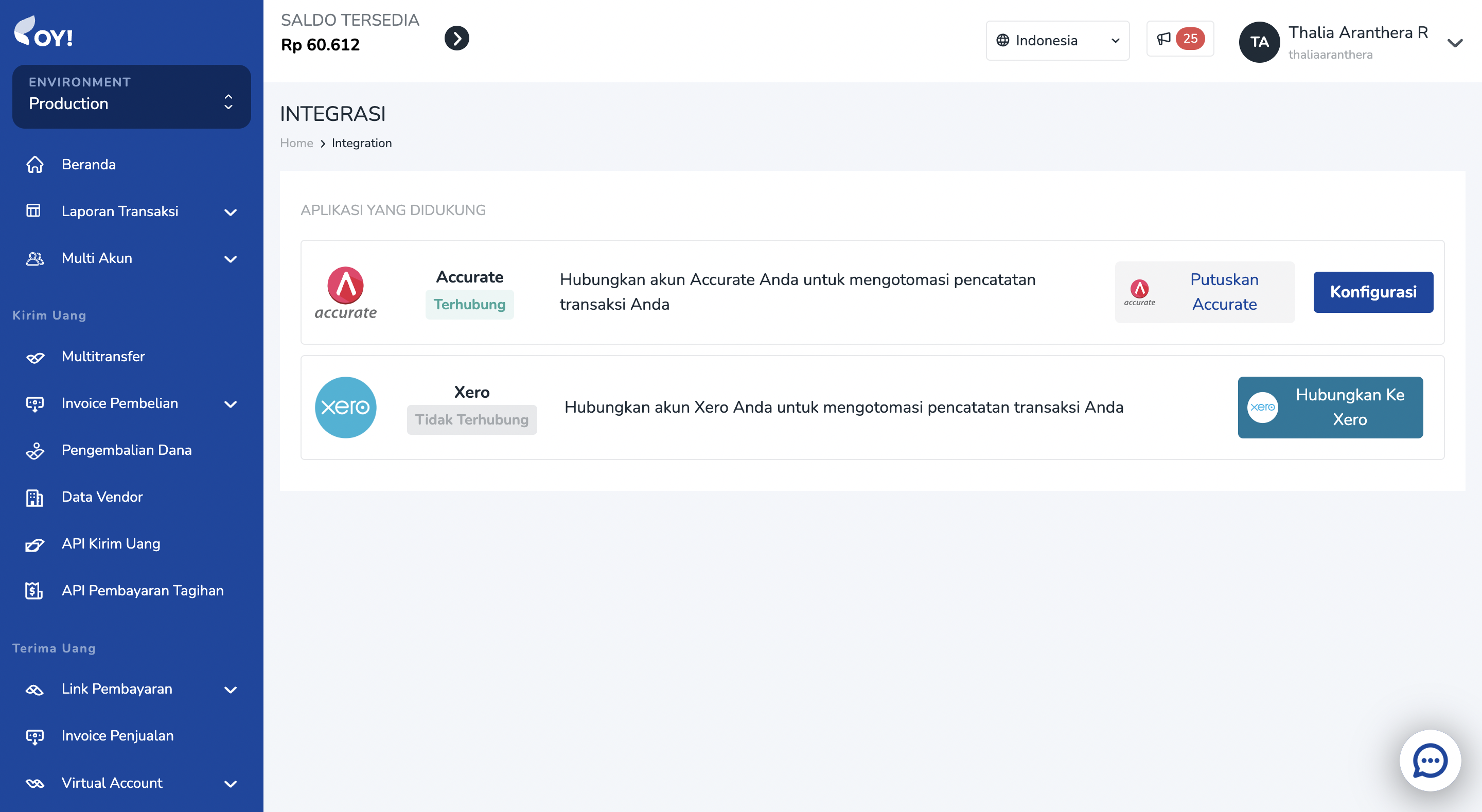

Connect your Xero

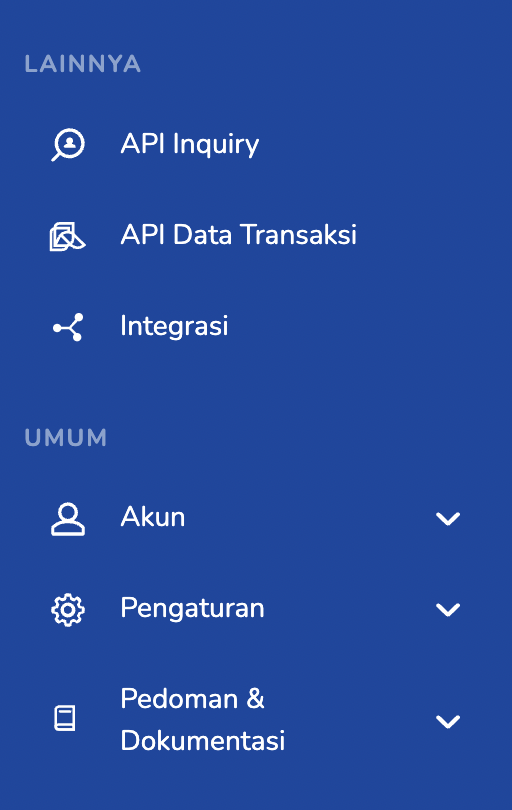

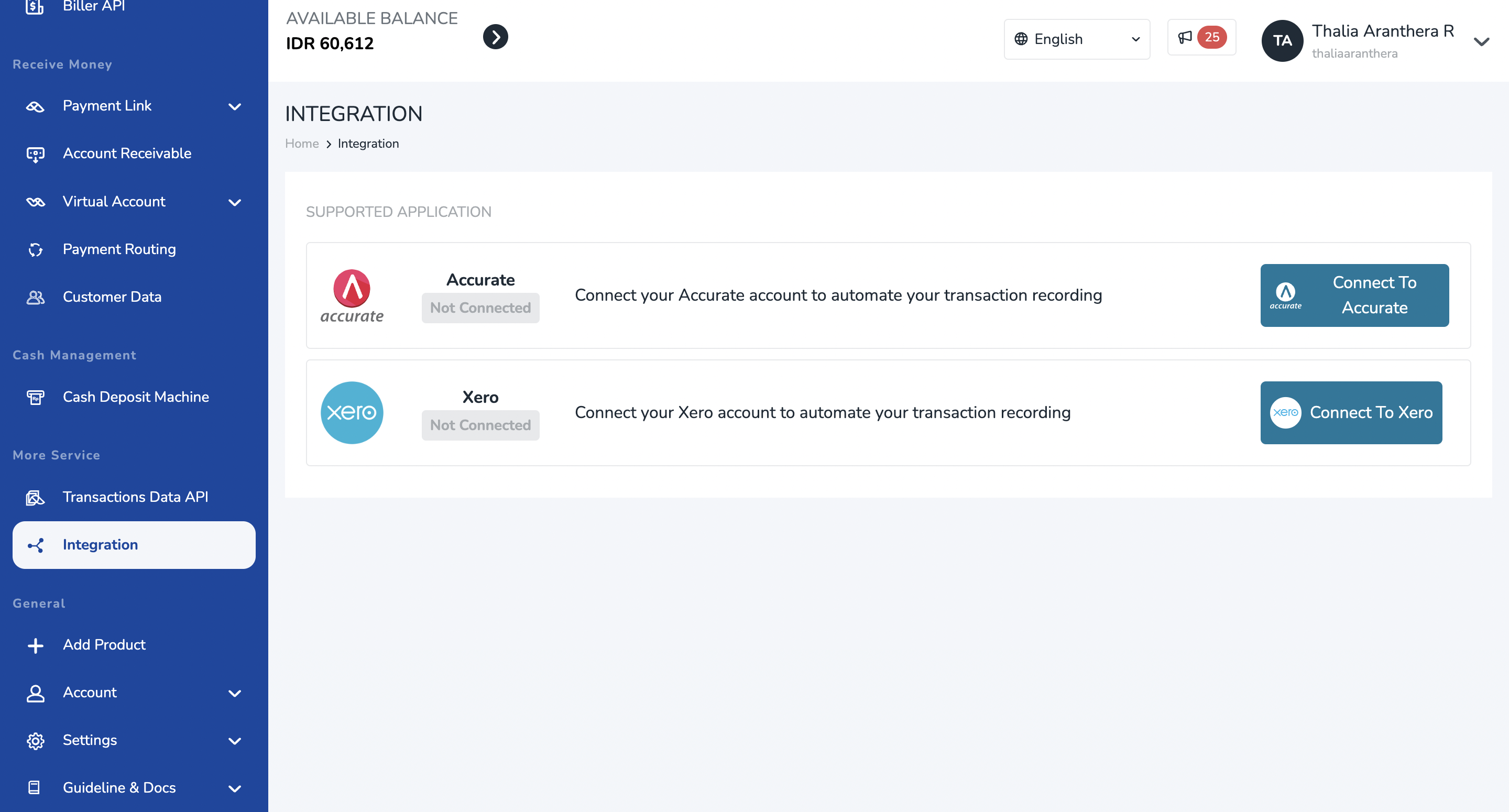

Login to your dashboard. In the sidebar, select Integration menu.

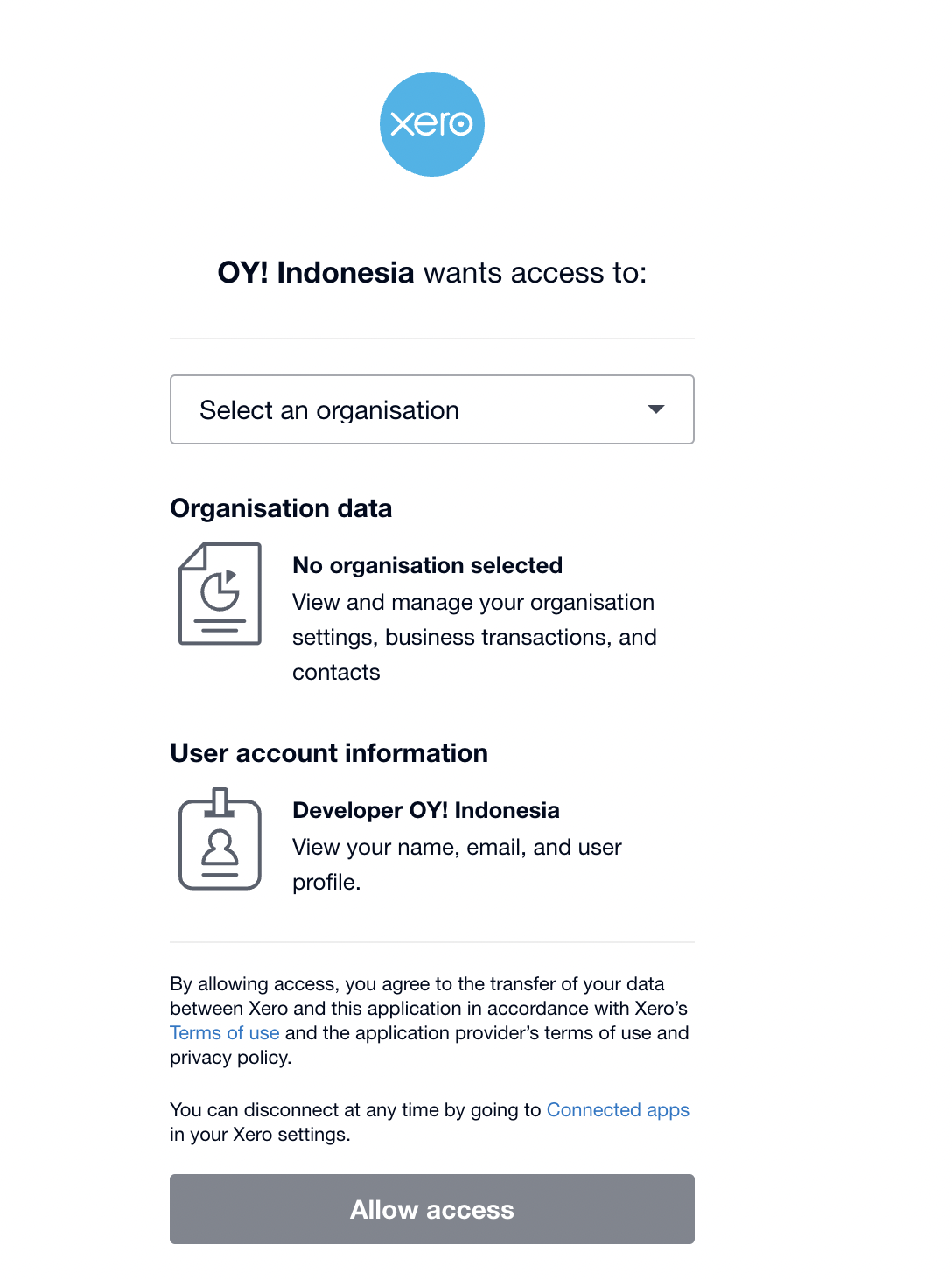

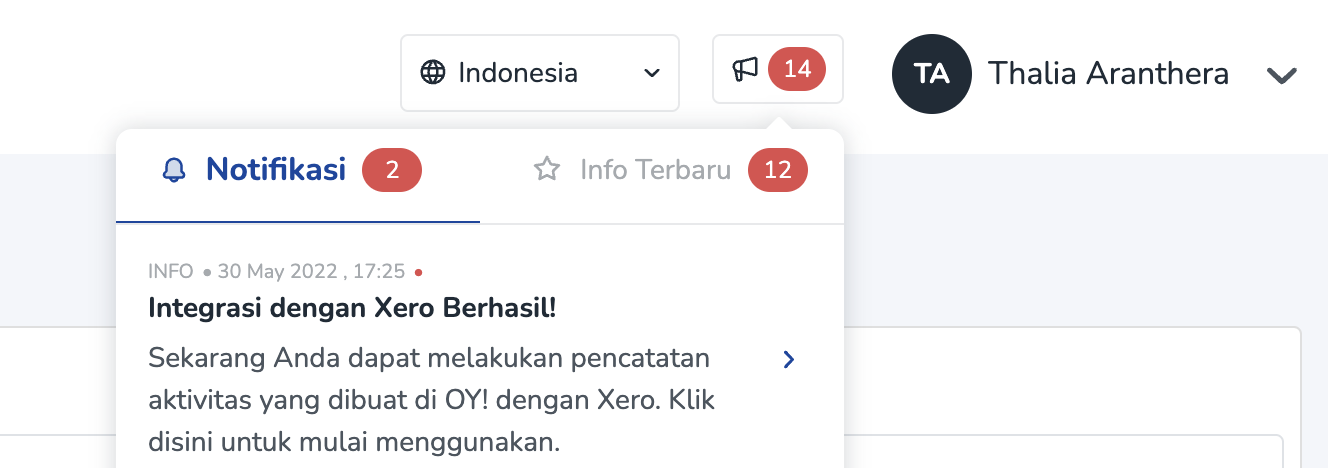

You will see Xero menu. Click “Connect” to connect your Xero account to OY!. You will be redirected to Xero’s login page. Once you have successfully logged in to Xero, a notification will appear.

Preview for Xero's login page

Preview for Notification

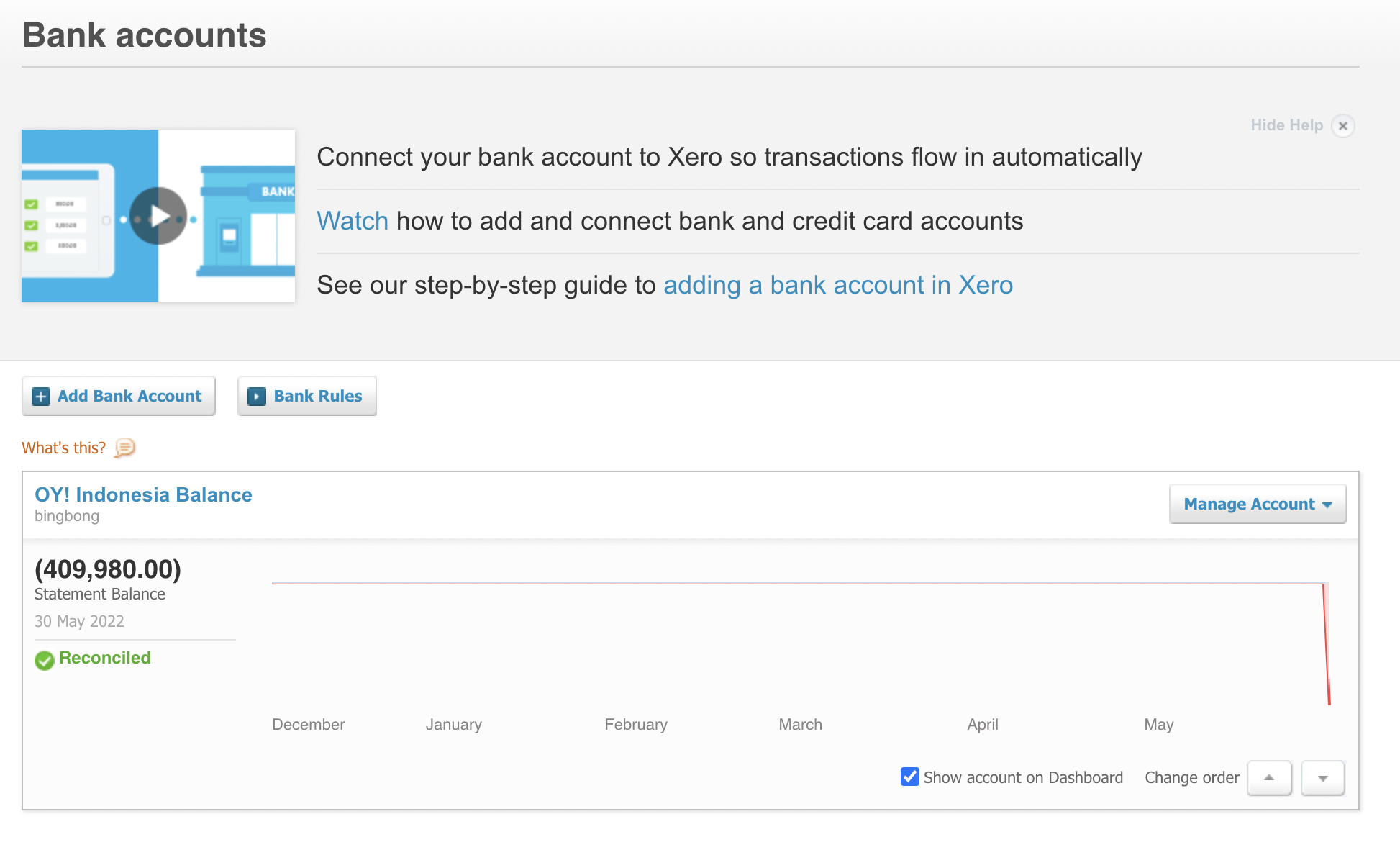

- Upon success connect to Xero, we will create a new Bank Account into your Xero account, named “OY! balance” in which any transaction happened in OY! will be recorded there.

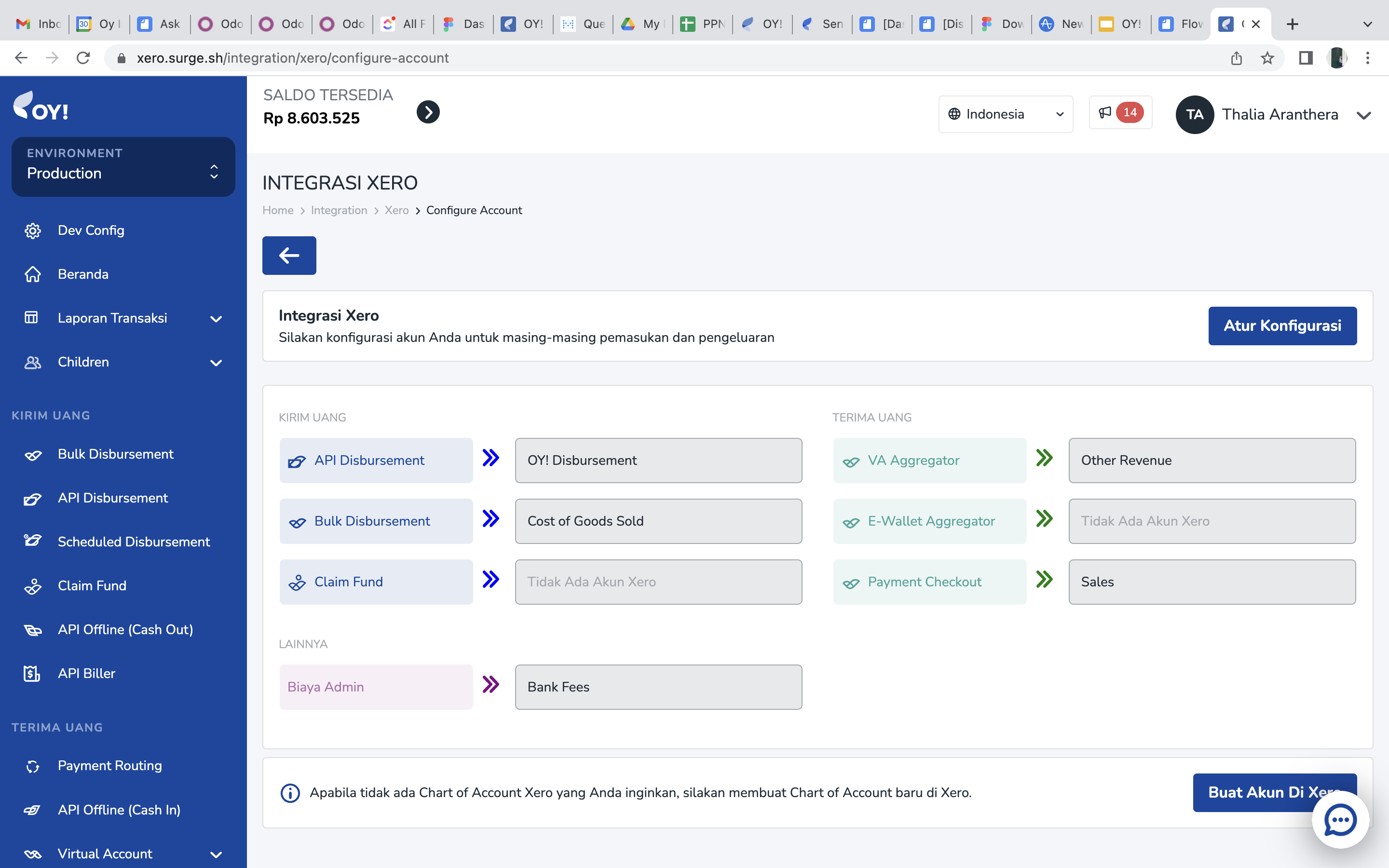

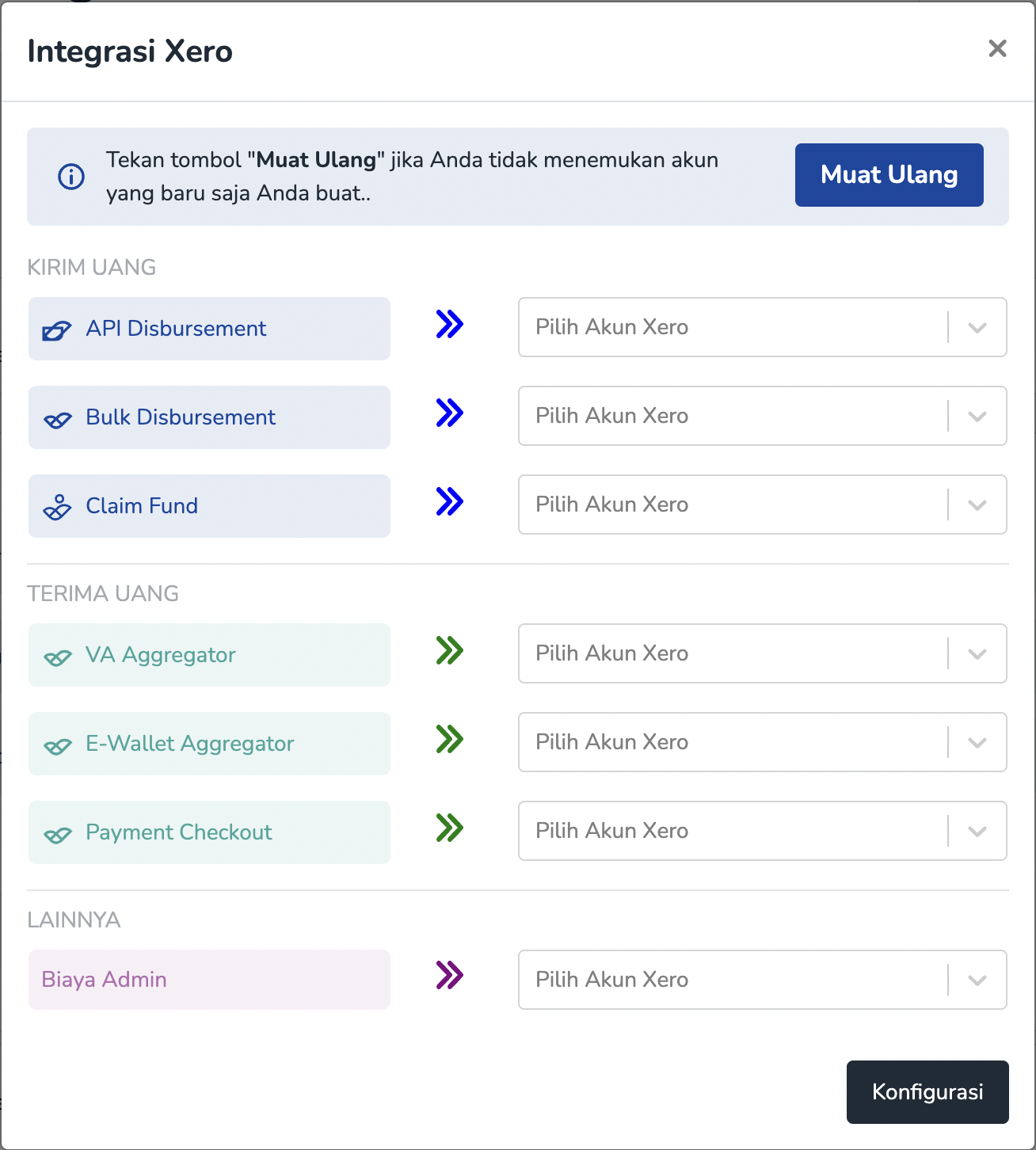

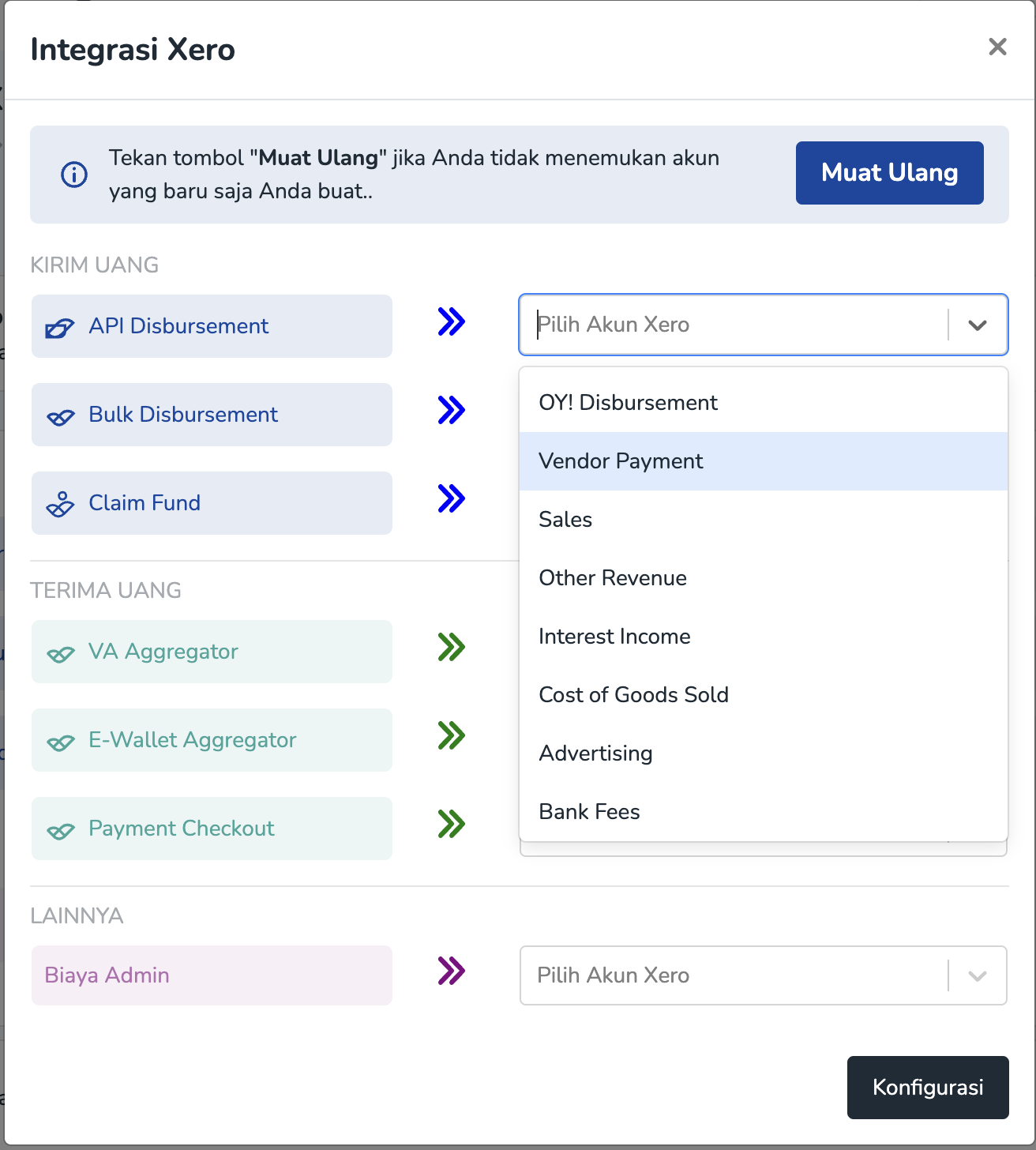

Map your Chart of Account

Once you have successfully connected to Xero, you will be directed to a page to map your Chart of Account.

Then, map each product to the corresponding Account. Any transaction using each product will be put into the chart of account you defined in this page.

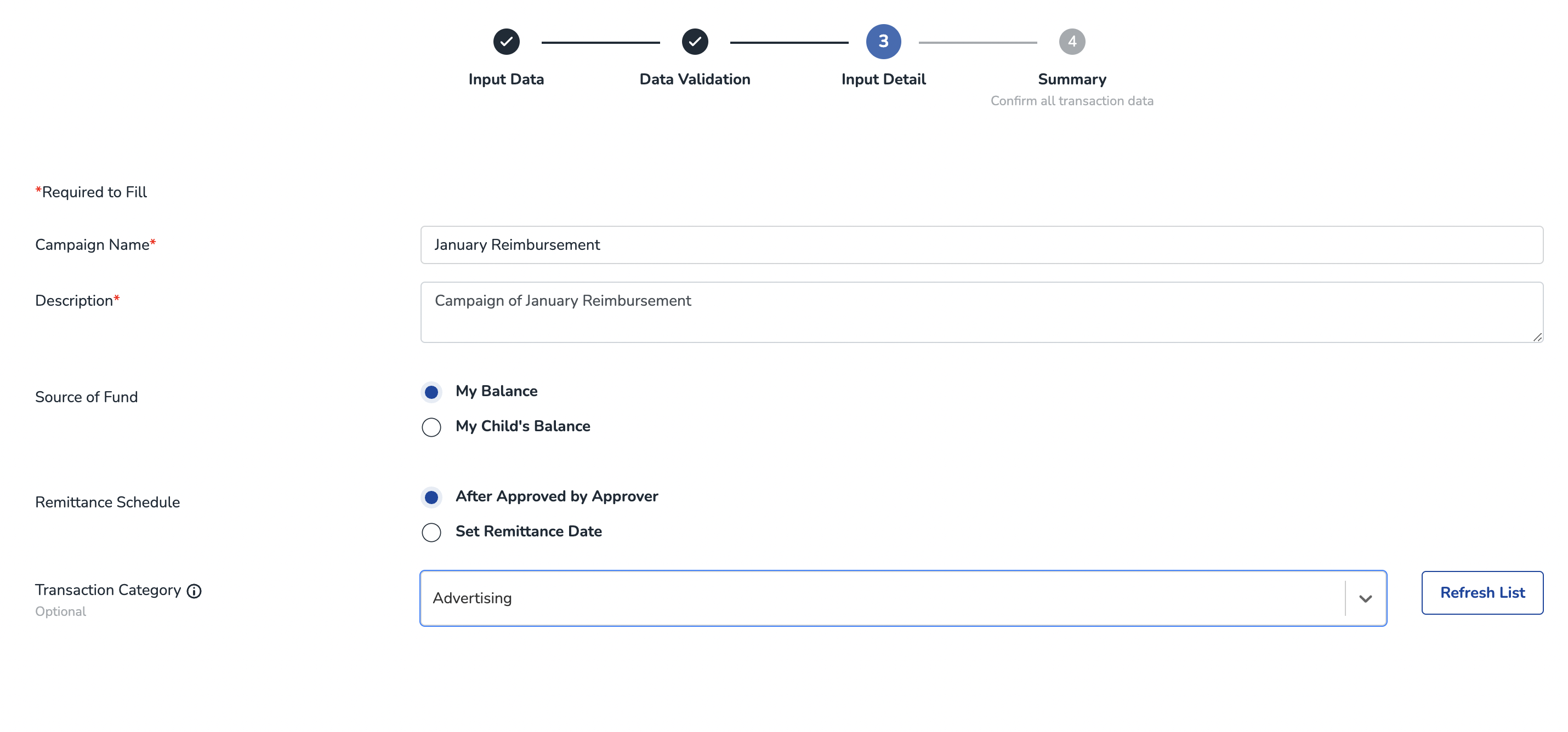

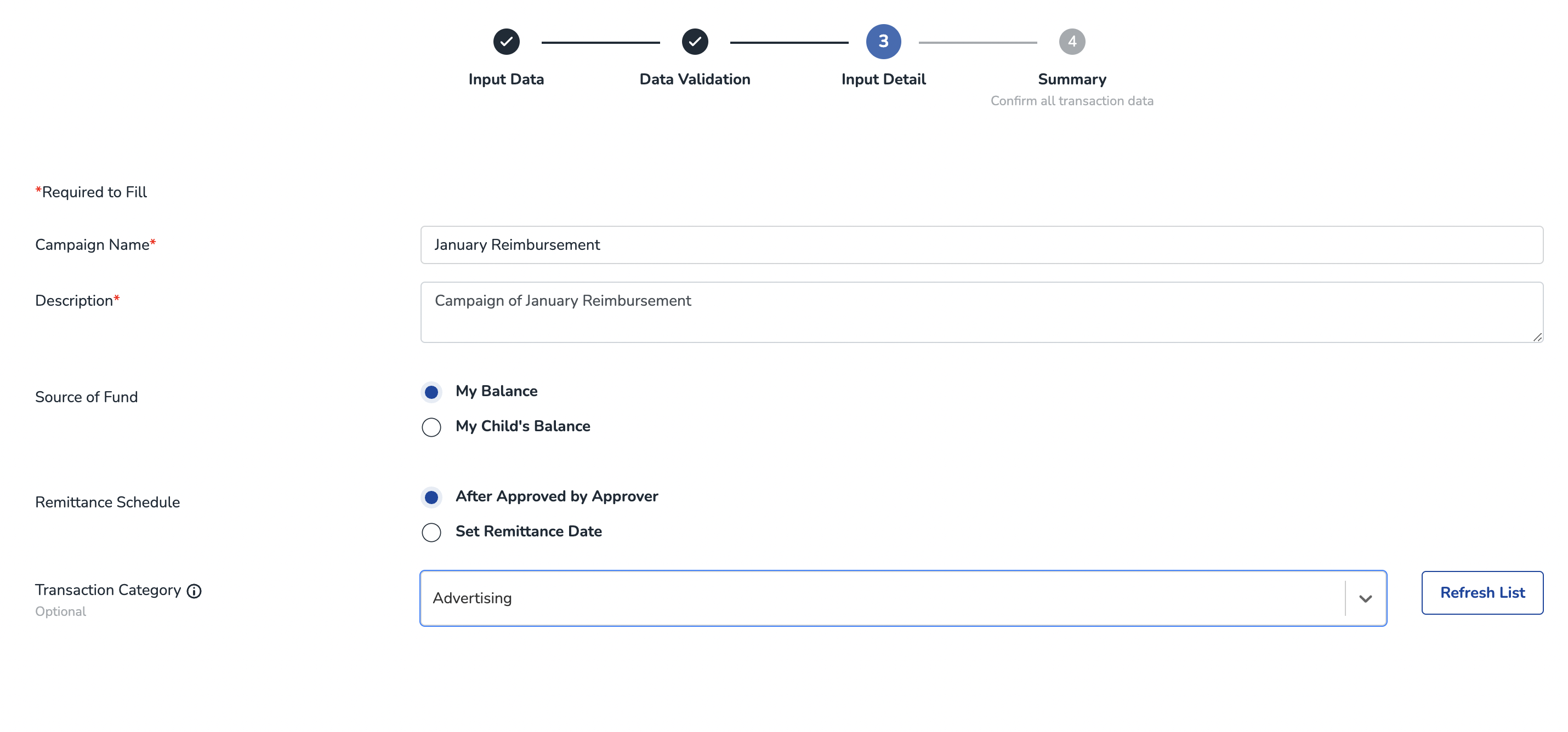

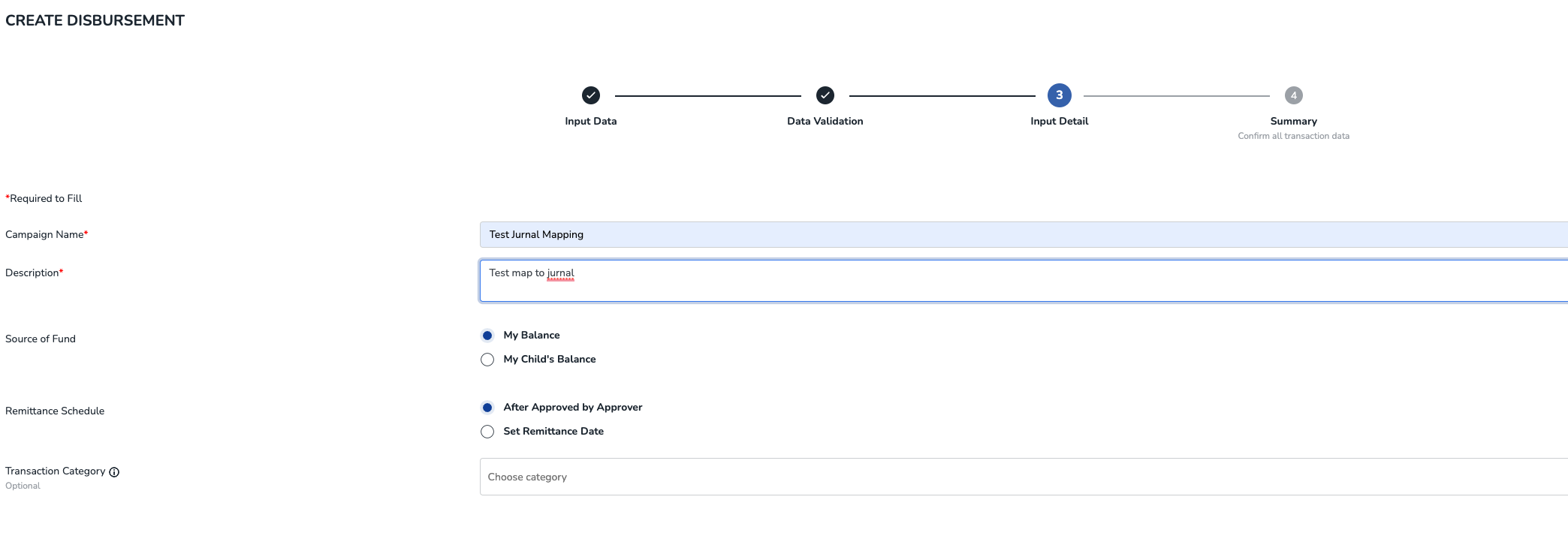

Note: Special for Bulk Disbursement product, you can define the Chart of Account later in the campaign creation process - Step 3 Input Detail page. In the Transaction Category field.

- You can change the CoA mapping anytime as needed, just go to Integration >> Xero >> Configuration.

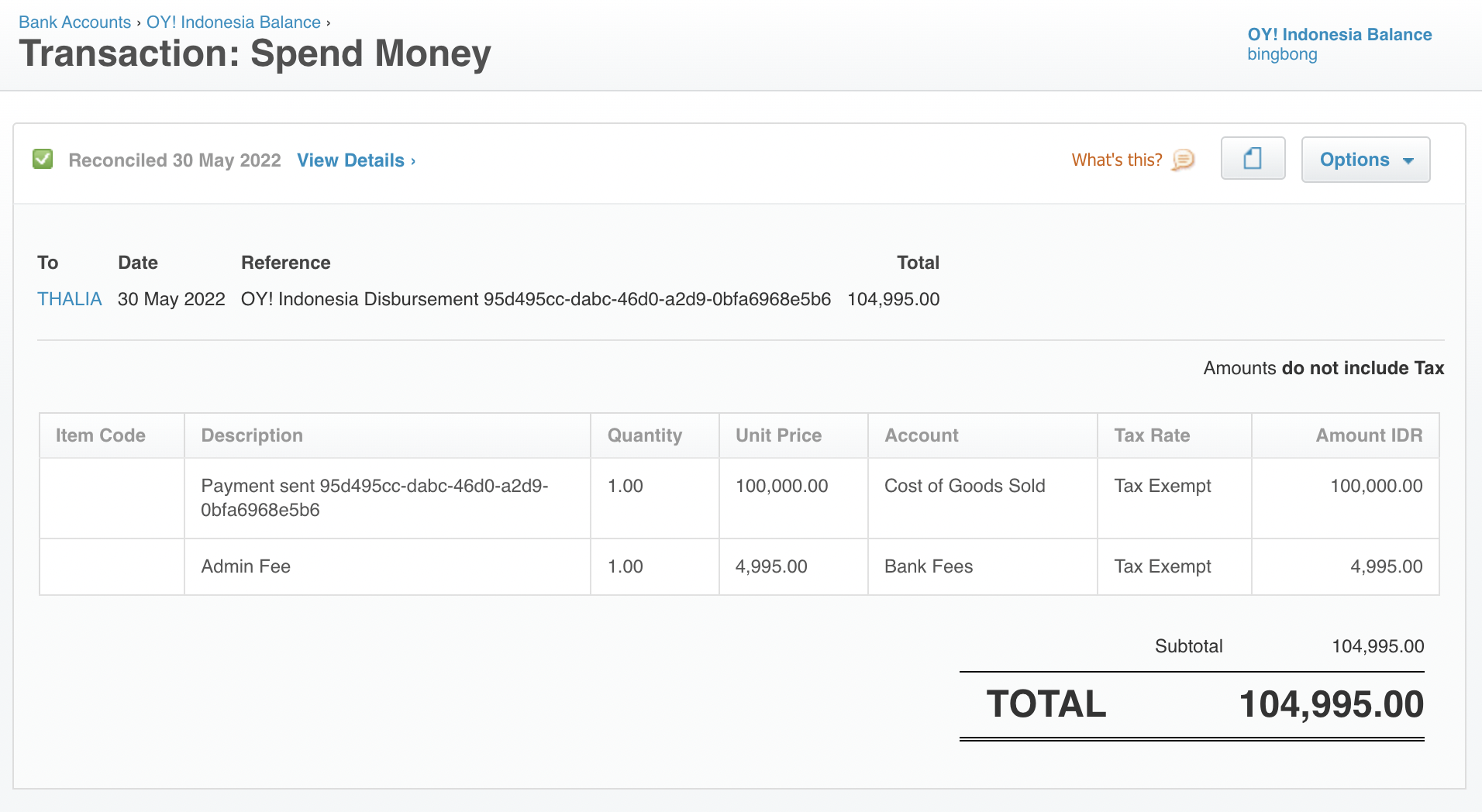

Record Transaction to Xero

- Now, your OY! account has been connected to your Xero account and each products has been mapped to its corresponding Chart of Account.

- Any success transaction that happened in OY! will be recorded to Xero with the corresponding Account you defined in Mapping Account menu.

- Transaction in OY! will be treated as SPEND or RECEIVE money transaction in a bank account (OY! Balance).

- Each transaction will contains of two rows. Row 1 contains of amount of transaction where row 2 contains of admin fee.

- In this version, any tax will be excluded. Means that you will need to input manually the tax invoice you obtained from OY! team to your Xero.

Disconnected your Xero

- To disconnect your Xero account from OY!, open the Integration menu on the sidebar. Then select “Disconnect”.

- Then, you will be disconnected from Xero. Any transaction that you execute via OY! will not be recorded into Xero.

Accurate Integration

Accurate is a local accounting platform that is mainly used by companies in Indonesia. We have integrated our system to Accurate system in order to help you optimize your workflow. By connecting your OY! account to your Accurate account, you do not have to log in to your Accurate account. This means that you do not have to manually record your transaction that happened in OY! to Accurate. You will get a seamless experience of recording your transaction.

How does it works?

Once you have connected your Accurate account in OY!, any transaction that happened in OY! will be automatically recorded to your Accurate account. Upon successful connection, we will trigger the creation of a new Bank Account, which is OY! Balance Bank Account. Transactions that happened in OY! will be recorded in that bank account, to PEMASUKAN or PENGELUARAN module. Then, you will be required to map your Accurate’s Chart of Account (in Accurate, it is Akun Perkiraan). Mapping your Chart of Accounts will help us to put your transaction into the correct Account.

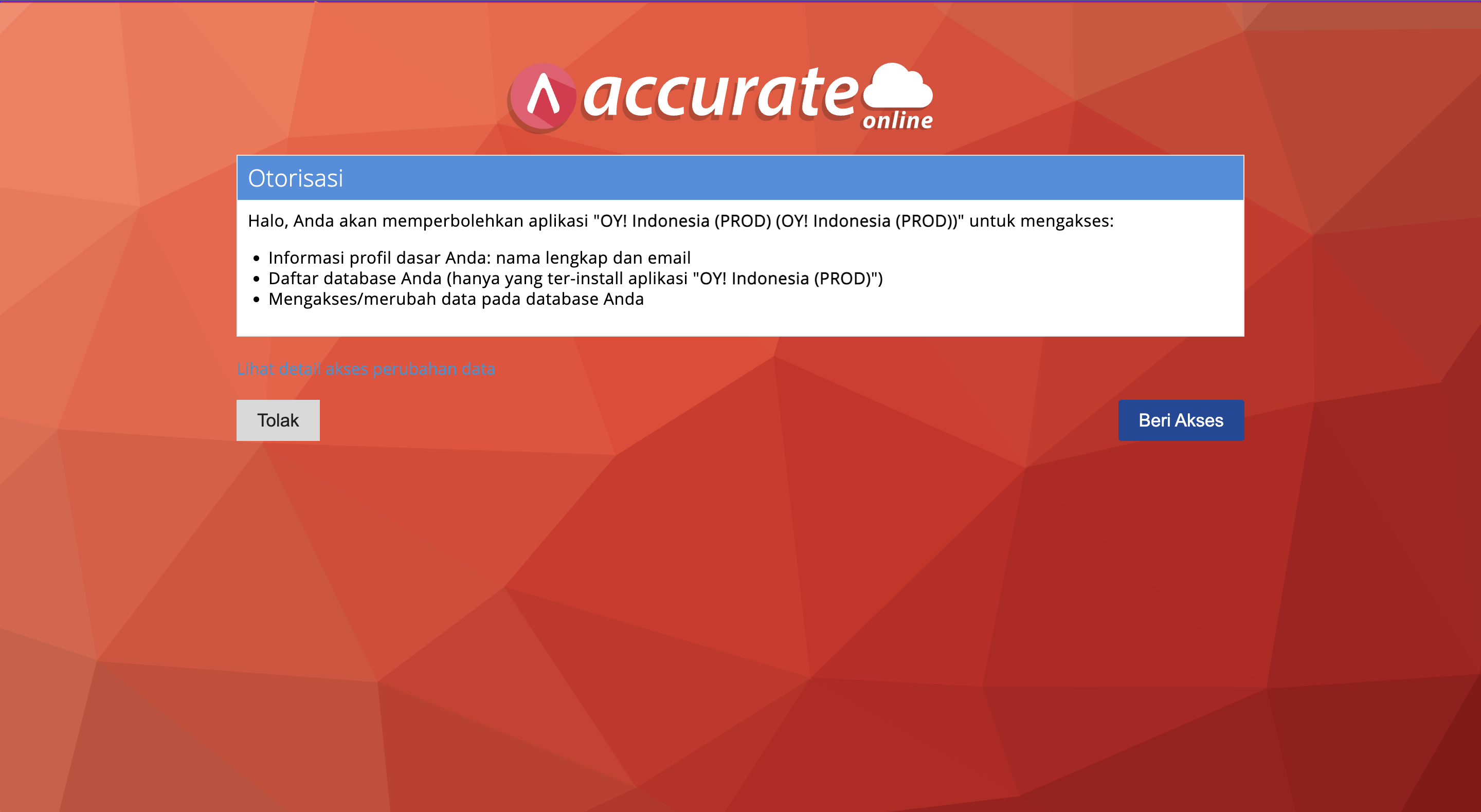

Connect your Accurate

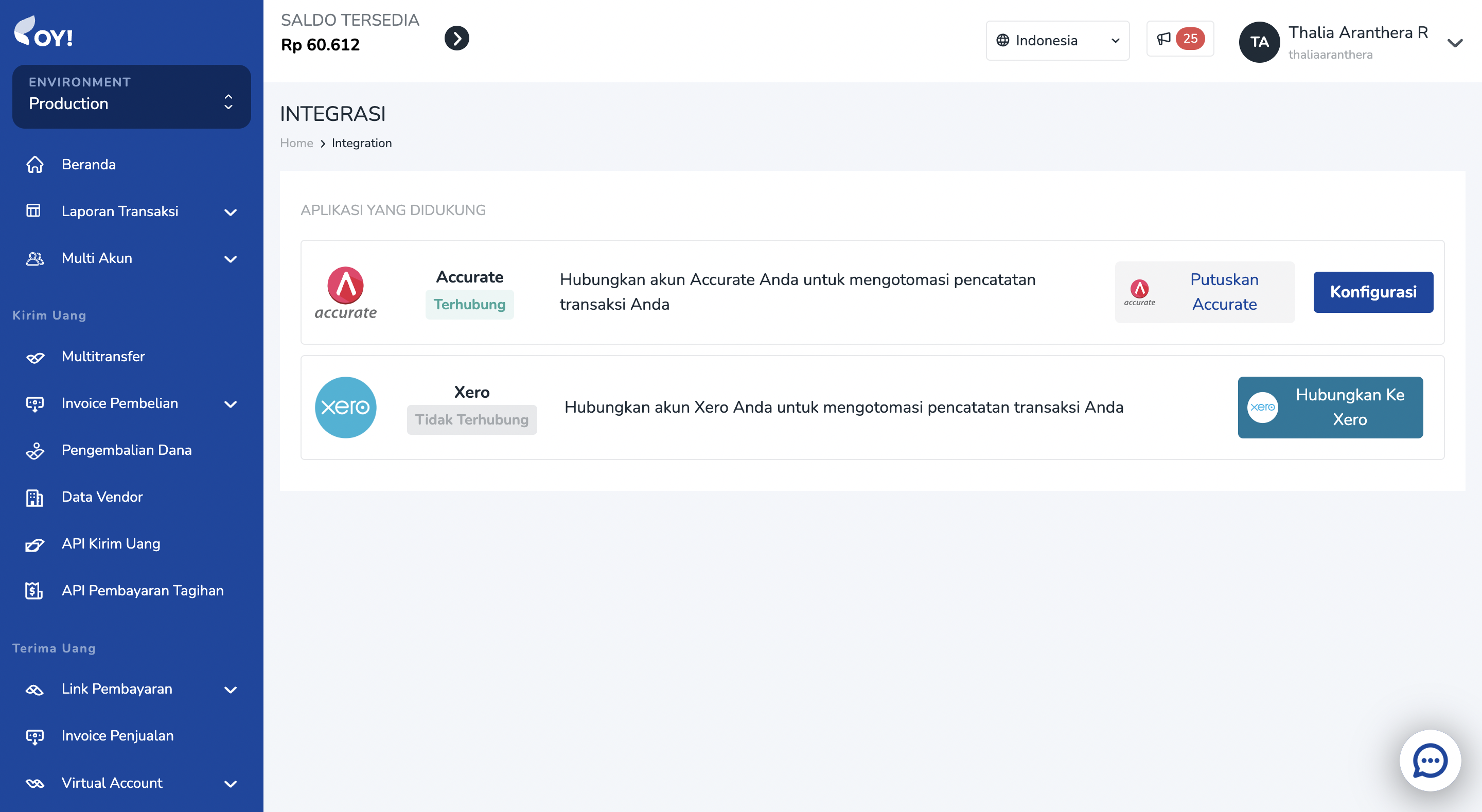

- Login to your OY! dashboard. In the sidebar, select the Integration menu.

- You will see Accurate menu. Click “Connect” to connect your Accurate account to OY!. You will be redirected to Accurate’s login page.

After login to your Accurate account, click Allow to allow conection between OY! and Accurate.

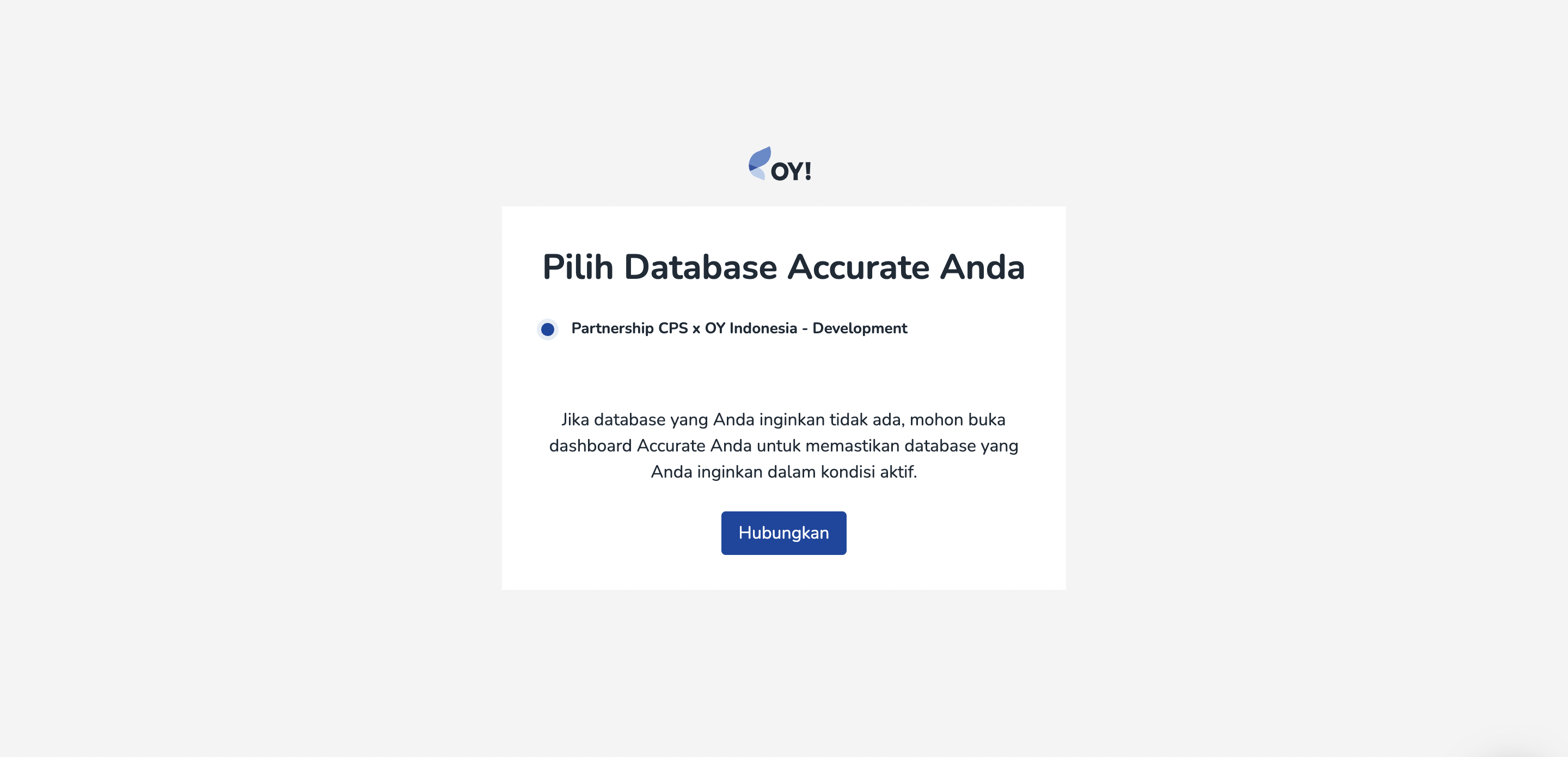

Next, please select an Accurate database that you want to connect with your OY! account.

Once you have successfully connected to Accurate, a notification in your OY! dashboard will appear and you can see your status is now "Connected/Terhubung".

Upon success connecting to Accurate, we will create a new Bank Account into your Accurate account, named “OY! balance” in which any transaction that happened in OY! will be recorded there. Your current OY! balance will also be mapped there.

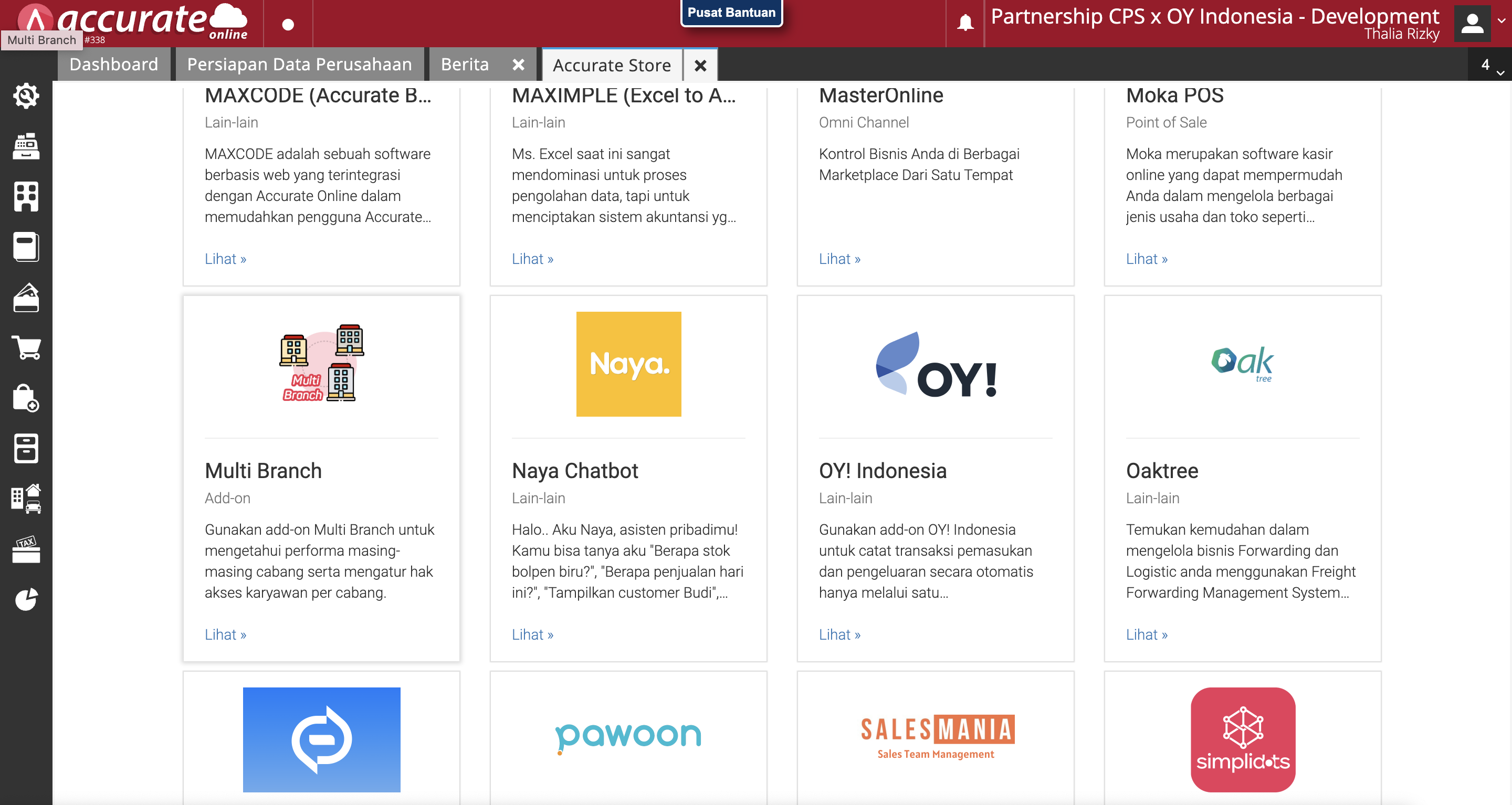

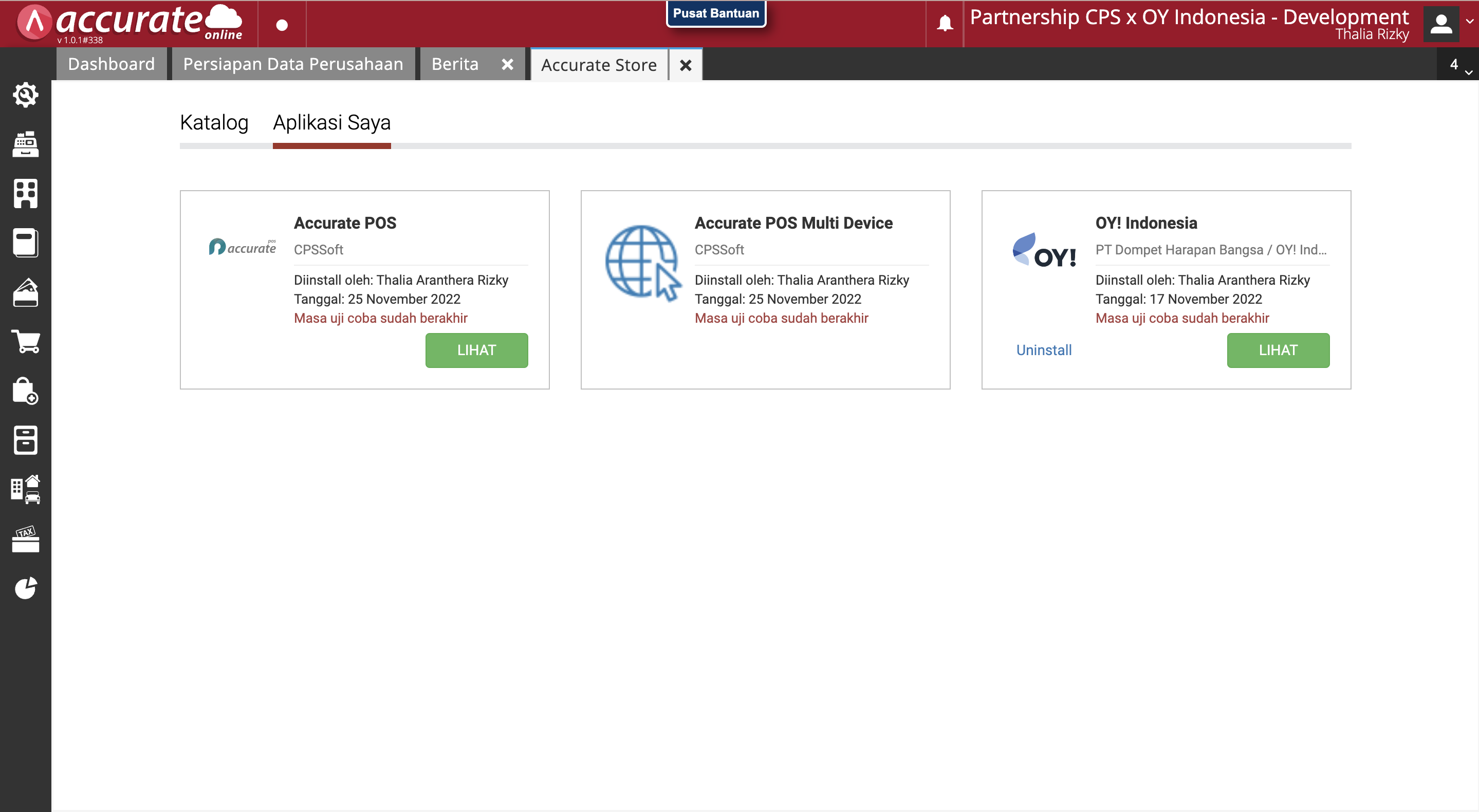

In your Accurate Dashboard, you can see that OY! Indonesia app will be listed in the Accurate Store >> Aplikasi Saya menu.

Note: A fee of IDR 20k/month will be added to your Accurate billing.

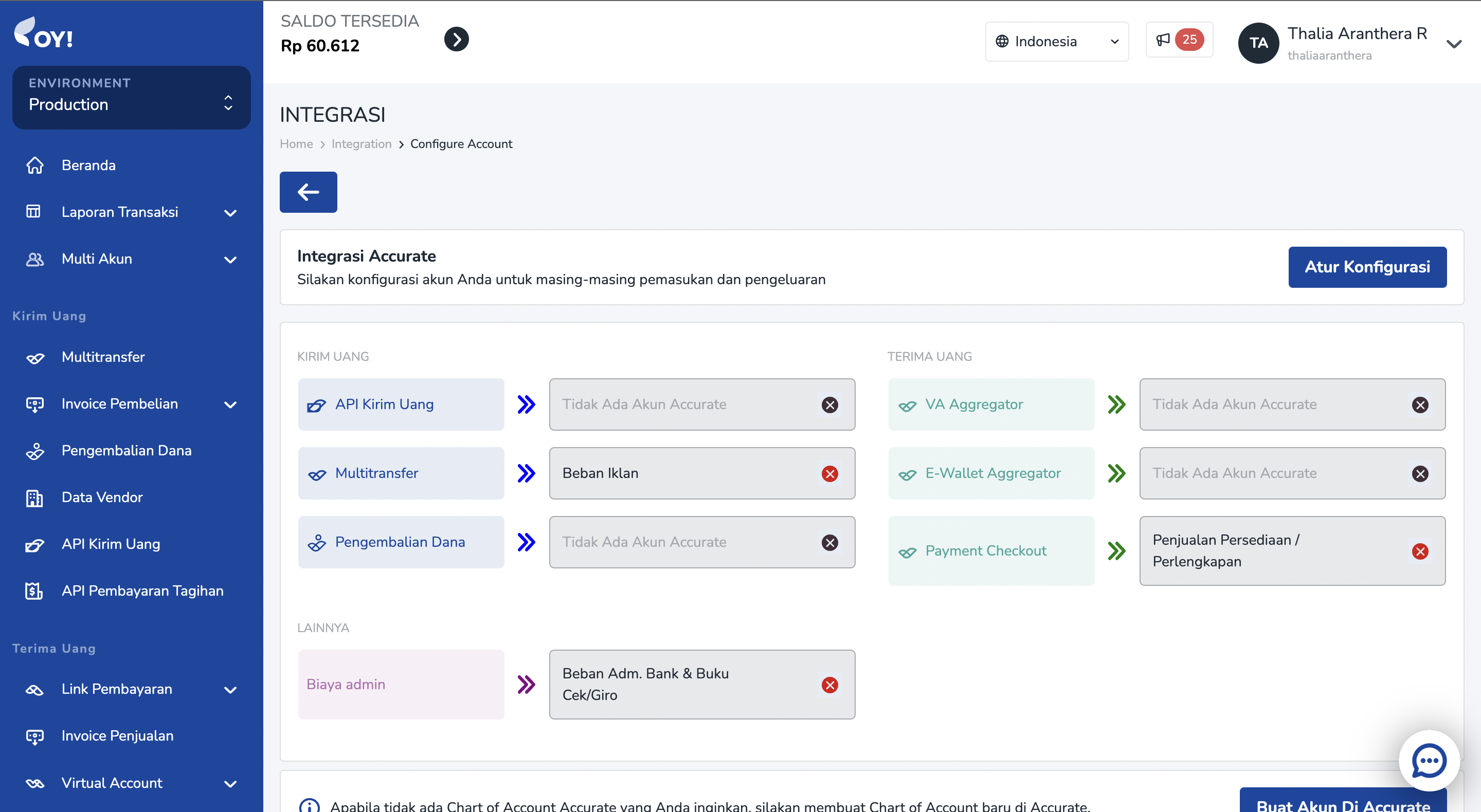

Map your Chart of Account (Akun Perkiraan)

- Click on "Configure" to map your Chart of Account (Akun Perkiraan).

- Then, map each product to the corresponding Account. Any transaction using each product will be put into the Chart of Accounts you defined on this page.

Note: Special for Bulk Disbursement product, you can define the Chart of Account later in the campaign creation process - Step 3 Input Detail page. In the Transaction Category field.

- You can change the CoA mapping anytime as needed, just go to Integration >> Accurate >> Configure.

Record Transaction to Accurate

- Now, your OY! account has been connected to your Accurate account and each product has been mapped to its corresponding Chart of Account.

- Any successful transaction that happened in OY! will be recorded to Accurate with the corresponding Account you defined in the Mapping Account menu.

- Transactions in OY! will be recorded in Pengeluaran or Pemasukan module, under OY! Balance bank account. It will also credited/debited your OY! Balance Bank Account.

- Note: For some reasons, we do not map Top up and Withdraw balance transactions to Jurnal. Therefore, you should adjust your bank’s Cash Bank account balance as well as OY! Indonesia Cash Bank account balance in your Accurate dashboard everytime you execute top up and withdraw transactions.

Disconnected your Accurate

- To disconnect your Accurate account from OY!, open the Integration menu on the sidebar. Then select “Disconnect”.

- Then, you will be disconnected from Accurate. Any transaction that you execute via OY! will not be recorded in Accurate.

- Note: To remove the bill, please make sure you also uninstall OY! app in your Accurate dashboard.

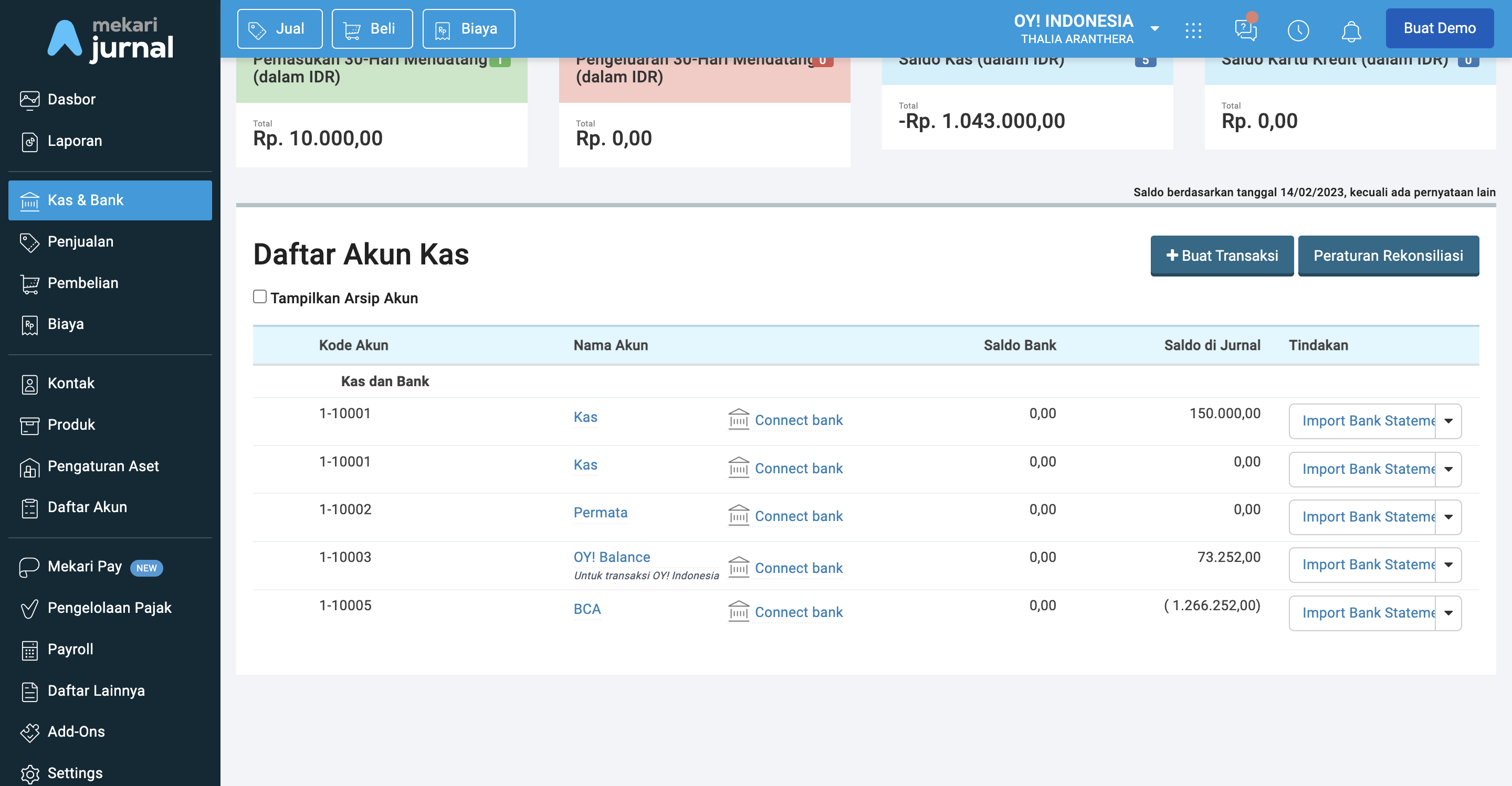

Jurnal Integration

Jurnal is a local accounting platform that is mainly used by companies in Indonesia. We have integrated our system to the Jurnal system in order to help you optimize your workflow. By connecting your OY! Account, you do not have to manually record your transaction that happened in OY! to Jurnal. You will get a seamless experience of recording your transaction.

How does it work?

Once you have connected your Jurnal account in OY!, any transaction that happened in OY! will be automatically recorded to your Jurnal account. Upon successful connection, we will trigger the creation of a new Bank Account, which is OY! Balance Bank Account. You will be required to map your Jurnal’s Chart of Account. Mapping your Chart of Accounts will help us to put your transaction into the correct Account. Transactions that happened in OY! will be recorded in that bank account, into the EXPENSES or SALES INVOICE modules.

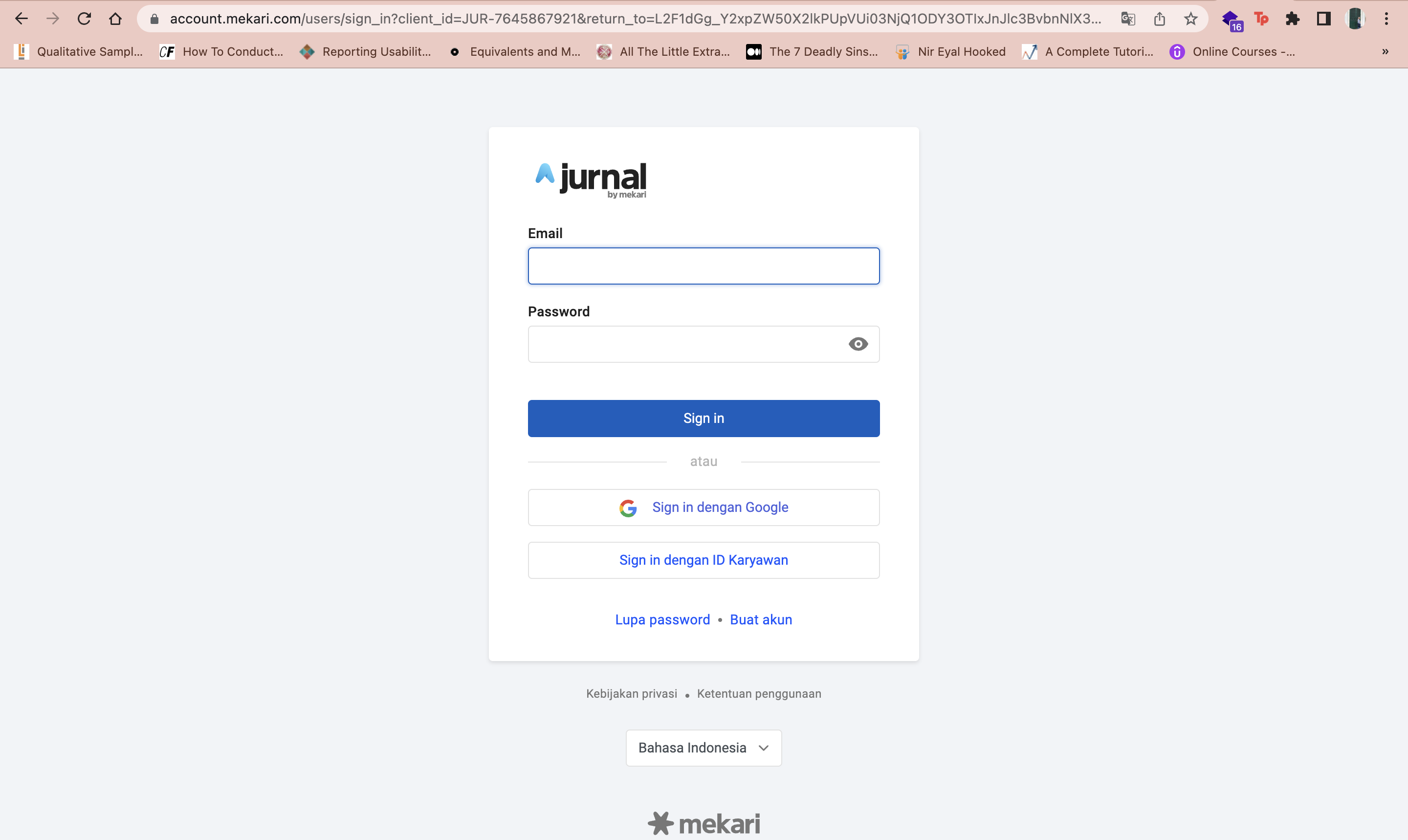

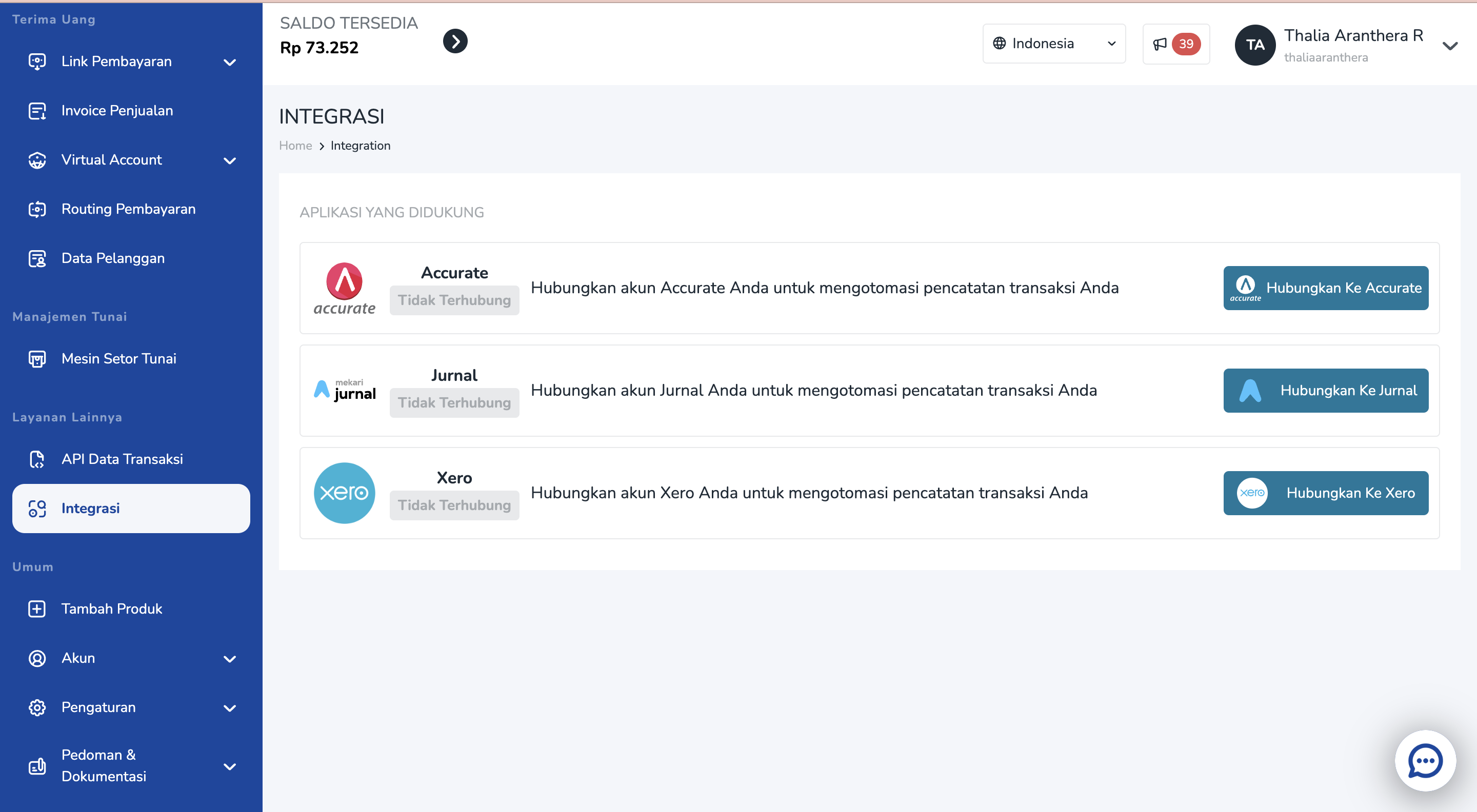

Connect your Jurnal

- Before connecting your Jurnal account, you need to log in to your Jurnal account in your browser.

Login to your OY! dashboard. In the sidebar, select the "Integration" menu.

You will see the Jurnal menu. Click “Connect” to connect your Jurnal account to OY!.

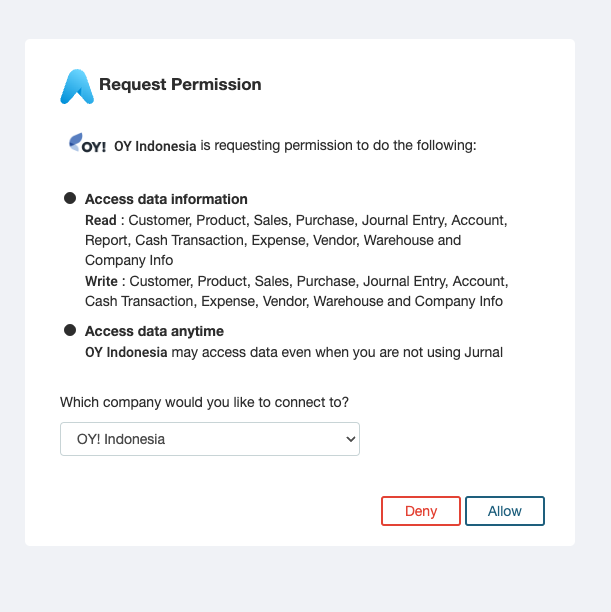

- There will be a page to ask for your consent regarding this connection process. Make sure to select OY! Indonesia. Click Allow to allow connection between OY! and Jurnal.

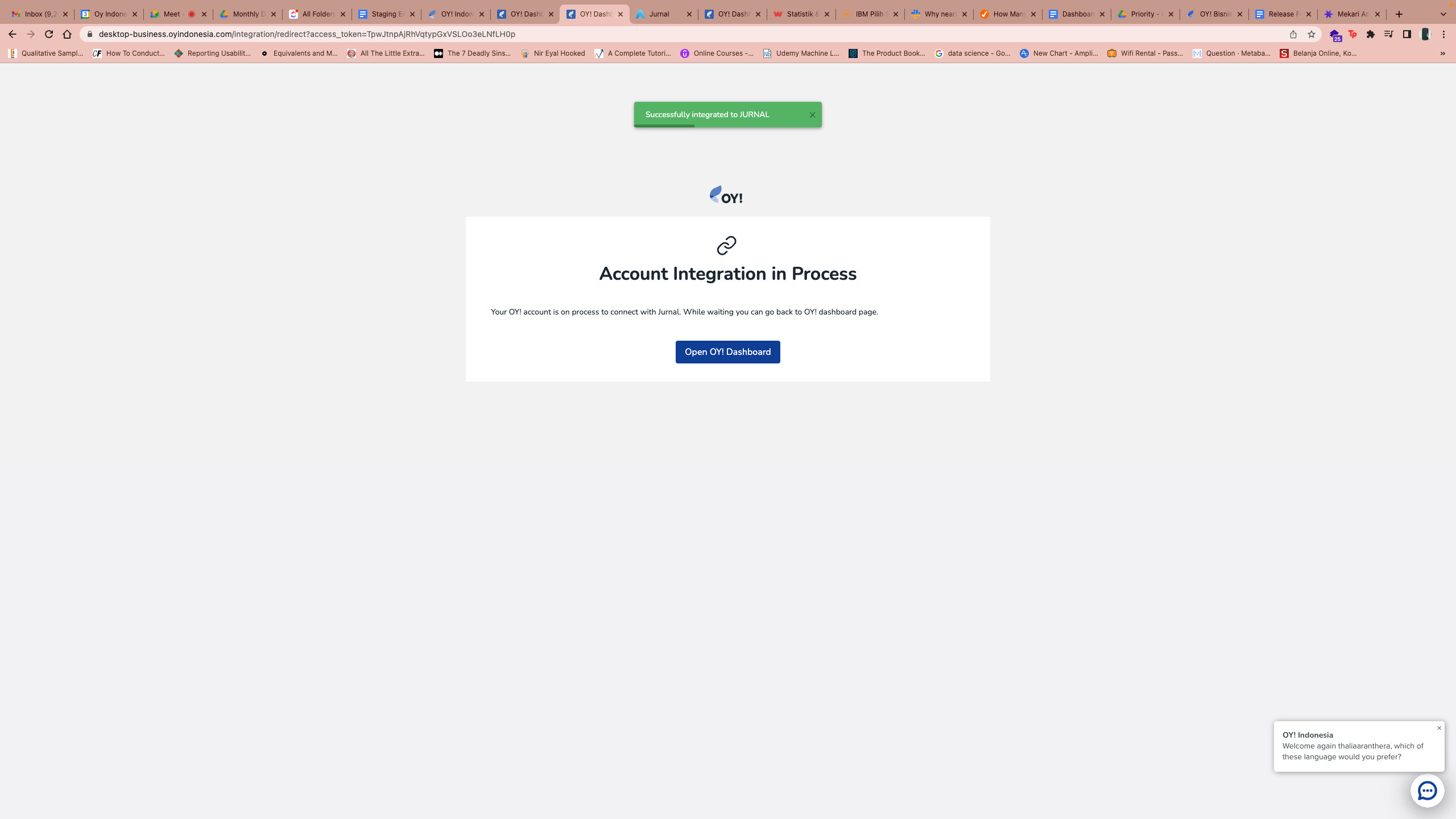

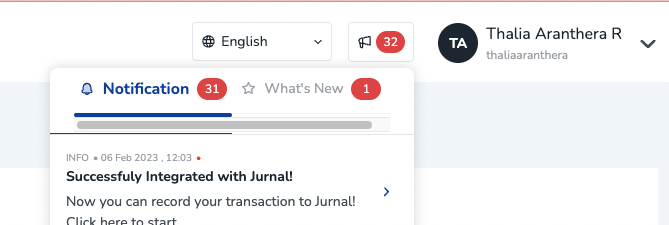

- Once you have successfully connected to Jurnal, a notification in your OY! dashboard will appear and you can see your status is now "Connected/ Terhubung".

- Upon success connecting to Jurnal, we will create a new Bank Account into your Jurnal account, named “OY! Balance”. Any transaction that happened in OY! will be recorded under that bank account. Your current OY! balance will be mapped into your OY! Balance Cash Bank Account as a bank deposit transaction.

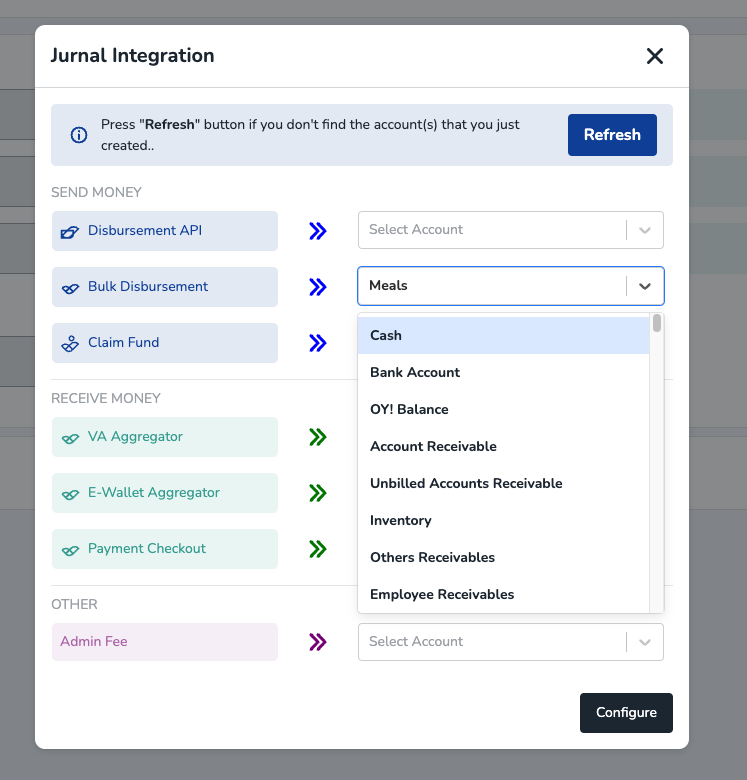

Map your Chart of Account

Click on "Configure" button in the "Integrasi" menu to map your Chart of Account.

Then, map each product to the corresponding Account. Any transaction using each product will be put into the Chart of Accounts you defined on this page.

- Note: Special for Bulk Disbursement product, you can define the Chart of Account later in the campaign creation process - Step 3 Input Detail page. In the Transaction Category field.

You can change the CoA mapping anytime as needed, just go to Integration >> Jurnal >> Configure.

Note: currently, we do not include mapping and recording the PPN tax. The applied tax will be recorded to Admin Fee Chart of Account. We will update this document as soon as possible once we have included mapping PPN function.

Record Transaction to Jurnal

- Now, your OY! account has been connected to your Jurnal account and each product has been mapped to its corresponding Chart of Account.

Any successful transaction that happened in OY! will be recorded to Jurnal with the corresponding Account you defined in the Mapping Account menu. Transactions from OY! will be recorded in the Expenses or Sales Invoice module, under OY! Balance bank account and it will credited/debited your OY! balance bank account. Note: Admin Fee of Receive Money transactions will be recorded in the Expenses module.

In this image, we show you a Disbursement Transaction with CoA "Iklan & Promosi" and admin fee with CoA "Komisi & Fee". It is recorded into the "Expenses" module in your Jurnal account with status LUNAS.

Note: For some reasons, we do not map Top up and Withdraw balance transactions to Jurnal. Therefore, you should adjust your bank’s Cash Bank account balance as well as OY! Indonesia Cash Bank account balance in your Jurnal dashboard everytime you execute top up and withdraw transactions.

Disconnected your Jurnal

- To disconnect your Jurnal account from OY!, open the Integration menu on the sidebar. Then select “Disconnect”.

- Then, you will be disconnected from Jurnal. Any transaction that you execute via OY! will not be recorded in Jurnal.

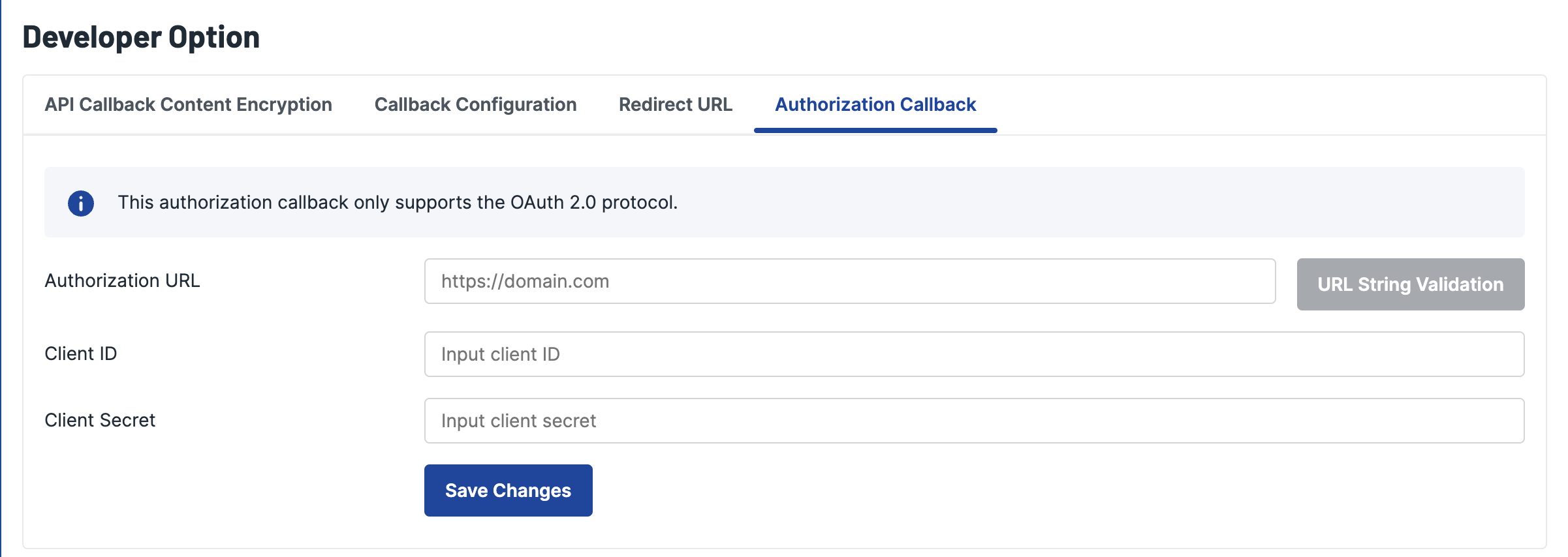

OY!'s Authorization Callback

When you successfully complete a transaction using OY!'s API-based product, OY! will send a callback to your system. To keep your system secure, we have provided a feature that allows you to control and approve these callbacks from OY! before they are received by your system.

Currently, we only support configuration for the OAuth 2.0 protocol. If your system uses OAuth 2.0, you can set up OY! callbacks to be directed to an authorization process before they are received by your system. To do this, simply enter the Authorization URL, client ID, and client secret via your dashboard.

How to Setup Authorization Callback

You can follow the steps below to set up callback authorization via your dashboard:

- Log in to the OY! dashboard as a super admin or admin, then select the "Settings" menu, and choose "Developer Options."

- Click on the "Authorization Callback" tab. Then, you should input your authorization details (Authorization URL, client ID, and client secret). This step is necessary to allow OY! to complete the authorization process before sending a callback to you.

- Click the "Save changes" button.

- Once you have configured your OAuth 2.0 credentials, all callbacks from OY! will go through your authorization process before you can receive them. OY! will obtain an access token along with the expiry time from your system.

- If you no longer want callbacks from OY! to go through the authorization process, you can remove all the OAuth information or credentials you've entered on this page and then click "Save Changes."

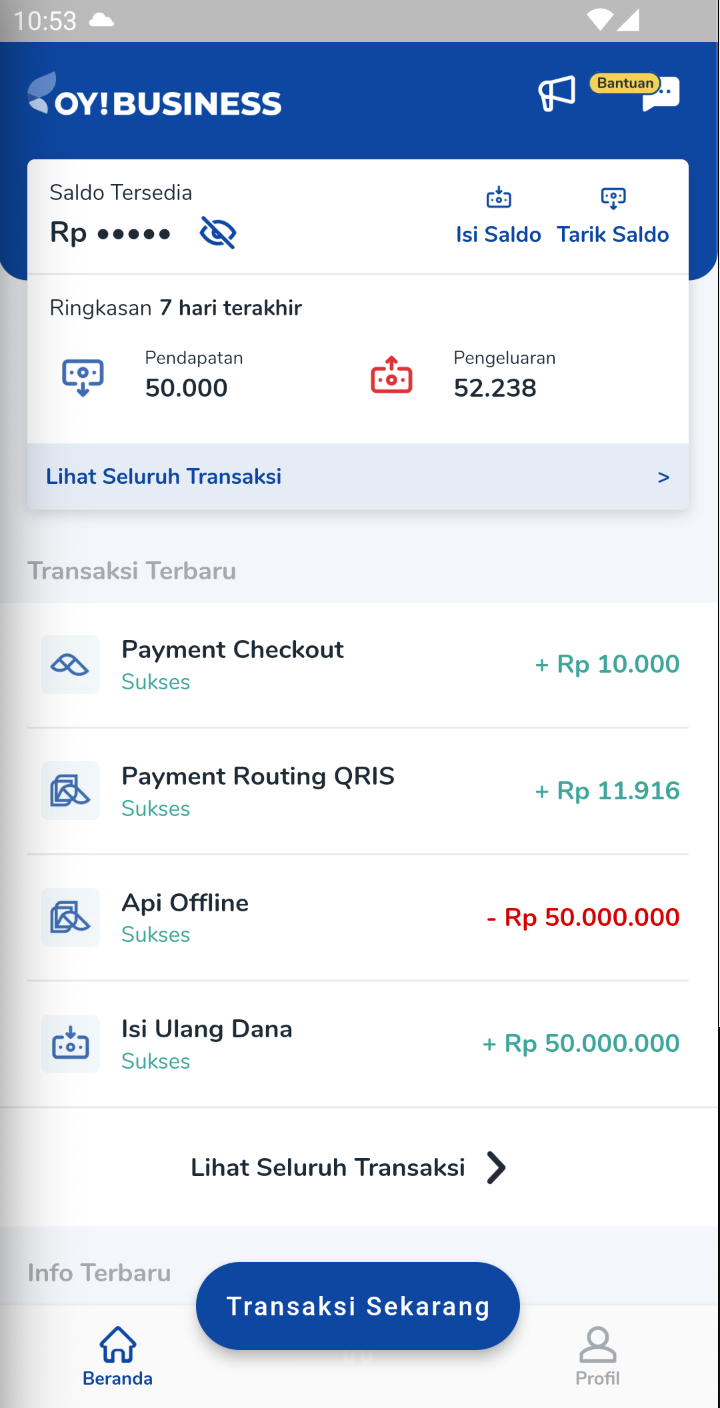

OY! Business App

OY! Business App

Great news for you who always in mobility mode but you need to access our dashboard! Now you can access your OY! dashboard from the tip of your finger. OY! Business offers you with easy access to OY! Dashboard, so you can do your financial activities everywhere you are, without opening your laptop or PC. In this app, you can see your balance, account statement, transaction status, send money and also receive money. Yes, doing transaction is now easier than before!

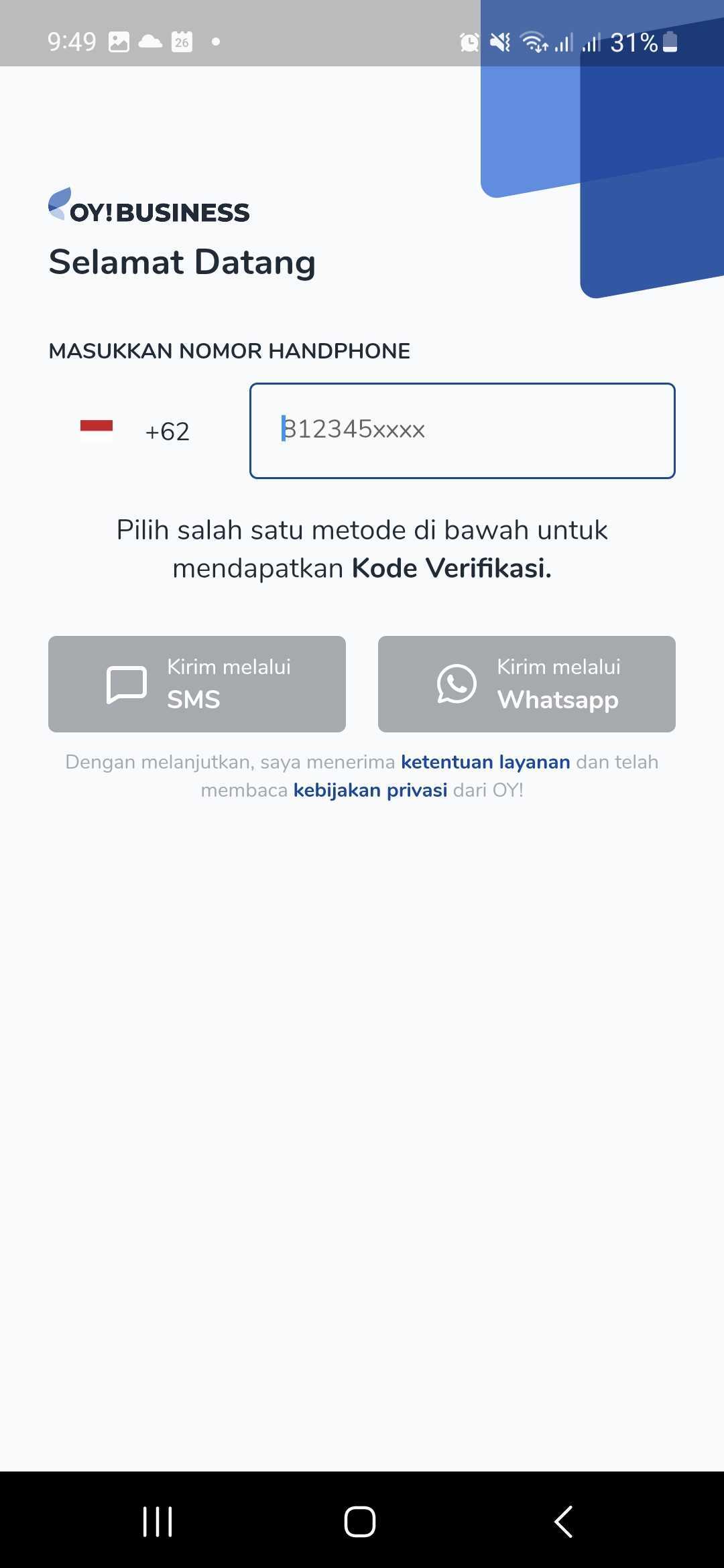

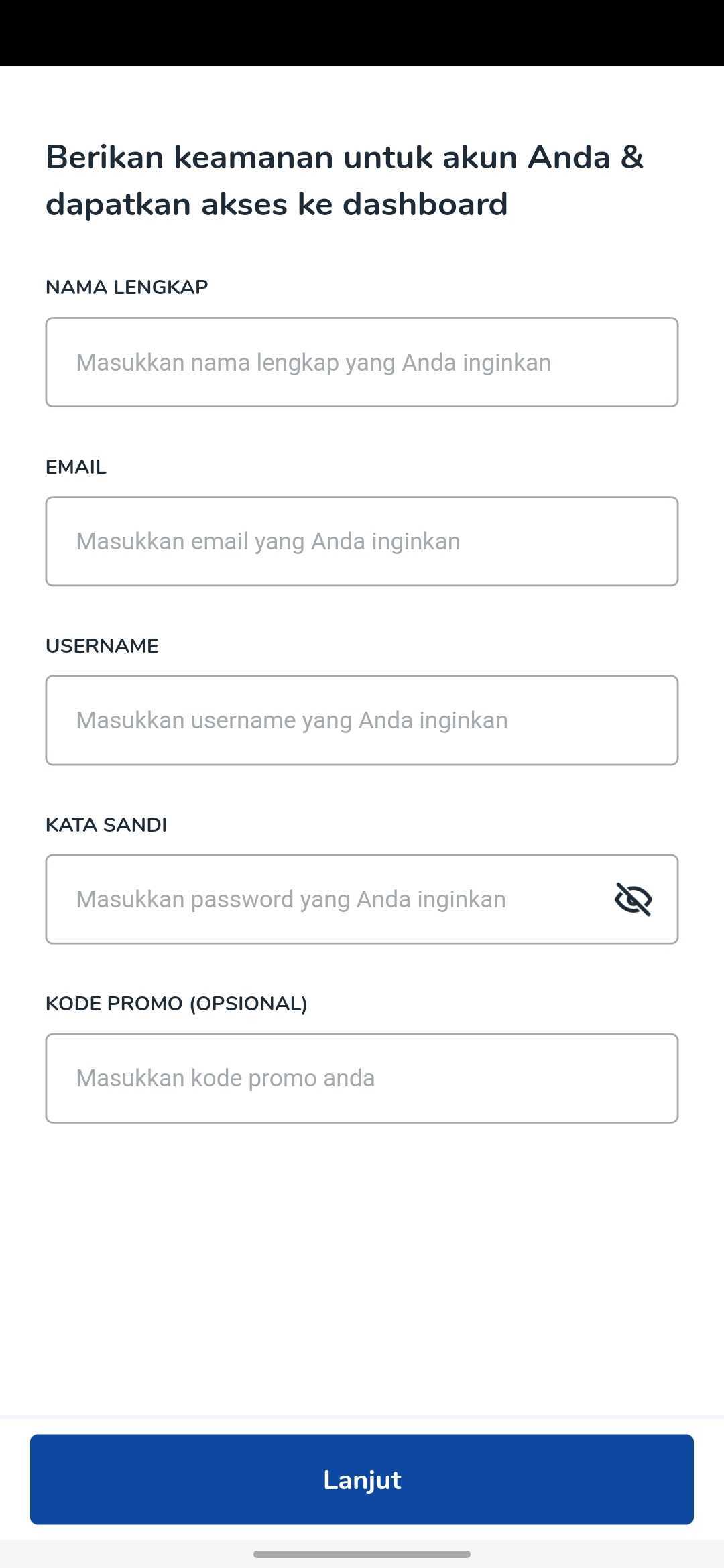

Register and KYB

- Open your OY! Business app in your Android phone.

- If it is your first time opening this application, you have to input your phone number.

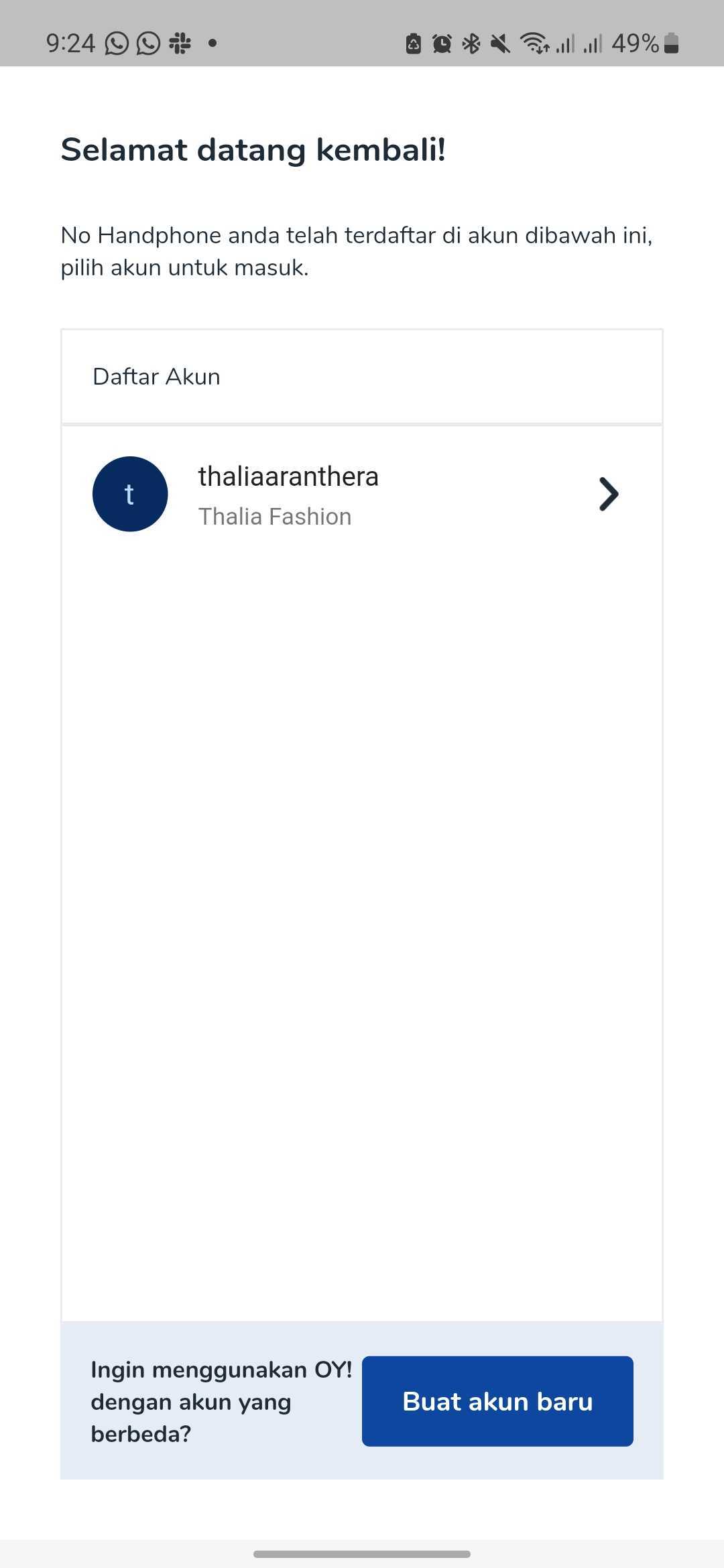

- Then, app will shows list of accounts that are tied to the phone number you entered before.

- If you want to create a new account, tap “Buat Sekarang”. Then follow the instruction.

- Once you success registering your new account, you can also submit your KYB.

Login

- Open your OY! Business app in your Android phone.

- If it is your first time opening this application, you will need to input your phone number to verify your account.

- Next, select which method for sending OTP. Make sure to input the right phone number. Then, please input the OTP number we just sent you.

- If the phone number is not yet registed in OY!, you will be required to create a new account.

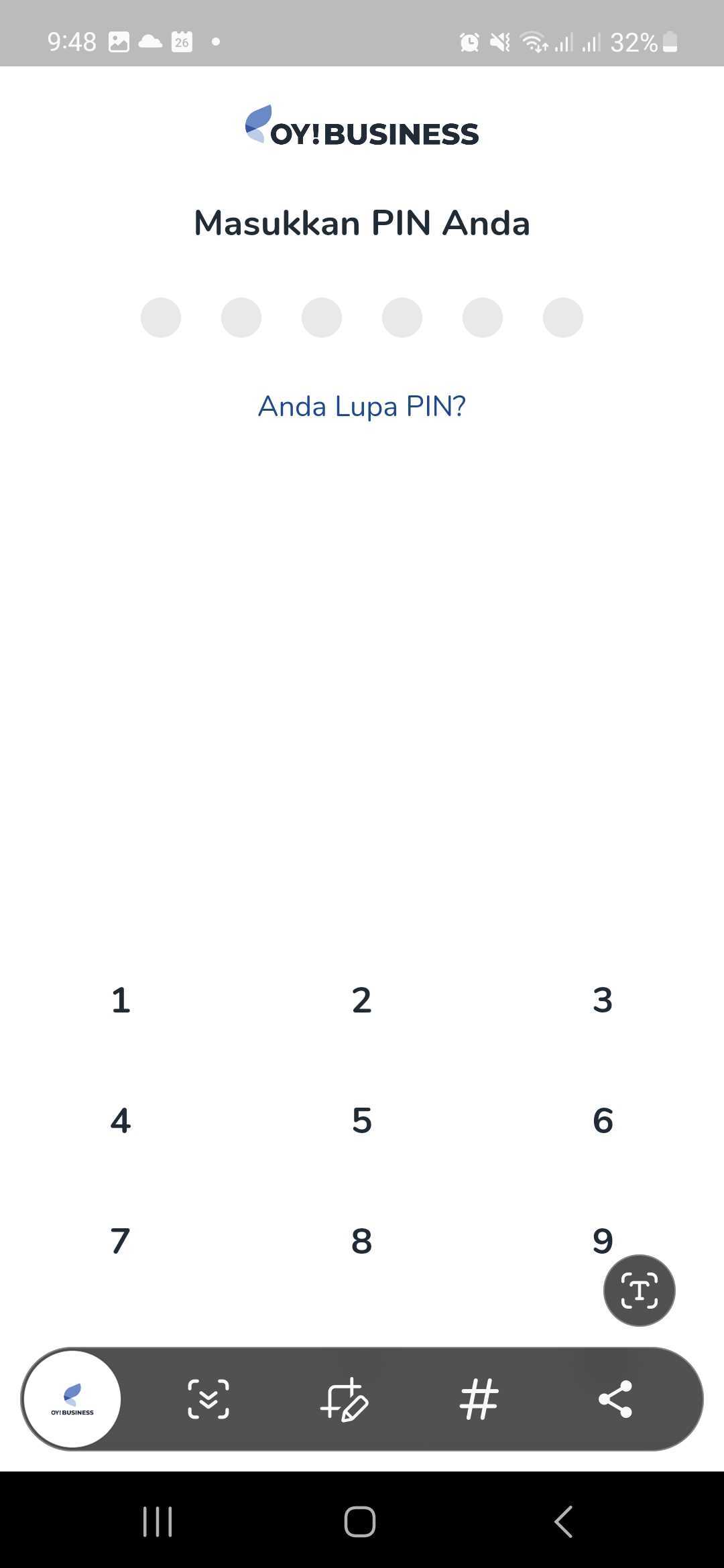

- However, if your phone number have been registered to OY! before, the app will displays list of accounts that are tied to the phone number you entered before.

- Select an account you want to log in to.

- First time logging in, you will be required to create a new PIN. This PIN will be used to log in to that account in the business app environment.

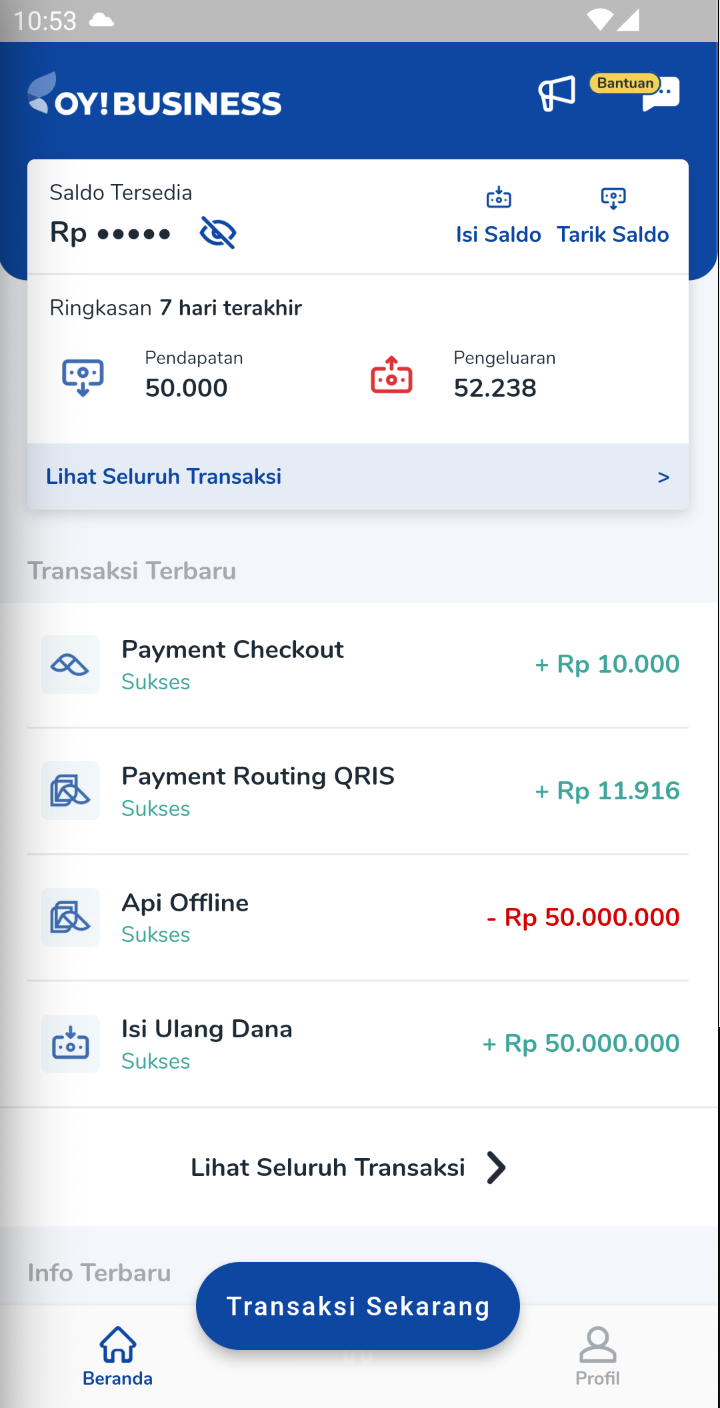

- Once you have successfully logged in, you will be directed to homepage. Here, you can see your balance and see your latest transaction.

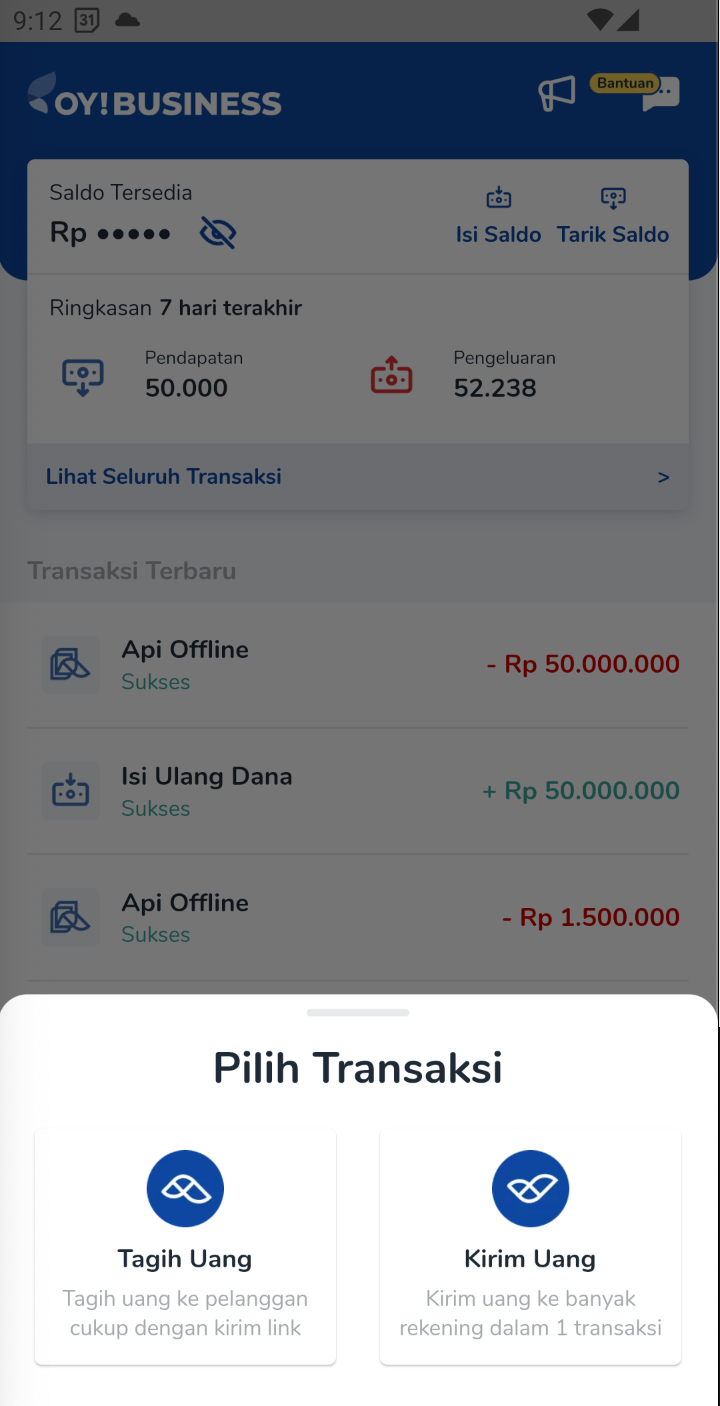

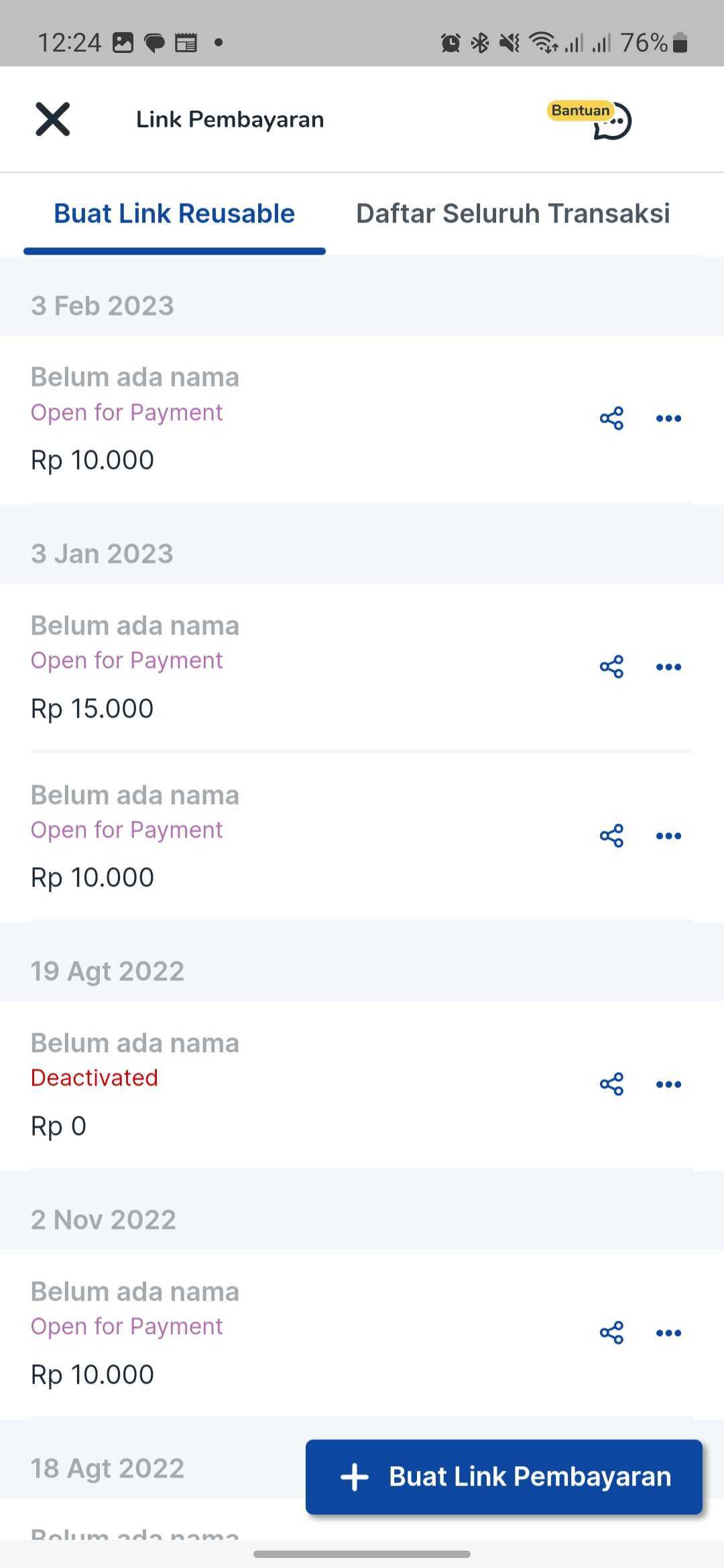

Create Payment Link

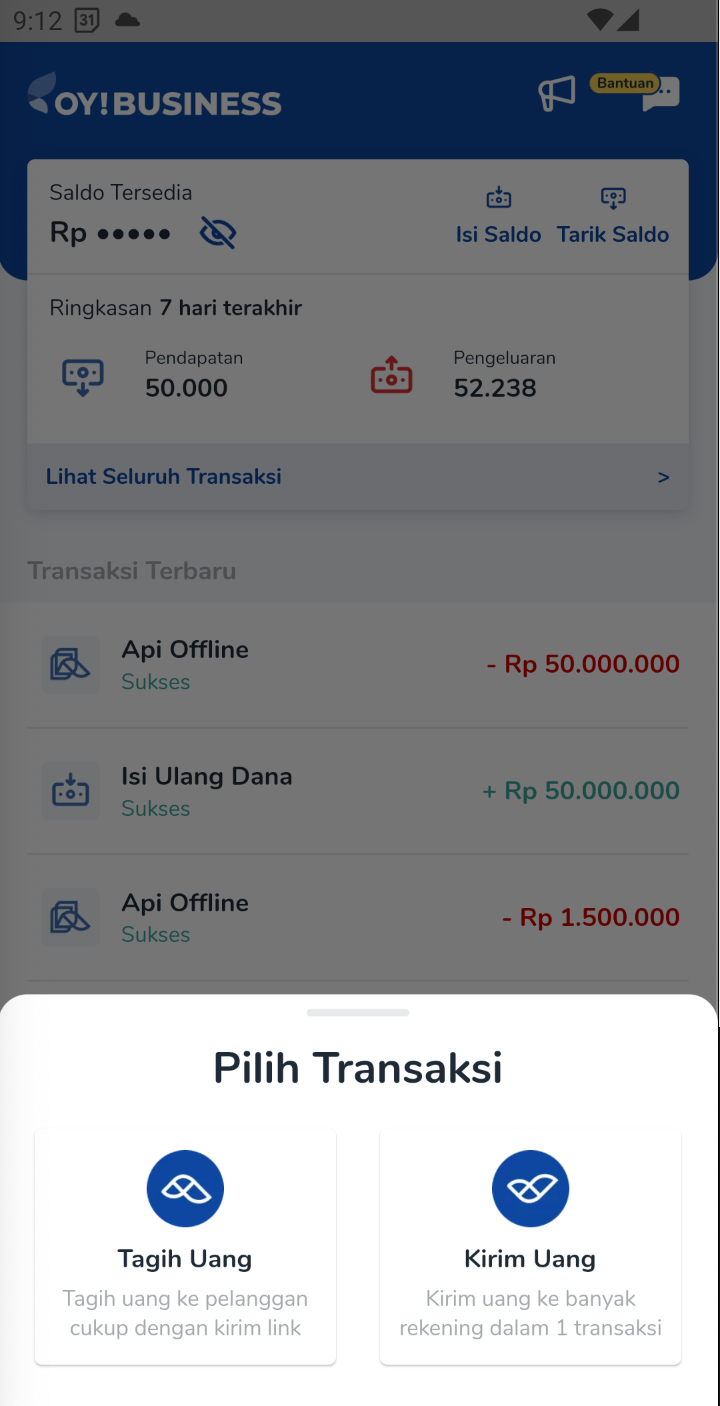

- In the homepage tap “Transaksi Sekarang” button.

- Then, select “Tagih Uang”.

- You will see your history of payment links and its transaction history. Then, tap “Buat Link Pembayaran” button in the bottom right.

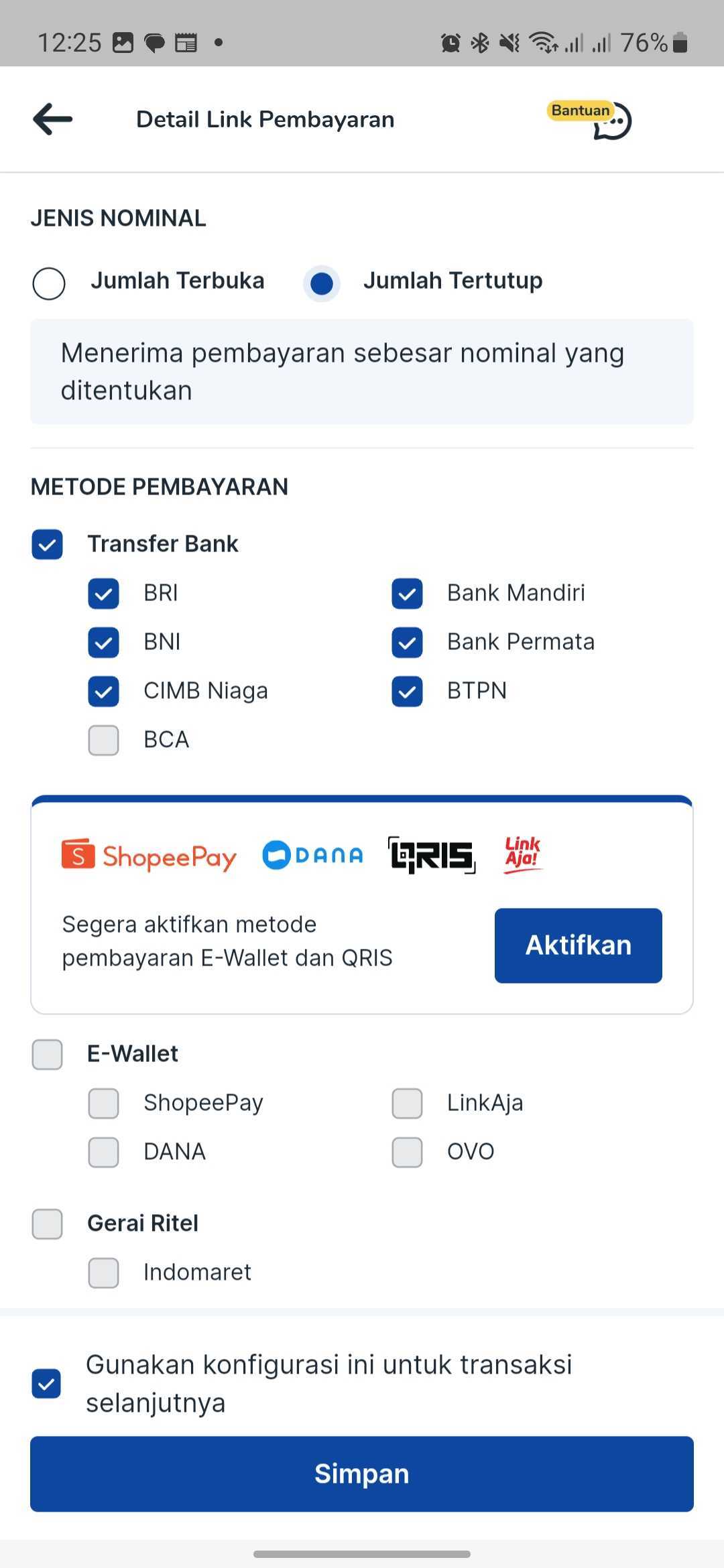

- Configure the payment link you want to create and fill all the required details. In this page, you can set the amount method (closed or open amount), admin fee method, payment link expiry date, and payment method(s) you want to provide to your customer(s). Them klik "Simpan".

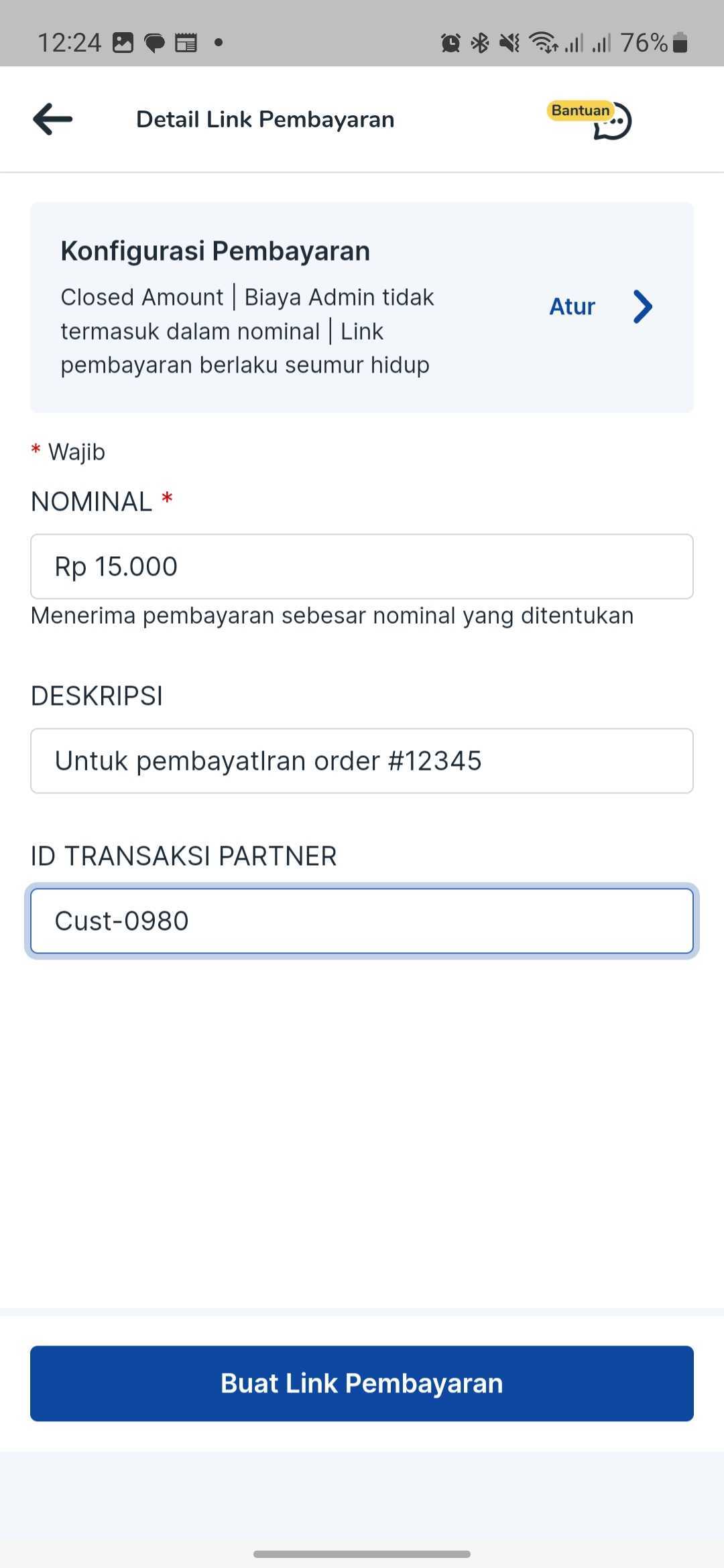

- Define the amount (if you select closed amount in the configuration page), description, and the transaction ID. Then, tap “Buat Link Pembayaran” button.

- Payment Link has been created and now you can share the link to your customer to receive payment from them.

Send Money (Bulk Disbursement)

- In the homepage tap “Transaksi Sekarang” button.

- Then, select “Kirim Uang”.

- You will see your bulk disbursement campaign history. Then, tap “Buat Disbursement” button in the bottom right.

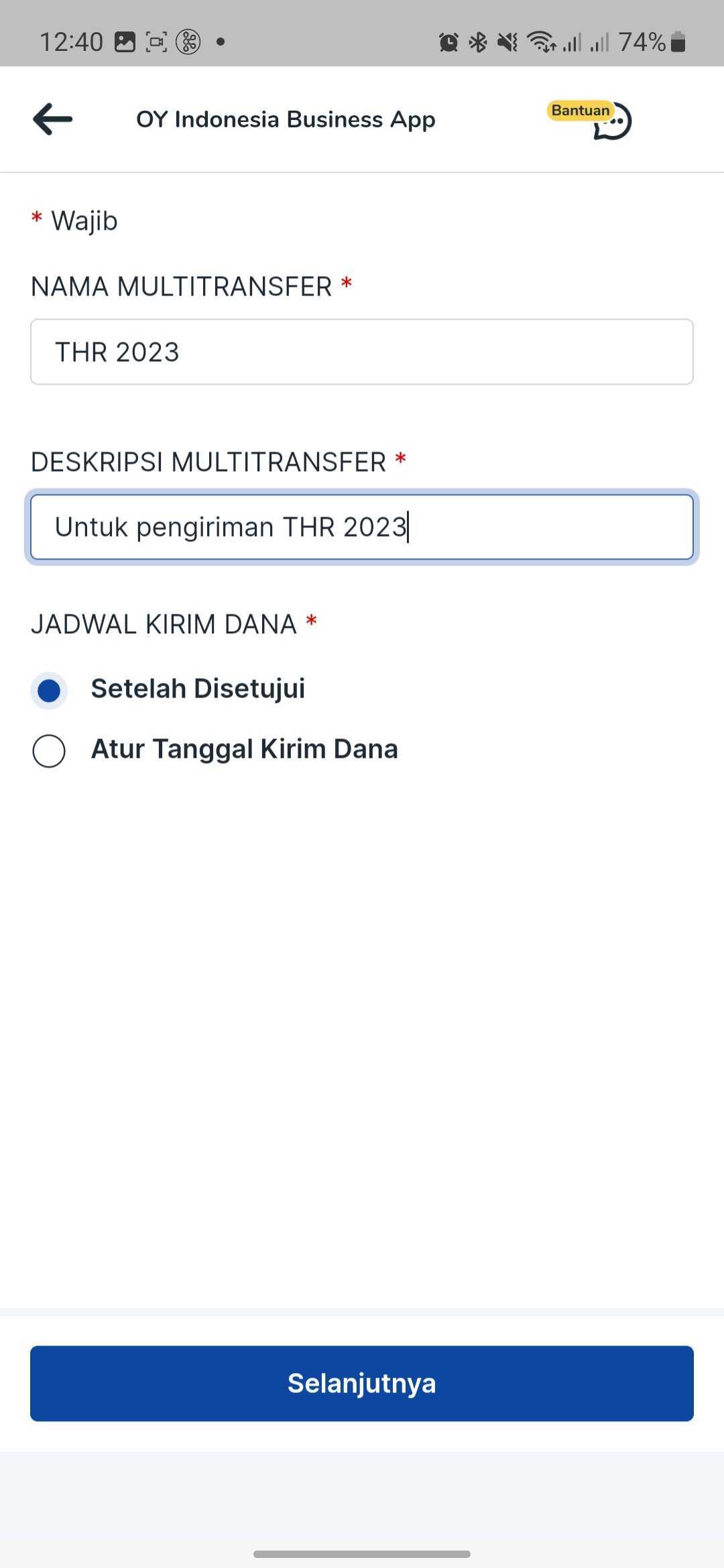

- Create your Bulk Disbursement campaign. First, fill out your campaign details.

- Next, fill the recipient data (bank, bank account number, amount, recipient email, phone number, note).

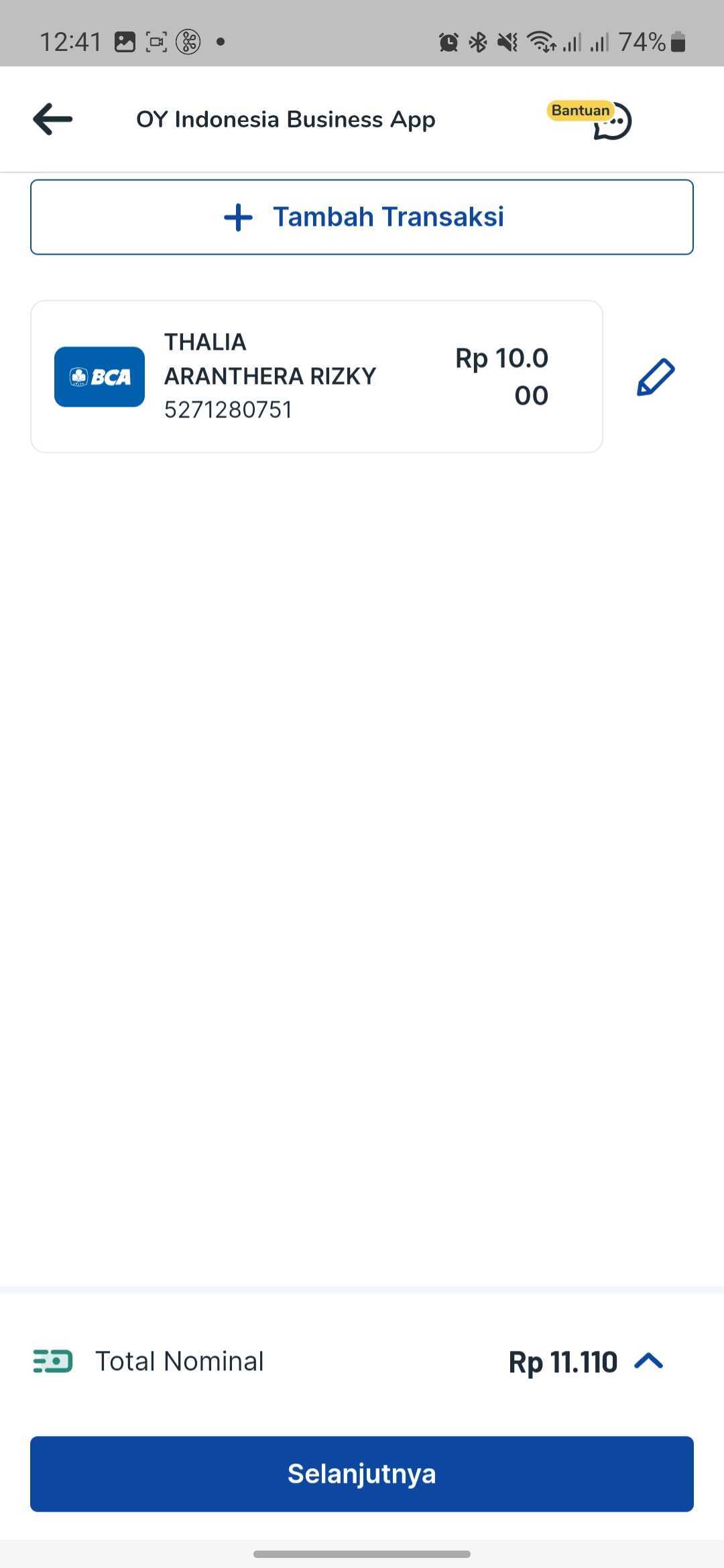

- Next, check on your recipient list. If you want to add more recipient, click on "Tambah Transaksi" button.

- Confirm your bulk disursement campaign. In this page you can ensure your campaign detail and your recipient data are correct before submitting the campaign.

- Your Bulk Disbursement campaign has been created and will be displayed on the Bulk Disbursement campaign history page. You may wait for your approver to approve the bulk disbursement so we can execute the transaction.

Sending Payments

API Disbursement

API disbursement product provides the capability for you to disburse to 100+ banks in Indonesia via OY! at any time. The integration process to use the API disbursement product is straight forward and the details can be checked here.

Key Features

Overbooking OY! can use the funds directly from your Mandiri or CIMB bank accounts for your disbursement needs. You will only need to top up the admin fee needed to execute the disbursements instead of the full amount of your disbursement. Please contact our business representative for further details about this feature. Check Transaction Status and Callback

For all disbursements executed, you will receive notifications regarding your transaction whether it is successful, failed or pending. We also provide an API for you to check the transaction status manually. IP proxy is also available upon request to enhance the security and integrity of the callback you will receive.

Check Balance

You can check your available balance at anytime to ensure that you have sufficient balance to execute a disbursement.

Registration and Set Up

Prerequisites

Register an account on the OY! dashboard

Activate your account through the activation link sent via email

Upgrade your account

Upgrade request is approved

Provide IP to be whitelisted and callback link to our business team

Receive an API Key from us

Integrate with our API

Testing

Once you successfully create an OY! account, you can immediately simulate disbursement via API. Follow the below steps to test the flow:

- Create an account

- Login into the dashboard

- Change the environment to “staging”

- Once the environment changed to staging, there will be API key staging available on the bottom left corner of the page

- Before creating a disbursement transaction, check your available balance through API GET https://api-stg.oyindonesia.com/api/balance

- Create a disbursement by sending a ‘POST’ request to https://api-stg.oyindonesia.com/api/remit (https://api-stg.oyindonesia.com/api/remit) using your staging API key. Enter the required and optional fields, as referenced in the API reference docs (https://api-docs.oyindonesia.com/#disbursement-fund-disbursement)

- Fill in the amount, recipient bank, recipient account, and the partner transaction-id

- To get the status of a disbursement request, you can call the API https://api-stg.oyindonesia.com/api/remit-status, This API also offers the option for callback status under field send_callback

- If payment is successful or failed, we will send a callback to the registered staging callback URL destination. Callback URL can be registered via our business representative.

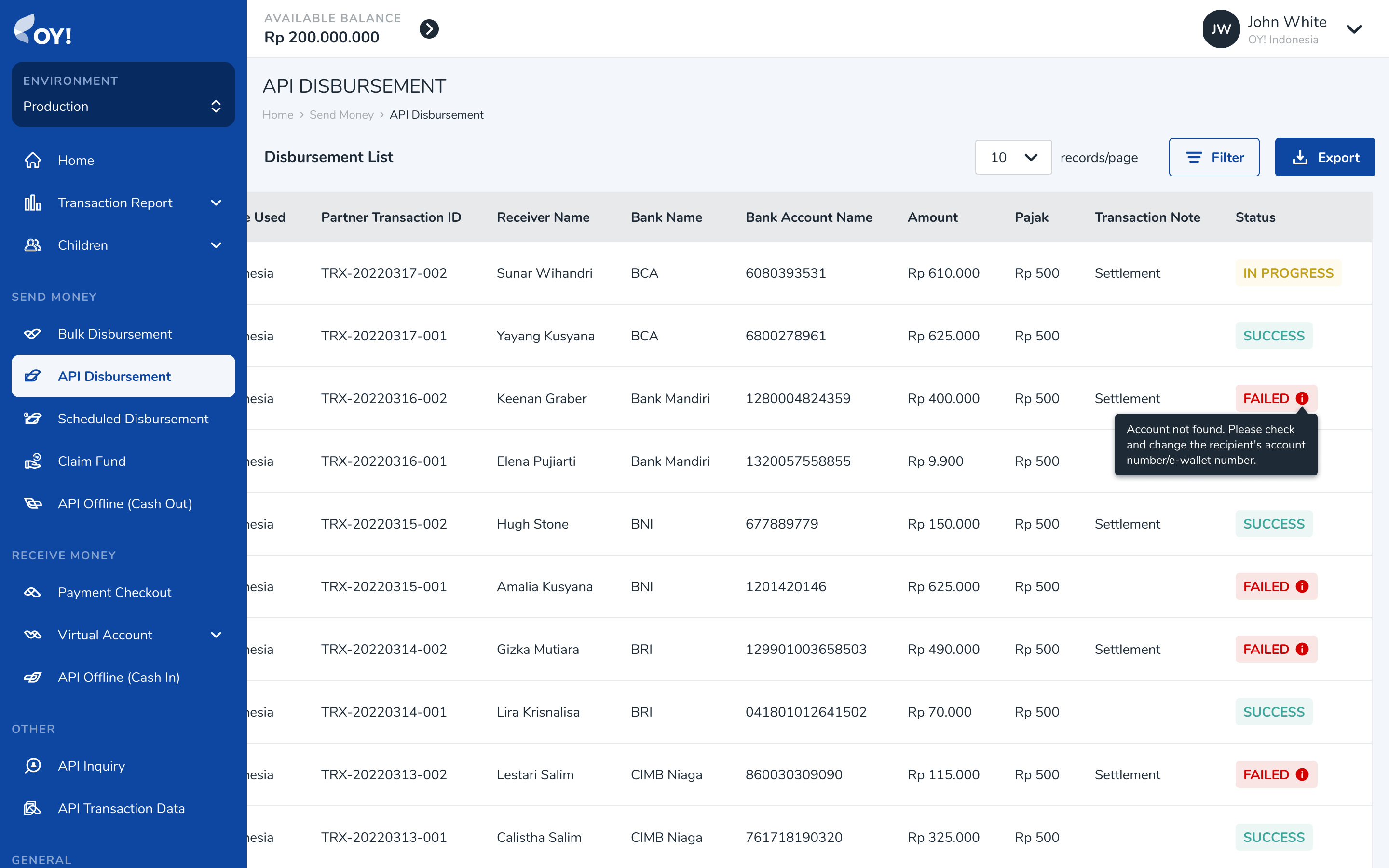

- The API disbursement transactions can be monitored through OY! dashboard from the “Send money - API disbursement” menu.

How to Use

In order to create disbursements, a sufficient available OY! balance is required in the account. More details and instructions about topping up to your OY! account coming soon.

Before you execute a disbursement, you can verify the beneficiary account information from our inquiry endpoint.

Below is an example of the request body for inquiry:

curl -X POST https://partner.oyindonesia.com/api/inquiry

-H 'content-type: application/json, accept: application/json, x-oy-username:myuser, x-api-key:987654'

-d '{

"recipient_bank": "022",

"recipient_account": "7823023345"

}'

It will return an error message if the request is not valid. Otherwise, below is the sample response parameters that will be returned:

{

"status":{

"code":"000",

"message":"Success"

},

"recipient_bank":"022",

"recipient_account":"7823023345",

"recipient_name":"Budi Budianto Budiman",

"timestamp":"16-10-2021 09:55:31"

}

Next, send a request body to execute a disbursement request to be sent to our disbursement endpoint.

Below is an example of the request body for the remit:

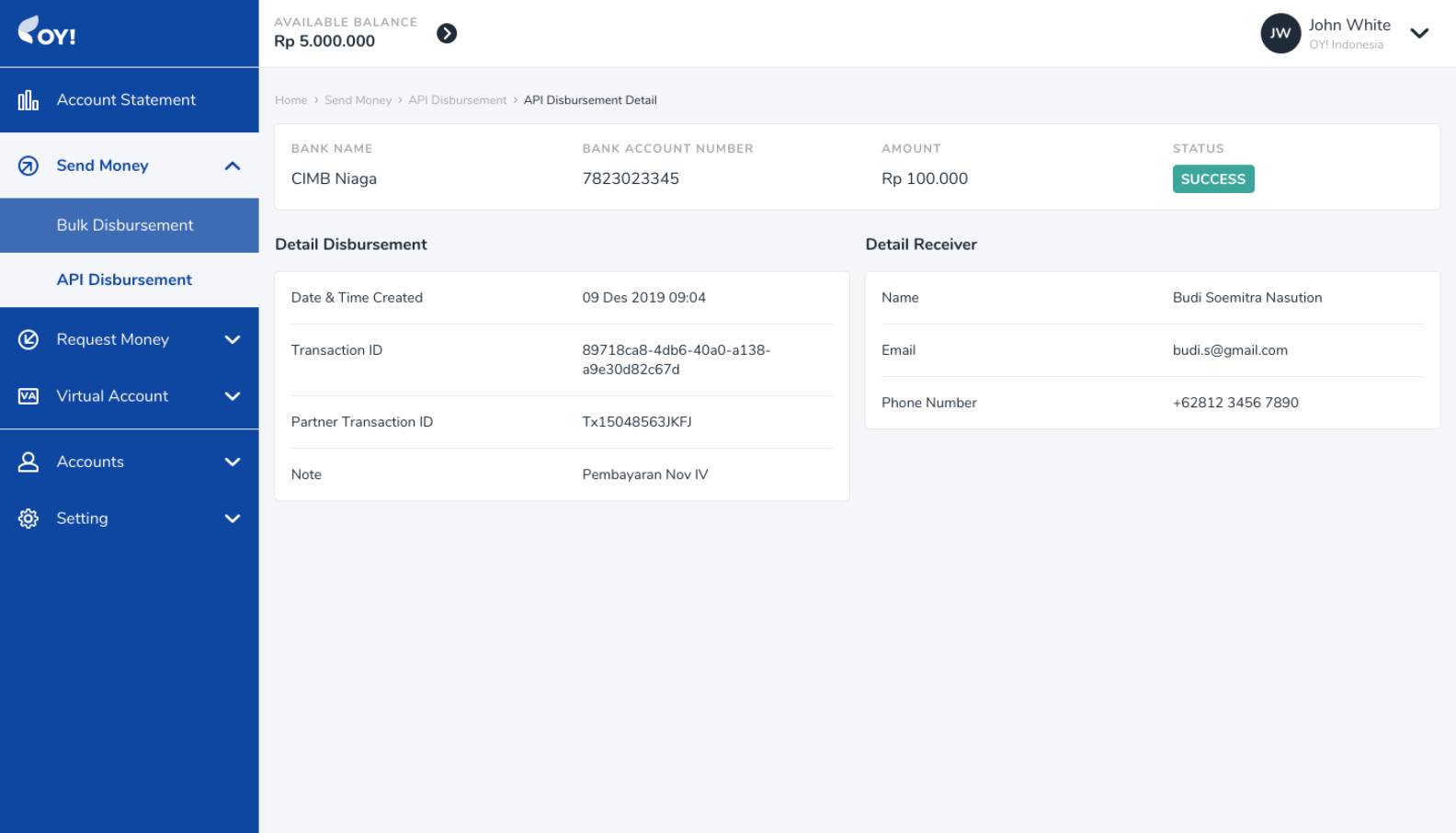

curl -X POST https://partner.oyindonesia.com/api/remit

-H 'content-type: application/json, accept: application/json, x-oy-username:myuser, x-api-key:7654321'

-d '{

"recipient_bank": "022",

"recipient_account": "7823023345",

"amount":100000, "note":"Pembayaran Nov IV",

"partner_trx_id":"Tx15048563JKFJ",

"email" :"budi.s@gmail.com"

}'

Below is the sample response parameters that will be returned:

{

"status":{

"code":"101",

"message":"Request is Processed"

},

"amount":100000,

"recipient_bank":"022",

"recipient_account":"7823023345",

"trx_id":"89718ca8-4db6-40a0-a138-a9e30d82c67d",

"partner_trx_id":"Tx15048563JKFJ",

"timestamp":"16-10-2019 10:23:42"

}

An enpoint to check the transaction is also available and can be accessed at anytime.

Below is an example of the request body:

curl -X POST https://partner.oyindonesia.com/api/remit-status

-H 'content-type: application/json, accept: application/json, x-oy-username:myuser, x-api-key:7654321'

-d '{

"partner_trx_id": "1234-asde",

"send_callback": "true"

}'

The above command returns a JSON structured similar like this:

{

"status":{

"code":"000",

"message":"Success"

},

"amount":125000,

"recipient_name":"John Doe",

"recipient_bank":"008",

"recipient_account":"1234567890",

"trx_id":"ABC-456",

"partner_trx_id":"1234-asde",

"timestamp":"16-10-2020 10:34:23",

"created_date": "24-01-2020 06:48:08",

"last_updated_date": "24-01-2020 06:48:39"

}

A callback with the following information will be sent to the callback endpoint that you can register with us.

Below is an example of the request body:

curl -X POST https://partner.oyindonesia.com/api/remit-status

-H 'content-type: application/json, accept: application/json, x-oy-username:myuser, x-api-key:7654321'

-d '{

"partner_trx_id": "Tx15048563JKFJ"

}'

Below is the sample response parameters that will be returned:

{

"status":{

"code":"000",

"message":"Success"

},

"amount":100000,

"recipient_name":"Budi Soemitra Nasution",

"recipient_bank":"022",

"recipient_account":"7823023345",

"trx_id":"89718ca8-4db6-40a0-a138-a9e30d82c67d",

"partner_trx_id":"Tx15048563JKFJ",

"timestamp":"16-10-2019 10:40:23",

"created_date": "16-10-2019 10:23:42",

"last_updated_date": "16-10-2019 10:34:23"

}

You can also check your balance anytime to ensure you have sufficient balance from our endpoint.

Below is an example of a request body to check the balance:

curl -X GET 'https://partner.oyindonesia.com/api/balance'

-H 'Content-Type: application/json'

-H 'Accept: application/json'

-H 'X-OY-Username: janedoe'

-H 'X-Api-Key: 7654321'

Below is the sample response parameters that will be returned:

{

"status":{

"code":"000",

"message":"Success"

},

"balance":100000000.0000,

"pendingBalance":2000000.0000,

"availableBalance":98500000.0000,

"overbookingBalance":98500000.0000,

"timestamp":"10-12-2019 12:15:37"

}

Lastly, all transactions can be monitored from the OY! dashboard which includes all the transaction details.

For further details on the parameters definition and proper usage, please refer to our API Documentation.

Bulk Disbursement

Our Bulk disbursement product provides the capability to execute disbursements to multiple beneficiaries with a single xlsx or csv file upload ("Campaign") up to 25,000 transactions. Bulk disbursement is made through the OY! dashboard, where details regarding the disbursement campaign can be found. No technical integration is required to use this product.

Key Features

Overbooking OY! can use the funds directly from your Mandiri or CIMB bank accounts for your disbursement needs. You will only need to top up the admin fee needed to execute the disbursements instead of the full amount of your disbursement. Please contact our business representative for further details about this feature.

Account Management

When you first create an account, your account will be assigned as a Super Admin role. As a Super Admin, you have the ability to create new sub-accounts and assign different roles to your team such as Admin, Maker and Approver that are applicable for bulk disbursement. The Super Admin and Admin can also edit or delete created sub-accounts.

Note: it is not necessary to create new sub-accounts in order to use bulk disbursement. The Super Admin and Admin roles allows you to directly create and approve bulk disbursements.

Detailed step-by-step instructions on setting up user management and the different role types coming soon.

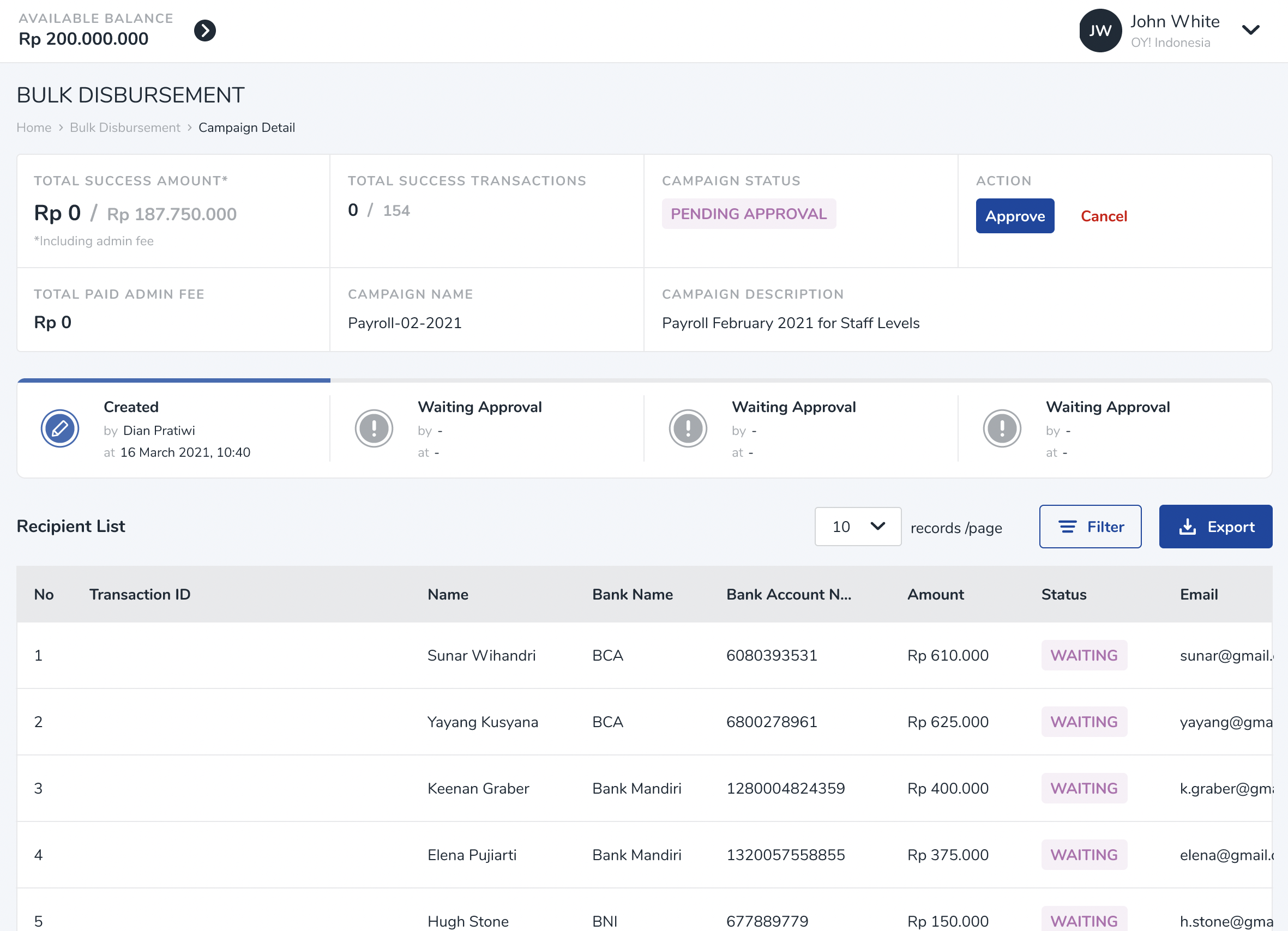

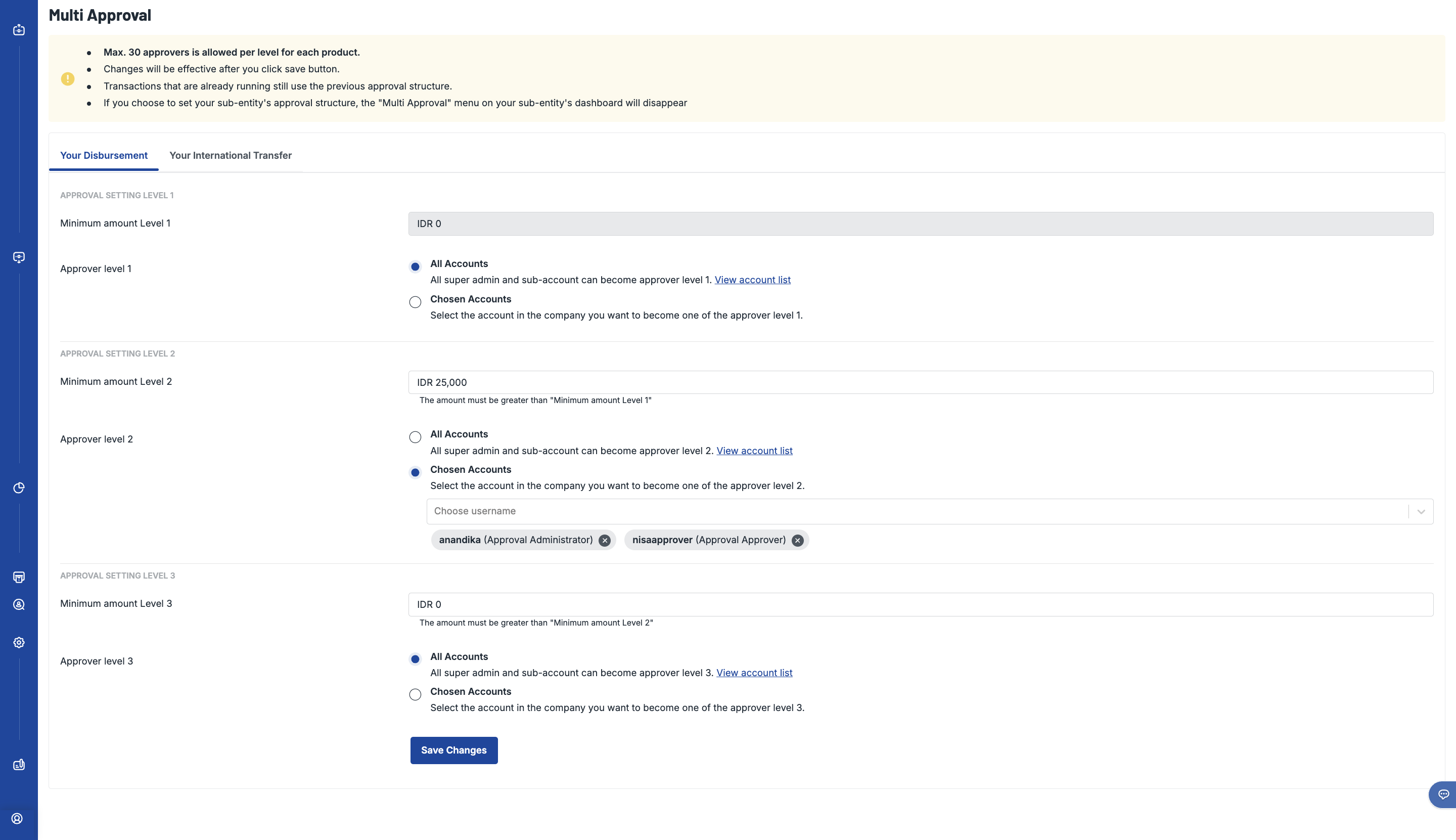

Multi-Layer Approval

Multi-layer Approval will improve your control over your bulk disburse transaction especially for big amount of money. You can setup up to 3 layers of approver before the transaction instruction is executed. By assigning proper approver and amount limitation, you can avoid a huge trouble on your business operational caused by incorrect transfer amount.

Overall Campaign Summary

Keep track of all the details of the entire campaign such as the total amount of disbursement, total number of transactions, and the maker and approver related information of a campaign.

Transaction Details

Itemized details of each individual transaction, including their respective statuses: success, pending, or failed.

Registration and Set Up

Prerequisites

Register an account on the OY! dashboard

Activate your account through the activation link sent via email

Upgrade your account

Upgrade request is approved

Testing

- Log on your OY! dashboard

- Choose "Staging" environment

- Click "Send Money" menu, and choose "Bulk disbursement"

- Click "Create Disbursement"

- Fill in the necessary details by following the steps explained in the “How to Use” section

How to Use

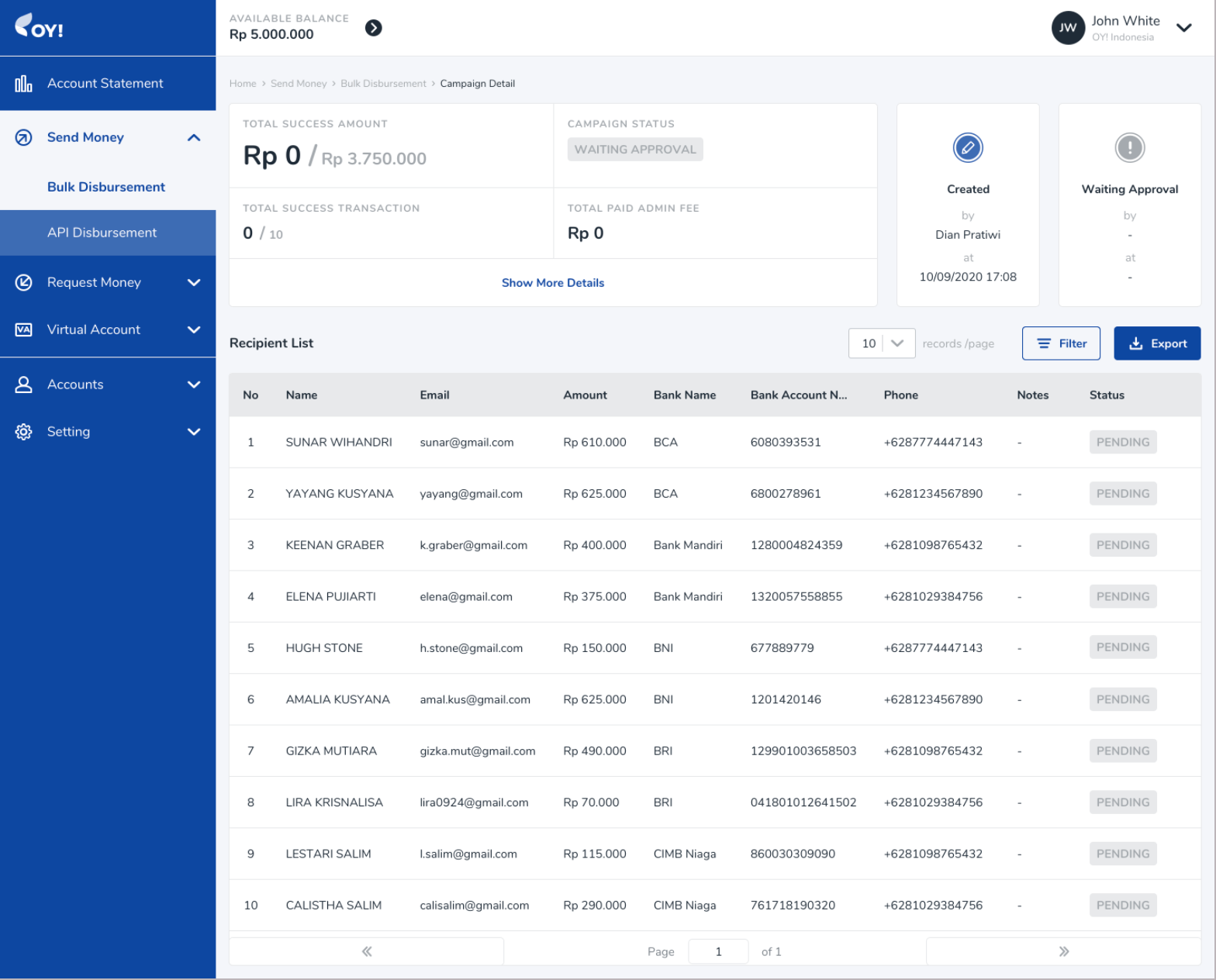

In order to create disbursement campaigns, a sufficient available OY! balance is required in the account. If there is an insufficient available balance in the account, campaigns can still be created but not approved.

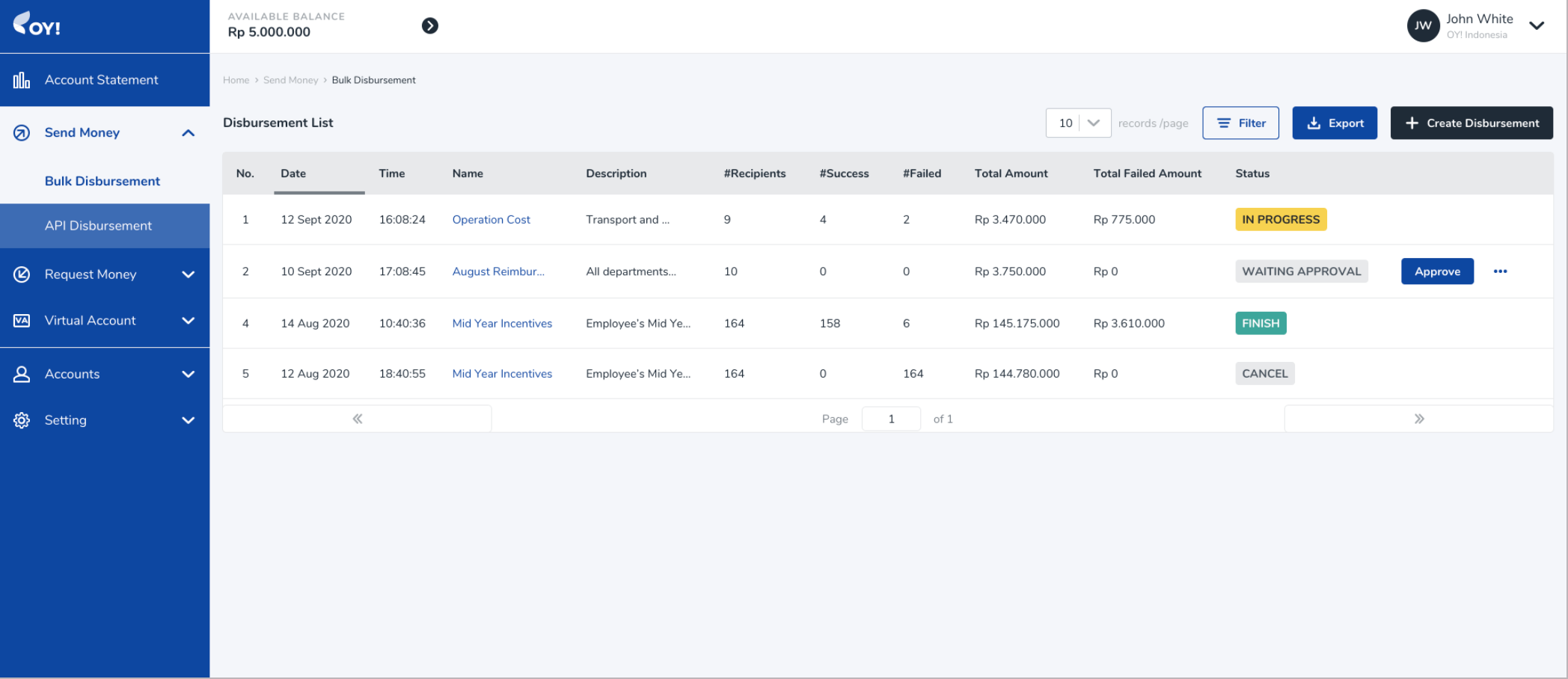

1. Create Disbursement: On the OY! dashboard, navigate to Send Payments > Bulk Disburse on your left menu bar. Click “Create Disbursement” on the far righthand side of that page to create a new bulk disbursement campaign.

2. Create Campaign Details: Fill in the campaign details with 2 options:

a. upload an xlsx or csv file

Please upload an xlsx or csv file with each individual transaction’s details of your bulk disbursement campaign. An example template for both file types are available for download on the OY! dashboard. The following list of items are required in your CSV file.

| Column | Description | Example |

|---|---|---|

| Name | Recipient Name | Budy |

| Recipient Email (can contain up to 5 emails with a total maximum of 255 characters, incoming transaction notifications will be sent to these emails) | Budi@email.com | |

| Amount | Amount in IDR (only numbers) | 100000 |

| Bank Code | Destination Bank | 014 |

| Bank Account Number | Recipient Bank Account Number | 12341234 |

| Phone Number | Recipient Phone Number | 62812341234 |

| Notes (Optional) | Transaction Notes |

b. add disbursement detail manually. : choose ‘add disbursement detail manually’ and fill out a campaign name and campaign description in the provided spaces. These details are strictly used as your tracking information only and will not be shared to the transaction recipients.

c. [Staging only] You can replicate failed status on individual transaction within the campaign by fill in Bank Account Number value with 3000000. Another value will be processed normally.

3. Re-verify all the Information and Submit: Once your xlsx or csv file is uploaded or filled out manually, you can verify all of the information uploaded from the file from the table displayed. If there is any incorrect submission such as invalid entry due to special characters, a red box will appear to highlight the entry that should be corrected. Issues must be resolved before a campaign can be submitted

4. Validate Name Matching After all the issue has been resolved, user able to click submit and there will be popup shown to validate each recipient name *with their *Bank Account Name as shown below:

if you choose YES: if there is a name difference, a popup name validation with details of mismatched transactions will be displayed. if the information inputted is invalid, you could edit the information and choose the ‘ validate’ button to revalidate the data, or you could click the ‘ignore mismatch’ button to ignore the name matching validation and to process the disbursement.

If there is no issue with the details uploaded, a validate and submit button will be available at the bottom of the list of transactions, indicating that all information is valid. Click “Submit” to complete creating the bulk disbursement campaign.

5. Approve/Cancel Campaign*: Once the bulk disbursement campaign is created, a new status of waiting approval will appear. Approve the campaign by clicking the “Approve” button. If you want to cancel a campaign, click the “...” button and select “Cancel”.

Once the bulk disbursement campaign is approved, details regarding the campaign can no long er be changed. This includes changes made to individual transactions and their respective recipient information.

The balances will also immediately reflect changes. For more information about the different types of balances, click here. You will also receive an email with the campaign information summary (“Outgoing Transfer Alert”) when transactions are executed.

Note:

- Depend on the approval layer that you configured, this transaction should be approved by all layer before it can be executed by the system.

- Multiple campaigns can be approved at a time as long as there is sufficient available balance to complete campaigns that have already been approved but are still in queue to be processed.

6. Keep Track of Campaign Details*: To check the details of the bulk disbursement campaign, click on the campaign name to find the campaign summary and its recipient list. Keep track of the both the overall campaign status and the status of individual transactions through the page.

7. Status: In-Progress, Finish, and Cancel*: Congratulations! You just made your first bulk disbursement with OY! Below are a list of statuses you will find on the OY! dashboard.

In-Progress

As your individual disbursements are executed, the status of your bulk disbursement campaign will indicate an in-progress status.

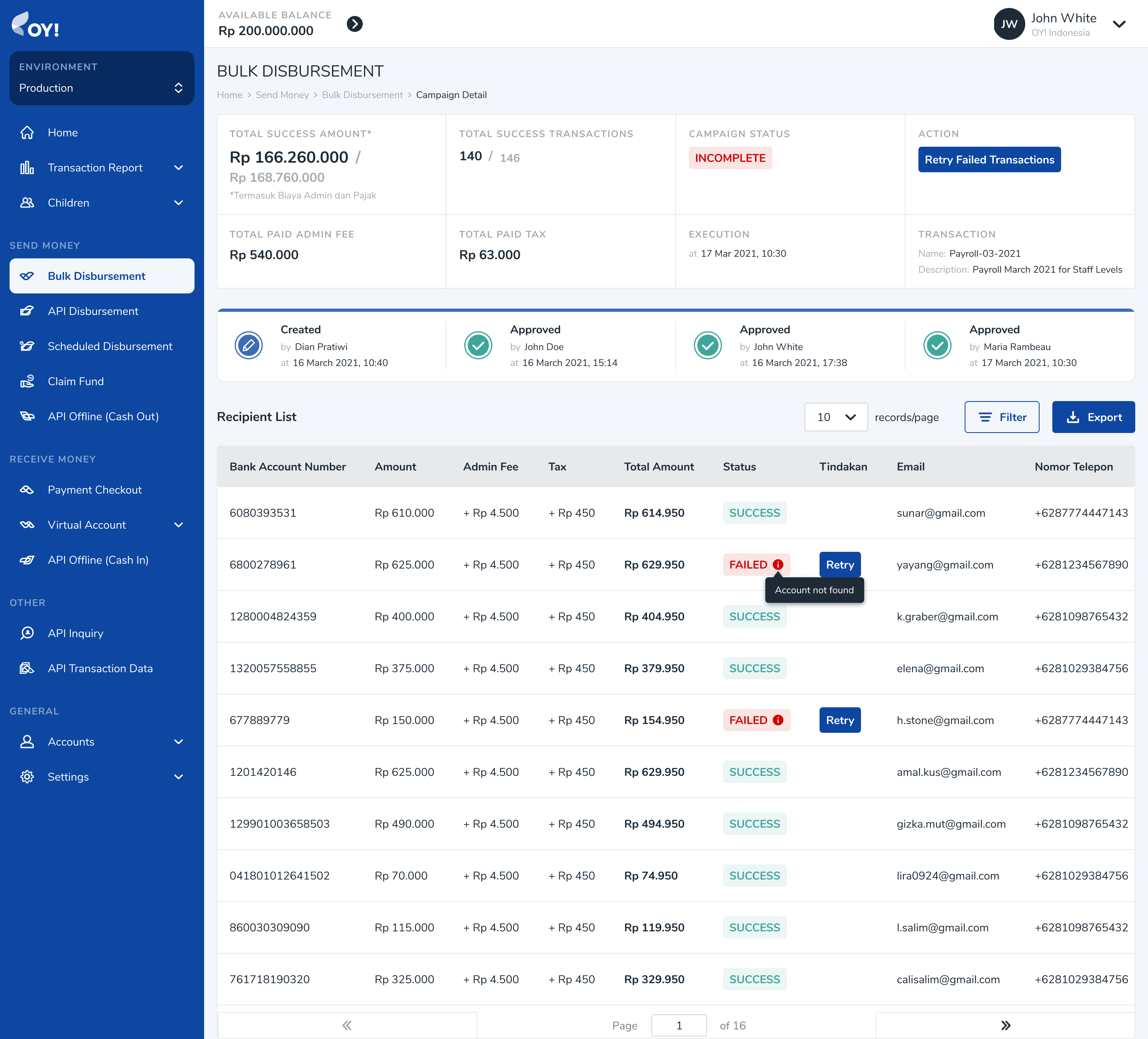

Incomplete

The status of your bulk disbursement will change to incomplete once all of the listed transactions have been executed and the relevant final statuses of Failed or partially Failed have been assigned. The failed transactions will be shown the failed reason and can be retried.

Finish

Once all of the listed transactions have been completed and the final status of success for all transactions has been achieved, the status of your bulk disbursement campaign will change to Finish. The recipients should have all received an email detailing an “Incoming Transfer Alert.” You can also download a report of the campaign details directly through the OY! dashboard.

Cancel

If you choose not to approve your disbursement campaign, the status of your bulk disbursement campaign will indicate a cancelled status.

You can also double check each of your transactions by navigating to the account statement page on the OY! dashboard.

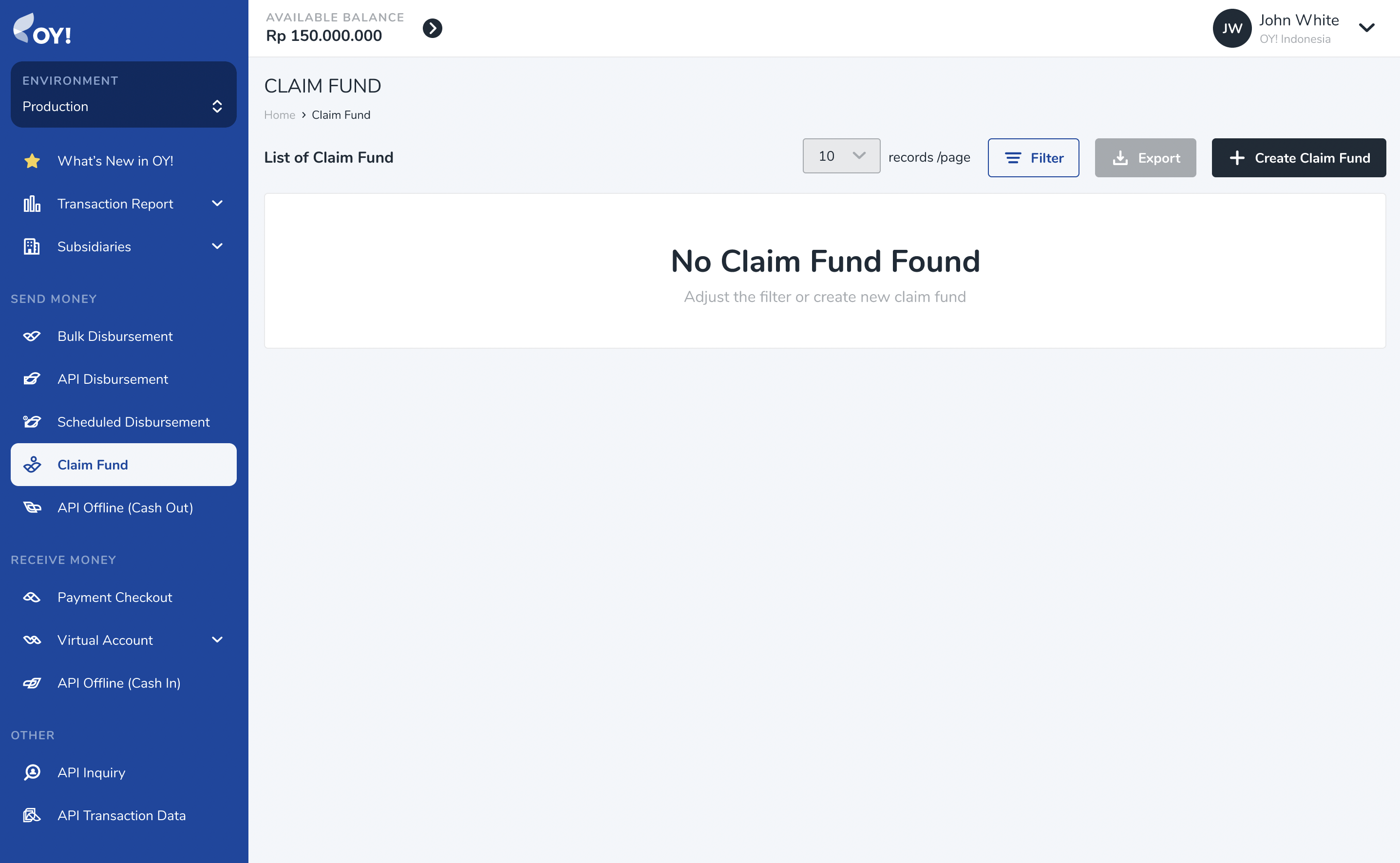

Claim Fund

Claim Fund product enable you to do disbursement without knowing your recipient bank account at first. You will simply create a link for them to fill-out bank account information and the payment will be processed by our system. This feature will remove you from the hassle of collecting your customer information manually then doing multiple bank transfer. Best use of this feature is : refunds, reimbursement claim, any disburse transaction in which the destination is not your regular partner.

At the moment, Claim Fund product is available only on OY! Business Dashboard.

Transaction Flow

Use Case

- Refund for purchase transaction

- Any money transfer transaction where you don't have recipient bank information

Registration and Set Up

Prerequisites

- Register an account on the OY! dashboard (https://business.oyindonesia.com/register?)

- Activate your account through the activation link sent via email

- Upgrade your account

- Upgrade request is approved

Testing

- Log on your OY! dashboard

- Choose "Staging" environment

- Click "Send Money" menu, and choose "Claim Fund"

- Click "Create Claim Fund"

- Fill in the necessary details by following the steps explained in the “How to Use” section

How to Use

In order to execute claim fund transaction successfully, a sufficient available OY! balance is required in the account. However, if there is an insufficient available balance, claim fund transaction can still be created but the approval will failed.

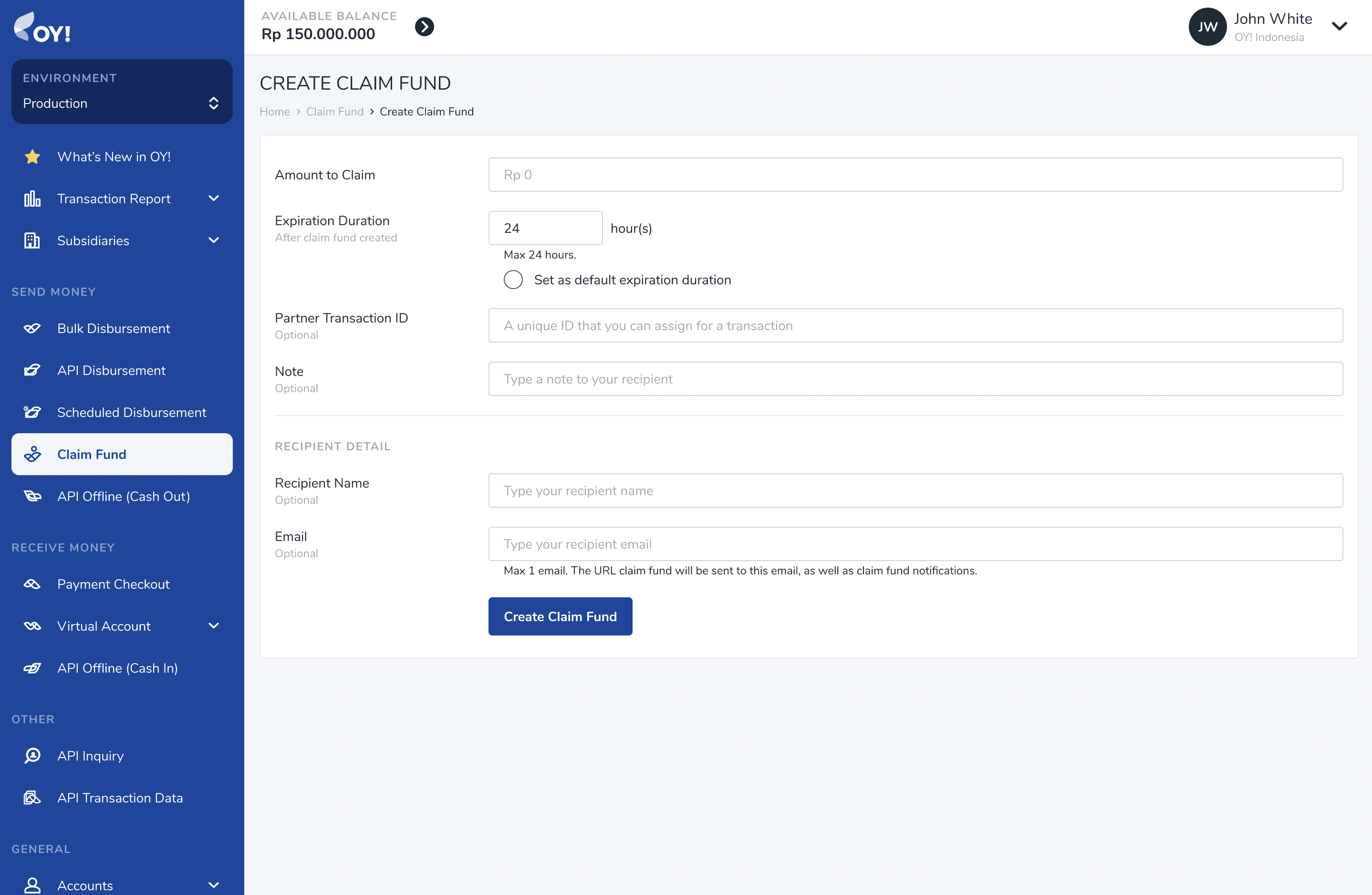

1. Business Dashboard - Create Claim Fund

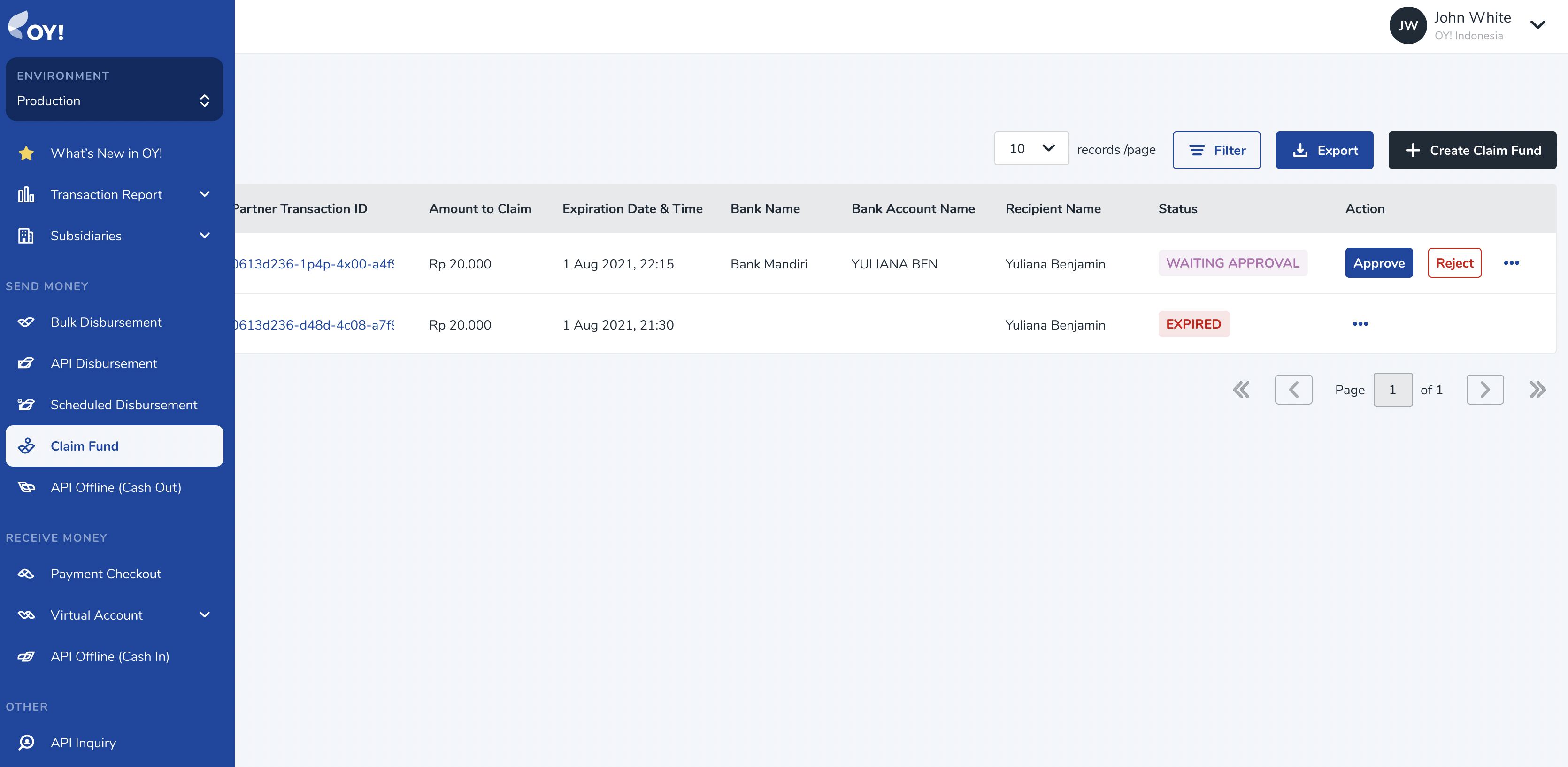

Create Claim Fund: On the OY! dashboard, navigate to Send Money > Claim Fund on your left menu bar. Click

Create Claim Fundbutton on the far righthand side of that page to create a new claim fund transaction.

Please fill-out the information accordingly. Below table is the description of each fields:

| Column | Description | Example |

|---|---|---|

| Amount to Claim | Amount of money to be sent | 1000000 |

| Expiration Duration | How long does this claim link be active. After expiration time, customer will not be able to submit their information then new claim fund link has to be created. | 12 Hours |

| Set as default expiration duration | Select this option to make it default expiration time for the next claim fund transaction. | - |

| Partner Transaction ID | Unique identifier for the recipient. | CF00001 |

| Note | additional remarks for recipient | Refund transaction |

| Recipient Name | Recipient Name | Dwiki Dermawan |

| Recipient Email | dwiki@gmail.com |

Click

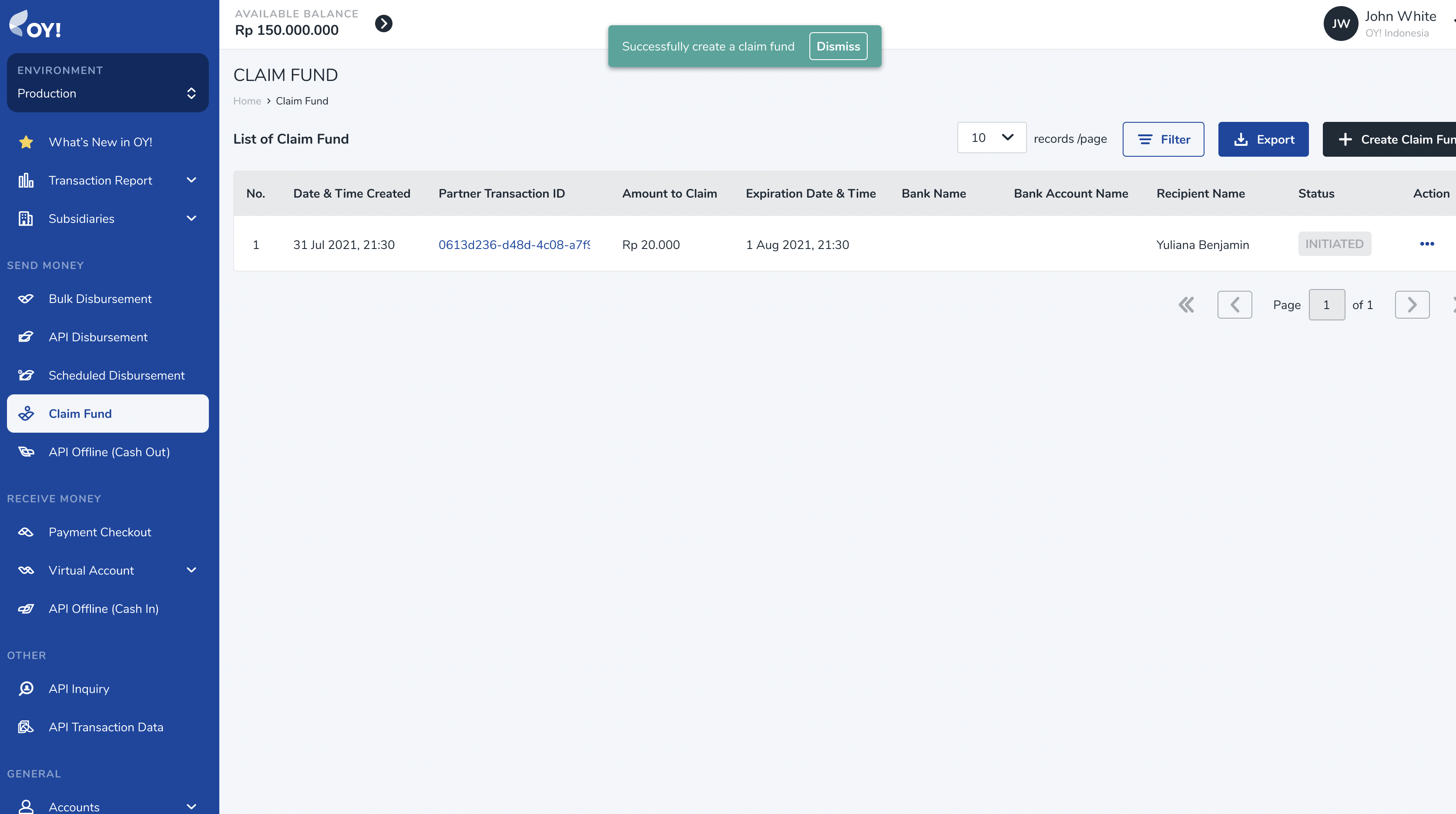

Create Claim Fundbutton to submit the transaction. Your recipient will get notified of this claim fund transaction through email. Transaction link will be attached on this email.Successful claim fund transaction will be listed on the claim fund transaction listing with INITIATED status.

Please be noted that this transaction still need account detail to be filled-out by the recipient.

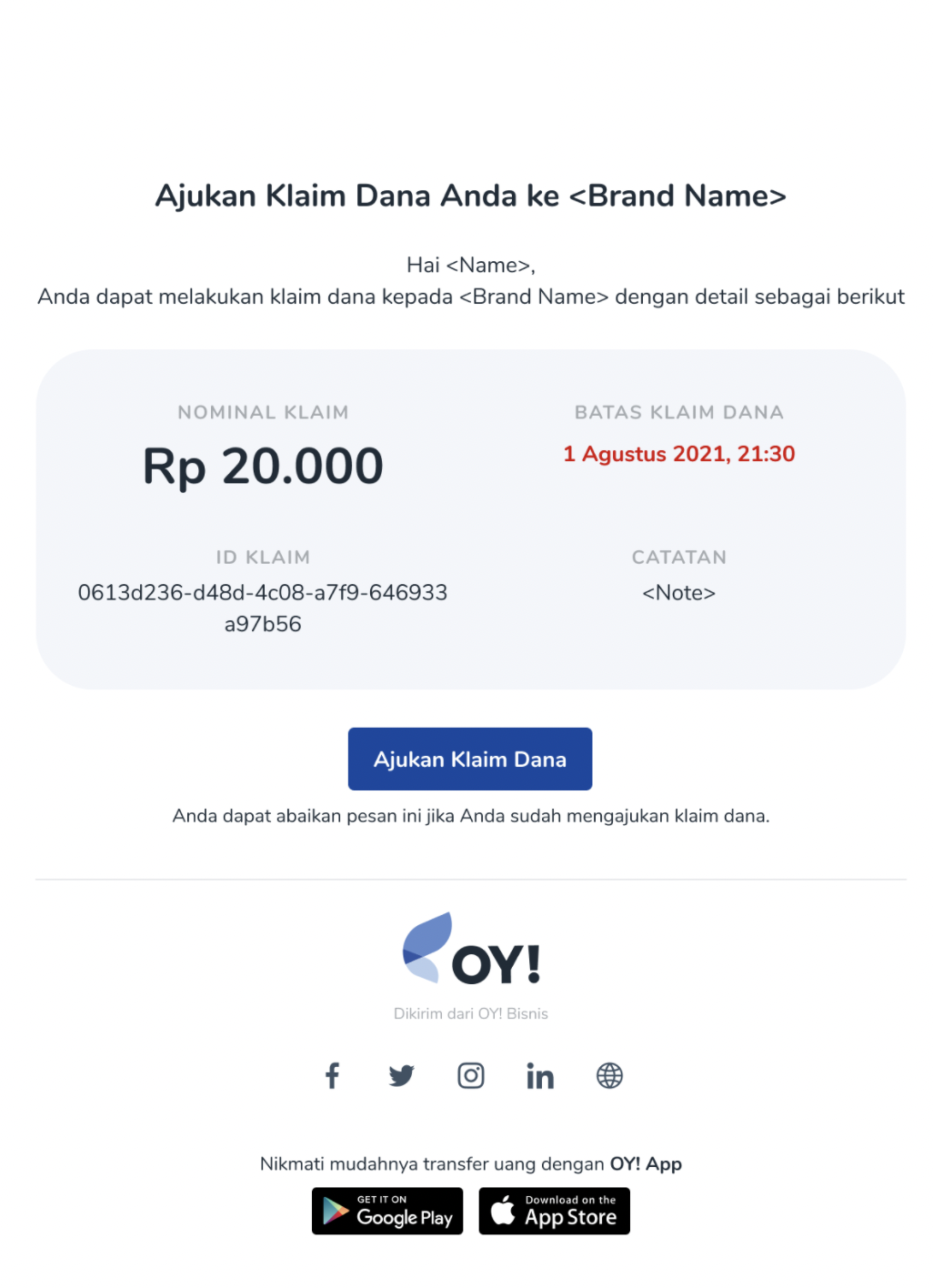

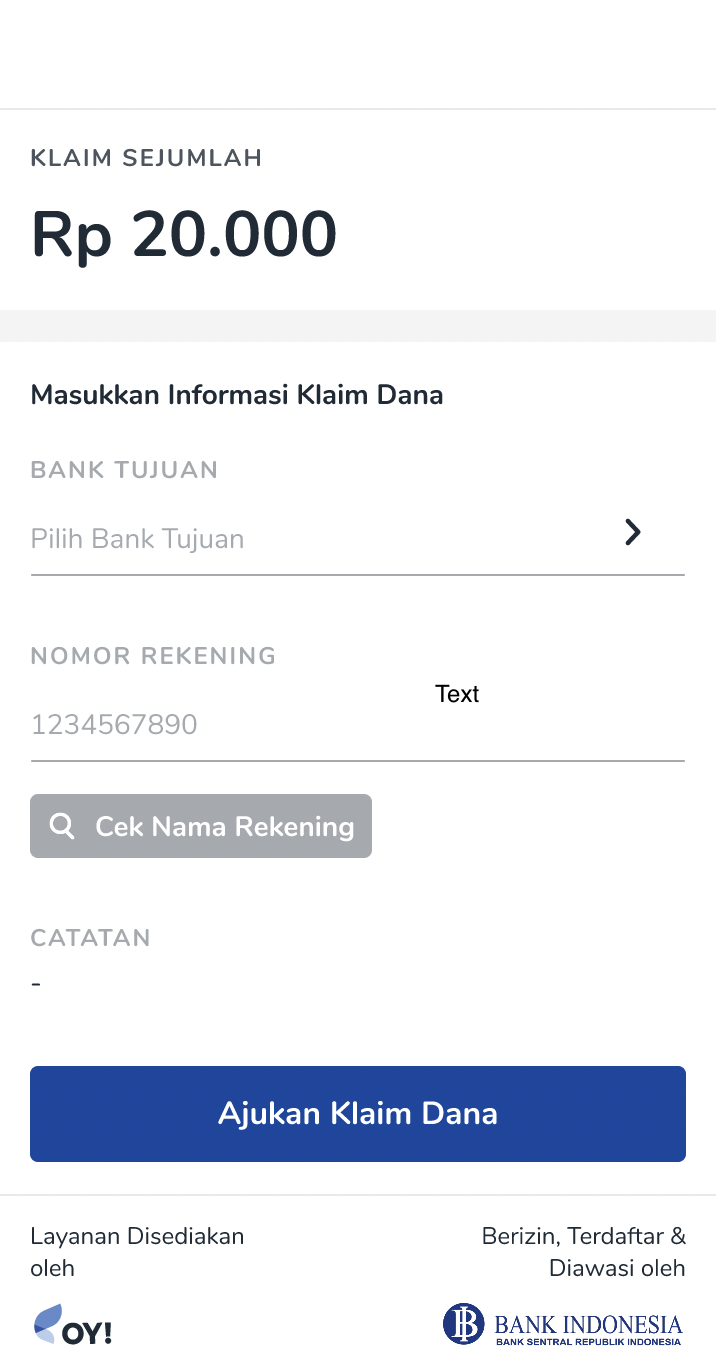

2. Fund Recipient - Input Account Information

On the notification email, user click the

Ajukan Klaim Danalink to get into claim fund input page.

User should fill-out the detail information so that OY! system can continue with the approval process.

3. Business Dashboard - Approve Transaction

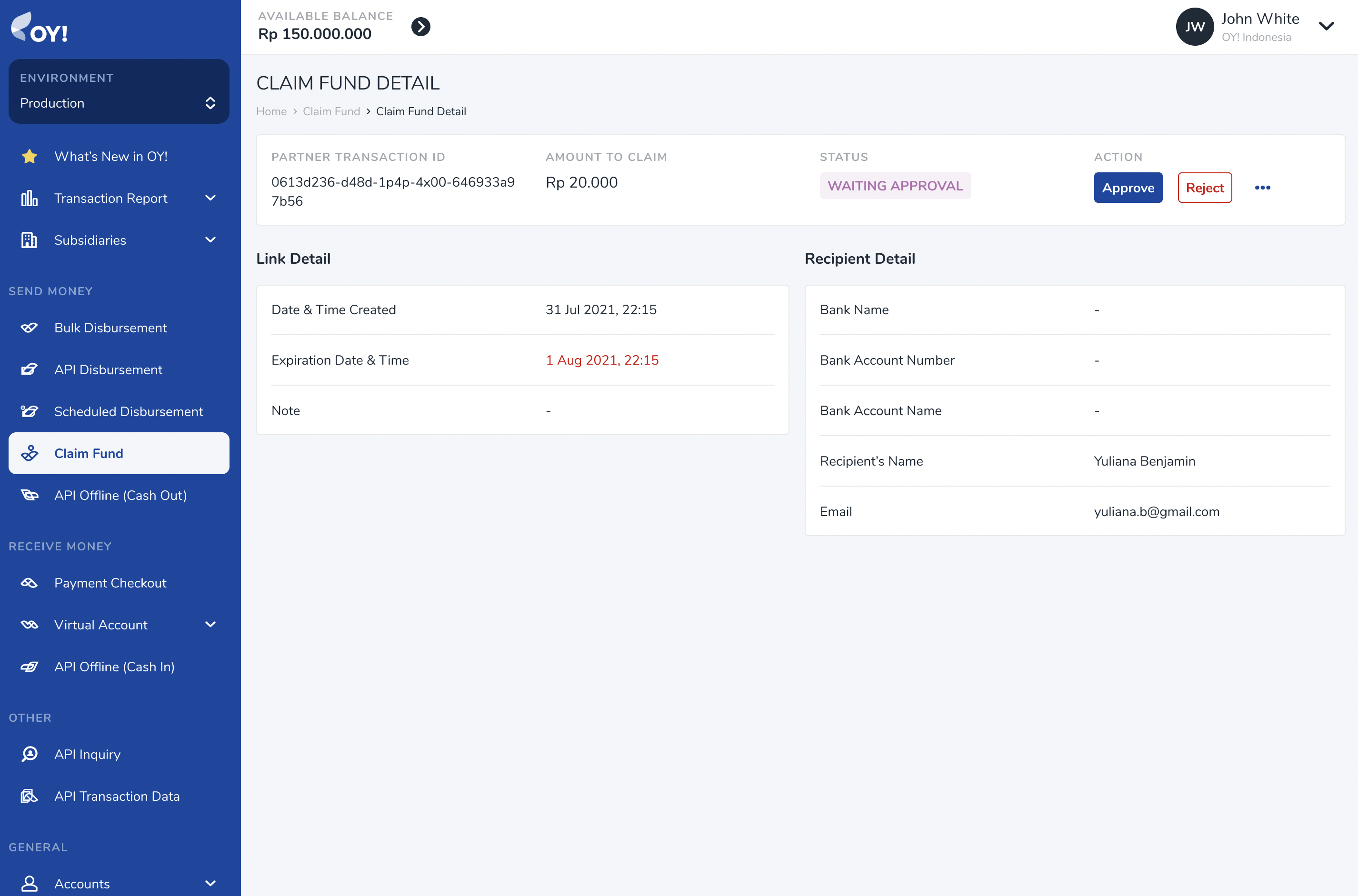

Transaction need to go through approval process to ensure that the money will be delivered to correct recipient and sufficient amount is available.

Approve claim fund transaction: On the OY! dashboard, navigate to Send Money > Claim Fund on your left menu bar. Transactions that already have user detail will be marked with

WAITING APPROVALstatus.

You can approve the transaction directly from this screen by clicking Approve button, or go to detail transaction to see more information before approve.

Click approve button to release the transaction to user.

The transaction is now marked as

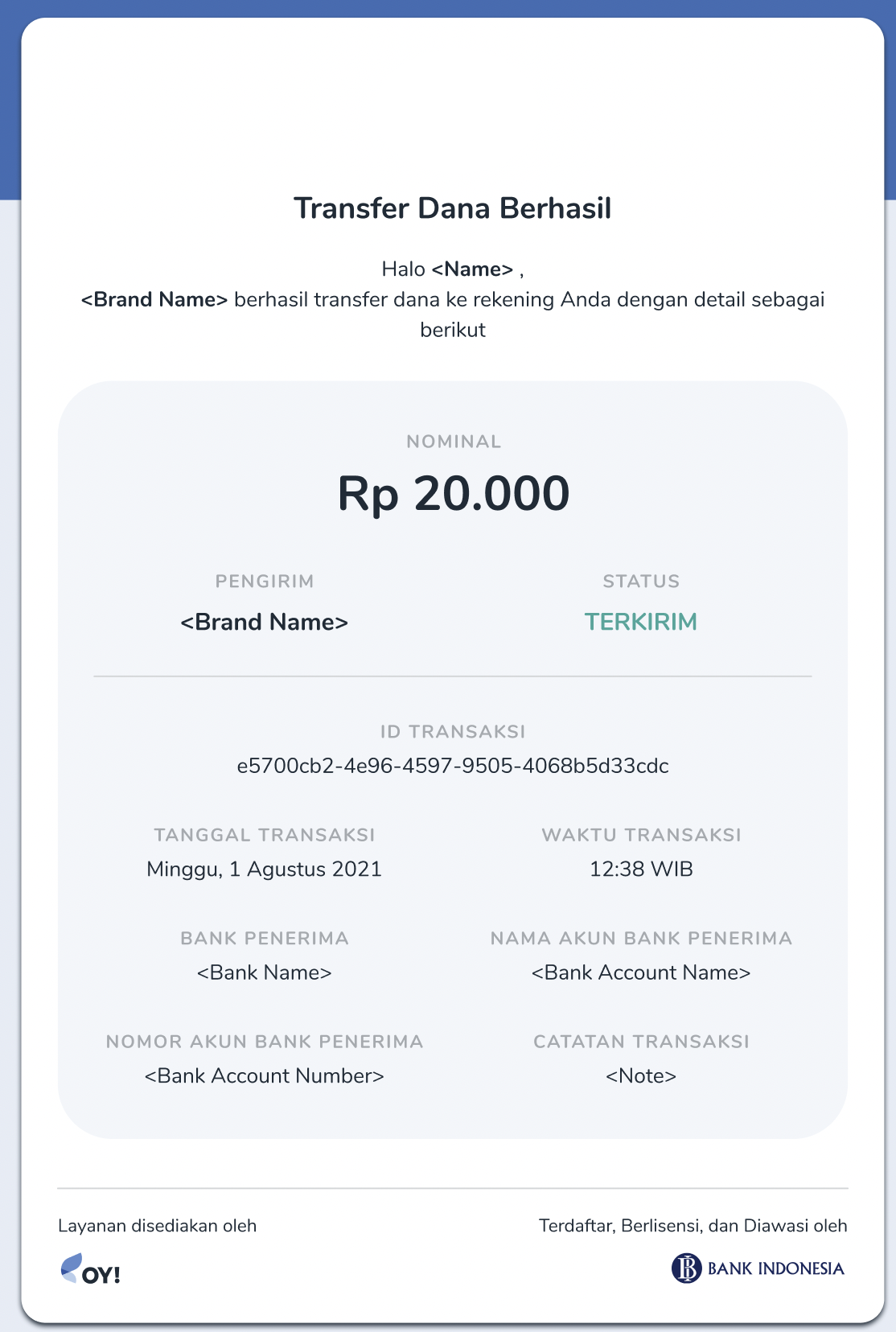

IN PROGRESSYour recipient should get the money delivered to their account immediately.

In parallel, your customer will also get email notification about successful claim fund transaction.

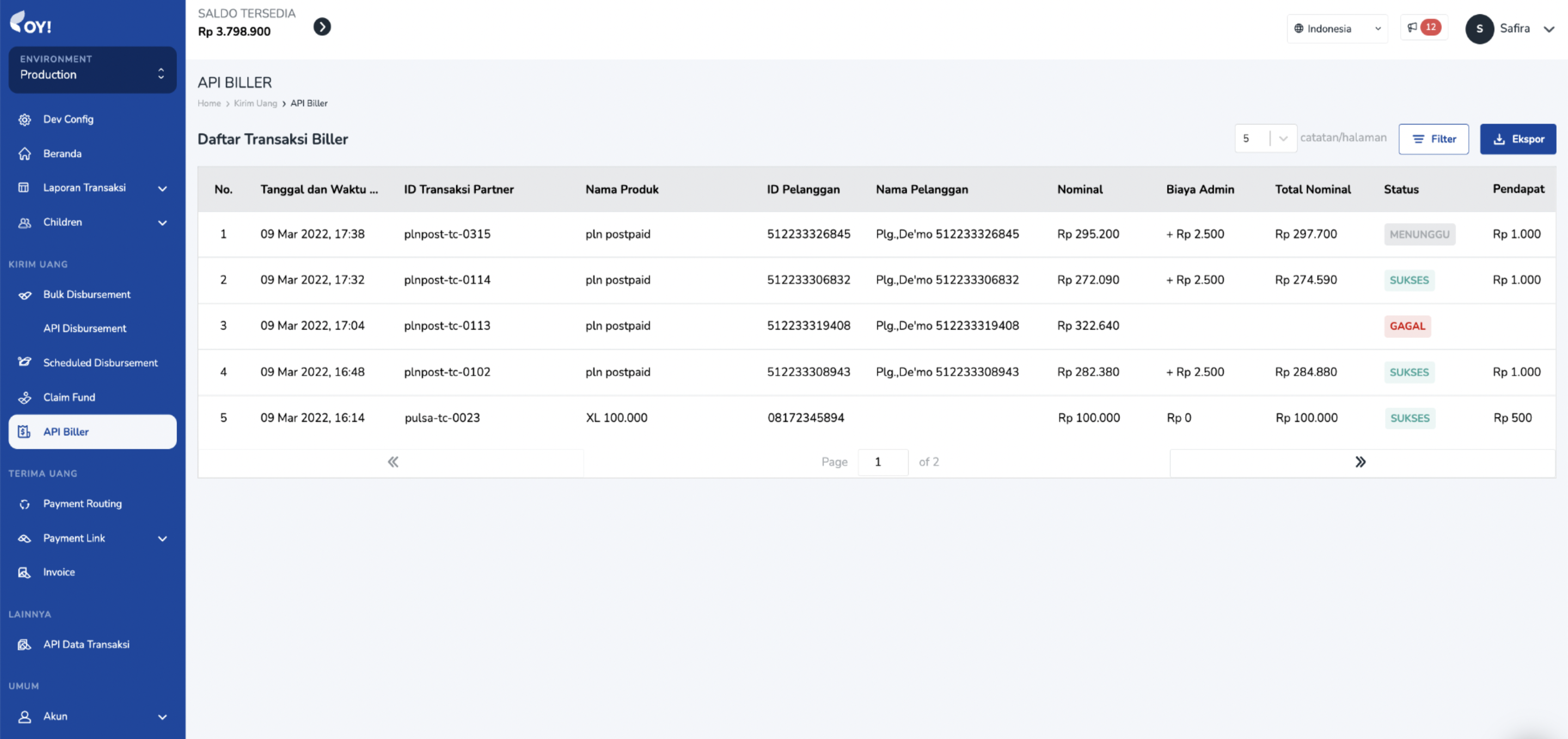

API Biller

API biller product provides the capability for you to pay the bill products. With 130+ types of billing products, you can provide numerous bill payment options with ease and in real-time. The integration process to use the API biller product is straight forward and the details can be checked here.

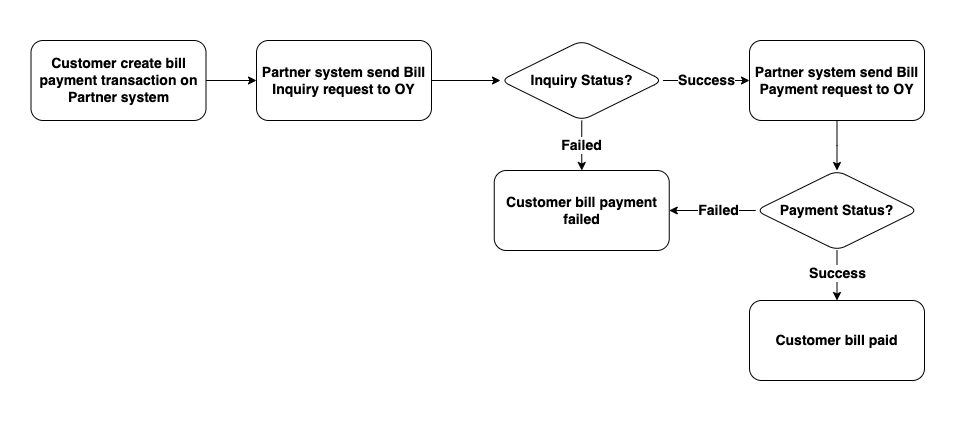

Transaction Flow

Key Features

Overbooking OY! can use the funds directly from your Mandiri or CIMB bank accounts for your bill payment needs. Please contact our business representative for further details about this feature.

Check Transaction Status and Callback

For all bill inquiry & bill payment executed, you will receive notifications regarding your transaction whether it is successful, failed or pending. We also provide an API for you to check the transaction status manually. IP proxy is also available upon request to enhance the security and integrity of the callback you will receive.

Check Balance

You can check your available balance at anytime to ensure that you have sufficient balance to execute a bill payment.

Registration and Set Up

Prerequisites

Register an account on the OY! dashboard

Activate your account through the activation link sent via email

Upgrade your account

Upgrade request is approved

Provide IP to be whitelisted and callback link to our business team

Receive an API Key from us

Integrate with our API

Testing

Once you successfully create an OY! account, you can immediately simulate bill payment via API. Follow the below steps to test the flow:

- Create an account

- Login into the dashboard

- Change the environment to “demo”

- Once the environment changed to demo, there will be API key demo available on the bottom left corner of the page

- Before creating a bill payment transaction, check your available balance through API GET https://api-stg.oyindonesia.com/api/balance

- Request inquiry for the bill you want to pay by sending a ‘POST’ request to https://api-stg.oyindonesia.com/api/v2/bill using your staging API key. Enter the required and optional fields, as referenced in the API reference docs (https://api-docs.oyindonesia.com/#bill-inquiry-biller-api)

- Fill in the customer-id, product-id, and the partner transaction-id. You will get the detail information about the bill that you want to pay.

- After successful inquiry, you should do the payment process by sending a ‘POST’ request to https://api-stg.oyindonesia.com/api/v2/bill/payment. Enter the required and optional fields, as referenced in the API reference docs (https://api-docs.oyindonesia.com/#pay-bill-biller-api)

- To get the status of a bill payment request, you can call the API https://api-stg.oyindonesia.com/api/v2/bill/status

- If payment is successful or failed, we will send a callback to the registered staging callback URL destination. Callback URL can be registered via our business representative.

- The API biller transactions can be monitored through OY! dashboard from the “Send money - API biller" menu.

How to Use

In order to create API biller transaction, a sufficient available OY! balance is required in the account. More details and instructions about topping up to your OY! account can you see here https://docs.oyindonesia.com/#top-up-oy-dashboard-tutorial.

Before you execute the bill payment, you have to verify the bill information from our bill inquiry endpoint.

Below is an example of the request body for inquiry:

curl -X POST https://partner.oyindonesia.com/api/v2/bill

-H 'content-type: application/json, accept: application/json, x-oy-username:myuser, x-api-key:987654'

-d '{

"customer_id": "512233308943",

"product_id": "plnpost",

"partner_tx_id": "Tx15048563JKFJ"

}'

It will return an error message if the request is not valid. Otherwise, below is the sample response parameters that will be returned:

{

"status":{

"code":"000",

"message":"Success"

},

"data": {

"tx_id": "a3d87877-e579-4378-844b-c06294fc9564",

"partner_tx_id": "Tx15048563JKFJ",

"product_id": "plnpost",

"customer_id": "512233308943",

"customer_name": "Plg.,De'mo 512233308943",

"amount": 282380,

"additional_data": "{\"customer_id\":\"512233308943\",\"customer_name\":\"Plg.,De'mo 512233308943\",\"admin_fee\":\"2.500\"}"

}

}

Next, send a request body to execute a bill payment request to be sent to our bill payment endpoint.

Below is an example of the request body for the bill payment:

curl -X POST https://partner.oyindonesia.com/api/v2/bill/payment

-H 'content-type: application/json, accept: application/json, x-oy-username:myuser, x-api-key:7654321'

-d '{

"partner_trx_id":"Tx15048563JKFJ",

"note" :"biller transaction test"

}'

Below is the sample response parameters that will be returned:

{

"status":{

"code": "102",

"message": "Request is In progress"

},

"data": {

"tx_id": "a3d87877-e579-4378-844b-c06294fc9564",

"partner_tx_id": "Tx15048563JKFJ",

"product_id": "plnpost",

"customer_id": "512233308943",

"customer_name": "Plg.,De'mo 512233308943",

"amount": 282380,

"note": "biller transaction test"

},

}

An endpoint to check the transaction is also available and can be accessed at anytime.

Below is an example of the request body:

curl -X POST https://partner.oyindonesia.com/api/b2/bill/status

-H 'content-type: application/json, accept: application/json, x-oy-username:myuser, x-api-key:7654321'

-d '{

"partner_trx_id": "Tx15048563JKFJ"

}'

The above command returns a JSON structured similar like this:

{

"status":{

"code": "000",

"message": "Success"

},

"data": {

"tx_id": "a3d87877-e579-4378-844b-c06294fc9564",

"partner_tx_id": "Tx15048563JKFJ",

"product_id": "plnpost",

"customer_id": "512233308943",

"customer_name": "Plg.,De'mo 512233308943",

"amount": 282380,

"additional_data": "\"{\\\"bill_period\\\":\\\"FEB2022\\\",\\\"total_amount\\\":\\\"282.380\\\",\\\"customer_id\\\":\\\"512233308943\\\",\\\"customer_name\\\":\\\"Plg.,De'mo 512233308943\\\",\\\"admin_fee\\\":\\\"2.500\\\",\\\"settlement_date\\\":\\\"09/03/2022 16:49\\\"}\"",

"status": "SUCCESS"

},

}

A callback with the following information will be sent to the callback endpoint that you can register with us.

You can also check your balance anytime to ensure you have sufficient balance from our endpoint.

Below is an example of a request body to check the balance:

curl -X GET 'https://partner.oyindonesia.com/api/balance'

-H 'Content-Type: application/json'

-H 'Accept: application/json'

-H 'X-OY-Username: janedoe'

-H 'X-Api-Key: 7654321'

Below is the sample response parameters that will be returned:

{

"status":{

"code":"000",

"message":"Success"

},

"balance":100000000.0000,

"pendingBalance":2000000.0000,

"availableBalance":98500000.0000,

"overbookingBalance":98500000.0000,

"timestamp":"10-12-2019 12:15:37"

}

Lastly, all transactions can be monitored from the OY! dashboard which includes all the transaction details.

For further details on the parameters definition and proper usage, please refer to our API Documentation.

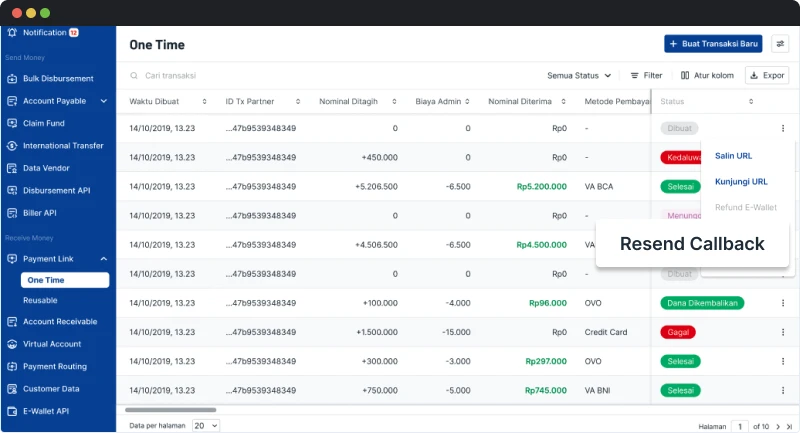

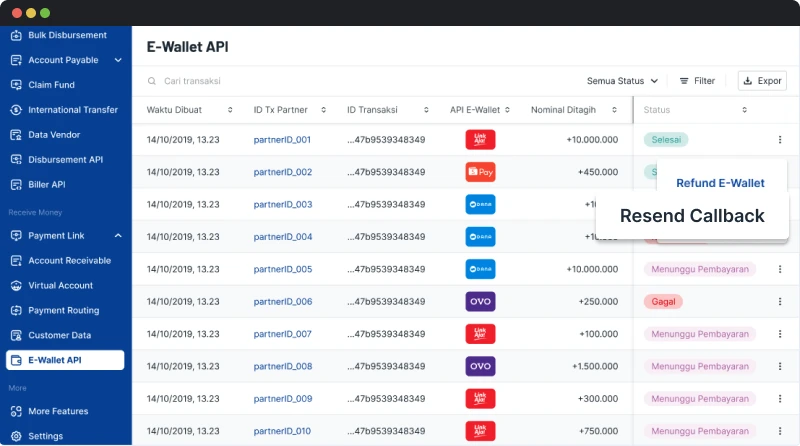

Feature: Resend Callback

Key Features

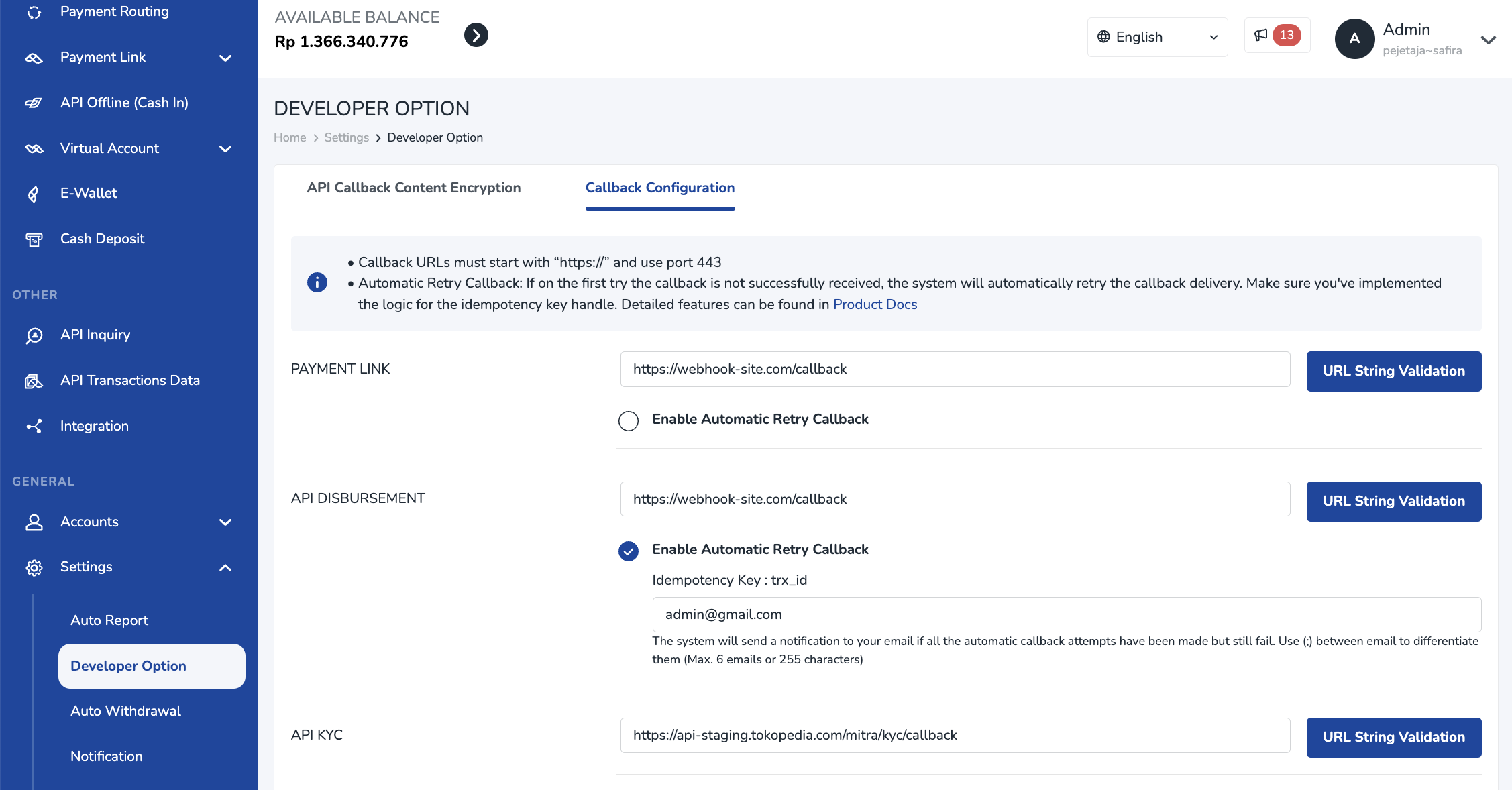

Retry Callback allows you to resend a callback of your transaction to your system. Initially, OY! will send a callback to your system after your transaction status has been updated. If your system failed to receive the callback, this feature can help you to retry the callback process. The process can be done in two ways

Automated retry callback If the callback is not successfully received on the first try, the system will automatically retry the callback delivery. If that callback is still not received by the client's system, the system will automatically retry until 5 occurrences. The interval of the sending process will be detailed in the Callback Interval section. If all automated Retry Callbacks have been sent but still returned failed, the system will send an email notification to the email address set in the configuration.

Manual retry callback Besides the automated process, you can manually request a callback via the dashboard.

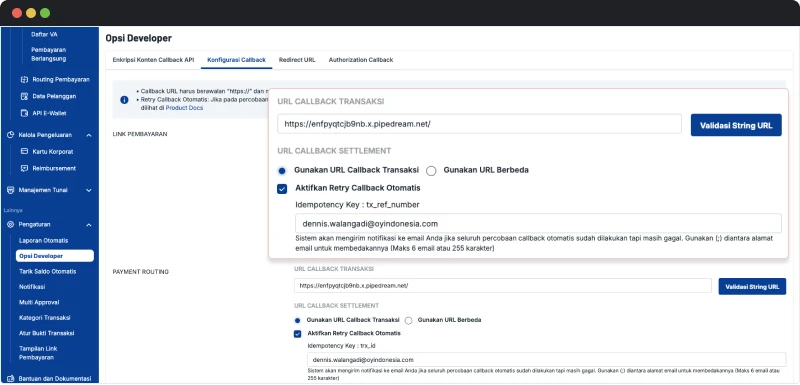

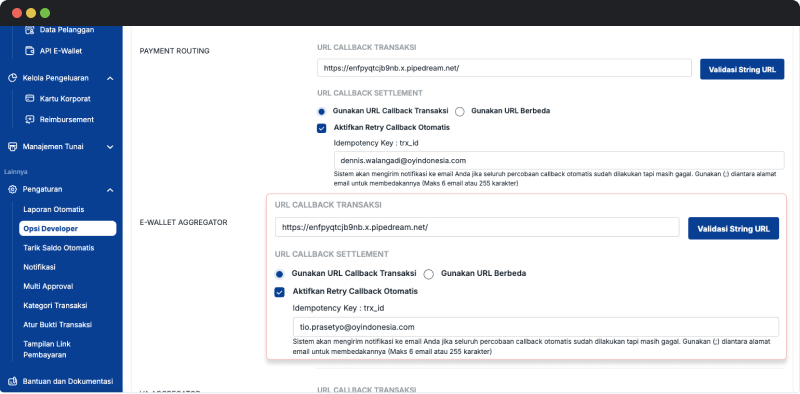

Registration and Set Up

Follow the instruction below to activate retry callback

- Login to your account in OY! Dashboard

- Open “Settings” and choose “Developer Option”. Choose “Callback Configuration”

- Fill your callback URL in the related product that you want to activate. Make sure the format is right. You can click URL String Validation button to validate the URL format.

- If you want to activate automated retry callback, check the Enable Automatic Retry Callback and fill in the email. The email will be used to receive a notification if all the automatic callback attempts have been made but still fail

- Click "Save Changes". The configuration will not able to be saved if the callback URL or/and email format are not valid.

Don't forget to whitelist these IPs in order to be able to receive callback from OY: 54.151.191.85 and 54.179.86.72

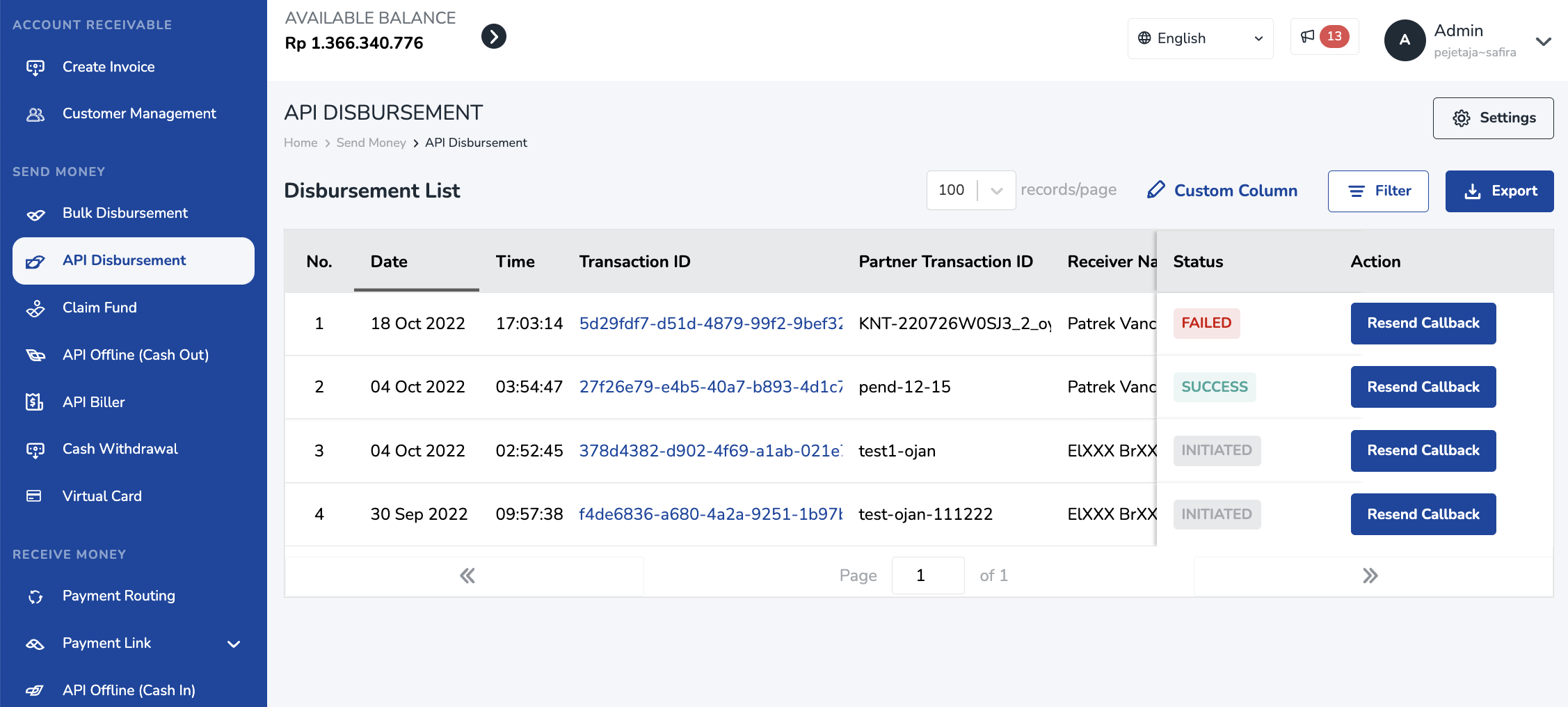

If you want to manually resend a callback, you can follow the instruction below

- Login to your account in OY! Dashboard

- Open the API Disbursement menu

- Click the "Resend Callback" button in the related transaction

Callback Interval

1st retry: realtime (after the first failed log received) 2nd retry: 1 min (after callback failed log for the 1st retry is received) 3rd retry: 2 mins (after callback failed log for the 2nd retry is received) 4th retry: 13 mins (after callback failed log for the 3rd retry is received) 5th retry: 47 mins (after callback failed log for the 4th retry is received)

If all automated Retry Callback (all the 5 attempts) has been sent but we still get a Failed response from your end, our system will send an automated email notification to the email address that has been set in the configuration earlier

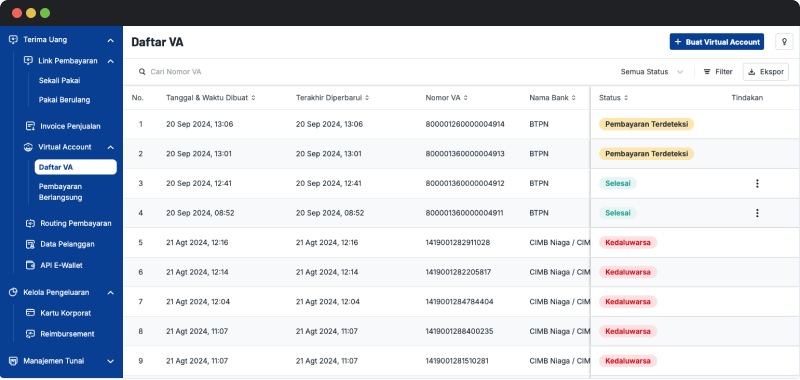

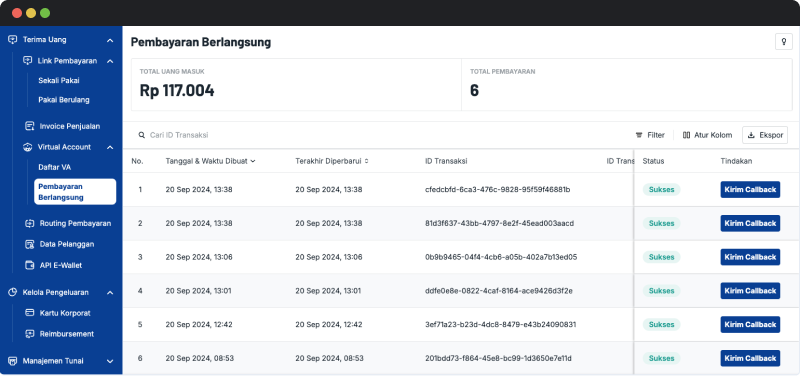

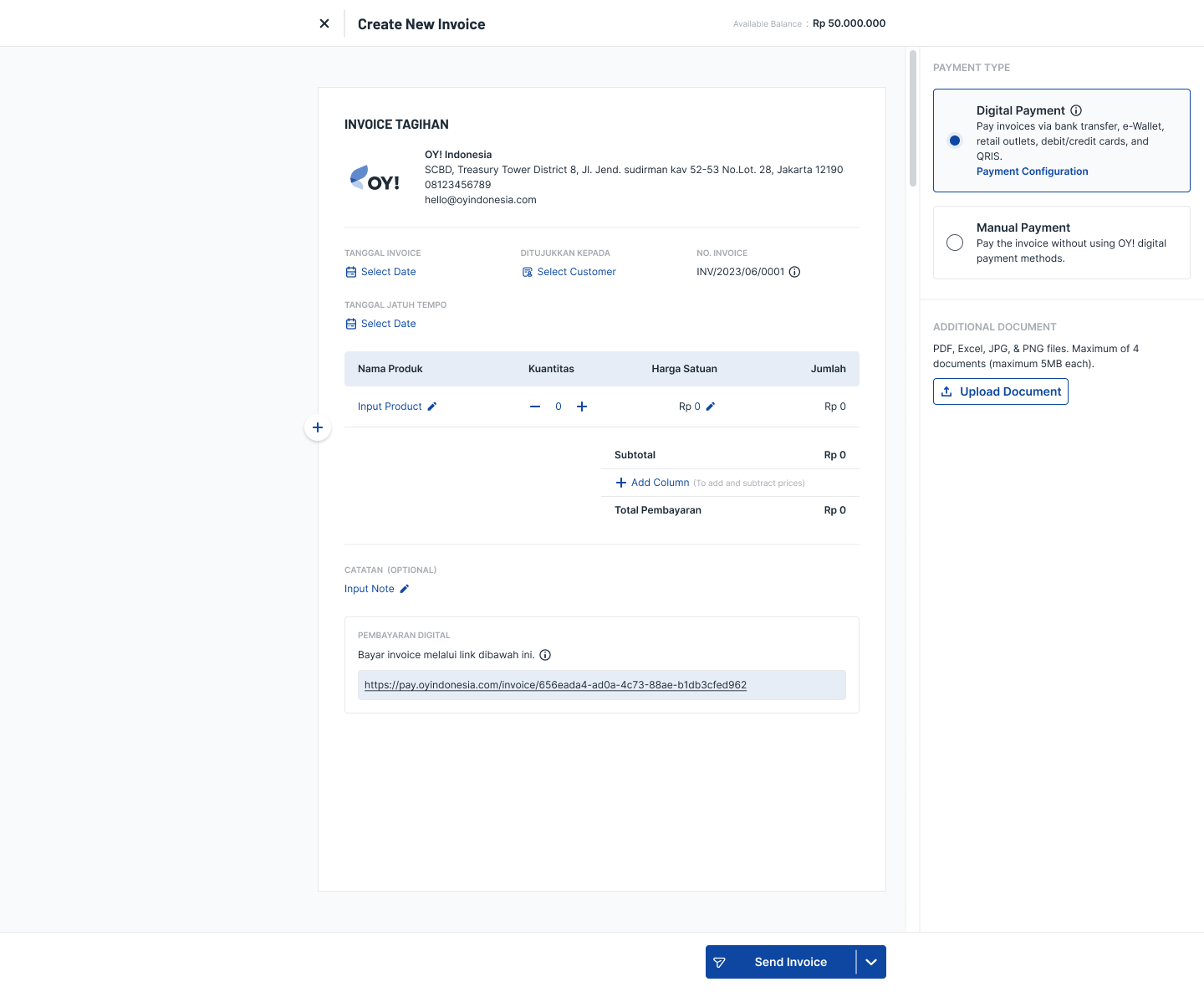

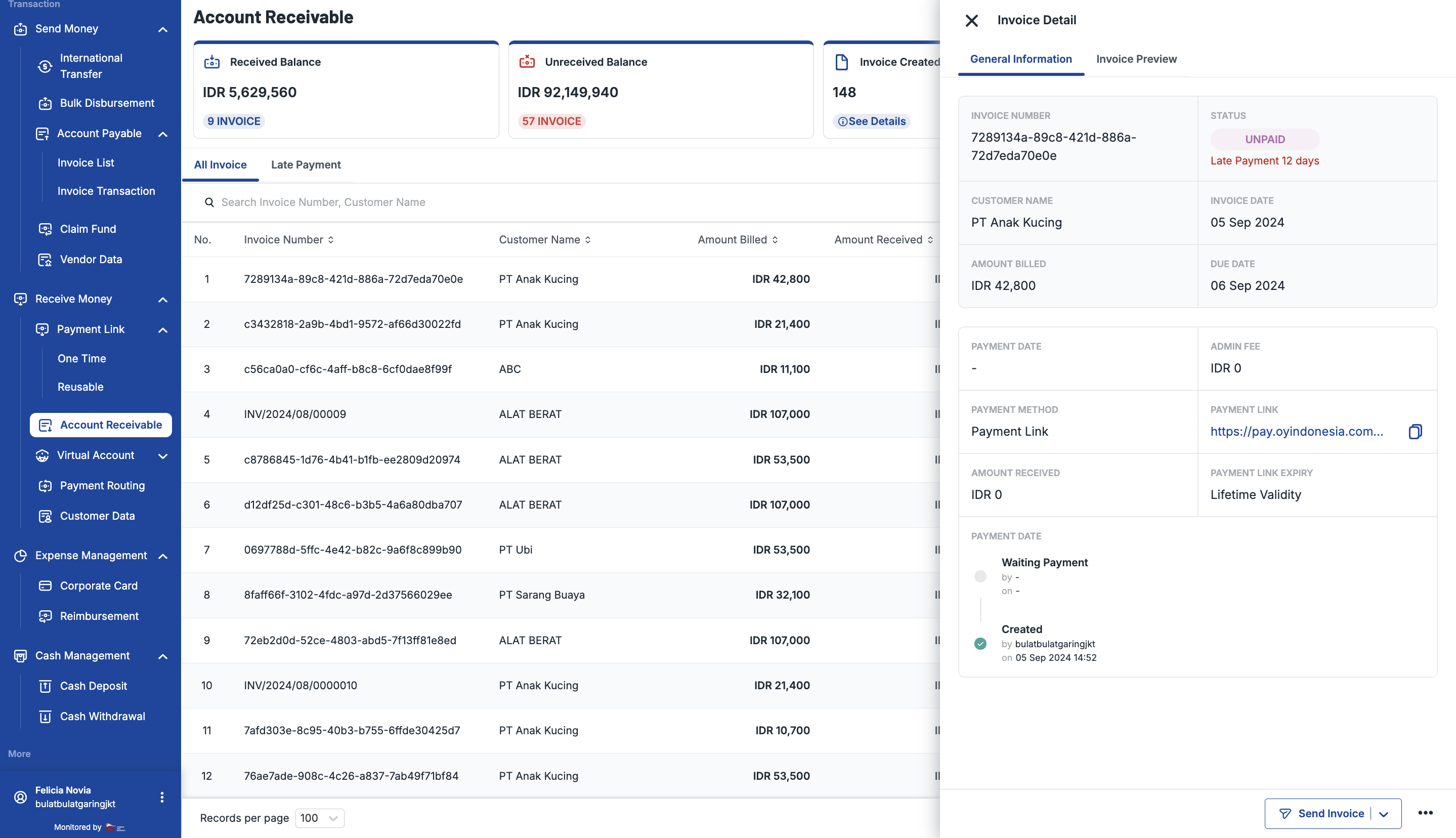

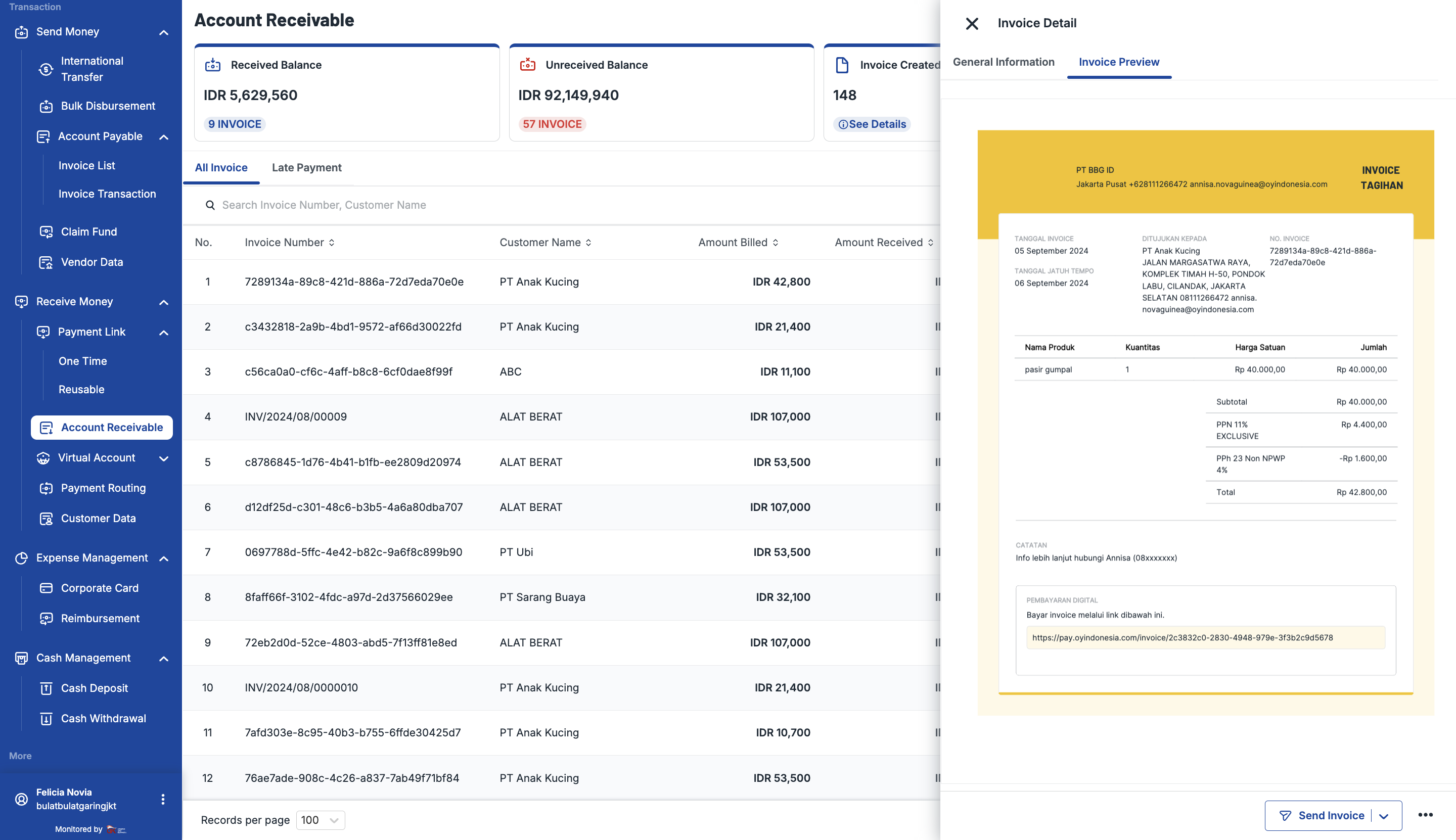

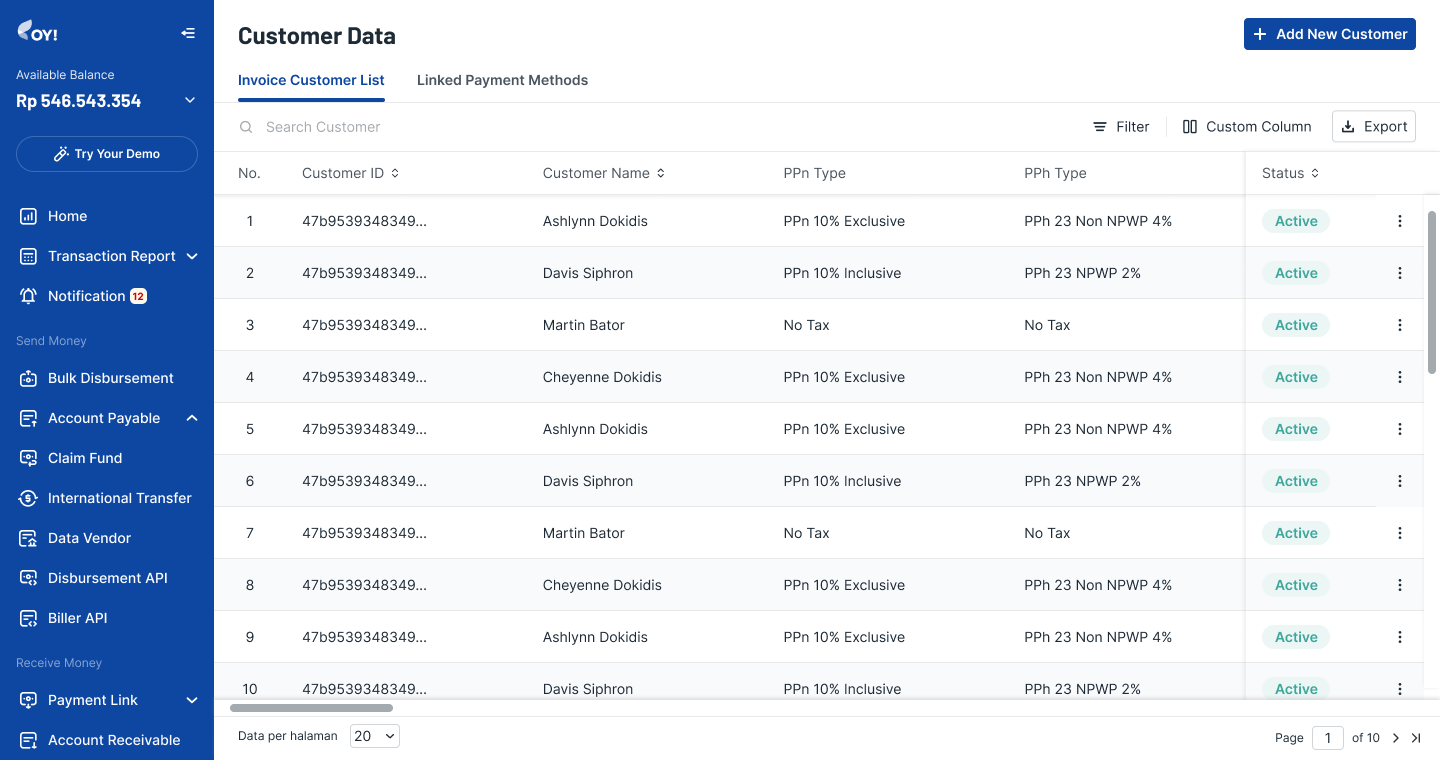

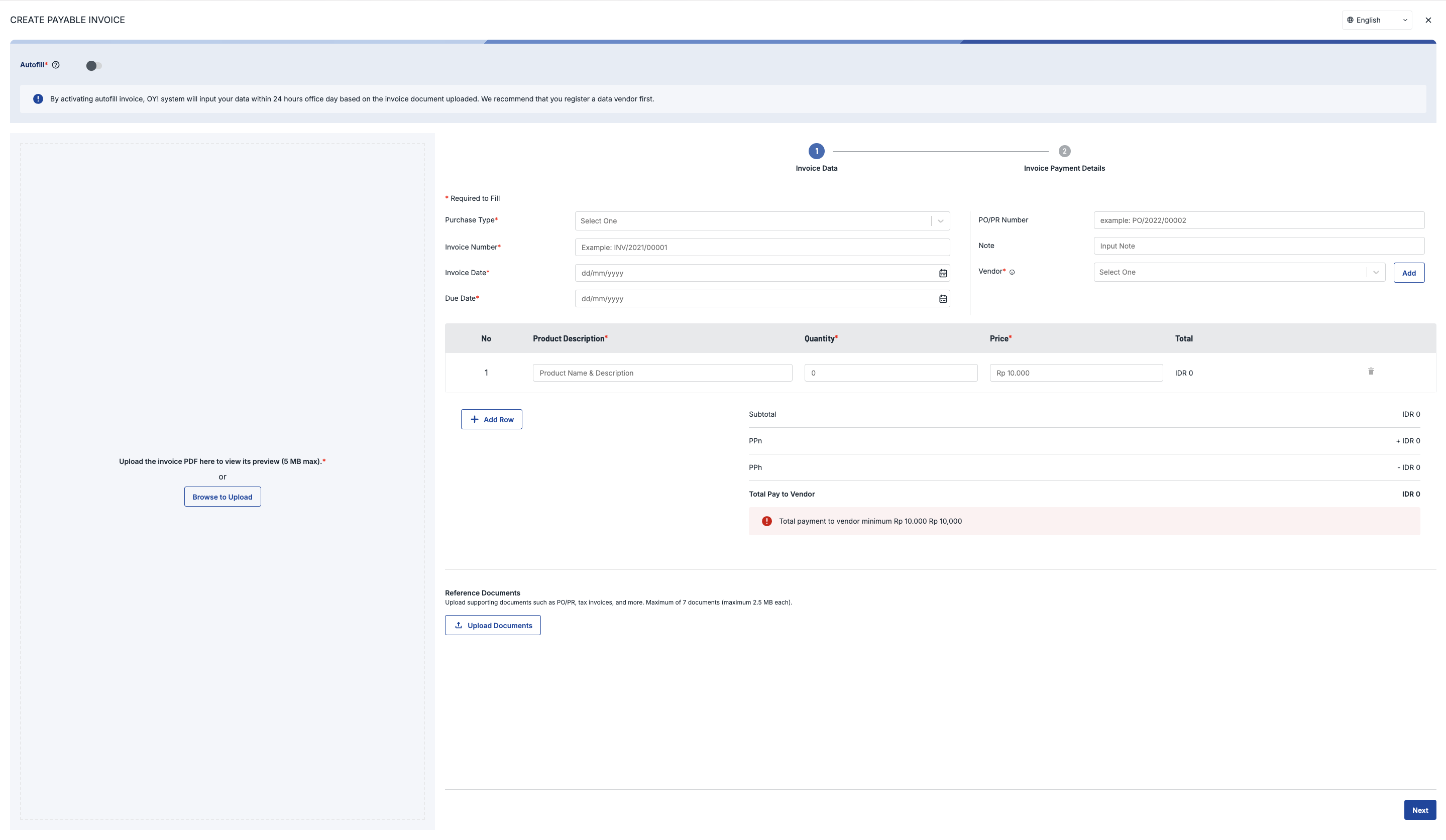

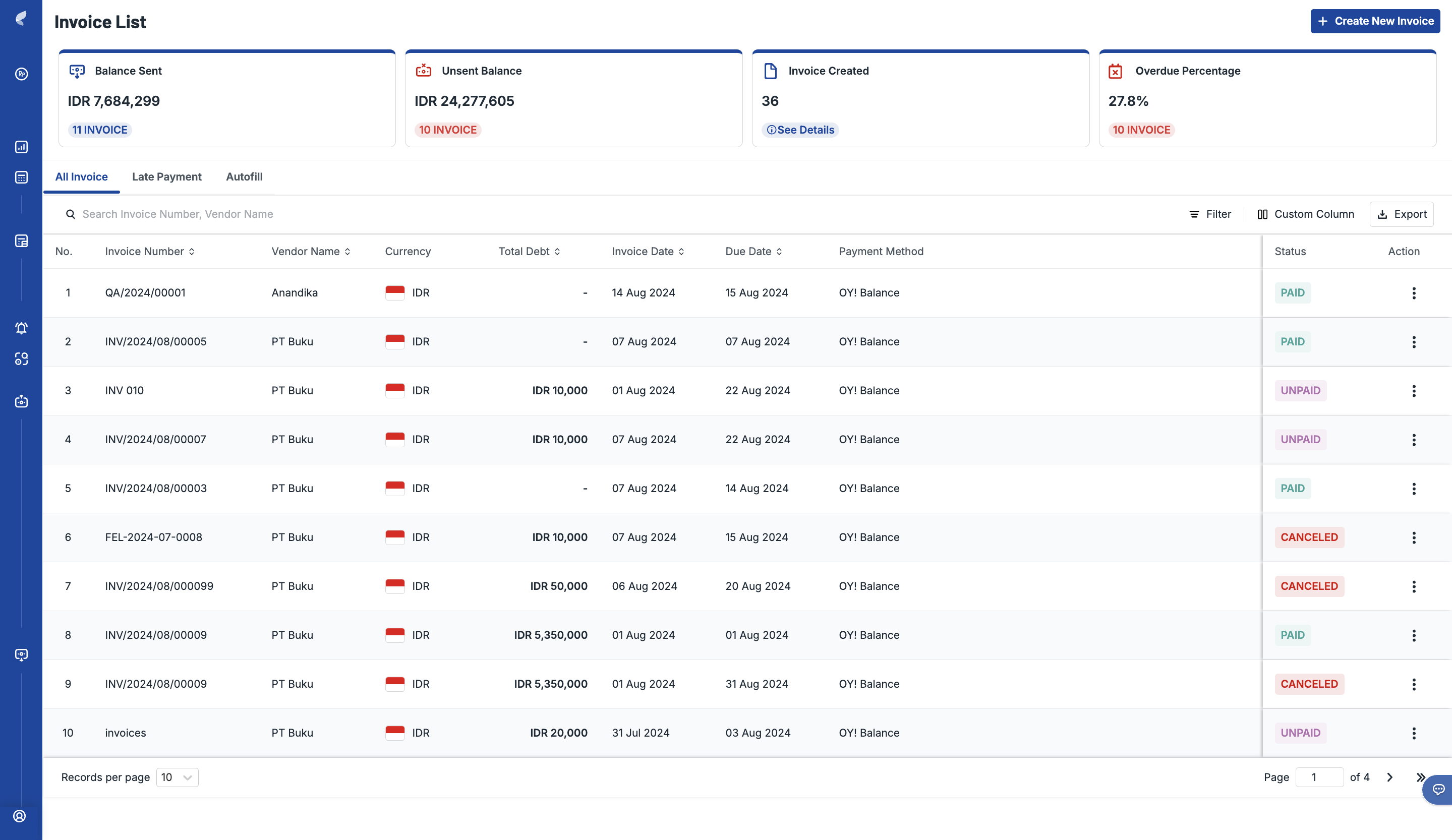

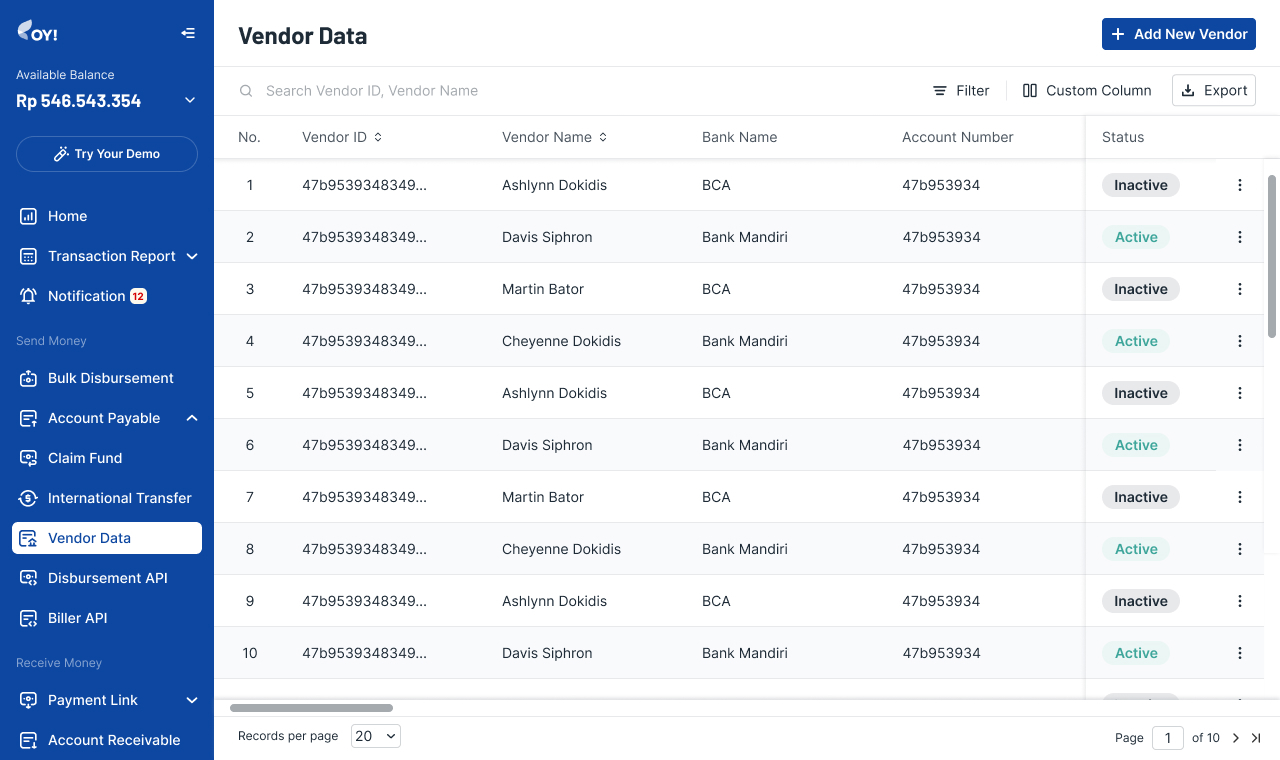

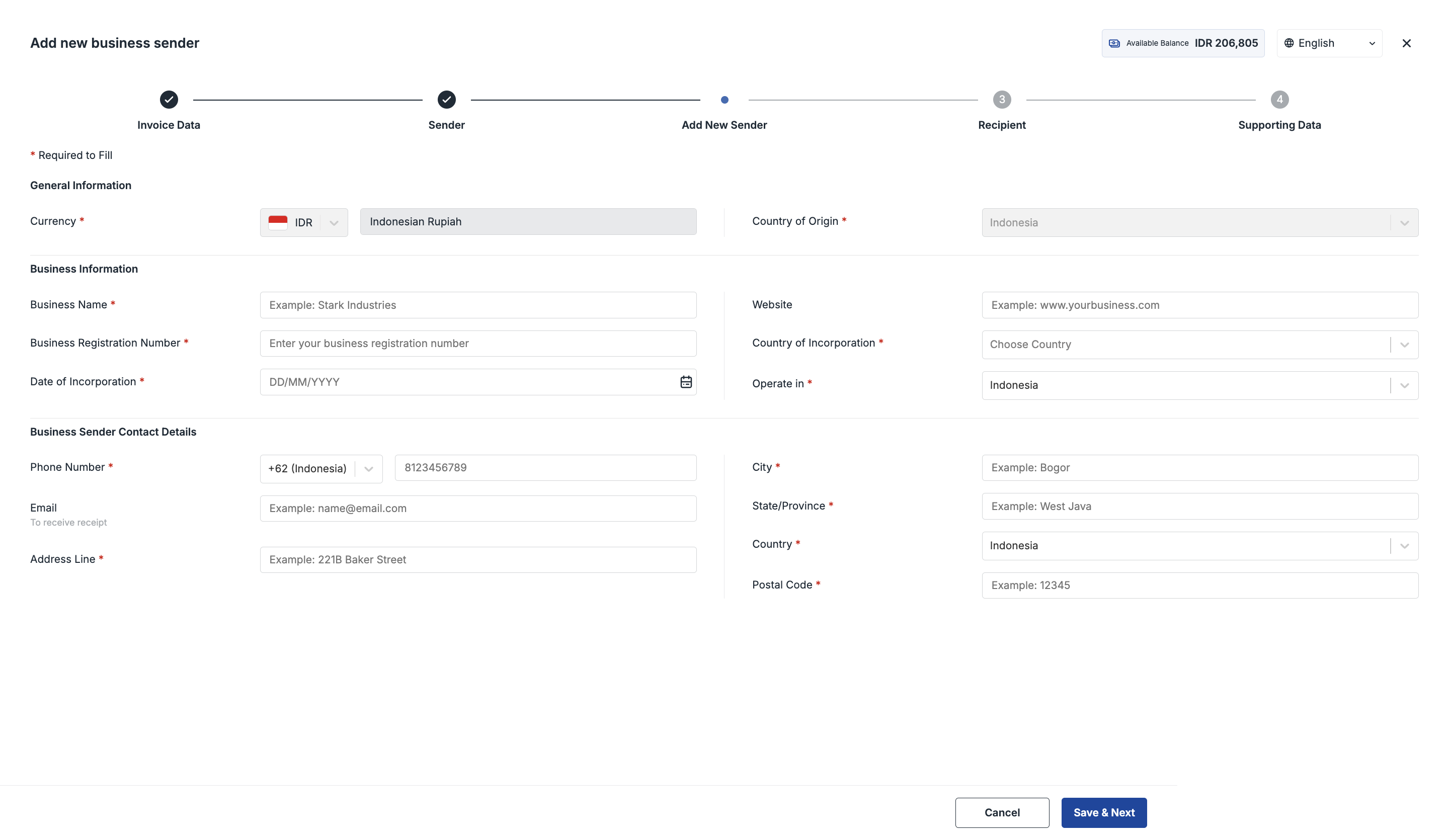

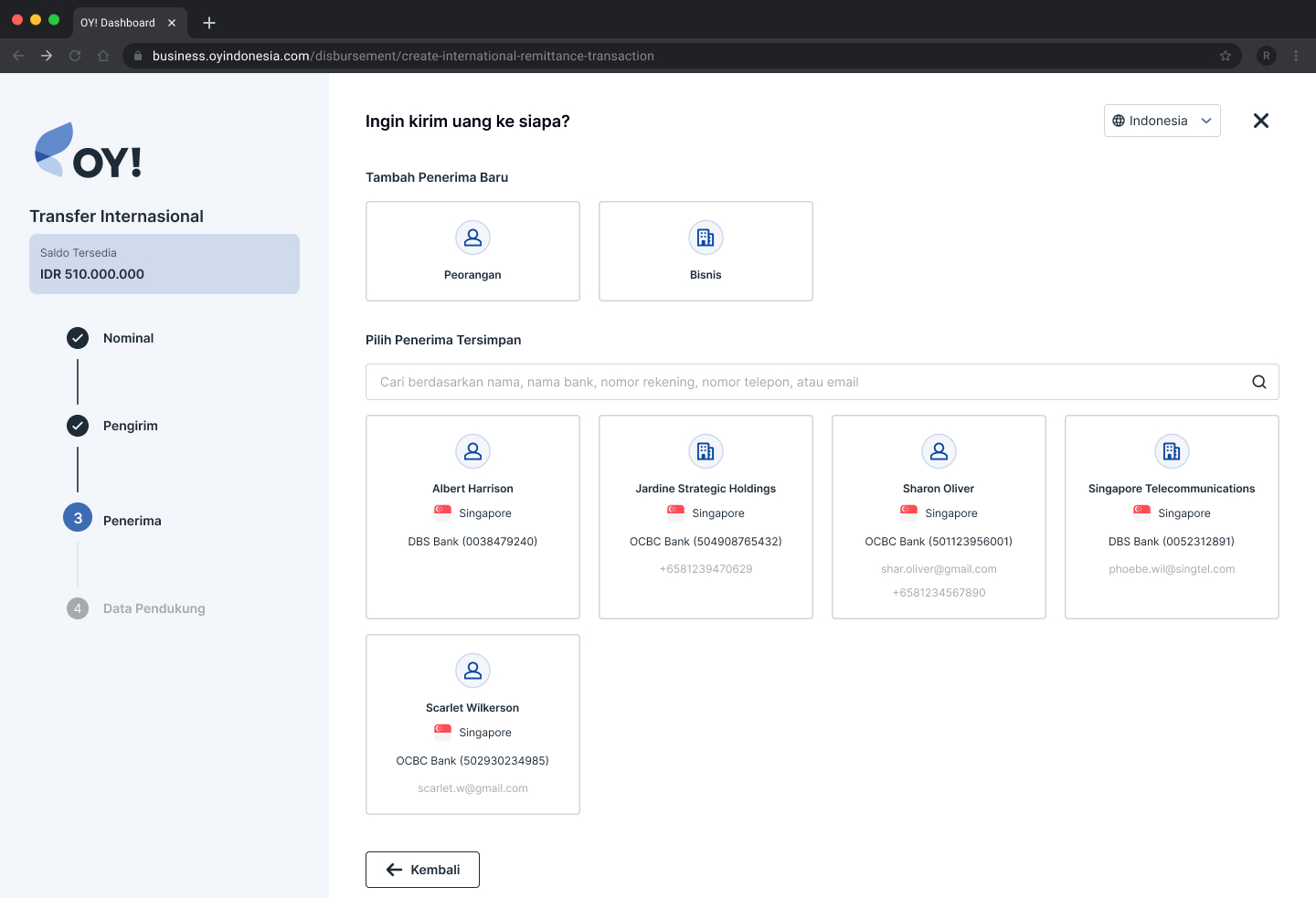

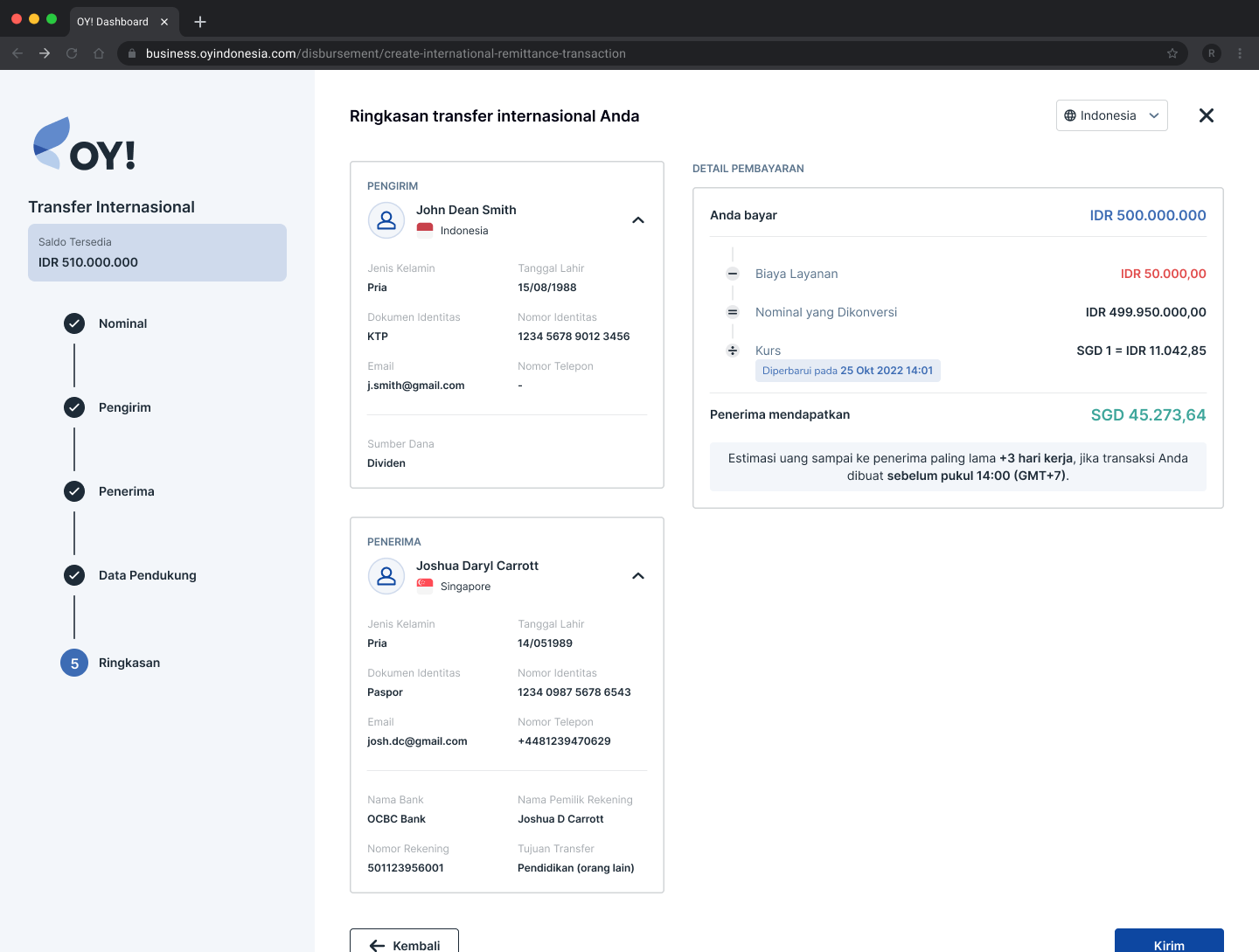

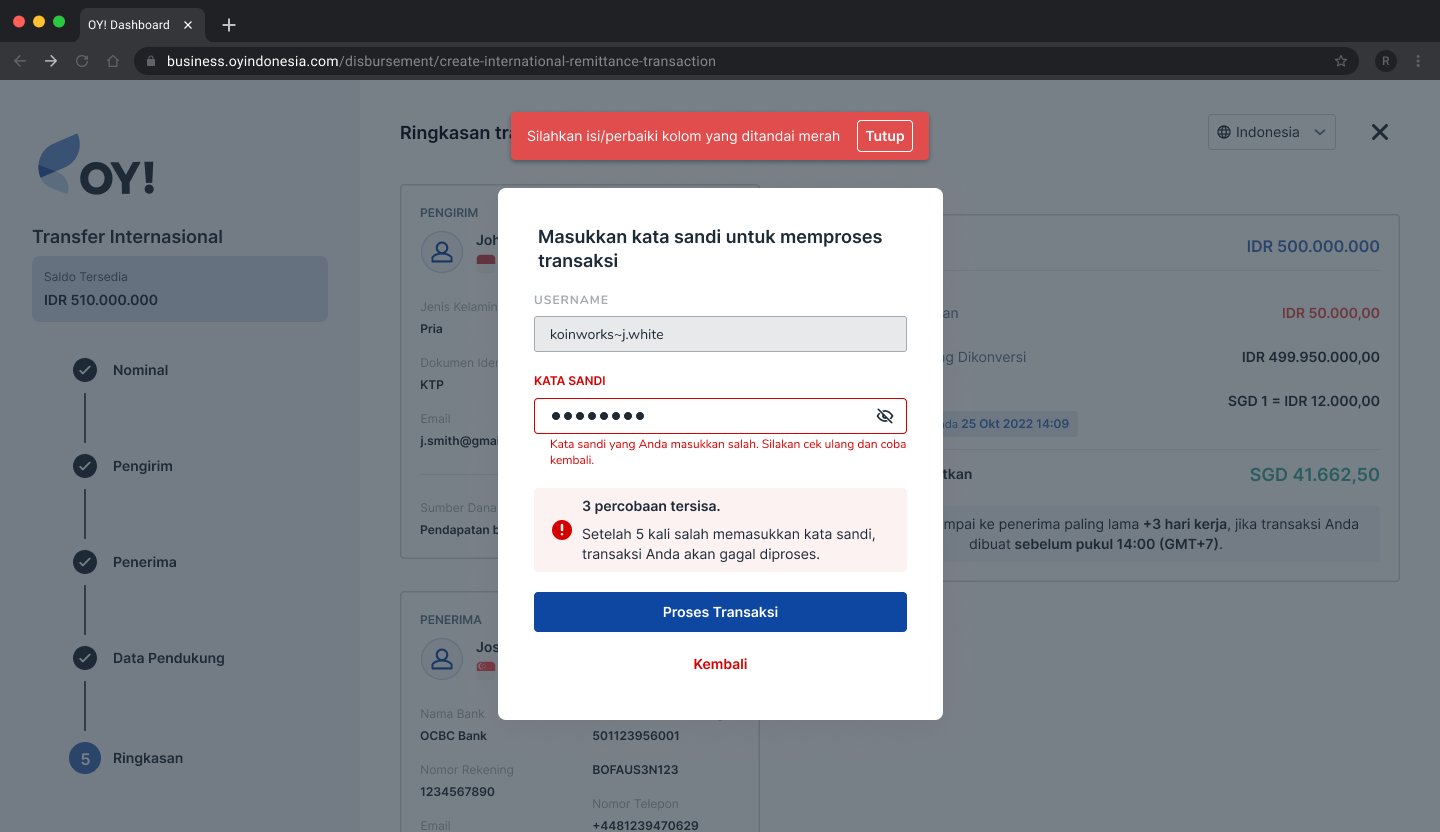

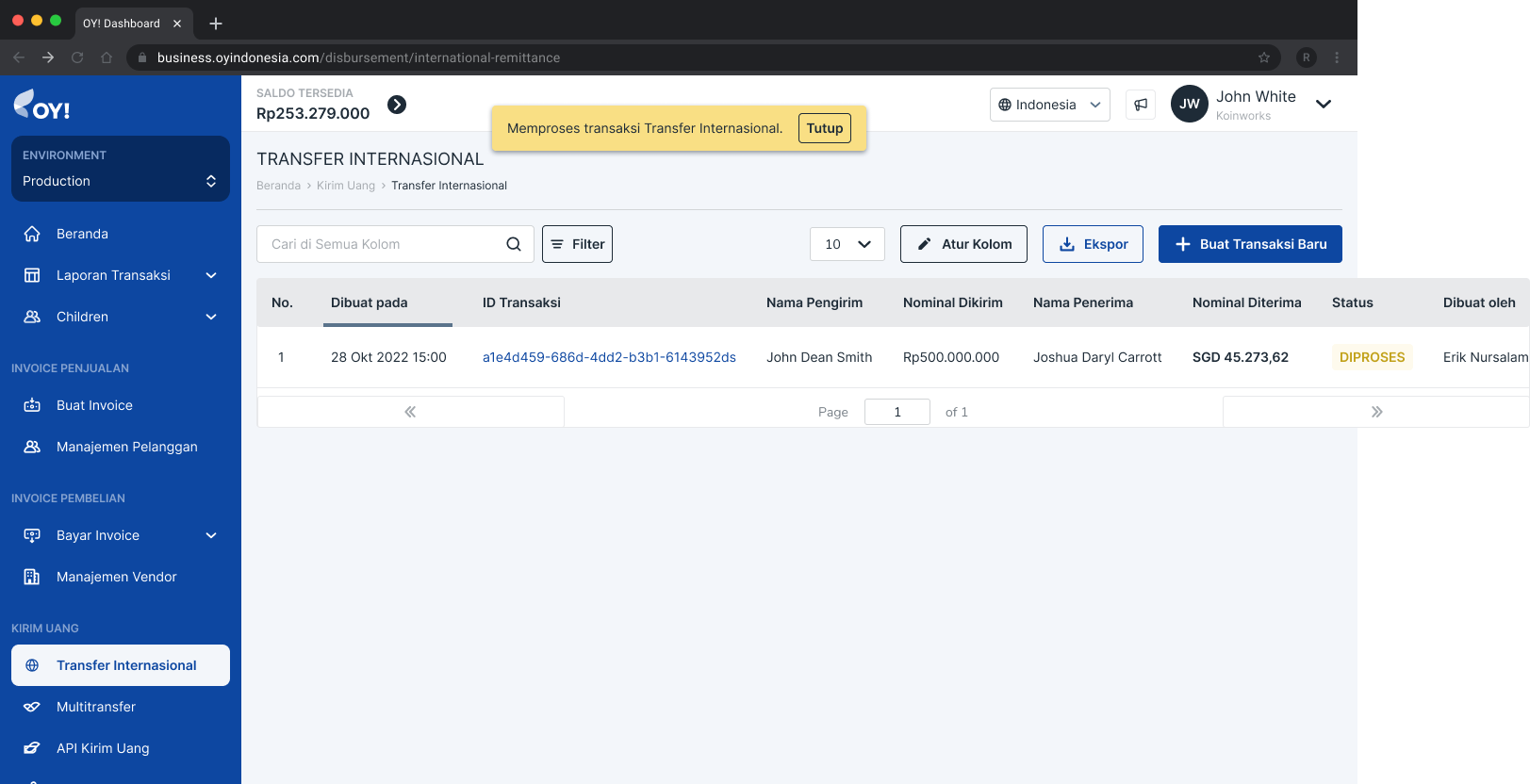

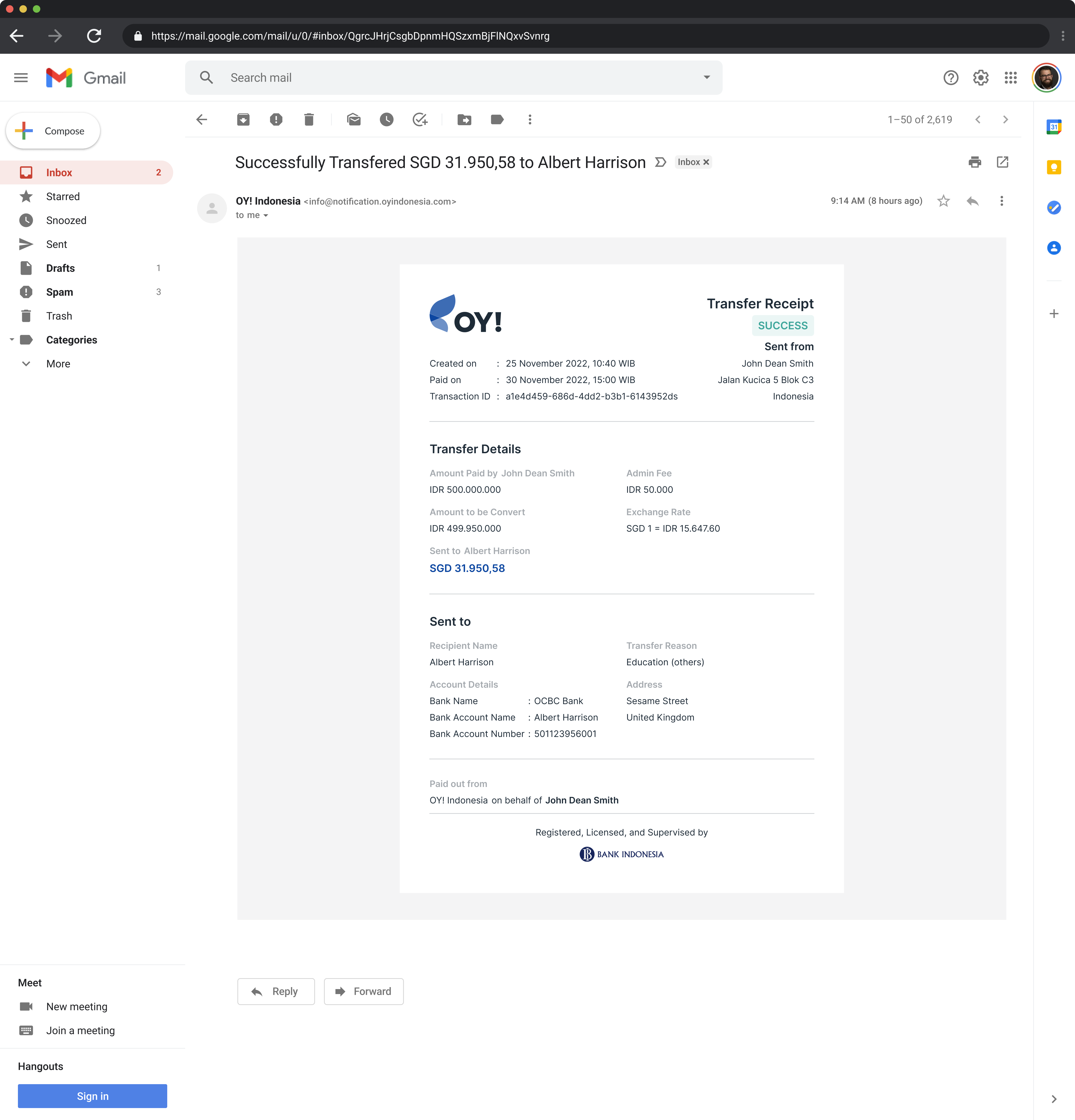

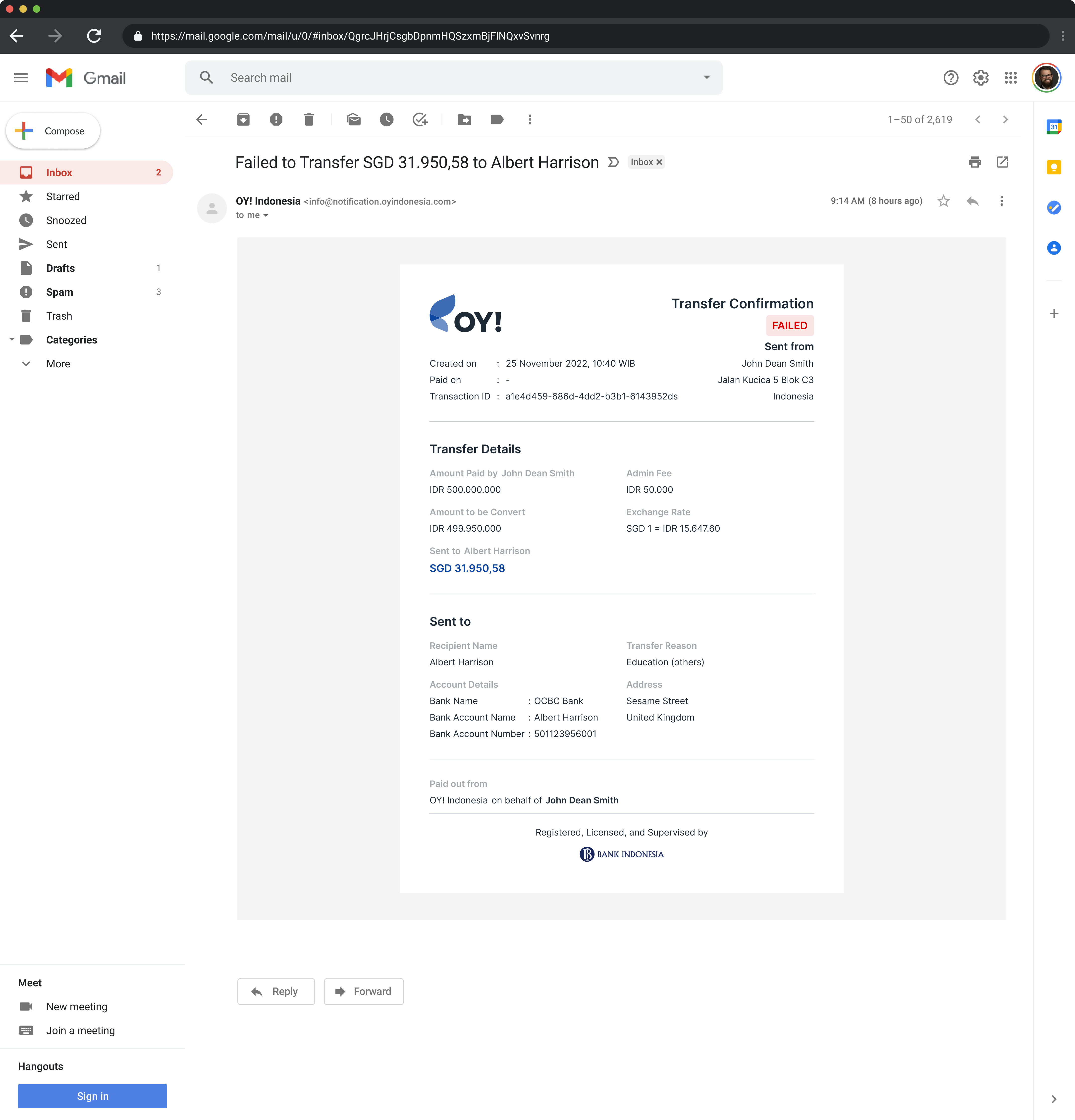

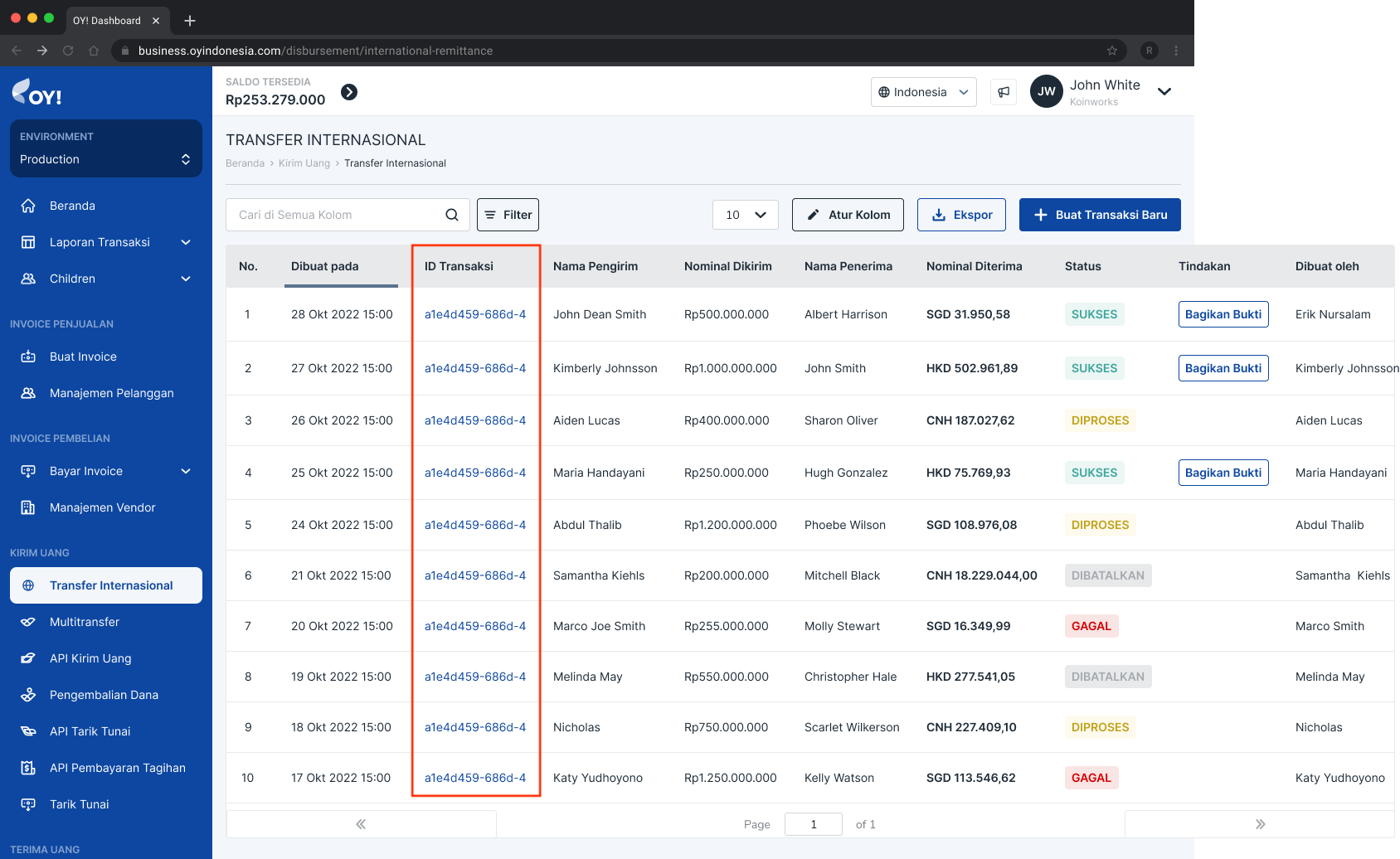

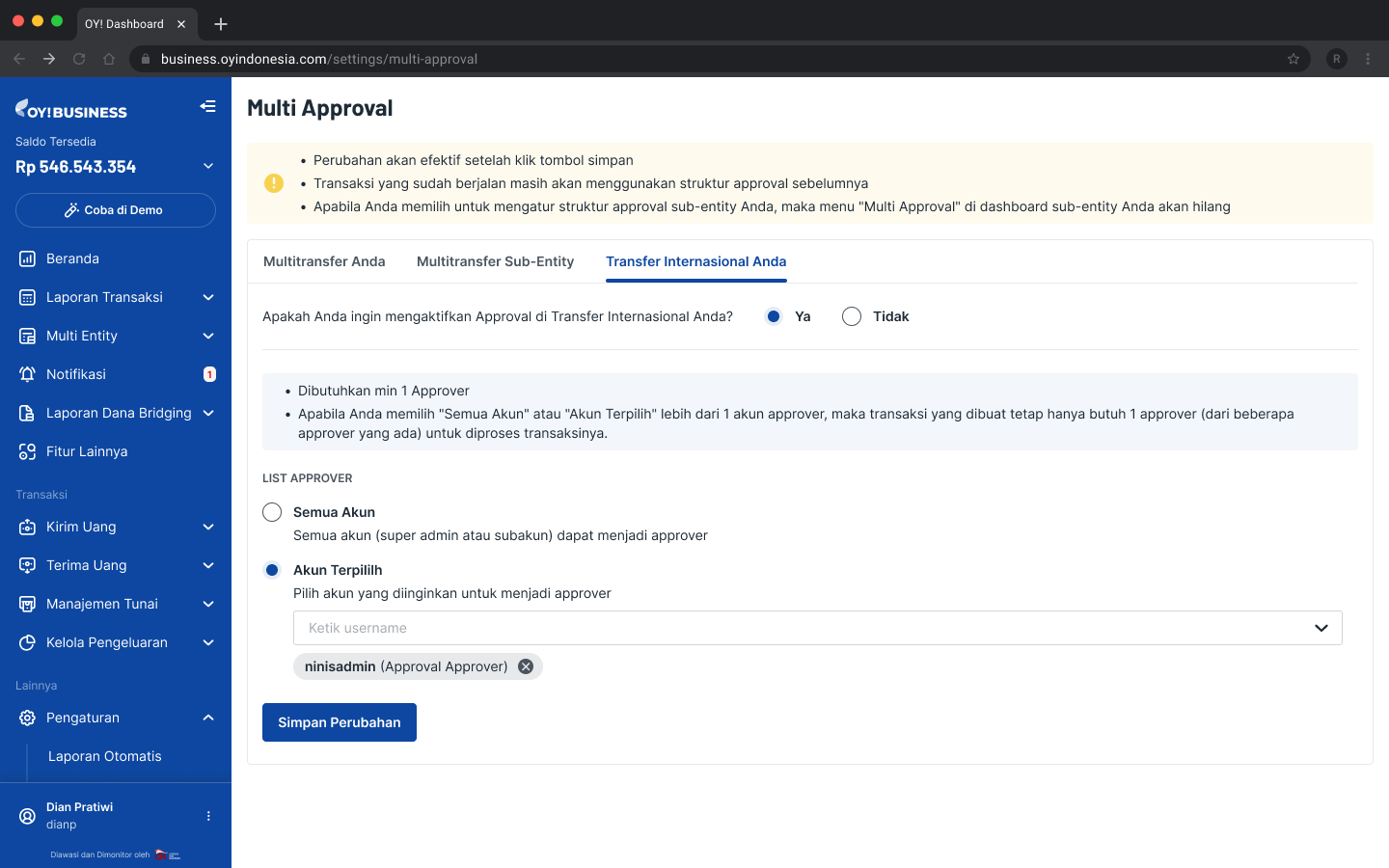

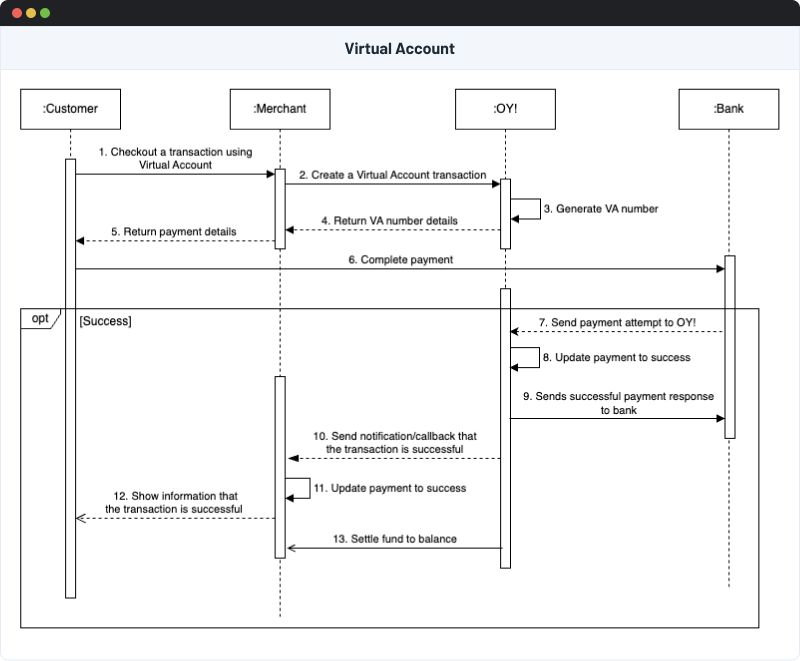

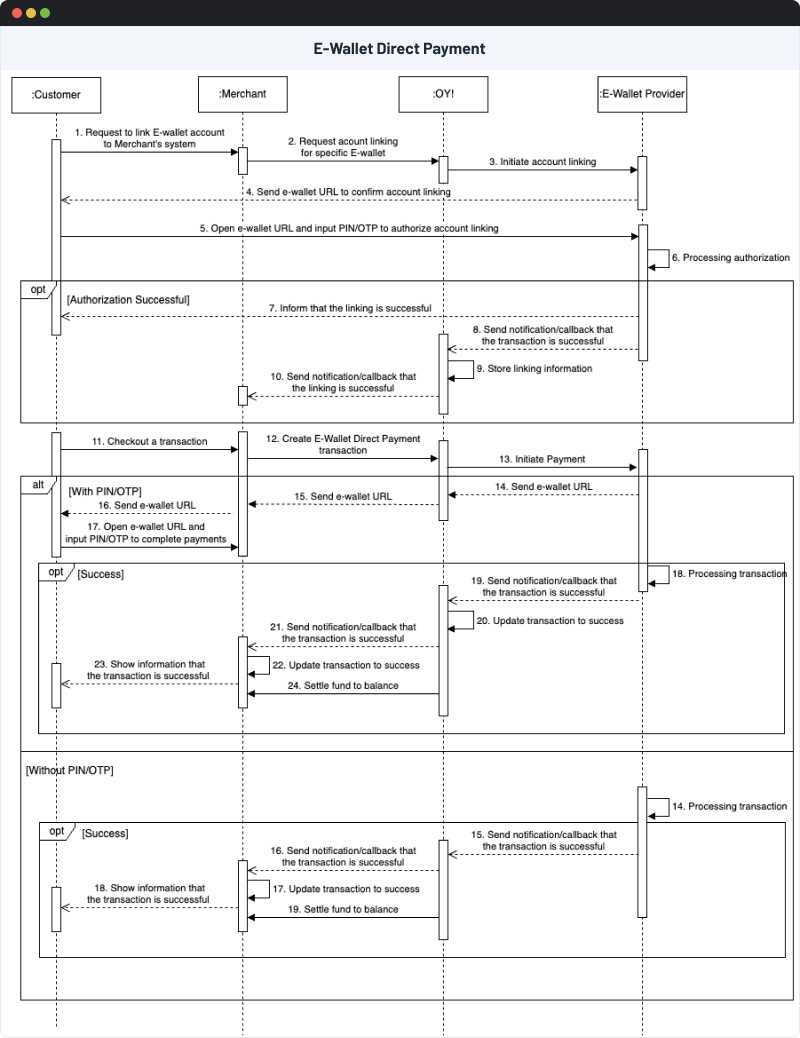

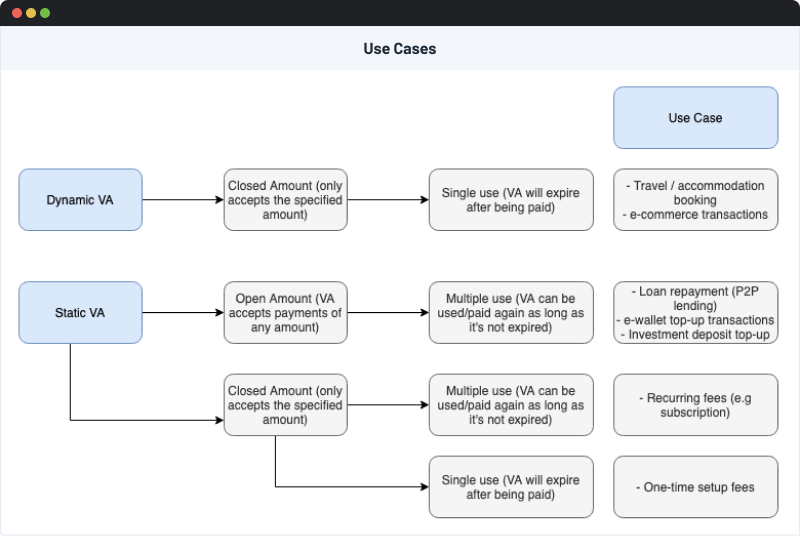

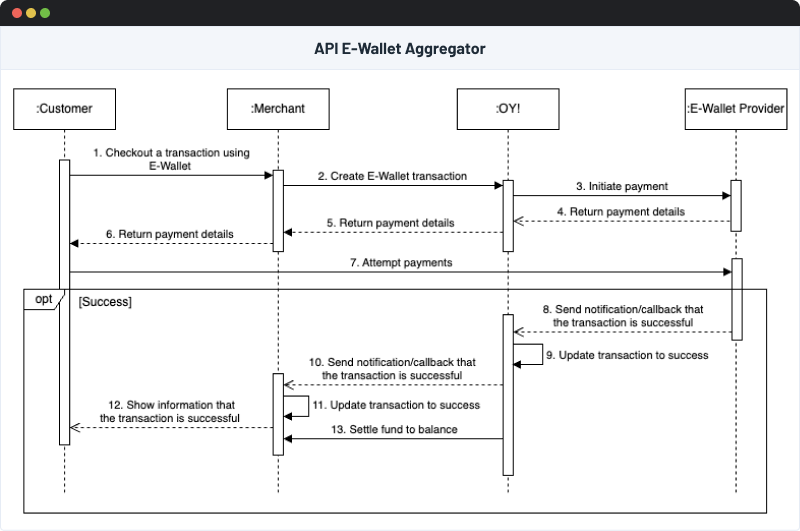

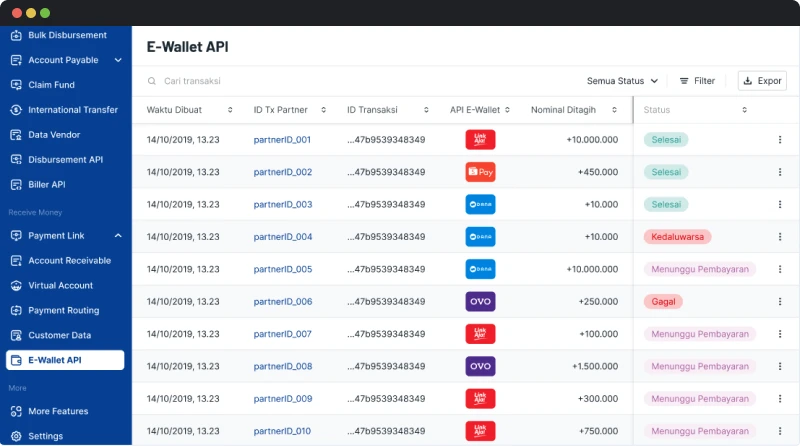

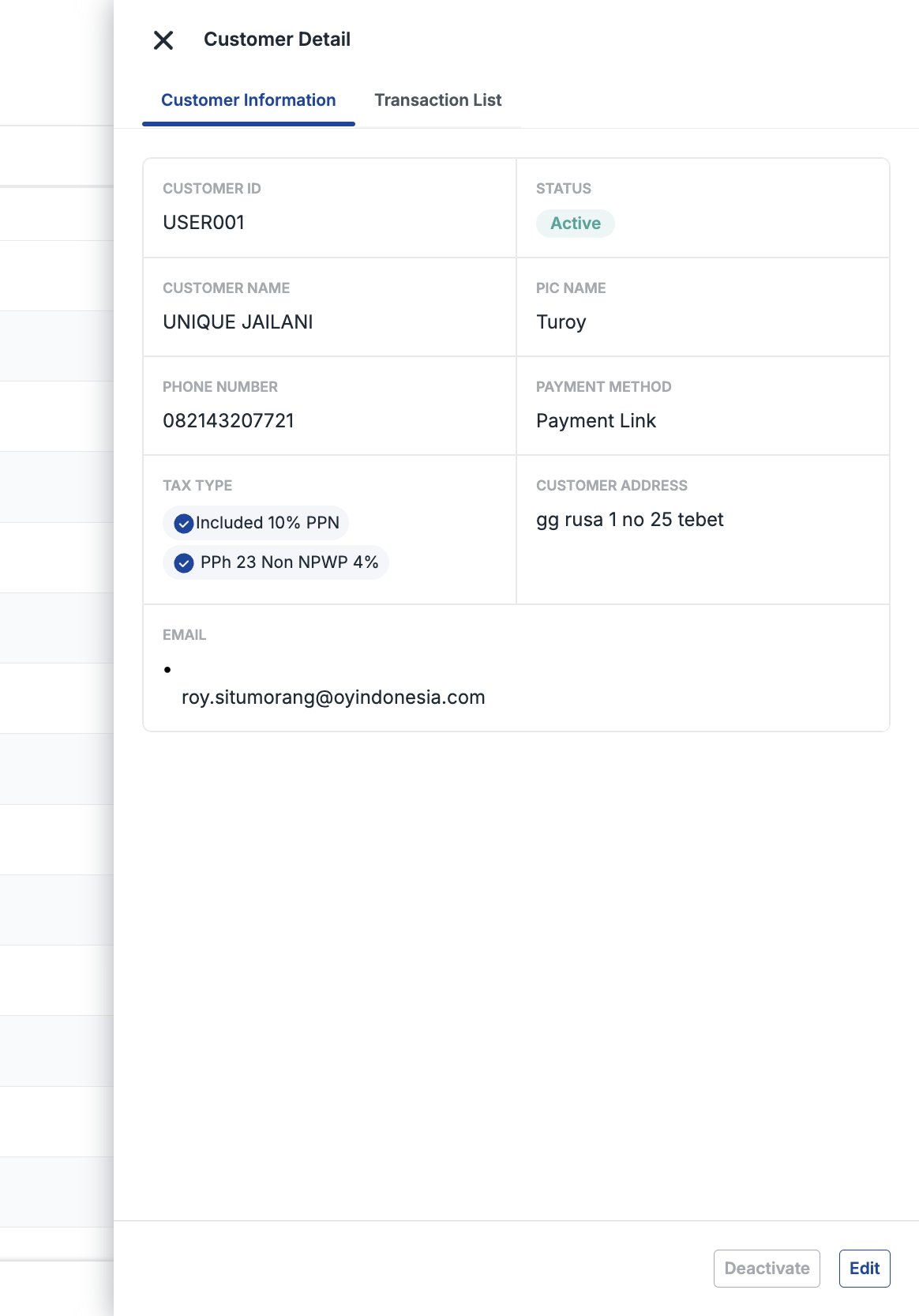

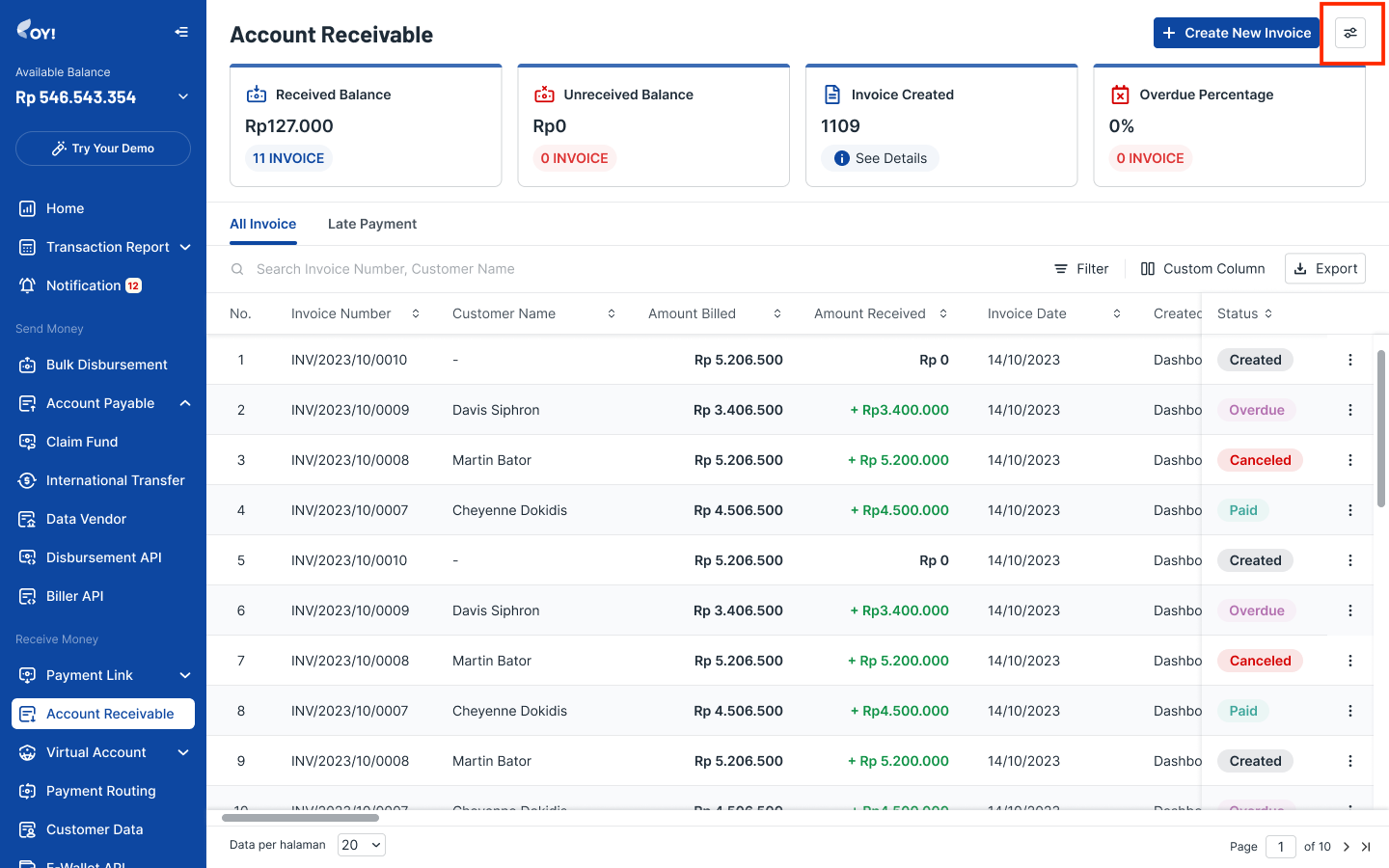

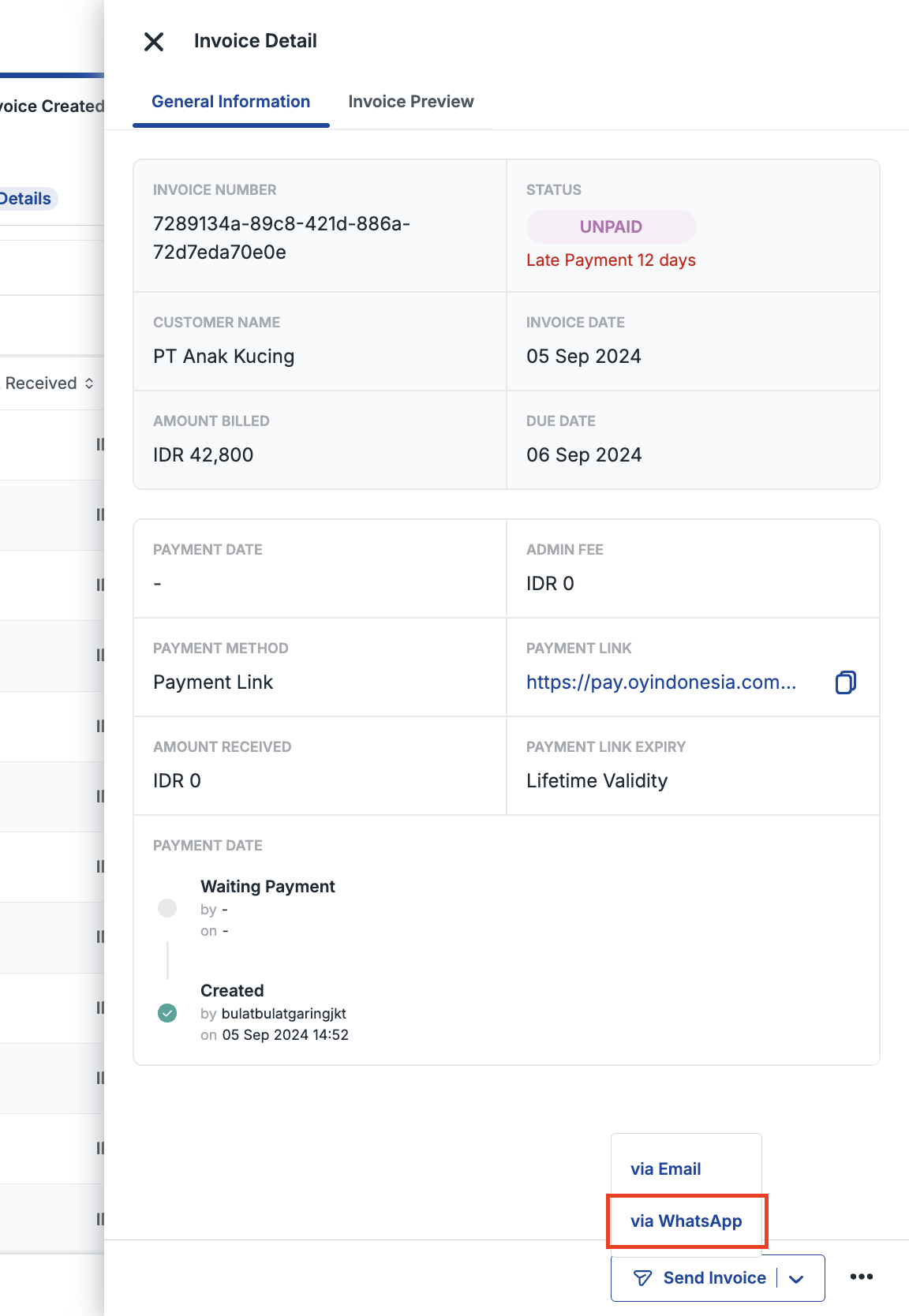

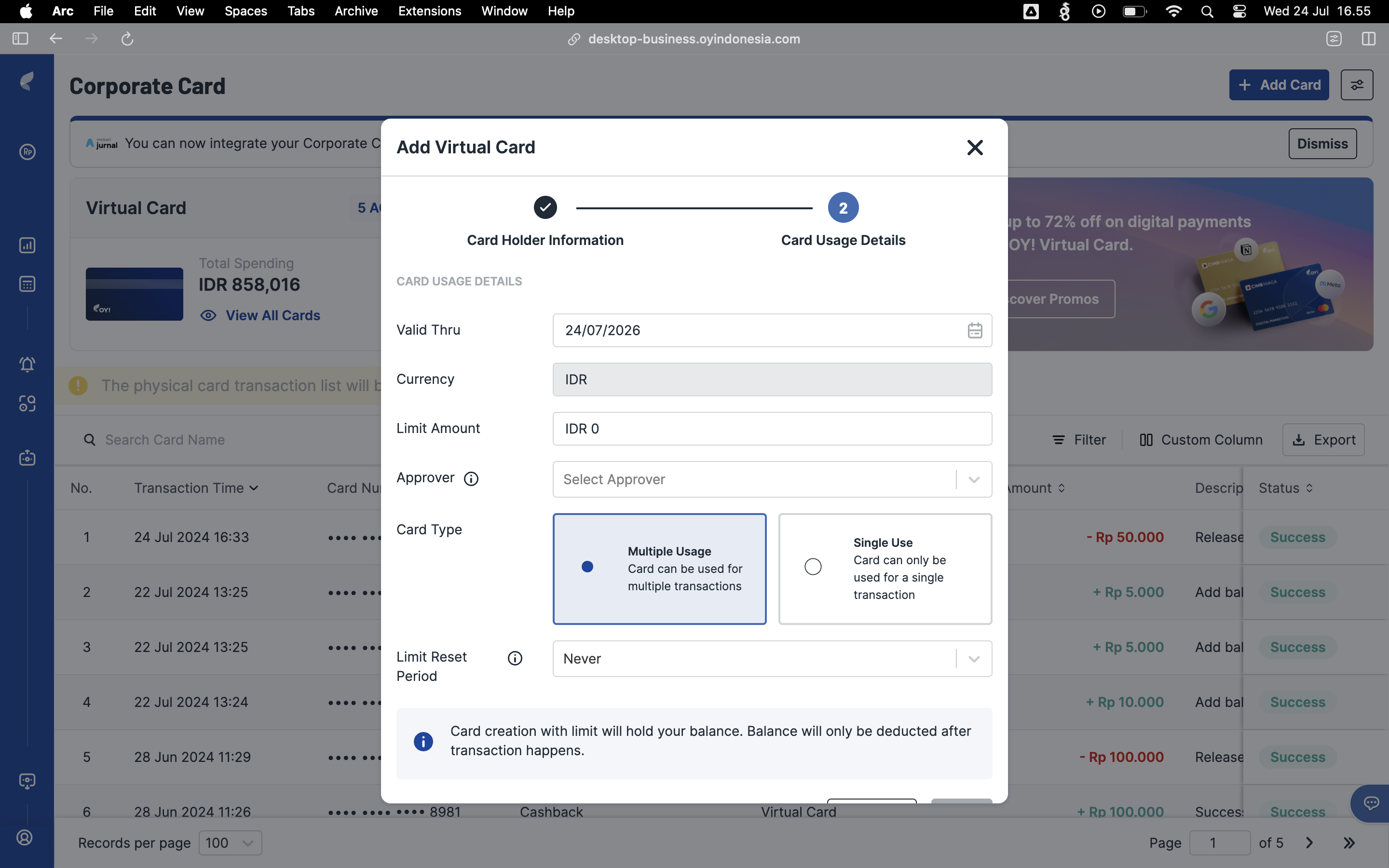

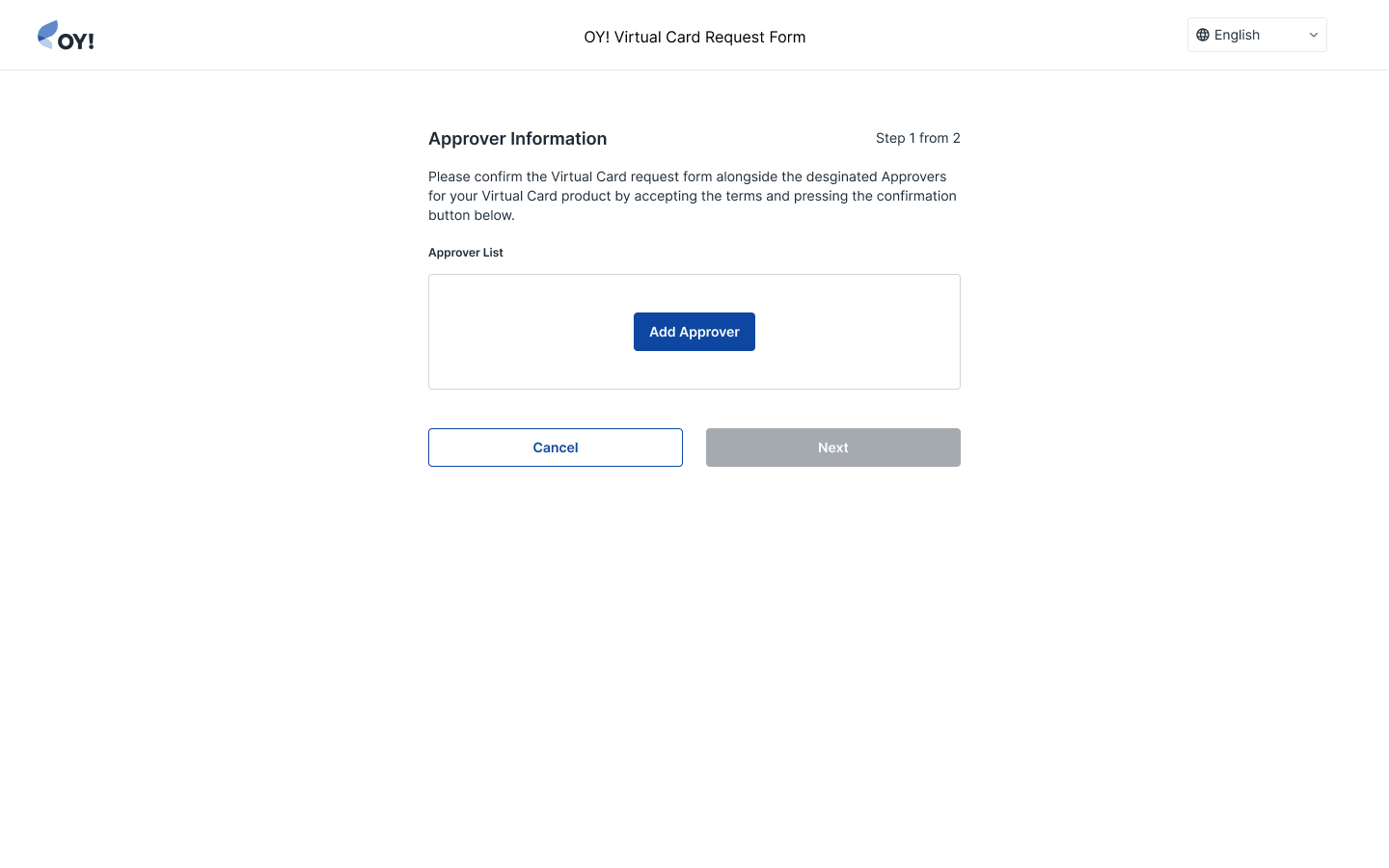

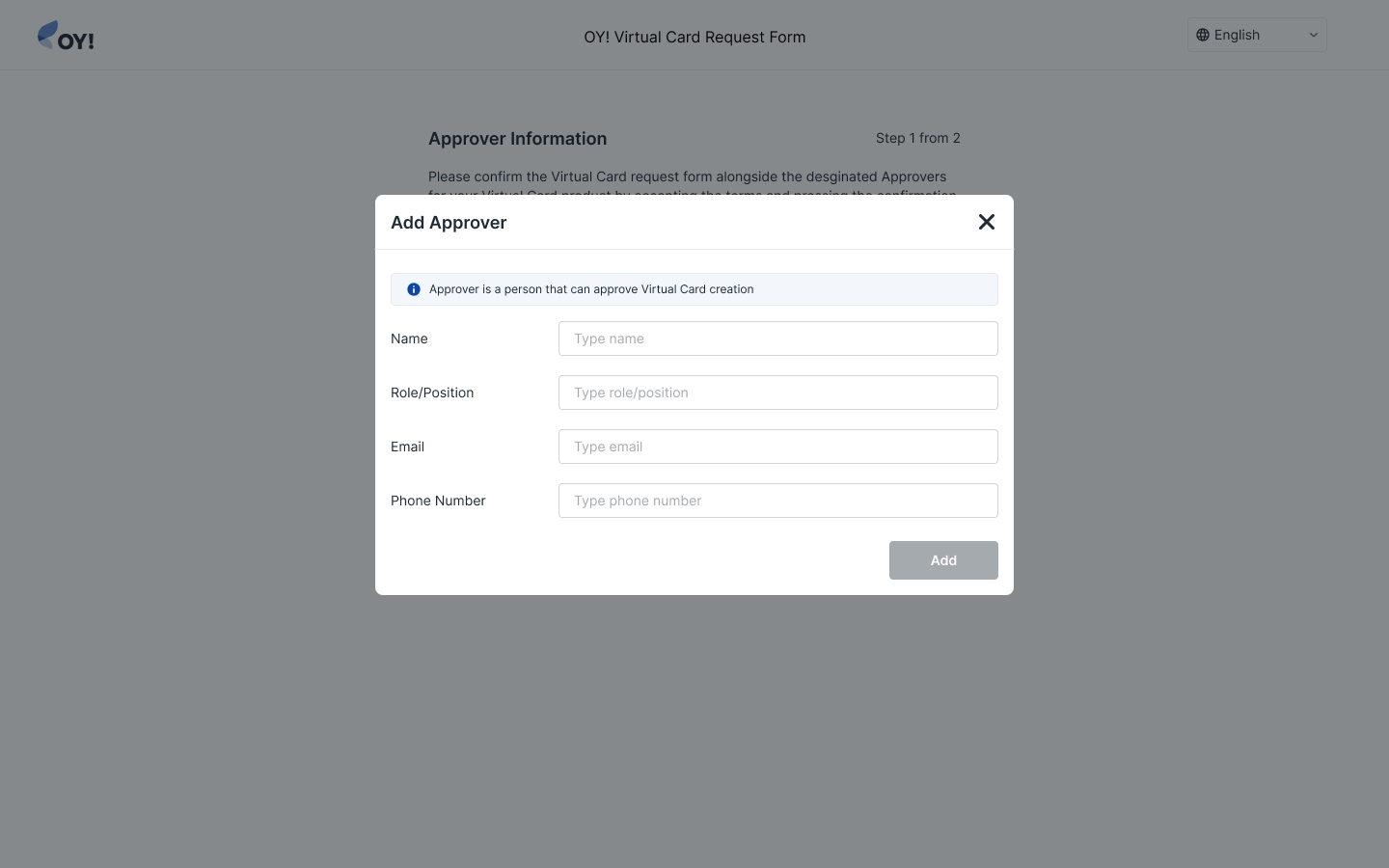

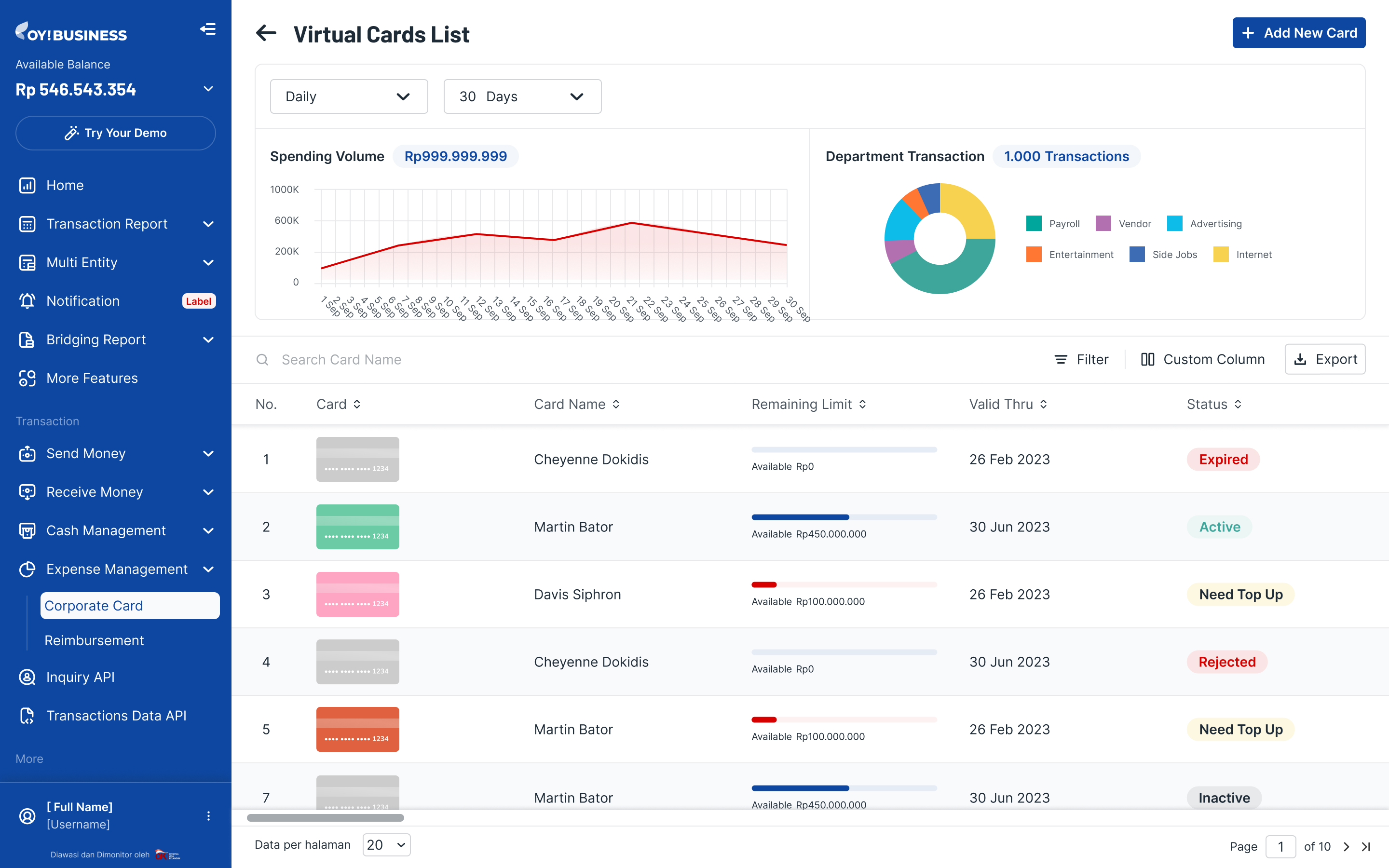

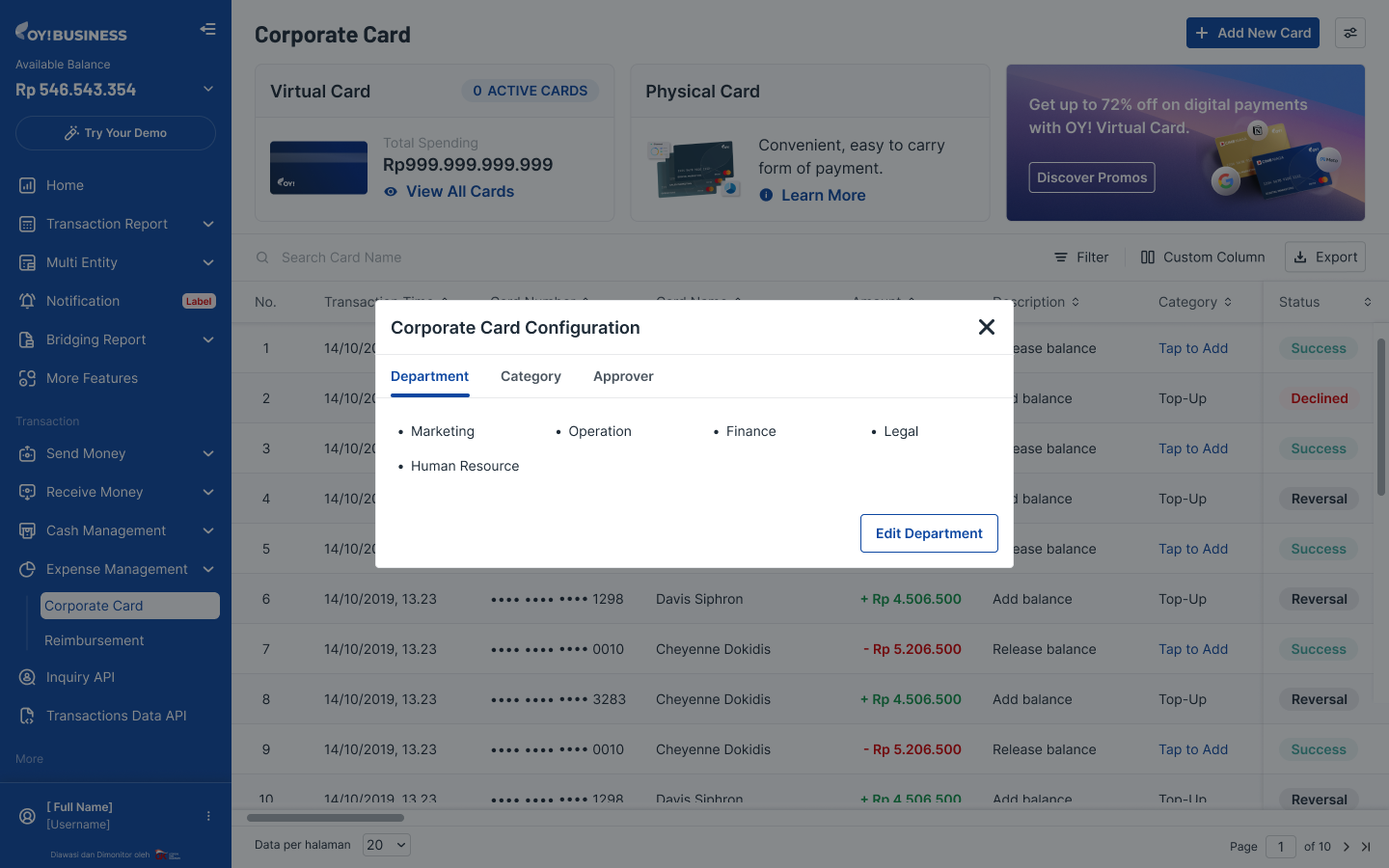

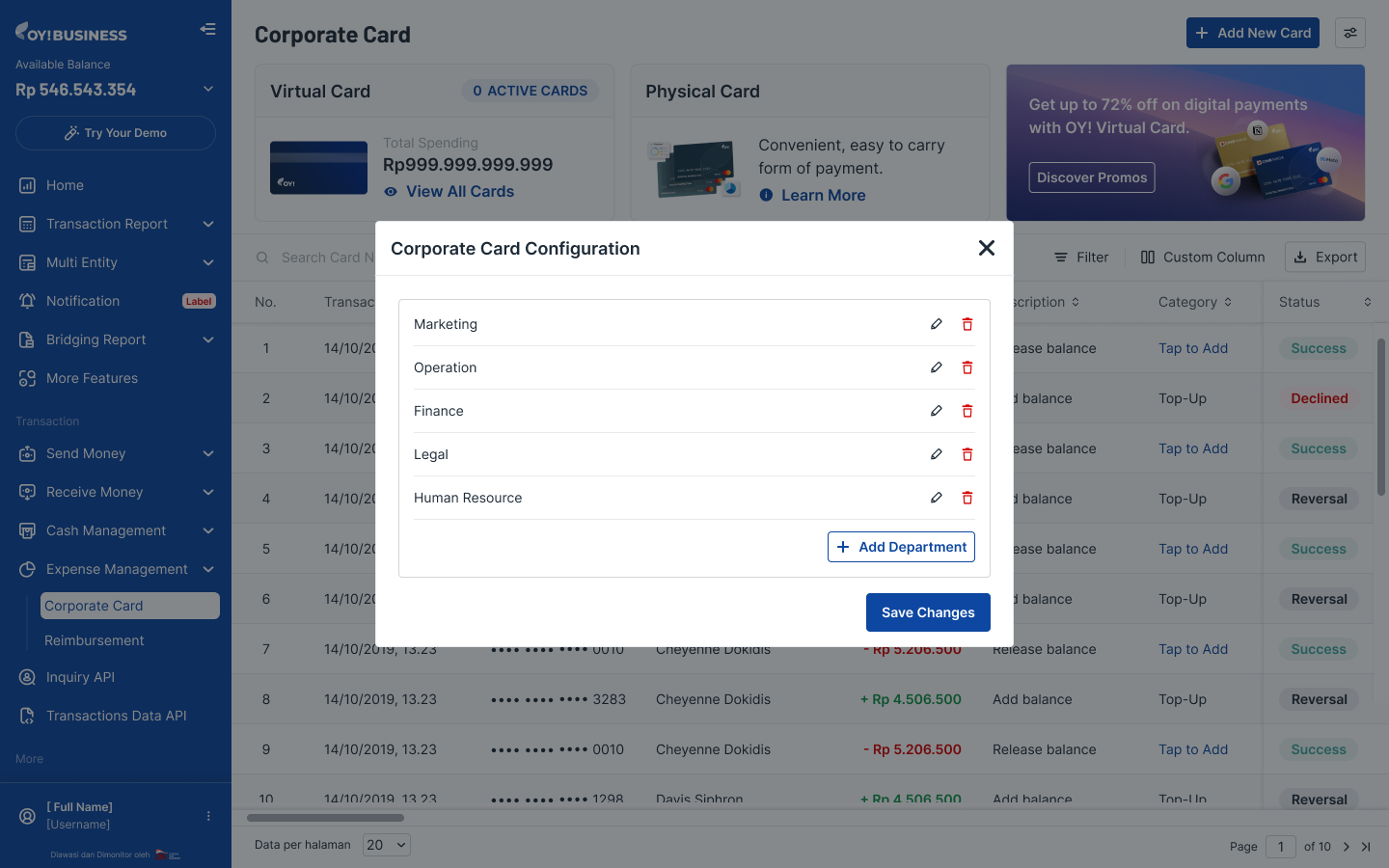

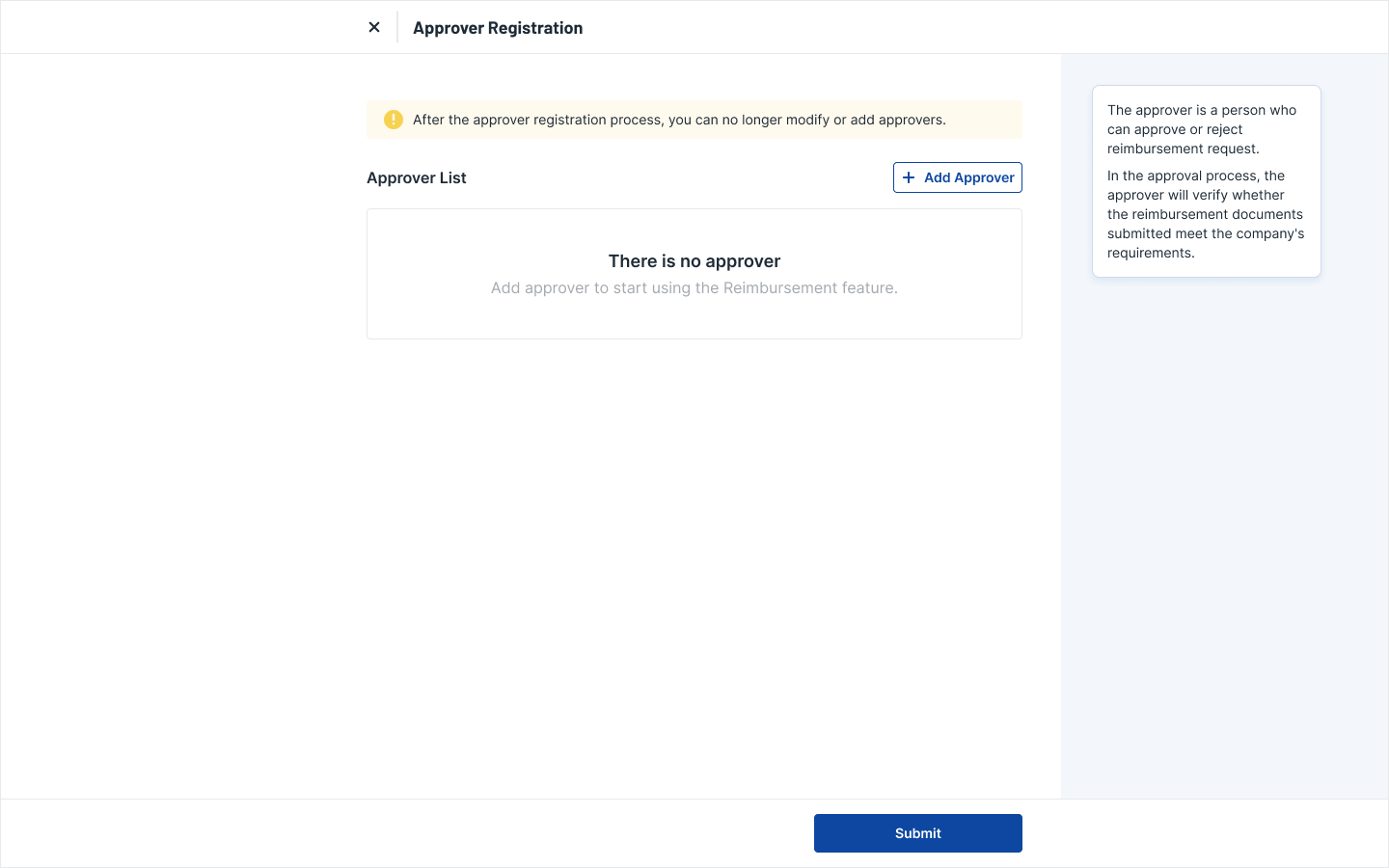

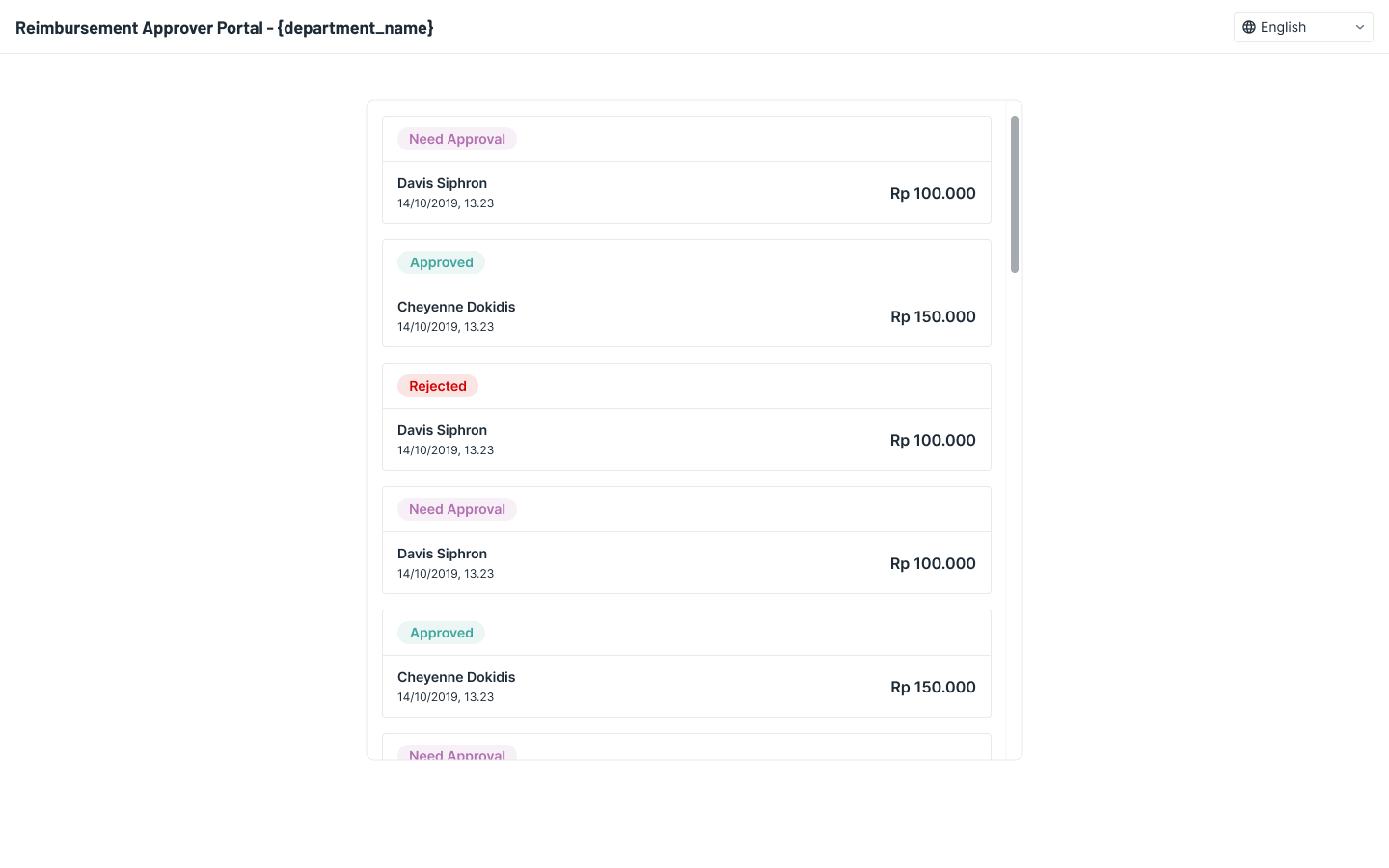

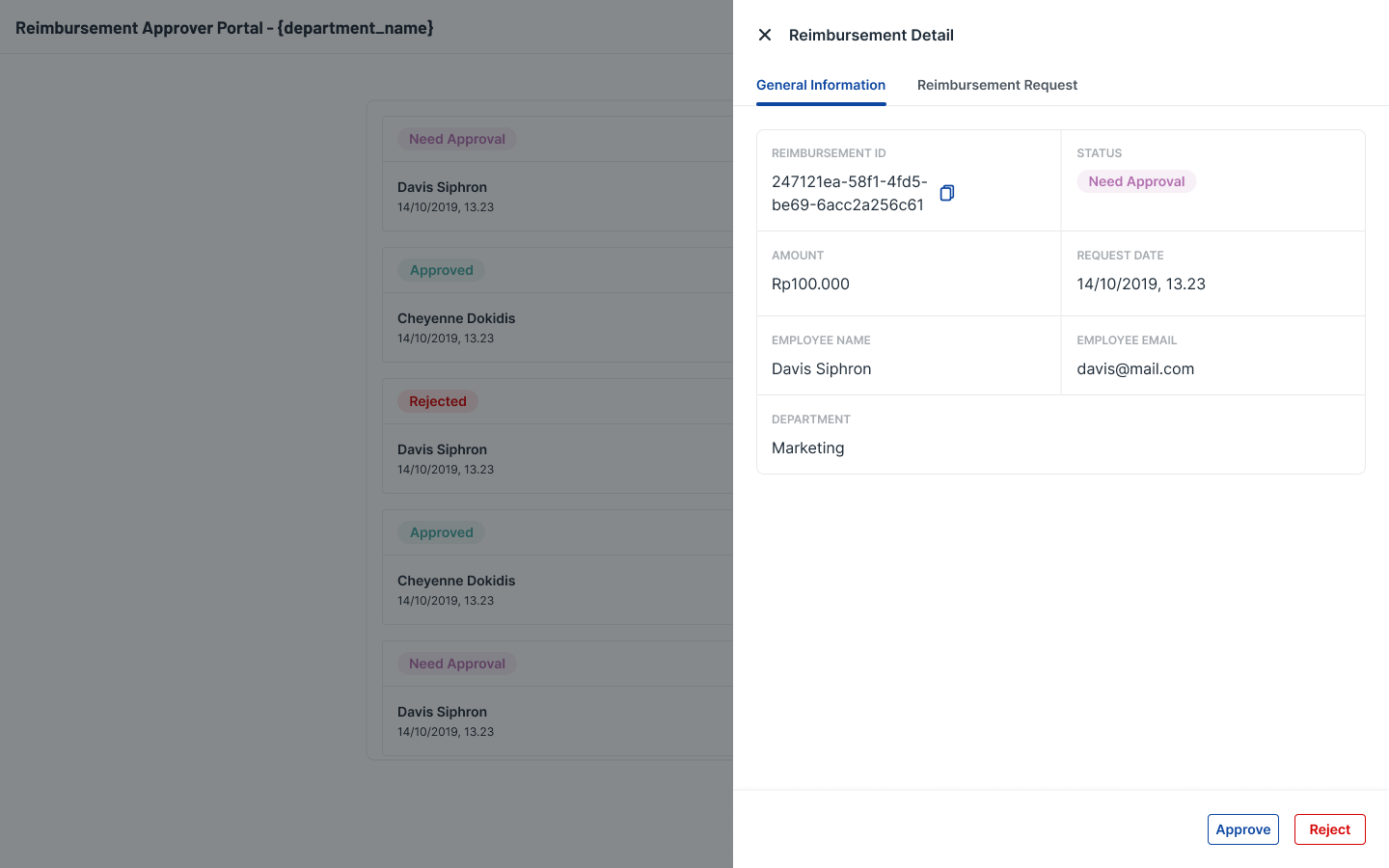

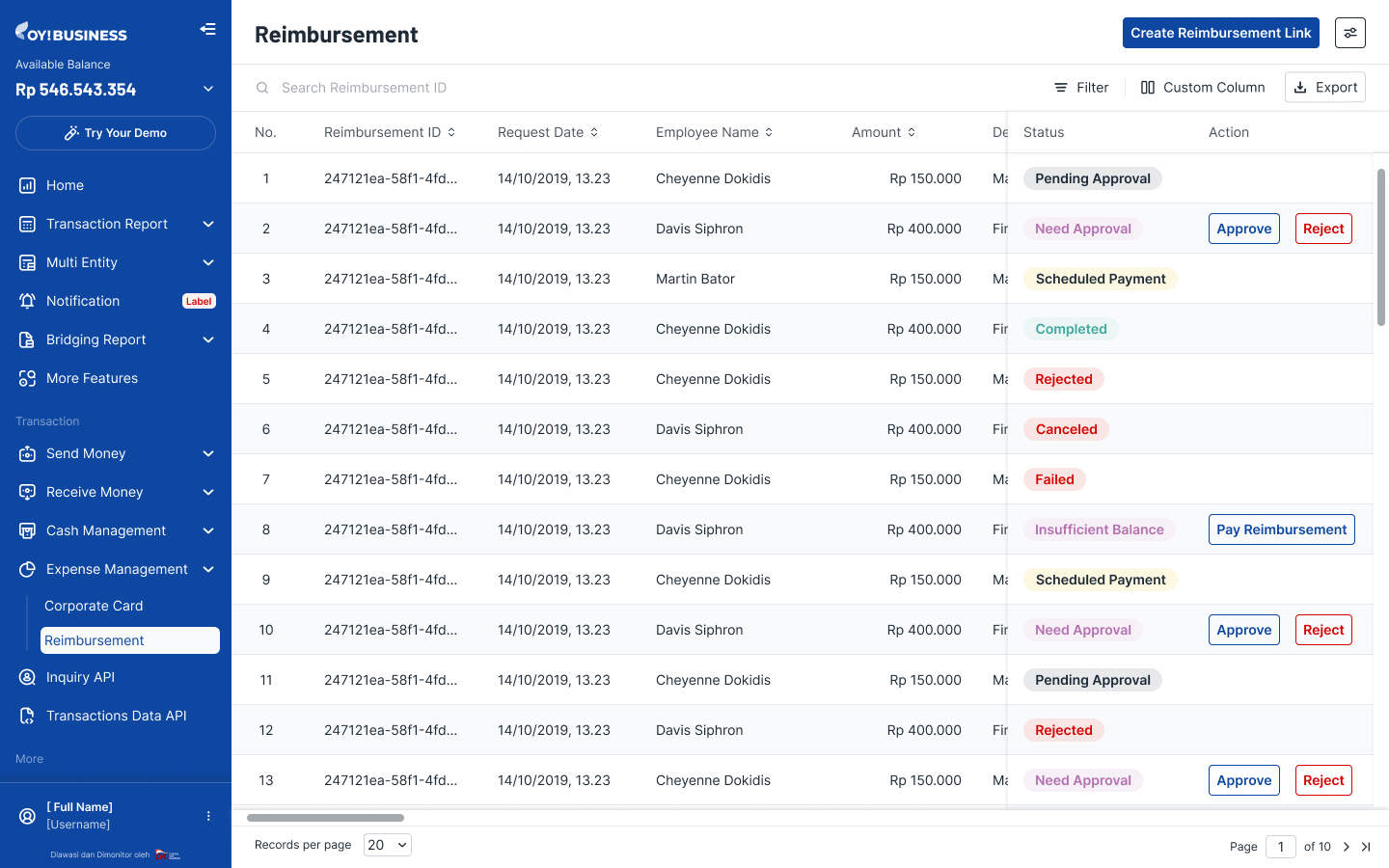

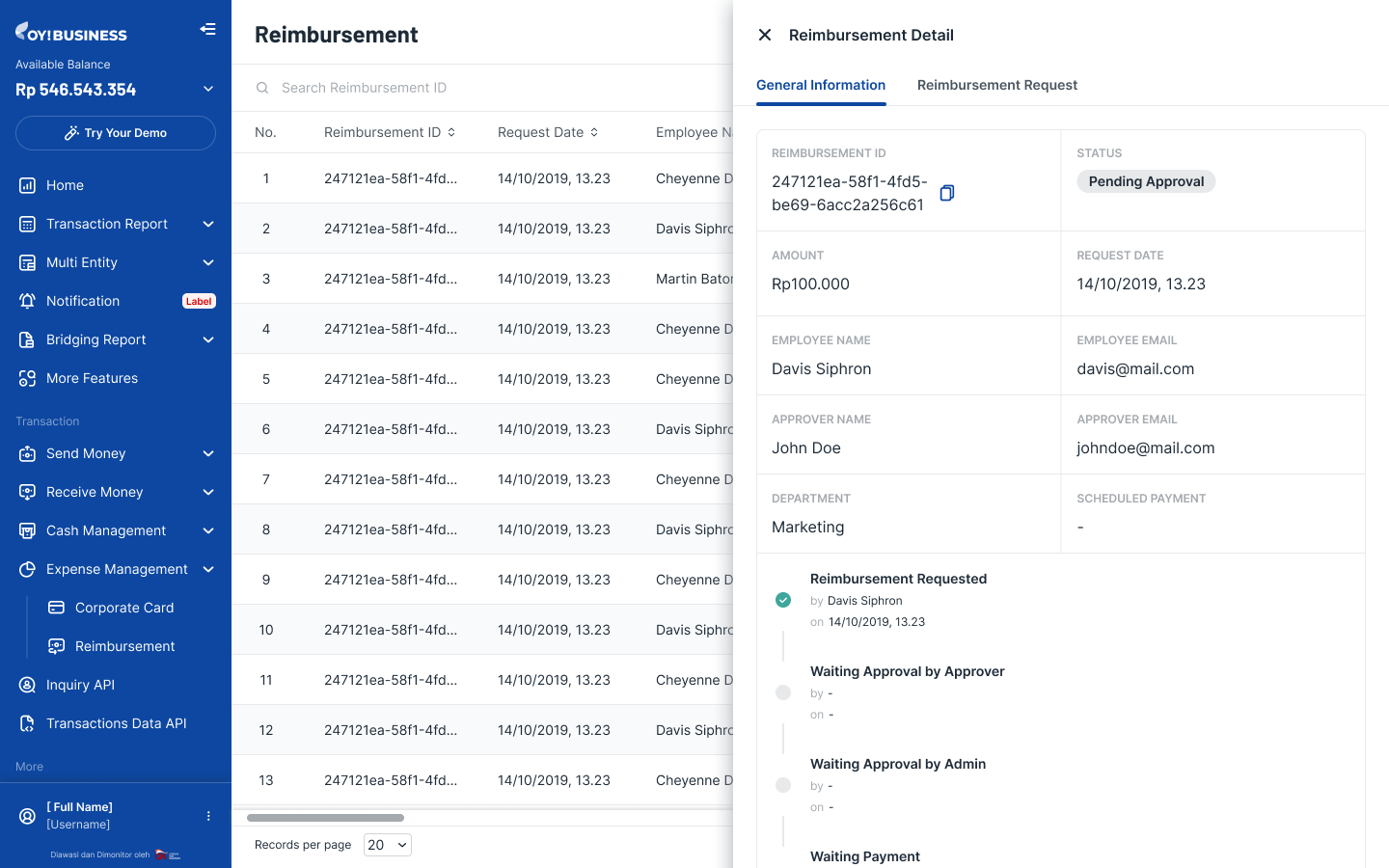

Idempotency Key